$30,000 a Month for 1,200 Square Feet? Why Monaco Is the World’s Most Expensive Place to Rent

International renters are willing to fork over millions for luxury apartments, thanks to the principality’s favourable tax policies and access to the high life

MONACO—With a budget of $30,000 a month, a Manhattan couple looking for a luxury rental apartment could afford a 3,100-square-foot Central Park West corner apartment, with three bedrooms, 9-foot beamed ceilings and picture windows overlooking the park.

Take that same rental budget to tiny, glamorous Monaco, and they could expect to spend that much on a modest two-bedroom apartment of less than 1,200 square feet, with a small kitchen and windowless bathroom but a nice waterfront location near the Casino de Monte-Carlo.

Hugging a steep stretch of Mediterranean coast between the French city of Nice and the France-Italy border, the principality of Monaco is among the world’s smallest sovereign states. With a footprint of just under 1 square mile, it is smaller than New York’s Central Park. But as one of the most appealing tax havens, it has created a rental market like no other, with international residents willing to pay millions of dollars in annual rent for the chance to live in style while benefiting from the lack of personal-income and capital-gains taxes.

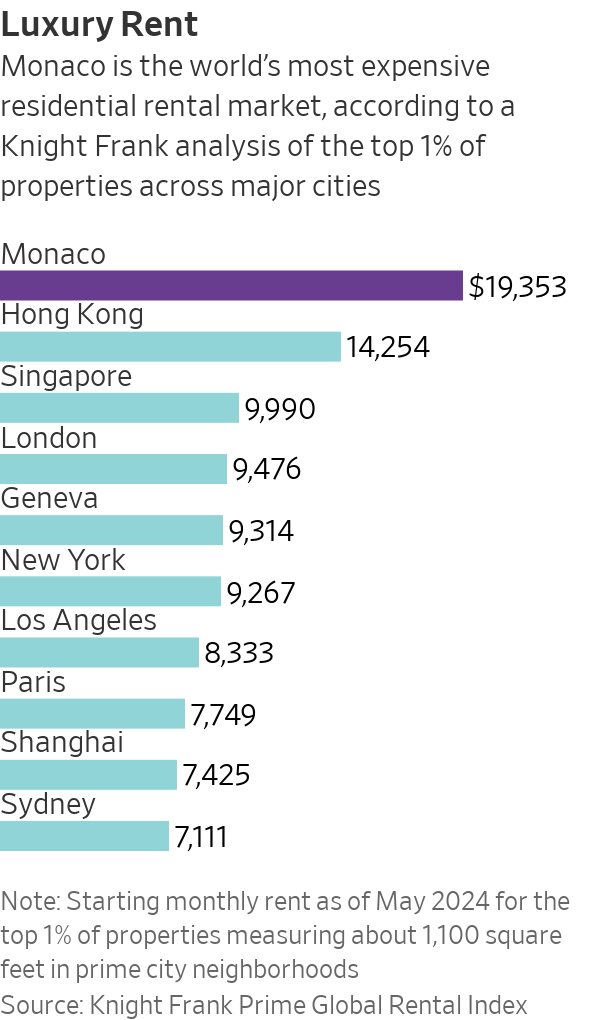

Monaco tops the list of the world’s most expensive residential rental markets, according to a May analysis provided to The Wall Street Journal by Knight Frank, a real-estate company that analyzes international trends. Knight Frank looked at the top 1% of properties measuring about 1,100 square feet across different cities. Monaco’s luxury rentals in this category start at more than $19,000 a month, 36% higher than in Hong Kong, which comes in second, and twice as much as in Singapore and London. In New York and Los Angeles, such prime rentals start at about $9,200 and $8,300 a month, respectively.

And that’s just for 1,100 square feet.

The concentration of wealth in Monaco means there is plenty of demand for larger luxury rentals, with concierge service and hotel-level amenities, which can easily exceed $100,000 a month. Rent prices are as high as $280,000 a month for some of the triplex penthouses at One Monte-Carlo, a multi-building commercial and all-rental residential complex completed in 2019, located a few minutes’ walk from the casino. Penthouses come with their own outdoor pools and an in-house landscaping team that looks after terrace trees.

Crisscrossed by winding roads, pristine Monaco stands in contrast to the rest of the French Riviera, which can be rundown or rustic by turns. Favourable tax policies may be the main draw, but One Monte-Carlo residents also praise the lack of crime and the exclusive shopping, with Louis Vuitton, Saint Laurent and Bulgari boutiques as neighbors.

Whether they are renting a one-bedroom for $150,000 a year or a luxurious penthouse for millions, Monaco renters must pay quarterly, a quarter in advance, along with a three-month security deposit.

Why would someone plop down more than $1.5 million on signing a lease—plus over $120,000 in additional annual service charges—rather than invest by buying outright?

Renting an apartment is often an initial key step in acquiring residency, explains Alexis Madier, a partner at the century-old Monaco law firm Gordon S. Blair, who specialises in seeing his clients through the application process. Tax benefits can kick in after one year, he says, and proof of at least a one-year rental agreement and a minimum 500,000 euro (about $535,000) deposit in a local bank are needed before that process can even begin. There is no guarantee the application will be accepted or renewed in the future, and renting is simply easier, faster and less risky than buying.

In 2023, Monaco had a permanent population of 38,367, and only about a quarter of those were actual citizens. The number of foreigners seeking residency has been generally rising since 2000, according to the government agency Monaco Statistics, and in the last few years, the luxury rental market has expanded to meet that demand. Applicants must commit to spending more time in Monaco than anywhere else, with renewals hinging on relevant authorities going through credit-card receipts and even chatting up doormen to verify applicant claims. It would be very difficult to fake your way into a residency, says Madier, so a Monaco base needs to serve as a real home.

Madier says that Northern Europeans, whose status as European Union or Schengen-zone citizens allows them a visa-free faster track to residency, have a standout presence among new arrivals. Notably near the bottom of the list are French nationals, who must still pay income tax in France regardless of a Monaco address. Some French families do relocate to take advantage of inheritance tax benefits, he says.

Americans owe U.S. tax on worldwide income regardless of where they live, so Madier says they stand to gain the least from acquiring residency.

The one thing that just about all new Monaco residents have in common is wealth, says Madier. The lawyer, who commutes daily from Nice, estimates that his foreign clients seeking residency have a minimum net worth of $30 million.

“Most residents adopt a low profile,” he says, contrasting his clientele with the day trippers and vacationers dressed to the nines. “When you see them on the street, they’re not showing off.”

A question hanging over the Monaco market—particularly when it comes to foreign investors and its banking sector—is whether a global watchdog may soon add the principality to a financial “gray list,” which would deem its anti-money-laundering efforts deficient and require increased monitoring from the group. But agents in Monaco say they expect little impact on the residential real-estate market, if that happens.

New residents may sleep in Monaco, but they take advantage of the south of France, known for its idyllic hinterland and excellent food, and the closeness of northern Italy, where they might go grocery shopping—if they go grocery shopping. One couple, who are in the process of acquiring Monaco residency, say they hire a chef to live in nearby France rather than bother with shopping and cooking. A pair of One Monte-Carlo residents treat nearby luxury hotels as watering holes, ordering room service or popping over for a meal at restaurants where a cup of coffee can cost $15.

Residency-seeking arrivals increasingly want ever grander domiciles, and the principality’s highest prices are found at new complexes or renovated historic buildings. Monaco agent Caroline Olds has a listing for a 3,450-square-foot, three-bedroom apartment located in a grand 1880s building, last renovated in 2021, with a monthly rent of $99,000. She also has a 2,750-square-foot, four-bedroom unit on the 31st floor of the Tour Odéon, a luxury residential skyscraper finished in 2015, asking $48,000 a month. Is that price rather low, considering the prestige of the building? “Well, it’s not the penthouse,” says Olds.

A longtime Monaco resident, Olds says that new arrivals are sometimes in for a shock. “People who come from outside Monaco are accustomed to big homes,” she says. For clients who can afford a mansion-size apartment, she has a penthouse listing, spread over four stories, with four bedrooms and some 8,300 square feet of terraces. The price: $268,000 a month.

Irene Luke, who runs the Monaco office of U.K. real-estate company Savills, says the new wave of luxury complexes like One Monte-Carlo have convinced some residents to stay put in rentals rather than buy. The Tour Odéon, for instance, offers residents a chauffeur on call, says Olds. And staff at One Monte-Carlo say they help residents with requests such as ordering bed-linen changes for last-minute return trips home from abroad and booking helicopters for quick jaunts to restaurants up the coast in France.

“They get used to the services,” says Luke, who handles both rentals and sales. Finding a comparable apartment to buy in this small area with precious few single-family homes, she adds, can cost upward of $50 million.

Starting down the path to residency creates a particular rhythm of tenancy and ownership, says Bjarni Breidfjord, the Paris- and Nice-based managing and creative director of Luxoria, an international interior-design studio with a Monaco clientele. Renting in the densely urban, high-rise microstate can quickly lead to buying in nearby France, he says. Clients “get a little claustrophobic, and then they need a country residence—anything that gets them a little garden space,” he says.

With a few notable exceptions, Monaco rentals are unfurnished and must be returned to their original condition after tenancy. “What is so weird about Monaco,” says Breidfjord, “is that even if you do an improvement, the owners want it back to the original state.”

He is often called upon to come up with solutions for wealthy clients used to sumptuous mansions who now plan to put down roots in boxy, low-ceiling apartments, where they may only stay for a few years. His solution: transform spaces with wall coverings and paint jobs, while leaving the floors as they are. “We refer to it as a ‘cosmetic renovation,’” he says.

This summer, Breidfjord says he will complete work on furnishing a 1,300-square-foot rental for a couple who are relocating to Monaco. With a monthly rent of $15,000—reasonable by Monaco standards—the couple are instilling a dose of luxury with a $375,000 budget, including Italian designer furniture and a $96,000 custom-built wine refrigerator.

Luke says the market for furnished apartments is starting to grow. Savills handles long-term, furnished units at the Columbus Hotel, near Monaco’s southern tip, where the 1,350-square-foot penthouse with an even-larger terrace rents for $37,500 a month. Miells, Monaco’s Christie’s affiliate, has a furnished rental at the opposite end of the principality also listed for $37,500 a month. The 2,450-square-foot three-bedroom, located on the 15th floor of a 1980s high-rise, has dramatic Mediterranean views.

People relocating “think they have enough to do moving here,” says Luke. With a laundry list that may include obtaining a visa, getting a residence card and moving children into schools, a turnkey home means “your accommodation is sorted immediately.”

One Monte-Carlo, where tenants are expected to sign at least a two-year lease, is a prime example of the investment being put into Monaco rentals. It is the brainchild of the Monte-Carlo Société des Bains de Mer, the state-controlled entity known as SBM, which owns a large chunk of the principality, including the casino, the opera house and the Hôtel de Paris Monte-Carlo, a 19th-century trophy property. Over the last few decades, SBM has gone all-in on luxury rentals, and its portfolio now includes 71 units, including three rare waterfront villas, where the rent is $280,000 a month.

In a market where luxury properties can sell for tens of millions, why is SBM emphasising residential rentals? “Very high rental fees,” says SBM Chairman and Chief Executive Stéphane Valeri, “represent very profitable long-term revenue.”

Valeri says the occupancy rate at One Monte-Carlo is close to 100%. Usually the only vacancy at any given time is a unit being renovated for the next tenant, he says.

SBM also now owns Villa La Vigie, an early 20th-century mansion just over the border in France that was long the Riviera base of late fashion designer Karl Lagerfeld. Costing up to $160,000 a week in high season, it is also available for longer-term rentals of up to two months for more than $1.18 million.

SBM’s One Monte-Carlo is set to get a run for its money with Mareterra, a new $2 billion waterfront luxury complex and neighborhood built on land reclaimed from the sea. Some of the world’s best-known architects, including Renzo Piano and Tadao Ando, are involved, and residents will have access to a private marina.

Comprising 134 large units, some up to 16,000 square feet, sale prices are hovering at almost $10,000 a square foot, with rental units in the 10,000-square-foot range going for around $160,000 a month, according to Stéphane Brianti, managing director of Ageprim, a Monaco real-estate agency handling both sales and rentals at the development. Occupancy for buyers and renters alike is set to start in late 2024, he says.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

Buyer demand, seller confidence and the First Home Guarantee Scheme are setting up a frantic spring, with activity likely to run through Christmas.

The spring property market is shaping up as the most active in recent memory, according to property experts Two Red Shoes.

Mortgage brokers Rebecca Jarrett-Dalton and Brett Sutton point to a potent mix of pent-up buyer demand, robust seller confidence and the First Home Guarantee Scheme as catalysts for a sustained run.

“We’re seeing an unprecedented level of activity, with high auction numbers already a clear indicator of the market’s trajectory,” said Sutton. “Last week, Sydney saw its second-highest number of auctions for the year. This kind of volume, even before the new First Home Guarantee Scheme (FHGS) changes take effect, signals a powerful market run.”

Rebecca Jarrett-Dalton added a note of caution. “While inquiries are at an all-time high, the big question is whether we will have enough stock to meet this demand. The market is incredibly hot, and this could lead to a highly competitive environment for buyers, with many homes selling for hundreds of thousands above their reserve.”

“With listings not keeping pace with buyer demand, buyers are needing to compromise faster and bid harder.”

Two Red Shoes identifies several spring trends. The First Home Guarantee Scheme is expected to unlock a wave of first-time buyers by enabling eligible purchasers to enter with deposits as low as 5 per cent. The firm notes this supports entry and reduces rent leakage, but it is a demand-side fix that risks pushing prices higher around the relevant caps.

Buyer behaviour is shifting toward flexibility. With competition intense, purchasers are prioritising what they can afford over ideal suburb or land size. Two Red Shoes expects the common first-home target price to rise to between $1 and $1.2 million over the next six months.

Affordable corridors are drawing attention. The team highlights Hawkesbury, Claremont Meadows and growth areas such as Austral, with Glenbrook in the Lower Blue Mountains posting standout results. Preliminary Sydney auction clearance rates are holding above 70 per cent despite increased listings, underscoring the depth of demand.

The heat is not without friction. Reports of gazumping have risen, including instances where contract statements were withheld while agents continued to receive offers, reflecting the pressure on buyers in fast-moving campaigns.

Rates are steady, yet some banks are quietly trimming variable and fixed products. Many borrowers are maintaining higher repayments to accelerate principal reduction. “We’re also seeing a strong trend in rent-vesting, where owner-occupiers are investing in a property with the eventual goal of moving into it,” said Jarrett-Dalton.

“This is a smart strategy for safeguarding one’s future in this competitive market, where all signs point to an exceptionally busy and action-packed season.”

Two Red Shoes expects momentum to carry through the holiday period and into the new year, with competition remaining elevated while stock lags demand.

ABC Bullion has launched a pioneering investment product that allows Australians to draw regular cashflow from their precious metal holdings.

Australia’s market is on the move again, and not always where you’d expect. We’ve found the surprise suburbs where prices are climbing fastest.