Why Prices of the World’s Most Expensive Handbags Keep Rising

Designers are charging more for their most recognisable bags to maintain the appearance of exclusivity as the industry balloons

The price of a basic Hermès Birkin handbag has jumped $1,000. This first-world problem for fashionistas is a sign that luxury brands are playing harder to get with their most sought-after products.

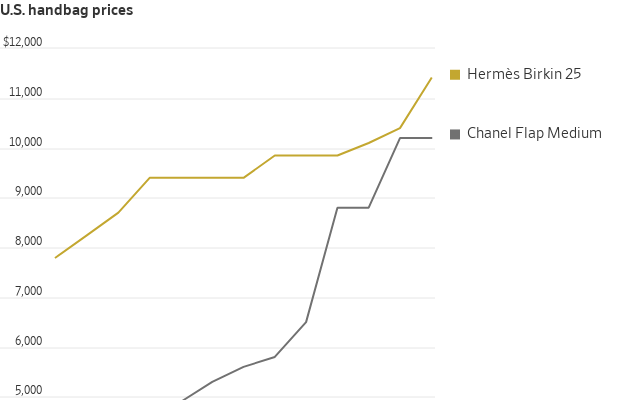

Hermès recently raised the cost of a basic Birkin 25-centimeter handbag in its U.S. stores by 10% to $11,400 before sales tax, according to data from luxury handbag forum PurseBop. Rarer Birkins made with exotic skins such as crocodile have jumped more than 20%. The Paris brand says it only increases prices to offset higher manufacturing costs, but this year’s increase is its largest in at least a decade.

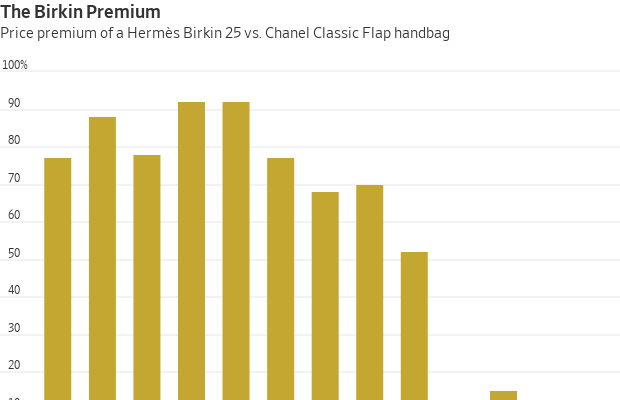

The brand may feel under pressure to defend its reputation as the maker of the world’s most expensive handbags. The “Birkin premium”—the price difference between the Hermès bag and its closest competitor , the Chanel Classic Flap in medium—shrank from 70% in 2019 to 2% last year, according to PurseBop founder Monika Arora. Privately owned Chanel has jacked up the price of its most popular handbag by 75% since before the pandemic.

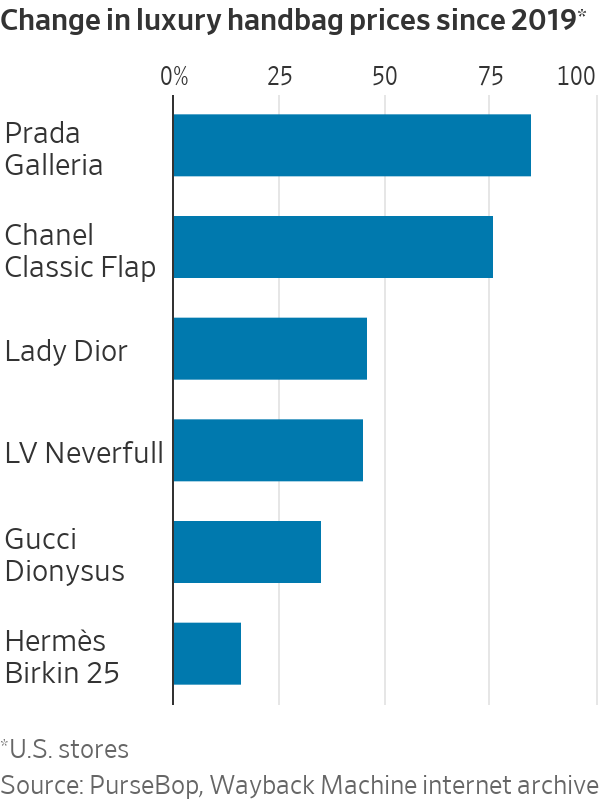

Eye-watering price increases on luxury brands’ benchmark products are a wider trend. Prada ’s Galleria bag will set shoppers back a cool $4,600—85% more than in 2019, according to the Wayback Machine internet archive. Christian Dior ’s Lady Dior bag and the Louis Vuitton Neverfull are both 45% more expensive, PurseBop data show.

With the U.S. consumer-price index up a fifth since 2019, luxury brands do need to offset higher wage and materials costs. But the inflation-beating increases are also a way to manage the challenge presented by their own success: how to maintain an aura of exclusivity at the same time as strong sales.

Luxury brands have grown enormously in recent years, helped by the Covid-19 lockdowns, when consumers had fewer outlets for spending. LVMH ’s fashion and leather goods division alone has almost doubled in size since 2019, with €42.2 billion in sales last year, equivalent to $45.8 billion at current exchange rates. Gucci, Chanel and Hermès all make more than $10 billion in sales a year. One way to avoid overexposure is to sell fewer items at much higher prices.

Many aspirational shoppers can no longer afford the handbags, but luxury brands can’t risk alienating them altogether. This may explain why labels such as Hermès and Prada have launched makeup lines and Gucci’s owner Kering is pushing deeper into eyewear. These cheaper categories can be a kind of consolation prize. They can also be sold in the tens of millions without saturating the market.

“Cosmetics are invisible—unless you catch someone applying lipstick and see the logo, you can’t tell the brand,” says Luca Solca, luxury analyst at Bernstein.

Most of the luxury industry’s growth in 2024 will come from price increases. Sales are expected to rise by 7% this year, according to Bernstein estimates, even as brands only sell 1% to 2% more stuff.

Limiting volume growth this way only works if a brand is so popular that shoppers won’t balk at climbing prices and defect to another label. Some companies may have pushed prices beyond what consumers think they are worth. Sales of Prada’s handbags rose a meagre 1% in its last quarter and the group’s cheaper sister label Miu Miu is growing faster.

Ramping up prices can invite unflattering comparisons. At more than $2,000, Burberry ’s small Lola bag is around 40% more expensive today than it was a few years ago. Luxury shoppers may decide that tried and tested styles such as Louis Vuitton’s Neverfull bag, which is now a little cheaper than the Burberry bag, are a better buy—especially as Louis Vuitton bags hold their value better in the resale market.

Aggressive price increases can also drive shoppers to secondhand websites. If a barely used Prada Galleria bag in excellent condition can be picked up for $1,500 on luxury resale website The Real Real, it is less appealing to pay three times that amount for the bag brand new.

The strategy won’t help everyone, but for the best luxury brands, stretching the price spectrum can keep the risks of growth in check.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Hand-built in Melbourne and limited to just 10 cars a year, the Zeigler/Bailey Z/B 4.4 is reshaping what a modern collector car can be.

Three completed developments bring a quieter, more thoughtful style of luxury living to Mosman, Neutral Bay and Crows Nest.

Capital Haus has snapped up Adelaide stalwart Baker Young, lifting its funds under management beyond AUD$1 billion and signalling a generational shift in the advice industry.

Capital Haus has moved to expand its national presence with the acquisition of Adelaide advisory firm Baker Young, one of Australia’s longest-standing private wealth practices.

The deal will see the combined group’s funds under management exceed AUD$1 billion, as adviser numbers and client coverage grow across the country.

Founded more than 40 years ago by Alan Young and David Baker, Baker Young today serves over 6,000 clients and manages AUD$700 million in assets.

Under the agreement, the Baker Young brand will be retained, and senior principals including Young and Baker will continue in active advisory roles.

Capital Haus will also migrate its existing clients to the refreshed ‘Baker Young, a Capital Haus company’ banner, which becomes its flagship advisory business.

A new offering for ultra-high-net-worth clients, Baker Young Private, will be introduced, providing access to wholesale opportunities, global private credit financing and capital raises.

Both firms’ clients will continue working with their current advisers, while gaining access to broader group-level capability, including global research, multi-asset solutions and cross-border services. Baker Young will also gain upgraded institutional-grade infrastructure and portfolio management systems.

The acquisition adds further momentum to Capital Haus’ expansion. Established in Sydney in 2019, the company has since launched offices in Dubai and Zurich and acquired practices in Townsville and Bateman’s Bay.

With the addition of Baker Young’s team, plus new managers from RiverX Investment Management and Active Super, the group now employs 41 advisers and support staff.

Brendan Gow, Founder and CEO of Capital Haus Group, said: “Baker Young has been a cornerstone of South Australia’s advice community for four decades, built on deep relationships and trust. We feel privileged to be the next custodian of that legacy.

“By moving our existing client base across to the Baker Young brand, as well as launching the new Baker Young Private service, this deal represents more than just a passing-the-torch moment. We’re combining heritage and innovation to set a new standard for financial advice at a time when the industry needs it most.”

The acquisition lands at a pivotal moment for the sector. Adviser numbers have halved since 2018, falling from around 28,900 to fewer than 15,300 as at September 2025, even as demand surges.

More than 10.2 million Australian adults were seeking financial advice in 2024, driven in part by intergenerational wealth transfer and growing expectations from Millennials and Gen Z for both trusted relationships and digitally enabled service.

Alan Young, Co-Founder and Joint MD of Baker Young, said: “For 40 years, our focus has been simple: put clients first and build relationships that span generations. Capital Haus shares that philosophy.

“We are planning for the long term – for our clients, our team and our brand. Becoming part of the Capital Haus Group means our legacy will endure, while also providing stability for clients, as well as access to exciting new opportunities. It is the right succession step for our practice and a positive evolution for our clients.”

David Baker, Co-Founder and Joint MD, added: “We’ve spent four decades building Baker Young on a foundation of trust, personalised service, and consistent performance. We’re energised by the shared vision Capital Haus is pursuing and we’re proud to be part of it.”

Gow said: “We believe the future of advice belongs to firms that can combine old-fashioned relationship banking with modern, global wealth capabilities. By bringing Baker Young into the Capital Haus family, we’re preserving one of Australia’s great advisory brands while building a platform that can serve the next generation of investors.”

Australia’s market is on the move again, and not always where you’d expect. We’ve found the surprise suburbs where prices are climbing fastest.

From office parties to NYE fireworks, here are the bottles that deserve pride of place in the ice bucket this season.