China’s Ghost Cities Are a Problem for Europe’s Luxury Brands, Too

Chinese consumers watching the value of their homes fall are losing the confidence to spend on designer goods

How closely is demand for $3,000 handbags tied to home prices in China? Quite closely, it turns out, which is unfortunate for luxury brands.

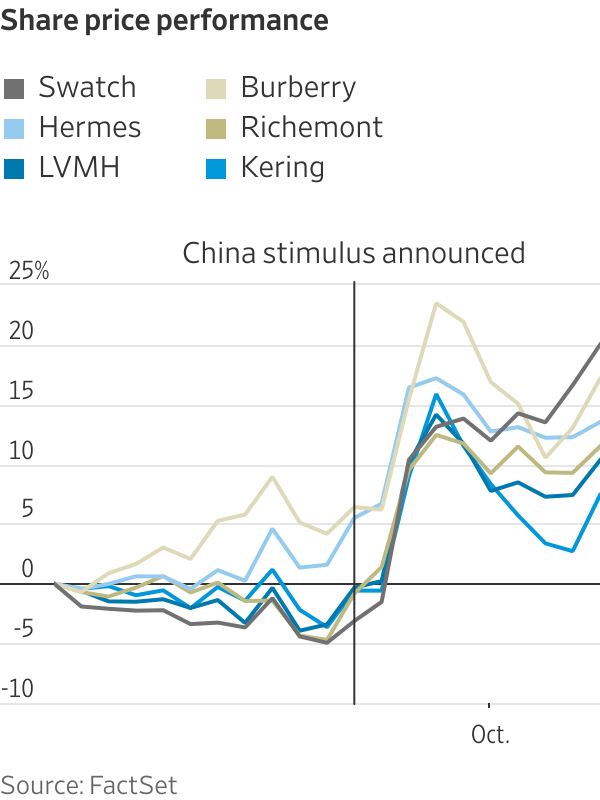

Europe’s luxury stocks fell in early trading Tuesday after China’s economic planning agency failed to announce additional measures to kickstart growth that some investors had hoped for. The sector is still up 10% on average since Beijing launched its initial stimulus plans late last month.

Beijing hopes a cut to mortgage rates, and lower down-payment requirements for buyers of second homes, will jump-start the country’s troubled housing market. A package of loans to brokers and insurers to buy Chinese shares has had initial success at lifting the stock market.

Luxury spending in China has traditionally been more correlated with its home prices than with the financial markets or overall economic growth. Around 60% of net household wealth was tied up in property before prices peaked in 2021. Barclays estimates that falling home prices have destroyed about $18 trillion in household wealth since then, which is equivalent to roughly $60,000 per family.

This, along with worries about the wider economy, is hurting consumer confidence. Retail sales rose just 2.1% in August compared with the same month last year, according to data from China’s National Bureau of Statistics. When global luxury brands start to report their third-quarter results next week, Chinese demand is expected to have slowed since they last updated investors.

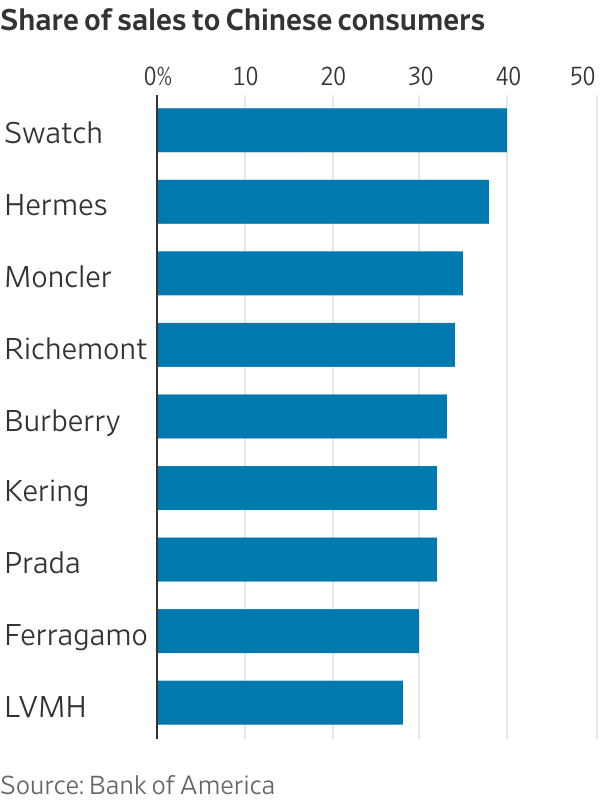

Flagging sales come at an unhelpful time for Europe’s luxury companies, which rely on Chinese consumers for a third of global luxury spending. After several bumpy years during the pandemic, luxury brands and their investors hoped that a comeback in Chinese spending would compensate for a slowdown among Europeans and Americans.

This looks increasingly unlikely. Luxury sales to Chinese shoppers are expected to shrink 7% in 2024 and by 3% next year, according to UBS estimates. As luxury brands have high fixed costs, including the most expensive retail rents in the world, a slowdown with such key customers could have an outsize impact on profit margins.

The last time the luxury industry went through such a rocky patch in China, barring the pandemic, was between 2014 and 2016 when Beijing was cracking down on corruption, including officials who were gifting Louis Vuitton handbags and Rolex watches in exchange for political favours. The global luxury industry barely grew for two years during China’s anticorruption drive, which also coincided with a property-market correction in the country. It didn’t help that shoppers in other markets were also tiring of logos back then.

Europe’s luxury stocks look expensive today compared with that time. As a multiple of expected earnings, listed brands’ shares now trade at a roughly 40% premium to their 2014 to 2016 average.

To justify the higher price tag, Beijing’s housing and wider economic stimulus would need to indirectly lift luxury demand. Measures rolled out so far may not be enough to slow the slide in home prices. China’s housing market is oversupplied by around 60 million units, according to Bloomberg Economics estimates.

New incentives to kick-start consumption are expected soon but will probably target mass-market products like white goods. China already rolled out trade-in subsidies for home appliances earlier this year and a range of consumption coupons.

None of this is very helpful for sellers of expensive luxury goods. For brands to see a recovery, Chinese consumers that spend anywhere from $7,000 to $43,000 a year on luxury products would need to feel much better about their finances than they currently do. Spending by this group has fallen 17% so far this year compared with the same period of 2023, according to a report by Boston Consulting Group.

Half-finished, abandoned housing estates are a big headache for China’s government, and are also on the mind of executives in Paris and Milan. Though the fortunes of luxury bosses likely isn’t high on Chinese officials’ priority list, their fates may be intertwined.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

Buyer demand, seller confidence and the First Home Guarantee Scheme are setting up a frantic spring, with activity likely to run through Christmas.

The spring property market is shaping up as the most active in recent memory, according to property experts Two Red Shoes.

Mortgage brokers Rebecca Jarrett-Dalton and Brett Sutton point to a potent mix of pent-up buyer demand, robust seller confidence and the First Home Guarantee Scheme as catalysts for a sustained run.

“We’re seeing an unprecedented level of activity, with high auction numbers already a clear indicator of the market’s trajectory,” said Sutton. “Last week, Sydney saw its second-highest number of auctions for the year. This kind of volume, even before the new First Home Guarantee Scheme (FHGS) changes take effect, signals a powerful market run.”

Rebecca Jarrett-Dalton added a note of caution. “While inquiries are at an all-time high, the big question is whether we will have enough stock to meet this demand. The market is incredibly hot, and this could lead to a highly competitive environment for buyers, with many homes selling for hundreds of thousands above their reserve.”

“With listings not keeping pace with buyer demand, buyers are needing to compromise faster and bid harder.”

Two Red Shoes identifies several spring trends. The First Home Guarantee Scheme is expected to unlock a wave of first-time buyers by enabling eligible purchasers to enter with deposits as low as 5 per cent. The firm notes this supports entry and reduces rent leakage, but it is a demand-side fix that risks pushing prices higher around the relevant caps.

Buyer behaviour is shifting toward flexibility. With competition intense, purchasers are prioritising what they can afford over ideal suburb or land size. Two Red Shoes expects the common first-home target price to rise to between $1 and $1.2 million over the next six months.

Affordable corridors are drawing attention. The team highlights Hawkesbury, Claremont Meadows and growth areas such as Austral, with Glenbrook in the Lower Blue Mountains posting standout results. Preliminary Sydney auction clearance rates are holding above 70 per cent despite increased listings, underscoring the depth of demand.

The heat is not without friction. Reports of gazumping have risen, including instances where contract statements were withheld while agents continued to receive offers, reflecting the pressure on buyers in fast-moving campaigns.

Rates are steady, yet some banks are quietly trimming variable and fixed products. Many borrowers are maintaining higher repayments to accelerate principal reduction. “We’re also seeing a strong trend in rent-vesting, where owner-occupiers are investing in a property with the eventual goal of moving into it,” said Jarrett-Dalton.

“This is a smart strategy for safeguarding one’s future in this competitive market, where all signs point to an exceptionally busy and action-packed season.”

Two Red Shoes expects momentum to carry through the holiday period and into the new year, with competition remaining elevated while stock lags demand.

Now complete, Ophora at Tallawong offers luxury finishes, 10-year defect insurance and standout value from $475,000.

ABC Bullion has launched a pioneering investment product that allows Australians to draw regular cashflow from their precious metal holdings.