Get Ready for the Full-Employment Recession

Job growth is soaring yet output is falling, by one measure. Blame a historic slump in productivity.

You would think from May’s blowout jobs report the economy was booming.

Here’s the puzzle: Other recent data suggest it is in recession.

The dichotomy emerges from the divergent behaviour of employment and output, two key indicators of economic activity.

In May, employers added 339,000 jobs, bringing the total number of jobs added this year to nearly 1.6 million, a gain of 2.5% annualised.

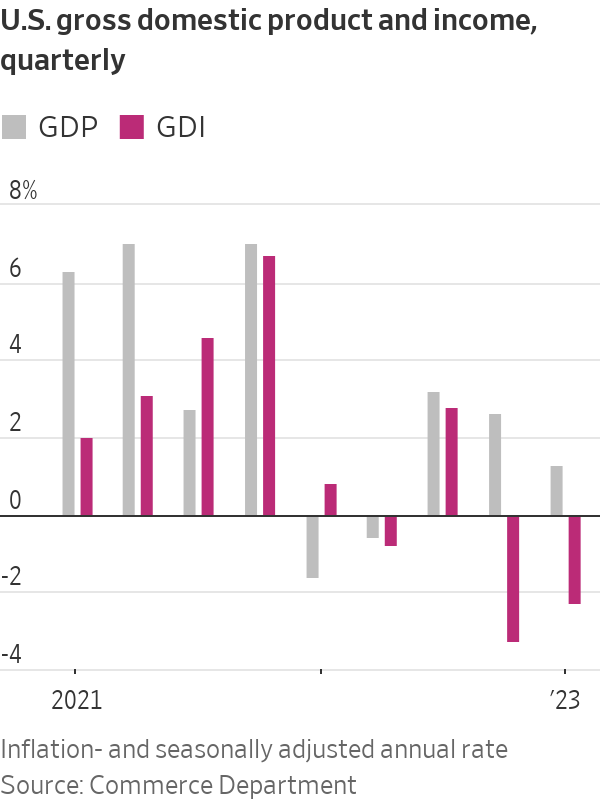

But real gross domestic income, a measure of total economic activity, shrank in both the fourth quarter and the first quarter. Two negative quarters of output growth are one indicator of a recession.

The economy has gone through periods where output has expanded faster than employment, but seldom the other way around, said Ryan Sweet, chief U.S. economist at Oxford Economics.

What explains these dissonant signals is productivity, or output per hour worked: It is cratering. That raises questions about whether the much-hyped technology adoption during the pandemic and, more recently, artificial intelligence are making a difference. It also raises the risk that the Federal Reserve will have to raise interest rates more to tame inflation.

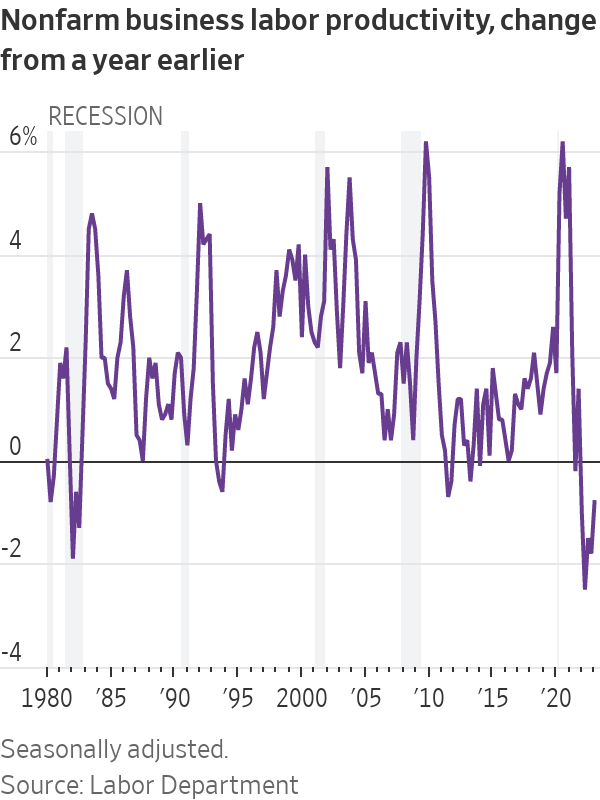

Labor productivity fell 2.1% in the first quarter from the fourth at an annual rate, and was down 0.8% in the first quarter from a year earlier, the Labor Department said Thursday. That is the fifth-straight quarter of negative year-over-year productivity growth—the longest such run since records began in 1948.

Those calculations are derived from gross domestic product, which shows output rising at a 1.3% annualised rate in the first quarter. But another key measure—gross domestic income—declined, implying an even bigger productivity collapse.

GDI is the yin to GDP’s yang, measuring incomes earned in wages and profits, while GDP tallies up purchases of goods and services produced. In theory, the two should be equal, since someone’s spending is another’s income.

They never exactly match because of statistical challenges. Lately, though, the divergence is dramatic. “Over the past two quarters, real GDP shows the economy expanding by 1.0%, not far off potential growth, whereas GDI shows it contracting by 1.4%, which amounts to a decent-sized recession,” said Paul Ashworth, chief U.S. economist at Capital Economics. The divergence is ominous: GDI previously undershot GDP dramatically during the 2007-09 financial crisis and in the early 1990s recession, Ashworth said.

The second quarter is also shaping up to be weak. S&P Global Market Intelligence sees second-quarter real GDP expanding at a 0.8% annual rate; Morgan Stanley projects 0.3%. The Atlanta Fed’s GDPNow model estimates 2%. Most economists don’t forecast GDI.

Usually, employment plummets during recessions because as factories, offices and restaurants produce less, they need fewer workers. That clearly isn’t happening. “If you look at the early 2000s, that was what was called a ‘jobless recovery,’ because employment took a long time to come back even though the economy was growing,” said Sweet. “This time around it could be the opposite—the economy could be contracting, but you’re not seeing job losses.”

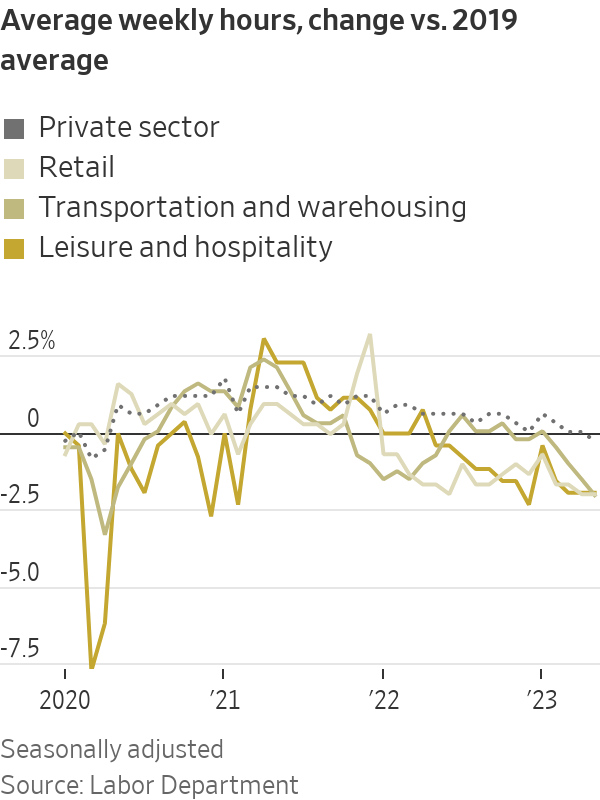

One reason could be labor hoarding. After struggling to hire and train workers during the pandemic-induced labor crunch, employers are now balking at letting them go, even as sales slip, given the labor market’s unusual tightness. There were 10.1 million vacant jobs in April, well above the 5.7 million people looking for work that month. Some firms—particularly services such as restaurants and travel-related businesses—ran short-staffed for the past couple of years and are still catching up.

A possible sign of this is hours worked per week, which in May fell slightly below the 2019 average, after having surged during the pandemic. This drop has been particularly sharp in retail and leisure-and-hospitality—industries that have been especially strapped for workers. The unemployment rate also rose in May, one sign of a potential cooling in the labour market.

It’s “not that technology got worse in the last year, but that businesses were selling less stuff and they’re nervous about their ability to attract employees, so they’re holding on to their employees,” said Jason Furman, an economist at Harvard University who served in the Obama administration. It is also plausible, he said, that the shift to working from home generated a hit to productivity, whose impact grows with the cumulative loss of creative exchange and mentoring.

Productivity growth is important in the long run because it is one of two engines of economic growth, the other being an expanding workforce. Sweet, the Oxford Economics economist, notes businesses have been spending on equipment, software and intellectual property, investments that should eventually raise productivity. Though it may take many years, so should recent advances in artificial intelligence.

A more imminent concern is that when workers produce more, companies can raise wages without increasing prices. When productivity falls, it is harder to keep inflation in check.

This could make things even more challenging for the Fed. “Companies probably have the ability to pass on higher prices to consumers if they want to,” said Neil Dutta, head of economic research at Renaissance Macro Research. “That would be problematic for the Fed.”

Moreover, if GDI is a better indicator of output than GDP, “it would mean that the economy has slowed more than we had thought, without bringing down inflation that much,” Furman said. That might mean it will ultimately take an even bigger economic pullback “to bring inflation down.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

The PG rating has become the king of the box office. The entertainment business now relies on kids dragging their parents to theatres.

From farm-to-table Thai to fairy-lit mango trees and Coral Sea vistas, Port Douglas has award-winning dining and plenty of tropical charm on the side.

Selloff in bitcoin and other digital tokens hits crypto-treasury companies.

The hottest crypto trade has turned cold. Some investors are saying “told you so,” while others are doubling down.

It was the move to make for much of the year: Sell shares or borrow money, then plough the cash into bitcoin, ether and other cryptocurrencies. Investors bid up shares of these “crypto-treasury” companies, seeing them as a way to turbocharge wagers on the volatile crypto market.

Michael Saylor pioneered the move in 2020 when he transformed a tiny software company, then called MicroStrategy , into a bitcoin whale now known as Strategy. But with bitcoin and ether prices now tumbling, so are shares in Strategy and its copycats. Strategy was worth around $128 billion at its peak in July; it is now worth about $70 billion.

The selloff is hitting big-name investors, including Peter Thiel, the famed venture capitalist who has backed multiple crypto-treasury companies, as well as individuals who followed evangelists into these stocks.

Saylor, for his part, has remained characteristically bullish, taking to social media to declare that bitcoin is on sale. Sceptics have been anticipating the pullback, given that crypto treasuries often trade at a premium to the underlying value of the tokens they hold.

“The whole concept makes no sense to me. You are just paying $2 for a one-dollar bill,” said Brent Donnelly, president of Spectra Markets. “Eventually those premiums will compress.”

When they first appeared, crypto-treasury companies also gave institutional investors who previously couldn’t easily access crypto a way to invest. Crypto exchange-traded funds that became available over the past two years now offer the same solution.

BitMine Immersion Technologies , a big ether-treasury company backed by Thiel and run by veteran Wall Street strategist Tom Lee , is down more than 30% over the past month.

ETHZilla , which transformed itself from a biotech company to an ether treasury and counts Thiel as an investor, is down 23% in a month.

Crypto prices rallied for much of the year, driven by the crypto-friendly Trump administration. The frenzy around crypto treasuries further boosted token prices. But the bullish run abruptly ended on Oct. 10, when President Trump’s surprise tariff announcement against China triggered a selloff.

A record-long government shutdown and uncertainty surrounding Federal Reserve monetary policy also have weighed on prices.

Bitcoin prices have fallen 15% in the past month. Strategy is off 26% over that same period, while Matthew Tuttle’s related ETF—MSTU—which aims for a return that is twice that of Strategy, has fallen 50%.

“Digital asset treasury companies are basically leveraged crypto assets, so when crypto falls, they will fall more,” Tuttle said. “Bitcoin has shown that it’s not going anywhere and that you get rewarded for buying the dips.”

At least one big-name investor is adjusting his portfolio after the tumble of these shares. Jim Chanos , who closed his hedge funds in 2023 but still trades his own money and advises clients, had been shorting Strategy and buying bitcoin, arguing that it made little sense for investors to pay up for Saylor’s company when they can buy bitcoin on their own. On Friday, he told clients it was time to unwind that trade.

Crypto-treasury stocks remain overpriced, he said in an interview on Sunday, partly because their shares retain a higher value than the crypto these companies hold, but the levels are no longer exorbitant. “The thesis has largely played out,” he wrote to clients.

Many of the companies that raised cash to buy cryptocurrencies are unlikely to face short-term crises as long as their crypto holdings retain value. Some have raised so much money that they are still sitting on a lot of cash they can use to buy crypto at lower prices or even acquire rivals.

But companies facing losses will find it challenging to sell new shares to buy more cryptocurrencies, analysts say, potentially putting pressure on crypto prices while raising questions about the business models of these companies.

“A lot of them are stuck,” said Matt Cole, the chief executive officer of Strive, a bitcoin-treasury company. Strive raised money earlier this year to buy bitcoin at an average price more than 10% above its current level.

Strive’s shares have tumbled 28% in the past month. He said Strive is well-positioned to “ride out the volatility” because it recently raised money with preferred shares instead of debt.

Cole Grinde, a 29-year-old investor in Seattle, purchased about $100,000 worth of BitMine at about $45 a share when it started stockpiling ether earlier this year. He has lost about $10,000 on the investment so far.

Nonetheless, Grinde, a beverage-industry salesman, says he’s increasing his stake. He sells BitMine options to help offset losses. He attributes his conviction in the company to the growing popularity of the Ethereum blockchain—the network that issues the ether token—and Lee’s influence.

“I think his network and his pizzazz have helped the stock skyrocket since he took over,” he said of Lee, who spent 15 years at JPMorgan Chase, is a managing partner at Fundstrat Global Advisors and a frequent business-television commentator.

ABC Bullion has launched a pioneering investment product that allows Australians to draw regular cashflow from their precious metal holdings.

From mud baths to herbal massages, Fiji’s heat rituals turned one winter escape into a soul-deep reset.