Are We Ready to Debate the Housing Crisis and Face Reality

ANALYSIS:

As the final-term Reserve Bank Governor, Philip Lowe, faced the House of Representatives Standing Committee on Economics last Friday, a sigh of relief was shared amongst mortgage holders that “the worst is over” regarding the fight against inflation. It only took 12 interest rate hikes to bring inflation at bay in the quickest contraction in monetary policy in Australia’s modern history. As many Australian mortgage holders are now tipping over the wretched mortgage cliff, we see signs within leading economic indicators such as retail sales, consumer business confidence and mortgage arrears, that there is much more pain to come.

To many people’s surprise, the economy has been incredibly resilient, despite stubbornly persistent rental and service inflation. Raising interest rates is unlikely to reduce these two lingering inflationary pests substantially. As further critical economic data comes to light, we believe the justification for further interest rises will soon abate.

At the same time, Australia’s largest trading partner, China, is experiencing the unthinkable ‘deflation’, which may have a contagion impact on our economy and prompt us to anticipate rate cuts sooner than we expect, leading to revisions in rate forecasts.

As the inflation storm clouds begin to settle down, we can assess the damage caused, especially concerning ongoing cost-of-living crises, inequitable wealth distribution, rental crises and falling labour productivity.

The Structural Problem

The most significant casualty is the housing market, specifically its ability to supply sufficient housing to keep rents stable and improve affordability. At the peak of the interest rate cycle and property unaffordability, it is economically strange that property prices are bucking the trend and have increased 9% from the trough to its current heights, reinforcing that something is fundamentally wrong with the housing market.

The first glaring issue in our current structural problem is rampant rental growth. CoreLogic’s latest July figures confirm annual national rental growth at 9.4% p.a. In the months ahead, there will surely be a vibrant, albeit distressing, public debate examining perhaps one of the biggest threats to our economy and quality of life: the dreaded ‘Housing Crisis’.

Our current Prime Minister, Anthony Albanese, will no doubt attempt to unify the states and territories to find an appropriate, balanced solution to ease the rental crisis and increase the supply of properties as he goes into this week’s cabinet meeting.

Rental Market and Rent Freezes

Sydney, and Australia more broadly, grapple with a clear rental crisis as we observe low vacancy rates (0.9%) and soaring rents.11 With 31% of Australians being renters,12 these issues impact a large, vulnerable demographic, who feel the full impacts associated with cost-of-living pressures. This is playing out not only as an economic issue but as an ongoing social issue that warrants immediate attention from politicians.

11 Vacancy rates: August 2022 (domain.com.au).

12 Housing statistics in Australia: home ownership & rent | Savings.com.au.

13The ACT is the only territory to limit rent increases but tenant groups say gaps in protection leave tenants vulnerable | The Canberra Times | Canberra, ACT.

14 https://www.abc.net.au/news/2023-08-11/asx-markets-business-live-news-philip-lowe-rba-inflation/102716942.

As a result, many people across the political spectrum propose rent control as a solution. However, such measures may backfire, as seen in ACT.13 As Philip Lowe recently made clear, rent control could be a short-term solution to improve housing affordability; however, in the long-term, such a solution will prove inadequate as the fundamental structural problem of low housing supply will persist.14

This is because a cap on rent increases would discourage property development and investment, leading to a lower supply and higher rents in the long-term, as observed in San Francisco and Ireland.15 These rental rules burden property investors as they are not given a reprieve from an increase in mortgage repayments and holding costs, which will drive much-needed investment away from the property sector.

When it comes to increasing supply, property developers and investors are the essential lubrication that enable the property machine to function. Therefore, even rumours of

additional tax for property investors is enough to spook and jeopardise the pipeline for much-needed developments, which is already significantly insufficient to meet current demand.

As Philip Lowe echoed his view on this matter at the parliamentary committee, government interventions in the rental market via rent freezes and caps have immediate short-term gains. However, it does not resolve long-term structural problems and only exacerbates these issues in the future.16

The key to addressing the crisis lies in increasing the housing supply. Government inefficiencies, especially with regard to planning systems, stifle progress. Efforts to aid homebuyers through subsidies, which has been a popular policy in the past, can also inadvertently drive-up housing prices.

Why has so Much Gone so Wrong so Quickly

There has been a long history of housing stock deficiency in Australia; we need to build enough property to meet demand, especially since the immigration reprieve experienced during COVID-19 lockdowns is slowly fading away. Once international borders reopened, net migration skyrocketed, with future forecasts migration and total population growth remaining elevated.

This is placing further pressure on our fragile construction industry, which has experienced a once-in-a-lifetime perfect storm. This is especially so for builders operating within the residential sector, who are locked into fixed-price contracts, and have dealt with construction costs flying up by 30%-40%, La Niña (a climate pattern leading to greater rainfall in Australia), supply chain issues, rising interest costs, labour shortages, as well as COVID-19 lockdowns and disruptions, whilst on thin margins. Unsurprisingly, ASIC data shows 1031 construction companies falling to the liquidator’s knife – more than anytime experienced over the past decade.

Project Feasibility

Traditionally, many medium to large-scale development projects take 3-6 years to obtain necessary approvals, then a further 8-12 months to obtain construction certificates. This is followed by off-plan marketing campaigns to get enough sales to meet financiers’ requirements even before the first shovel hits the ground. Not to mention it also takes time for councils to consider re-zoning.

Construction costs over the past three years have skyrocketed by 30-40% due to inflation and labour shortages within the sector. Land values typically remain constant and do not provide room for adjustment. This has resulted in many approved projects being shelved as developers wait for property prices to increase enough to compensate for construction costs, holding costs and greater demand for purchasers to buy off-the-plan.

Ultimately, the supply component of the property market is driven by the private sector – an army of mum-and-dad investors to established property developers. Unfortunately, making money on property projects is at one of its most challenging times in decades, further contributing to the challenge of providing property supply to the system.

Planning and Rezoning Process

We also want to avoid knee-jerk, desperate planning outcomes as well as unnecessary rezoning of more farmland and urban sprawl, which have only been short-term fixes to the underlying problem of inadequate supply; however, in most cases, this does not generate net gains as the benefits are outweighed by government spending and immense costs on infrastructure projects.

It takes 4-8 years for councils to consider large-scale rezoning projects properly. Nevertheless, we should look at best practices and improve the bureaucratic red tape to avoid future property price and rental increases; however, make no mistake – there is no quick fix.

Solutions to the housing crisis will involve all levels of government coordination, patience, well-measured policies, and a deep understanding of the delicate balance between different stakeholders’ interests.

In short, the housing crisis is here to stay for several years. We will continue having to talk about it and lay blame to governments, developers, builders, and investors. The government’s job is to make the planning system more efficient, promote property development and investment, and let the market deliver supply based on demand.

Ultimately, market forces will result in property prices remaining elevated and, over time, property will attract capital once the perceived market risk normalises. We should then see the necessary supply to meet demand.

Msquared Capital is a private credit provider with investment opportunities backed by quality property along the Eastern Seaboard; we ensure that all investment opportunities are based on risk-to-reward as our core offering and performance. Mortgage funds perform well during volatile times, and capital preservation is regular, with a reliable monthly income that gives our investors peace of mind.

Formula 1 may be the world’s most glamorous sport, but for Oscar Piastri, it’s also one of the most lucrative. At just 24, Australia’s highest-paid athlete is earning more than US$40 million a year.

From gorilla encounters in Uganda to a reimagined Okavango retreat, Abercrombie & Kent elevates its African journeys with two spectacular lodge transformations.

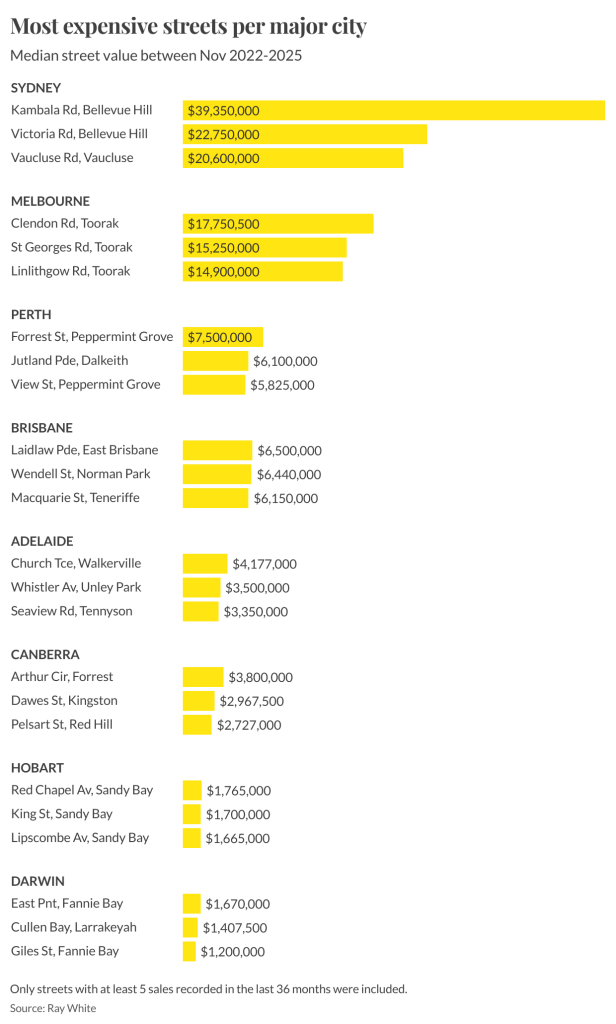

Ray White senior data analyst Atom Go Tian says Sydney’s elite postcodes are pulling further ahead, with Bellevue Hill dominating the nation’s most expensive streets in 2025.

Sydney has cemented its status as the nation’s luxury capital, with Kambala Road in Bellevue Hill being Australia’s most expensive street this year, posting a median house price of $39.35 million.

And, according to Ray White senior data analyst Atom Go Tian, last year’s leader, Wolseley Road, was excluded from this year’s rankings due to limited sales.

“Wolseley Road recorded only three sales this year and was therefore excluded from the rankings, though its $51.5 million median would have otherwise retained the top position,” he says.

Bellevue Hill continues its dominance, accounting for six of the nation’s top 10 streets. Tian says the suburb’s appeal lies in its rare blend of location and lifestyle advantages.

“The suburb’s enduring appeal lies in its rare combination of proximity to both the CBD and multiple beaches, harbour views, and large estate-sized blocks on tree-lined streets.”

Vaucluse remains a powerhouse in its own right. “Vaucluse extends this harbourside premium with even more direct beach access and panoramic water views,” he says.

The gulf between Sydney and the rest of the country remains striking.

According to Tian, “Sydney’s most expensive streets are more than five times more expensive than the leading streets in Perth and Brisbane, and more than 10 times the premium streets in Canberra and Adelaide.”

He attributes this to Sydney’s economic role and geographic constraints, describing it as “Australia’s financial capital and its most internationally connected city.”

Beyond Sydney, each capital city has developed its own luxury hierarchy. Tian highlights Melbourne’s stronghold in Toorak, noting that “Melbourne’s luxury market remains centred around Toorak, led by Clendon Road, St Georges Road and Linlithgow Road.”

Brisbane’s prestige pockets are more dispersed: “Brisbane’s luxury real estate shows a more diverse pattern,” he says, led by Laidlaw Parade at $6.5 million. Perth’s top-end market remains anchored in the Peppermint Grove–Dalkeith corridor, with Forrest Street at $7.5 million.

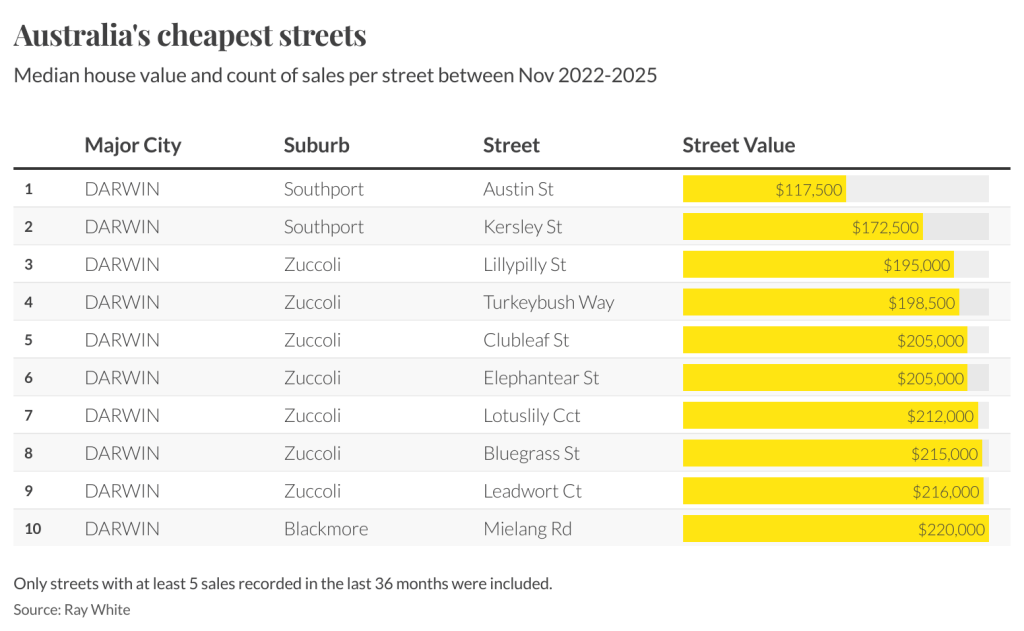

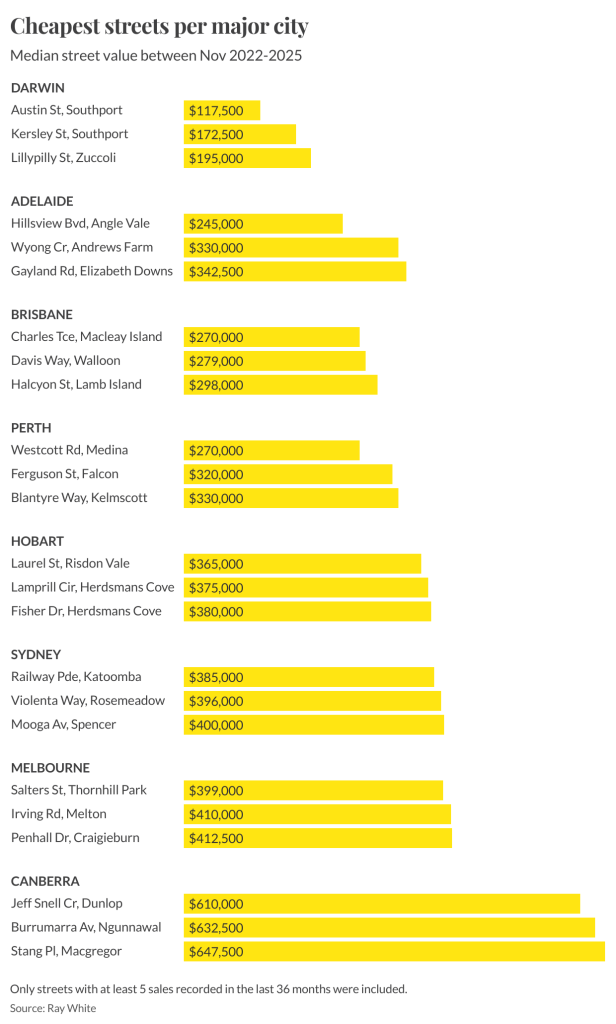

He also points to the stark contrast at the lower end of the spectrum. “Darwin presents a mirror image, hosting all 10 of the country’s cheapest streets,” Tian says. Austin Street in Southport sits at just $117,500.

The national spread reaches its extreme in New South Wales. “Sydney emerges as the most polarised market, spanning an extraordinary range from Railway Parade in Katoomba at $385,000 to Kambala Road’s $39.35 million,” Tian says.

Methodology: Tian’s analysis examines residential house sales between November 2022 and November 2025, with only streets recording at least five sales included. Several streets with higher medians, including Black Street, Queens Avenue and Clairvaux Road in Vaucluse, were excluded because they did not meet the sales threshold.

When the Writers Festival was called off and the skies refused to clear, one weekend away turned into a rare lesson in slowing down, ice baths included.

Once a sleepy surf town, Noosa has become Australia’s prestige property hotspot, where multi-million dollar knockdowns, architectural showpieces and record-setting sales are the new normal.