Money Angst? You Might Consider a Financial Therapist

Unconscious beliefs and emotions can mess up how people handle their finances. The hard part is finding experts qualified to handle both money and the mind.

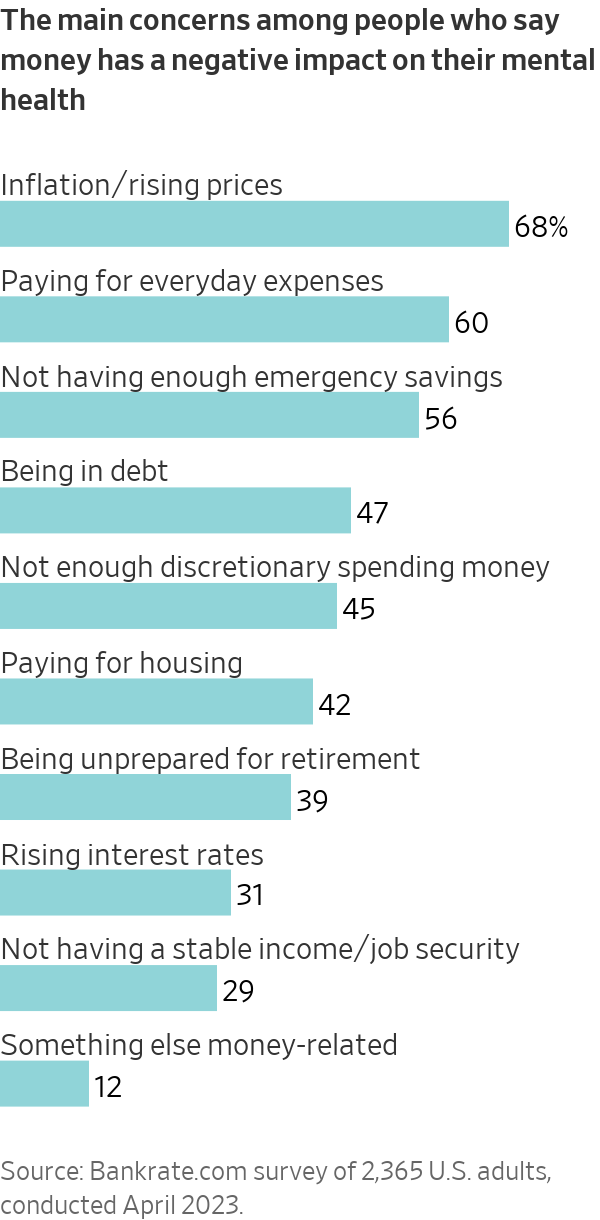

Do you worry a lot about higher food and gas bills? Fight with your spouse over spending splurges? Fear you’ll outlive your savings?

Some people seek to ease such money anxieties by hiring a financial therapist.

The goal of financial therapists ultimately is to help people make good financial decisions, typically by raising their clients’ awareness of how their emotions and unconscious beliefs have affected their sometimes messy experiences with money.

Needs for such help often arise following a job loss, bankruptcy or marital partner’s financial infidelity—when one spouse hides or misrepresents financial information from the other. Even something seemingly positive, such as getting a big inheritance or winning a lottery, can cause financial anxiety.

“Folks are craving help with financial well-being,’’ says Ashley Agnew , president of the Financial Therapy Association, a professional group launched in 2009.

Financial therapists tend to come from mental-health and financial-planning disciplines, and there are signs that their ranks are rising: The Financial Therapy Association has 430 members, up from 225 in 2015. Still, according to the group, fewer than 100 financial therapists have completed its certification process, introduced in 2019. You can be an association member without being certified by it.

The reason for the increased interest is clear: Many Americans are worried about their personal finances. In a survey of about 3,000 U.S. adults conducted last October by Fidelity Investments, more than one-third of respondents said they were in “worse financial shape” than in the previous year. Some 55% of those respondents blamed inflation and cost-of-living increases.

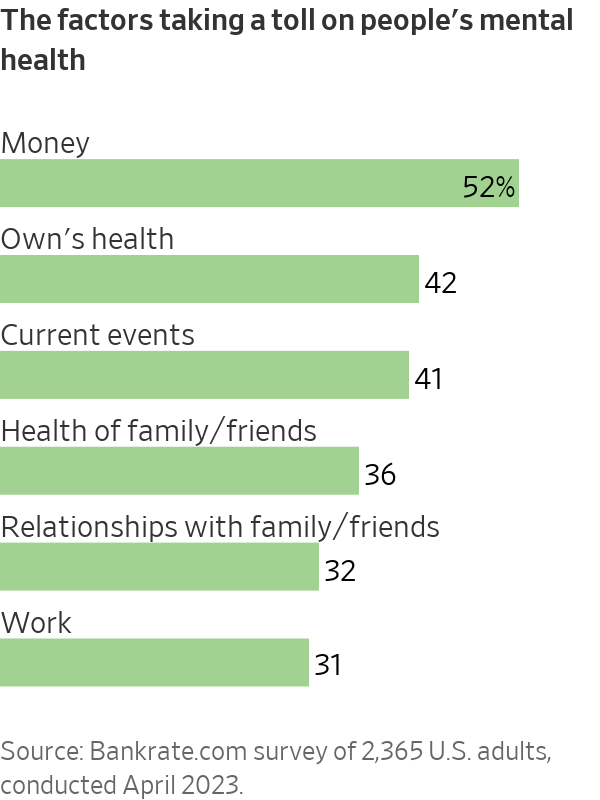

Similarly, 52% of 2,365 Americans polled for Bankrate.com said money negatively affected their mental health in 2023. That is 10 percentage points higher than in 2022. Financially anxious and stressed individuals are less likely to plan for retirement, prior research has concluded.

Messy divorce

New York advisory firm Francis Financial hired financial therapist Allen Sakon last November to aid individual clients. Many are divorced or widowed women with complicated money problems.

Certain clients “don’t believe they have enough resources, even though objectively they do,” says Sakon, who is a certified financial therapist, financial planner and accountant. Meanwhile, others with limited means mistakenly believe “they can live as extravagantly as they want,’’ she says.

Sakon currently counsels a recently divorced woman who is struggling with her dramatically lower income and the imminent sale of the family’s suburban New York home. “Her world has been turned upside down” by a financially messy divorce, Sakon says.

Though the woman has stressful new money responsibilities, she long avoided financial decisions, according to Sakon. “A money-avoidant grown-up is typically someone who was excluded from money discussions as a child,” she says.

Sakon says she hopes to eventually help this client feel capable of making financial decisions based on her resources and the financial plan that Sakon created for her.

Nate Astle , a certified financial therapist in Kansas City, Mo., met nine times from May 2023 to February 2024 with Andrea and Gianluca Presti , a 30-something Texas couple who were having persistent spats over money. Andrea Presti , an email marketer, says she believed that “if we didn’t go to financial therapy, I was going to question our entire relationship and whether we could continue.”

The wife cites an argument over the possible purchase of an expensive new car to replace their decade-old vehicle as an example of the couple’s financial conflicts. They disagreed over whether to give up a car that still worked well.

The husband, Gianluca Presti, a music producer, says financial therapy taught him and his wife to communicate better through active listening. He says he stopped being the couple’s money gatekeeper, became more open-minded about spending—and agreed to pay up to $45,000 cash for a new car. “We have to be a team if we want to solve financial issues,” he now realises.

Astle helped the Prestis revamp their household budget as well. It now reflects each spouse’s interests by including expenditures, investments and savings.

Astle, who is also a marriage and family therapist, says he has seen his financial-therapy clients more than double to 43 since 2022.

Possible pitfalls

Still, there are possible pitfalls when hiring a financial therapist. One major drawback: Anyone can claim they are qualified to practice financial therapy.

No government agency regulates the young profession. Candidates for certification by the Financial Therapy Association must take online courses designed by the association covering financial and therapeutic techniques, counsel clients for 250 hours and pass a 100-question test. But you can call yourself a financial therapist and not be certified by the association.

Meanwhile, the cost of financial therapy varies widely—from $125 to $350 an hour, Agnew estimates. Insurance rarely covers the tab.

In addition, there is no broad evidence that financial therapy works well. No large-scale studies demonstrating the field’s effectiveness have been conducted.

Another potential downside is that financial therapists with mental-health backgrounds typically lack extensive financial-planning experience—and vice versa. It is wise to interview at least three financial therapists, experts suggest. Then, pick someone who admits the limits of their expertise.

“I am very upfront about my boundaries,” says practitioner Aja Evans , a licensed mental-health counsellor who isn’t certified in financial therapy. Evans adds that she failed the certification test but plans to take it again during 2024—and before she becomes Financial Therapy Association president in January.

She says she feels well-qualified to help clients recognise how their upbringing affects their money beliefs today. “But I am in no shape or form going to be advising you about your investments, money moves or creating a financial plan,” Evans says. For clients who want that assistance, she says, she refers them to certified financial planners and accountants she knows well.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A long-standing cultural cruise and a new expedition-style offering will soon operate side by side in French Polynesia.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The boom in casual footware ushered in by the pandemic has ended, a potential problem for companies such as Adidas that benefited from the shift to less formal clothing, Bank of America says.

The casual footwear business has been on the ropes since mid-2023 as people began returning to office.

Analyst Thierry Cota wrote that while most downcycles have lasted one to two years over the past two decades or so, the current one is different.

It “shows no sign of abating” and there is “no turning point in sight,” he said.

Adidas and Nike alone account for almost 60% of revenue in the casual footwear industry, Cota estimated, so the sector’s slower growth could be especially painful for them as opposed to brands that have a stronger performance-shoe segment. Adidas may just have it worse than Nike.

Cota downgraded Adidas stock to Underperform from Buy on Tuesday and slashed his target for the stock price to €160 (about $187) from €213. He doesn’t have a rating for Nike stock.

Shares of Adidas listed on the German stock exchange fell 4.5% Tuesday to €162.25. Nike stock was down 1.2%.

Adidas didn’t immediately respond to a request for comment.

Cota sees trouble for Adidas both in the short and long term.

Adidas’ lifestyle segment, which includes the Gazelles and Sambas brands, has been one of the company’s fastest-growing business, but there are signs growth is waning.

Lifestyle sales increased at a 10% annual pace in Adidas’ third quarter, down from 13% in the second quarter.

The analyst now predicts Adidas’ organic sales will grow by a 5% annual rate starting in 2027, down from his prior forecast of 7.5%.

The slower revenue growth will likewise weigh on profitability, Cota said, predicting that margins on earnings before interest and taxes will decline back toward the company’s long-term average after several quarters of outperforming. That could result in a cut to earnings per share.

Adidas stock had a rough 2025. Shares shed 33% in the past 12 months, weighed down by investor concerns over how tariffs, slowing demand, and increased competition would affect revenue growth.

Nike stock fell 9% throughout the period, reflecting both the company’s struggles with demand and optimism over a turnaround plan CEO Elliott Hill rolled out in late 2024.

Investors’ confidence has faded following Nike’s December earnings report, which suggested that a sustained recovery is still several quarters away. Just how many remains anyone’s guess.

But if Adidas’ challenges continue, as Cota believes they will, it could open up some space for Nike to claw back any market share it lost to its rival.

Investors should keep in mind, however, that the field has grown increasingly crowded in the past five years. Upstarts such as On Holding and Hoka also present a formidable challenge to the sector’s legacy brands.

Shares of On and Deckers Outdoor , Hoka’s parent company, fell 11% and 48%, respectively, in 2025, but analysts are upbeat about both companies’ fundamentals as the new year begins.

The battle of the sneakers is just getting started.

Australia’s housing market rebounded sharply in 2025, with lower-value suburbs and resource regions driving growth as rate cuts, tight supply and renewed competition reshaped the year.

From the shacks of yesterday to the sculptural sanctuaries of today, Australia’s coastal architecture has matured into a global benchmark for design.