Your Old Clothes Are Worth Billions

Secondhand apparel retail is a booming business, but turning a profit is harder than it sounds

Closets are full of unworn clothes ready for purging, thrifting is in vogue , and everybody’s looking for a good deal these days. It all sounds like a golden business opportunity—if anyone can figure it out.

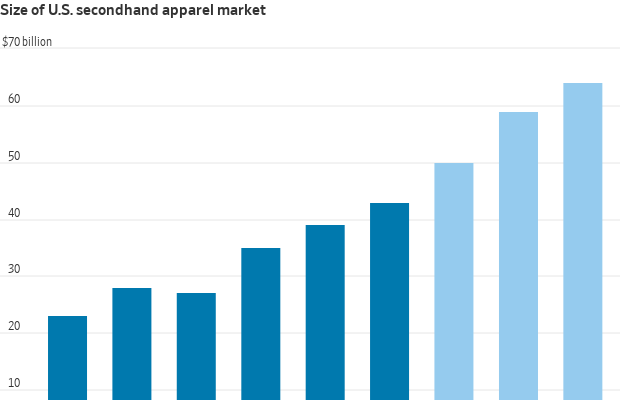

Americans on average throw away some 70 pounds of clothes a year, and thrifting is becoming more popular by the day—particularly among younger consumers. The U.S. secondhand apparel market was worth about $43 billion last year, according to an annual market report from the online apparel reseller ThredUp . It estimates that the market could grow about 11% a year on average through 2028. The market is fragmented, with about 74% of thrift stores being independently run, according to a report from Piper Sandler.

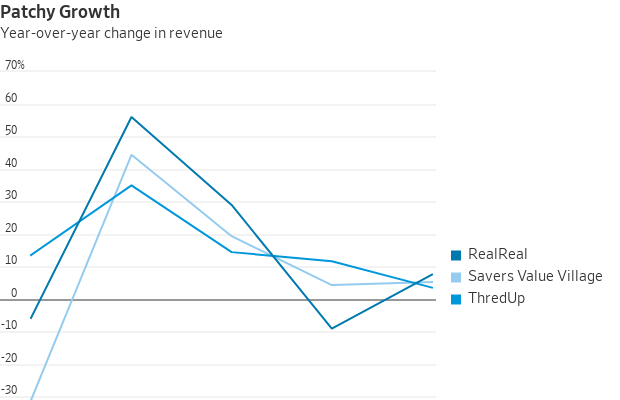

Companies specialising in thrift, though, are struggling to stitch together a compelling investment case. Shares of the online seller ThredUp and the bricks-and-mortar thrift-store chain Savers Value Village are each down around 29% year to date. The luxury online resale platform RealReal has fared better, but in large part thanks to a debt exchange it announced in late February to address liquidity concerns. ThredUp and RealReal are both down significantly from their peaks a few years back.

This could simply be air coming out of highly inflated expectations. ThredUp and the RealReal made their debuts with much fanfare in 2021 and 2019, respectively. Savers listed last year with a lofty valuation. But sales growth for all three companies has slowed, and they are all growing slower than the overall market.

Nonprofits such as Goodwill control a sizeable portion of the secondhand market, with a steady supply of donations, and eBay dominates the resale market online. ThredUp and RealReal’s bet is that consignors and buyers would be willing to pay a premium for a more convenient selling and buying experience. Sellers need only mail in or drop off their goods, and the platforms do the work of photographing, pricing and tagging each item by size, brand, colour and condition so that items are easily searchable. For RealReal, there is an extra human step of making sure the products aren’t fakes. A single-item distribution system is difficult to recreate and is therefore a powerful moat, says Dylan Carden, an equity analyst at William Blair, referring to ThredUp.

But the expensive process also means profitability is distant: Neither ThredUp nor RealReal is expected to turn a profit on the basis of generally accepted accounting principles for the next four years, according to analyst estimates polled by Visible Alpha.

Balancing the quantity of supply with quality has been difficult. ThredUp last year introduced fees that are subtracted from the payout customers receive if their items are sold on the platform. The change is meant to encourage consumers to send in high volumes of high-quality clothes. RealReal last year tweaked its commission structure to motivate consignors to send in expensive items priced above $100.

While these moves could attract higher quality, they might also divert consignors to platforms such as Poshmark and eBay, where selling involves more work but potentially higher payout. Notably, both of those marketplaces have authentication features for high-end items, and eBay has been trying to simplify sellers’ listing process through generative AI .

Meanwhile, the bricks-and-mortar Savers comes with the promise of a more efficient shopping experience than nonprofits. Piper Sandler estimates that its sales per store is nearly twice that of Goodwill and more than six times that of the Salvation Army. But the retailer faces similar quality challenges.

Only about half the items that Savers gets actually end up on the sales floor, and of those about half actually are sold, according to a company filing. Savers receives all of its items—whether directly or indirectly—by paying nonprofits by the pound for donated products. Savers has previously said that it might be able to snag higher-quality donations by placing its drop-off trailers—known as GreenDrop—near locations frequented by wealthier shoppers.

While Savers has been profitable for the past three years, same-store sales have unexpectedly slowed in recent quarters, and its investment case is highly dependent on new-store growth. This remains a risk. Previous management had trouble opening up stores because they weren’t able to procure enough supplies of secondhand clothing, notes Peter Keith, equity analyst at Piper Sandler, who is still confident about the company’s ability to expand.

Much like that shirt you only wore once, secondhand-apparel sellers so far hold more promise than substance.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

There has rarely, if ever, been so much tech talent available in the job market. Yet many tech companies say good help is hard to find.

What gives?

U.S. colleges more than doubled the number of computer-science degrees awarded from 2013 to 2022, according to federal data. Then came round after round of layoffs at Google, Meta, Amazon, and others.

The Bureau of Labor Statistics predicts businesses will employ 6% fewer computer programmers in 2034 than they did last year.

All of this should, in theory, mean there is an ample supply of eager, capable engineers ready for hire.

But in their feverish pursuit of artificial-intelligence supremacy, employers say there aren’t enough people with the most in-demand skills. The few perceived as AI savants can command multimillion-dollar pay packages. On a second tier of AI savvy, workers can rake in close to $1 million a year .

Landing a job is tough for most everyone else.

Frustrated job seekers contend businesses could expand the AI talent pipeline with a little imagination. The argument is companies should accept that relatively few people have AI-specific experience because the technology is so new. They ought to focus on identifying candidates with transferable skills and let those people learn on the job.

Often, though, companies seem to hold out for dream candidates with deep backgrounds in machine learning. Many AI-related roles go unfilled for weeks or months—or get taken off job boards only to be reposted soon after.

Playing a different game

It is difficult to define what makes an AI all-star, but I’m sorry to report that it’s probably not whatever you’re doing.

Maybe you’re learning how to work more efficiently with the aid of ChatGPT and its robotic brethren. Perhaps you’re taking one of those innumerable AI certificate courses.

You might as well be playing pickup basketball at your local YMCA in hopes of being signed by the Los Angeles Lakers. The AI minds that companies truly covet are almost as rare as professional athletes.

“We’re talking about hundreds of people in the world, at the most,” says Cristóbal Valenzuela, chief executive of Runway, which makes AI image and video tools.

He describes it like this: Picture an AI model as a machine with 1,000 dials. The goal is to train the machine to detect patterns and predict outcomes. To do this, you have to feed it reams of data and know which dials to adjust—and by how much.

The universe of people with the right touch is confined to those with uncanny intuition, genius-level smarts or the foresight (possibly luck) to go into AI many years ago, before it was all the rage.

As a venture-backed startup with about 120 employees, Runway doesn’t necessarily vie with Silicon Valley giants for the AI job market’s version of LeBron James. But when I spoke with Valenzuela recently, his company was advertising base salaries of up to $440,000 for an engineering manager and $490,000 for a director of machine learning.

A job listing like one of these might attract 2,000 applicants in a week, Valenzuela says, and there is a decent chance he won’t pick any of them. A lot of people who claim to be AI literate merely produce “workslop”—generic, low-quality material. He spends a lot of time reading academic journals and browsing GitHub portfolios, and recruiting people whose work impresses him.

In addition to an uncommon skill set, companies trying to win in the hypercompetitive AI arena are scouting for commitment bordering on fanaticism .

Daniel Park is seeking three new members for his nine-person startup. He says he will wait a year or longer if that’s what it takes to fill roles with advertised base salaries of up to $500,000.

He’s looking for “prodigies” willing to work seven days a week. Much of the team lives together in a six-bedroom house in San Francisco.

If this sounds like a lonely existence, Park’s team members may be able to solve their own problem. His company, Pickle, aims to develop personalised AI companions akin to Tony Stark’s Jarvis in “Iron Man.”

Overlooked

James Strawn wasn’t an AI early adopter, and the father of two teenagers doesn’t want to sacrifice his personal life for a job. He is beginning to wonder whether there is still a place for people like him in the tech sector.

He was laid off over the summer after 25 years at Adobe , where he was a senior software quality-assurance engineer. Strawn, 55, started as a contractor and recalls his hiring as a leap of faith by the company.

He had been an artist and graphic designer. The managers who interviewed him figured he could use that background to help make Illustrator and other Adobe software more user-friendly.

Looking for work now, he doesn’t see the same willingness by companies to take a chance on someone whose résumé isn’t a perfect match to the job description. He’s had one interview since his layoff.

“I always thought my years of experience at a high-profile company would at least be enough to get me interviews where I could explain how I could contribute,” says Strawn, who is taking foundational AI courses. “It’s just not like that.”

The trouble for people starting out in AI—whether recent grads or job switchers like Strawn—is that companies see them as a dime a dozen.

“There’s this AI arms race, and the fact of the matter is entry-level people aren’t going to help you win it,” says Matt Massucci, CEO of the tech recruiting firm Hirewell. “There’s this concept of the 10x engineer—the one engineer who can do the work of 10. That’s what companies are really leaning into and paying for.”

He adds that companies can automate some low-level engineering tasks, which frees up more money to throw at high-end talent.

It’s a dynamic that creates a few handsomely paid haves and a lot more have-nots.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

From Italy’s $93,000-a-night villas to a $20,000 Bowral château, a new global ranking showcases the priciest Airbnbs available in 2026.