Christian Dior’s $57 Handbags Have a Hidden Cost: Reputational Risk

An Italian investigation is shining a harsh light on the supply chain of luxury brands

Christian Dior struck gold when it found a supplier willing to assemble a €2,600 handbag, equivalent to around $2,816, for just €53 a piece—or did it? Cleaning up the reputational damage may not come cheap.

A Milan court named LVMH -owned Dior and Giorgio Armani as two brands whose products were made in sweatshop-like conditions in Italy. Images of an unkempt facility where designer handbags were produced, which was raided as part of an investigation into Italy’s fashion supply chain, are worlds apart from those the luxury industry likes to show its customers.

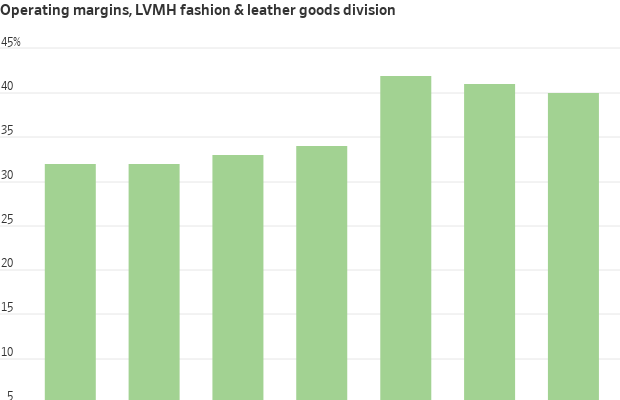

To keep up with the strong demand for their goods, some high-end brands rely on independent workshops to supplement their in-house factories. Sales at LVMH’s leather goods division have almost doubled since 2019.

While more outsourced manufacturing is understandable in a boom, brands may also have taken cost-saving measures too far in a push to juice profits. Some of Dior’s production was contracted out directly to a Chinese-run factory in Italy, where workers assembled the bags in unsafe conditions, according to a translated court order. In other instances, Dior’s suppliers subcontracted work out to low-cost factories that also used irregular labour.

Nipping the problem in the bud would require hundreds of millions of dollars worth of investment in new facilities to bring more manufacturing in-house. The alternative is for Dior to pay its suppliers more and keep them on a tighter leash. Either way, the result seems likely to be lower profits than shareholders have grown accustomed to.

Top luxury brands such as Christian Dior can have very high margins because consumers are willing to pay steep prices for goods they see as status symbols. They also can spread high fixed costs, such as expensive advertising campaigns over a large volume of sales.

For the LVMH group overall, the cost of making the products it sells—everything from Champagne to watches to cosmetics—amounted to 31% of sales in 2023. But the margins on big-brand handbags are probably at the high end of the spectrum.

Bernstein analyst Luca Solca estimates that a €10 billion luxury fashion label, roughly Dior’s size, may spend just 23% of its sales on the raw materials and labour that go into its products. This implies a €2,600 Dior purse would cost €598 to make, equivalent to $US647 for a roughly $US2,800 product at current exchange rates.

In reality, the cost may be even lower, based on the results of the Italian investigation. The €53-a-piece assembly price it cited, equivalent to around $US57, didn’t include the cost of the leather and hardware, but that would add only another €150 or so, according to one Italian supplier.

Advertising fees are a further €156 per handbag, according to Bernstein’s analysis, and depreciation of the company’s assets is €156. Running the brand’s stores—including paying the rent on some of the most exclusive shopping streets in the world—and head-office costs come to an additional €390. This leaves €1,300 of pure operating profit for Dior, or a 50% margin.

“This is the reality of the business,” says Solca. “The retail price for the goods of major luxury brands is typically between eight and 12 times the cost of making the product.”

LVMH hasn’t commented on the investigation, which first made headlines nearly a month ago. Meanwhile, a public-relations storm is brewing. Luxury influencers on social media are asking what exactly people are paying for when they shell out for a fancy purse. Recent price increases also make the cheap manufacturing costs hard to stomach. A mini Lady Dior bag that cost $3,500 in 2019 will set shoppers back $5,500 today, a 57% increase.

A dozen other luxury labels that remain unnamed are under investigation for similar issues in their Italian supply chains, so this may be a much wider problem.

Profits will take a hit if the industry decides to clean up its act. But the cost of doing nothing might be higher. Luxury brands that charge customers thousands of dollars and rely on a reputation for quality can’t afford to be cheap.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Impact investing is becoming more mainstream as larger, institutional asset owners drive more money into the sector, according to the nonprofit Global Impact Investing Network in New York.

In the GIIN’s State of the Market 2024 report, published late last month, researchers found that assets allocated to impact-investing strategies by repeat survey responders grew by a compound annual growth rate (CAGR) of 14% over the last five years.

These 71 responders to both the 2019 and 2024 surveys saw their total impact assets under management grow to US$249 billion this year from US$129 billion five years ago.

Medium- and large-size investors were largely responsible for the strong impact returns: Medium-size investors posted a median CAGR of 11% a year over the five-year period, and large-size investors posted a median CAGR of 14% a year.

Interestingly, the CAGR of assets held by small investors dropped by a median of 14% a year.

“When we drill down behind the compound annual growth of the assets that are being allocated to impact investing, it’s largely those larger investors that are actually driving it,” says Dean Hand, the GIIN’s chief research officer.

Overall, the GIIN surveyed 305 investors with a combined US$490 billion under management from 39 countries. Nearly three-quarters of the responders were investment managers, while 10% were foundations, and 3% were family offices. Development finance institutions, institutional asset owners, and companies represented most of the rest.

The majority of impact strategies are executed through private-equity, but public debt and equity have been the fastest-growing asset classes over the past five years, the report said. Public debt is growing at a CAGR of 32%, and public equity is growing at a CAGR of 19%. That compares to a CAGR of 17% for private equity and 7% for private debt.

According to the GIIN, the rise in public impact assets is being driven by larger investors, likely institutions.

Private equity has traditionally served as an ideal way to execute impact strategies, as it allows investors to select vehicles specifically designed to create a positive social or environmental impact by, for example, providing loans to smallholder farmers in Africa or by supporting fledging renewable energy technologies.

Future Returns: Preqin expects managers to rely on family offices, private banks, and individual investors for growth in the next six years

But today, institutional investors are looking across their portfolios—encompassing both private and public assets—to achieve their impact goals.

“Institutional asset owners are saying, ‘In the interests of our ultimate beneficiaries, we probably need to start driving these strategies across our assets,’” Hand says. Instead of carving out a dedicated impact strategy, these investors are taking “a holistic portfolio approach.”

An institutional manager may want to address issues such as climate change, healthcare costs, and local economic growth so it can support a better quality of life for its beneficiaries.

To achieve these goals, the manager could invest across a range of private debt, private equity, and real estate.

But the public markets offer opportunities, too. Using public debt, a manager could, for example, invest in green bonds, regional bank bonds, or healthcare social bonds. In public equity, it could invest in green-power storage technologies, minority-focused real-estate trusts, and in pharmaceutical and medical-care company stocks with the aim of influencing them to lower the costs of care, according to an example the GIIN lays out in a separate report on institutional strategies.

Influencing companies to act in the best interests of society and the environment is increasingly being done through such shareholder advocacy, either directly through ownership in individual stocks or through fund vehicles.

“They’re trying to move their portfolio companies to actually solving some of the challenges that exist,” Hand says.

Although the rate of growth in public strategies for impact is brisk, among survey respondents investments in public debt totaled only 12% of assets and just 7% in public equity. Private equity, however, grabs 43% of these investors’ assets.

Within private equity, Hand also discerns more evidence of maturity in the impact sector. That’s because more impact-oriented asset owners invest in mature and growth-stage companies, which are favored by larger asset owners that have more substantial assets to put to work.

The GIIN State of the Market report also found that impact asset owners are largely happy with both the financial performance and impact results of their holdings.

About three-quarters of those surveyed were seeking risk-adjusted, market-rate returns, although foundations were an exception as 68% sought below-market returns, the report said. Overall, 86% reported their investments were performing in line or above their expectations—even when their targets were not met—and 90% said the same for their impact returns.

Private-equity posted the strongest results, returning 17% on average, although that was less than the 19% targeted return. By contrast, public equity returned 11%, above a 10% target.

The fact some asset classes over performed and others underperformed, shows that “normal economic forces are at play in the market,” Hand says.

Although investors are satisfied with their impact performance, they are still dealing with a fragmented approach for measuring it, the report said. “Despite this, over two-thirds of investors are incorporating impact criteria into their investment governance documents, signalling a significant shift toward formalising impact considerations in decision-making processes,” it said.

Also, more investors are getting third-party verification of their results, which strengthens their accountability in the market.

“The satisfaction with performance is nice to see,” Hand says. “But we do need to see more about what’s happening in terms of investors being able to actually track both the impact performance in real terms as well as the financial performance in real terms.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.