Europe’s Stagnating Economy Falls Further Behind the U.S.

Thanks to robust growth and its relative insulation from geopolitical crisis, the U.S. economy has left Europe behind

Europe’s economy stagnated in the final three months of last year, expanding a divide between a booming U.S. economy and a European continent that is increasingly left behind.

The fresh economic data showed higher borrowing costs had compounded the earlier impact of higher energy prices in the wake of Russia’s invasion of Ukraine.

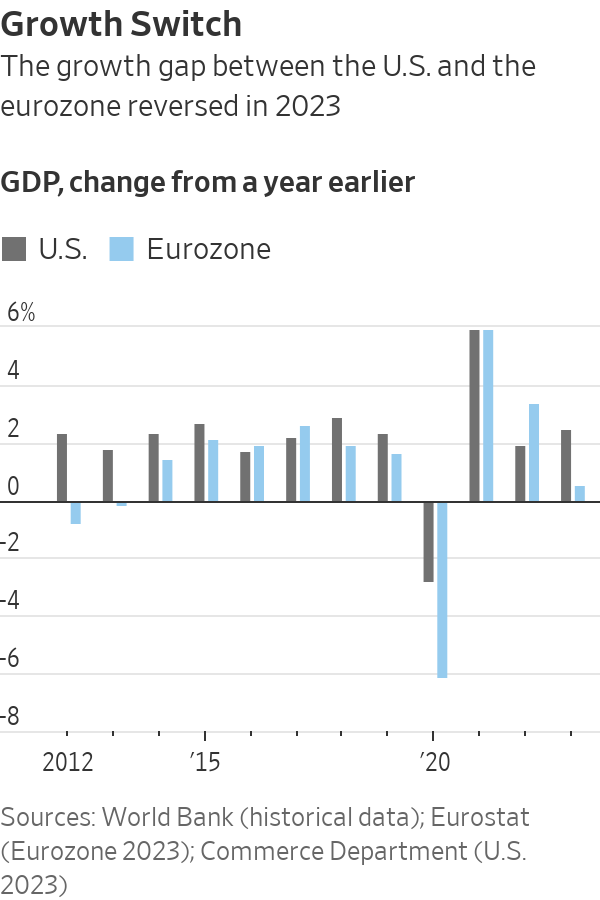

By contrast, the U.S. economy has been expanding robustly and enjoyed its strongest performance relative to the eurozone since 2013—with the exception of the Covid-19 pandemic.

One factor that is threatening to weigh further on the European economy is its proximity to geopolitical flashpoints. Russia’s war on Ukraine sent energy prices rocketing in 2022, hitting European manufacturers. The U.S., as an energy producer, was comparatively unaffected, and its natural-gas industry even benefited when it became Europe’s energy supplier of last resort after Russia throttled gas deliveries to the region.

Now the crisis in the Middle East, which has gummed up cargo traffic through the Red Sea, is adding costs to European importers and disrupting European supply chains. There too, the U.S. hasn’t suffered as much since it has alternative routes for goods coming from Asia.

Europe’s Stoxx 600 index rose 12.64% last year, a little over half the performance of the S&P 500, which rose 24.23% over the same period.

The European Union’s statistics agency Tuesday said gross domestic product in the eurozone was unchanged in the final three months of last year. That followed a decline in the three months through September. During 2023 as a whole, Eurostat recorded growth of just 0.5%, while the U.S. economy expanded by 2.5%.

Still, the divergence between the giant economic blocs is more a story of surprising U.S. strength than unanticipated weakness in the eurozone. The U.S. grew much faster than economists had expected it would at the start of 2023, while the eurozone was about as badly hit by high energy prices and rising interest rates as had been expected. Economists forecast the growth gap will narrow somewhat in the course of the year.

Europe’s policymakers don’t expect the stagnation in output to extend deep into 2024. Instead, they see a pickup in activity as wages rise faster than prices, reversing the declines in real incomes that followed the war in Ukraine and a rise in energy and food bills.

“We have the conditions for recovery that are coming into place,” said European Central Bank President Christine Lagarde Thursday. “I’m not suggesting that it’s going to pick up radically, but it’s coming into place from what we see.”

Helping Europe is the fact that energy prices are falling from post-invasion highs faster than policymakers had expected. That should help boost household spending on other goods and services and lower costs for Europe’s hard-pressed factories.

With inflation easing, the ECB is expected to lower its key interest rate later this year, which would also jolt growth by easing the pressure on household spending and business investment.

Yet the eurozone faces fresh threats too, mainly from the conflict that began with the attack on Israel by Hamas on Oct. 7. Disruptions to shipping in the Red Sea have pushed freight costs sharply higher and led to delays for European manufacturers that rely on Asian suppliers for parts. A further escalation of the conflict could reverse the decline in energy costs and stall the anticipated recovery.

The International Monetary Fund now expects the eurozone to grow by 0.9% this year, a downgrade from its previous 1.2% growth estimate, according to the Fund’s quarterly World Economic Outlook report published on Tuesday. By contrast, it sees the U.S. growing by 2.1% against its earlier 1.5% forecast.

Strong U.S. growth and an estimated 4.6% increase in China’s GDP according to the IMF should more than offset Europe’s disappointing performance and translate into a soft landing for the world economy this year. The IMF now sees the world economy growing at 3.1% this year, the same rate as last year and faster than the 2.9% growth projected in October.

“We find that the global economy continues to display remarkable resilience,” Pierre-Olivier Gourinchas, IMF Chief Economist, told reporters, pointing to the speed at which inflation had receded as a positive surprise.

He warned, however, that geopolitical distortions could reignite price increases. Core inflation—which excludes volatile energy and food prices—isn’t quite back to the pre pandemic trend, particularly for services sector prices, he said.

IMF economists also cautioned that financial markets have been overly optimistic in anticipating early rate cuts by central banks. They project policy interest rates to remain at current levels for the U.S. Federal Reserve, the European Central Bank, and the Bank of England until the second half of 2024, before gradually declining as inflation moves closer to targets. Some investors and analysts expect a Federal Reserve rate cut in the first half of this year.

Back in Europe, Tuesday’s GDP data showed Germany was the weakest of Europe’s large economies at the end of last year, with output falling in the final quarter. However, revised figures showed it avoided a contraction in the three months through September.

“The economy remains stuck in the twilight zone between recession and stagnation,” said Carsten Brzeski, an economist at ING Bank.

While Italy’s economy expanded slightly, the French economy flatlined for the second straight quarter. Ireland, which had been a major source of growth for the eurozone over the previous decade, saw its GDP fall by 1.9% in 2023 as a pandemic-driven boom in its key pharmaceutical industry ended.

In a rare bright spot, Spain finished the year with another strong quarter and matched the U.S. growth rate over 2023 as a whole, thanks to a surge in international tourism as the last of the Covid-19 restrictions were lifted.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Impact investing is becoming more mainstream as larger, institutional asset owners drive more money into the sector, according to the nonprofit Global Impact Investing Network in New York.

In the GIIN’s State of the Market 2024 report, published late last month, researchers found that assets allocated to impact-investing strategies by repeat survey responders grew by a compound annual growth rate (CAGR) of 14% over the last five years.

These 71 responders to both the 2019 and 2024 surveys saw their total impact assets under management grow to US$249 billion this year from US$129 billion five years ago.

Medium- and large-size investors were largely responsible for the strong impact returns: Medium-size investors posted a median CAGR of 11% a year over the five-year period, and large-size investors posted a median CAGR of 14% a year.

Interestingly, the CAGR of assets held by small investors dropped by a median of 14% a year.

“When we drill down behind the compound annual growth of the assets that are being allocated to impact investing, it’s largely those larger investors that are actually driving it,” says Dean Hand, the GIIN’s chief research officer.

Overall, the GIIN surveyed 305 investors with a combined US$490 billion under management from 39 countries. Nearly three-quarters of the responders were investment managers, while 10% were foundations, and 3% were family offices. Development finance institutions, institutional asset owners, and companies represented most of the rest.

The majority of impact strategies are executed through private-equity, but public debt and equity have been the fastest-growing asset classes over the past five years, the report said. Public debt is growing at a CAGR of 32%, and public equity is growing at a CAGR of 19%. That compares to a CAGR of 17% for private equity and 7% for private debt.

According to the GIIN, the rise in public impact assets is being driven by larger investors, likely institutions.

Private equity has traditionally served as an ideal way to execute impact strategies, as it allows investors to select vehicles specifically designed to create a positive social or environmental impact by, for example, providing loans to smallholder farmers in Africa or by supporting fledging renewable energy technologies.

Future Returns: Preqin expects managers to rely on family offices, private banks, and individual investors for growth in the next six years

But today, institutional investors are looking across their portfolios—encompassing both private and public assets—to achieve their impact goals.

“Institutional asset owners are saying, ‘In the interests of our ultimate beneficiaries, we probably need to start driving these strategies across our assets,’” Hand says. Instead of carving out a dedicated impact strategy, these investors are taking “a holistic portfolio approach.”

An institutional manager may want to address issues such as climate change, healthcare costs, and local economic growth so it can support a better quality of life for its beneficiaries.

To achieve these goals, the manager could invest across a range of private debt, private equity, and real estate.

But the public markets offer opportunities, too. Using public debt, a manager could, for example, invest in green bonds, regional bank bonds, or healthcare social bonds. In public equity, it could invest in green-power storage technologies, minority-focused real-estate trusts, and in pharmaceutical and medical-care company stocks with the aim of influencing them to lower the costs of care, according to an example the GIIN lays out in a separate report on institutional strategies.

Influencing companies to act in the best interests of society and the environment is increasingly being done through such shareholder advocacy, either directly through ownership in individual stocks or through fund vehicles.

“They’re trying to move their portfolio companies to actually solving some of the challenges that exist,” Hand says.

Although the rate of growth in public strategies for impact is brisk, among survey respondents investments in public debt totaled only 12% of assets and just 7% in public equity. Private equity, however, grabs 43% of these investors’ assets.

Within private equity, Hand also discerns more evidence of maturity in the impact sector. That’s because more impact-oriented asset owners invest in mature and growth-stage companies, which are favored by larger asset owners that have more substantial assets to put to work.

The GIIN State of the Market report also found that impact asset owners are largely happy with both the financial performance and impact results of their holdings.

About three-quarters of those surveyed were seeking risk-adjusted, market-rate returns, although foundations were an exception as 68% sought below-market returns, the report said. Overall, 86% reported their investments were performing in line or above their expectations—even when their targets were not met—and 90% said the same for their impact returns.

Private-equity posted the strongest results, returning 17% on average, although that was less than the 19% targeted return. By contrast, public equity returned 11%, above a 10% target.

The fact some asset classes over performed and others underperformed, shows that “normal economic forces are at play in the market,” Hand says.

Although investors are satisfied with their impact performance, they are still dealing with a fragmented approach for measuring it, the report said. “Despite this, over two-thirds of investors are incorporating impact criteria into their investment governance documents, signalling a significant shift toward formalising impact considerations in decision-making processes,” it said.

Also, more investors are getting third-party verification of their results, which strengthens their accountability in the market.

“The satisfaction with performance is nice to see,” Hand says. “But we do need to see more about what’s happening in terms of investors being able to actually track both the impact performance in real terms as well as the financial performance in real terms.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.