What the Stock Market Taught Us This Year: Don’t Fall for These Investing Traps

2023 has been a year in which investors have been more influenced by perception than reality. And that means opportunities in 2024.

The uncertainty around near-term interest rates has dominated the story of the stock market in 2023. Perhaps not since the 1970s—when runaway inflation and sky-high interest rates were the crisis du jour—has monetary policy affected investment outcomes in such a pronounced way.

Yet look more closely, and it would seem that Wall Street has been more influenced by perception than reality: Company and individual balance sheets remain mostly healthy, businesses are battle tested and unemployment remains low. Similarly, the malaise surrounding the economic environment belies what we are seeing. Cruise ships are sold out, restaurants are packed, holiday shopping was off to a strong start and 82% of S&P 500 companies reported a positive earnings surprise in the third quarter.

Still, a nervous atmosphere has undercut stock performance. Scores of share prices have been lacklustre as company fundamentals have been eclipsed by macroeconomic conjecture. We have lost the trees in the forest.

But as someone once declared, “It is a market of stocks, not a stock market.” This is a wise reminder that no matter the conditions, there are investment opportunities to be had. In fact, the more economic obfuscation, the more sectors are hammered, the more stocks are orphaned, the better the odds of long-term investment success.

After a year of hand-wringing through monetary policy guesswork and market fluctuations, many wonder how best to maneuvre in the new year. Here’s our advice: Avoiding some of the biggest market traps can be a winning strategy.

Don’t Fed-watch

“Don’t fight the Fed” is a well-known market mantra. The idea is to buy stocks when the Fed is lowering interest rates and sell when the Fed is raising them.

This psychology has dominated the stock market all year, creating a futile guessing game. Are they still raising rates? For how much longer? Will rates fall soon? Will it be a hard landing or a soft landing? But this Fed obsession, reacting to every pronouncement, simply sucks up time. It has all been noise. Despite the fear and uncertainty, dire predictions didn’t come true.

What that means is that sectors that sold off because of heightened fears—including banks, some industrial names and anything real estate related—could be well-positioned for investors willing to take a longer-term view.

After surviving a midyear crisis, for instance, the banking sector is already beginning to show signs of recovery as market anxiety subsides. Similarly, oversold housing-related stocks should rebound once people adjust to the new rate environment, and the U.S. housing shortage, exacerbated by the pandemic, drives new construction.

It doesn’t mean every sector that got hit by investor angst is ripe for buying. Commercial real estate is an obvious example. But it does mean that if you invested by watching the Fed like a tennis match, and then reacting to every volley, you will get it wrong.

Don’t buy the hype

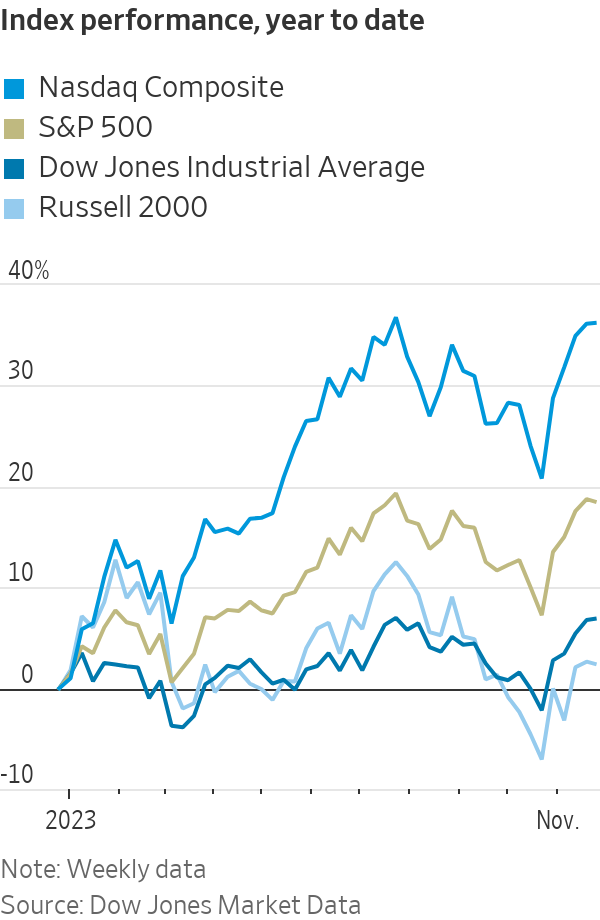

The selloff in many areas has inflicted pain that has been concealed by the cap-weighted dominance of a few celebrity stocks in the S&P 500 index. A handful of tech and tech-related stocks, weight-loss drugs and artificial-intelligence providers offer the sum total of stock-market outperformance this year. Beyond these headliners, there is less and less attention on individual names.

Those tech behemoths, dubbed the “Magnificent Seven,” account for more than 30% of the index and 87% of its return through October. Let us say that again: Just seven stocks represent one-third of the S&P 500 index. Some now consider Google parent Alphabet, Amazon.com, Apple, Facebook parent Meta Platforms, Microsoft, Nvidia and Tesla to be defensive businesses that can grow through any economic cycle.

We’ve seen this before, and the lesson is always the same: Winner-takes-all can dominate over shorter time frames but is rarely a winning bet in the long run. At some point, this narrow market supremacy will end, to the benefit of many overlooked issues.

In other words, these hyped celebrity stocks have more downside than upside from here. There are more-compelling opportunities to be had.

For example, the small-fry stocks found in the Russell 2000 index are among the most neglected shares waiting to get their due. The index has been languishing in a bear market since 2021—partially driven by their perceived economic sensitivity and partially driven by Wall Street indifference.

The result is that the total market cap of the Magnificent Seven is now three times the size of every single stock in the Russell 2000 index combined—making just seven stocks the equivalent of 6,000 small-cap names. On average, 47 analysts follow the typical Magnificent Seven stock versus just five for a small-cap name. Nine percent of smaller companies have no followers at all.

Here’s the silver lining: Less coverage means more market inefficiency means more opportunities. Stock prices trade on fundamentals. And when those solid fundamentals shine through, share prices rise. Additionally, when tepid U.S. growth inevitably picks up, small-caps are poised to strongly outperform as they have done every other time in the past.

The upshot is that you can go ahead and buy the hype if you want to, blinded by the celebrity names. But that’s not where the upside opportunities are likely to be.

Don’t anchor to the here and now

This time is different. Except it hardly ever is.

That’s a lesson investors rarely learn. Case in point: the extremely low interest rates that have persisted for much of the past two decades. Over the past 50 years, U.S. interest rates have averaged 5.98%. Today’s 5.5% rate seems high compared with the 0.25% paid during the recession of 2008, but no comparison to 1980 when rates topped out at 20%.

Similarly, at the start of the new millennium, a 30-year fixed-rate mortgage was 8.08%—basically in line with 2023 levels, but significantly higher than the bargain 2.96% rate that could be had just two years ago.

Higher interest rates now feel like a shock to our systems because we got anchored to some extreme lows. When considered in the full context of a longer history, though, they are in line.

Now people are anchored to the S&P 500 beating everything else. But just as we have seen with interest rates in 2023, the trend will revert to the mean, even if it takes a while.

Don’t fear volatility

Although it may feel uncomfortable, it is often easier to invest at the extremes—when valuations are crushed, buy signals are blaring and the bad news is priced in. Such conditions have the greatest profit potential, but the inherent volatility makes investors nervous.

This angst is playing out in the price action surrounding earnings announcements. FactSet reports that stocks are getting hit harder for negative earnings surprises. In turn, this drives up their volatility. In the third quarter, an earnings miss cost the typical company 5.2% in market value—more than twice the 2.3% average over the past five years.

Instead of running for the exits, we view volatility as our friend and actively seek to take advantage of the price movements. Everyone says they want to buy low, but when the opportunity arises, many wait for the dust to settle and miss the moneymaking moment.

Don’t bet against America

The market has turned more optimistic as the year winds down and we see plenty of value-beneath-the-surface stocks.

But even if investors have found some trees, they still have some concerns about the forest. Two terrible wars, congressional dysfunction, a border emergency and mounting unrest lurk over our economy as well as those around the globe.

In these unnerving moments, we are comforted by the faith in the resiliency of our capitalist democracy from capitalism’s own Yoda, Warren Buffett. He wrote in the 2012 Berkshire Hathaway shareholder letter, “Of course, the immediate future is unknown; America has faced the unknown since 1776…. Periodic setbacks will occur, yes, but investors and managers are in a game that is heavily stacked in their favour.”

Indeed, our markets have overcome a Great Depression, multiple recessions, global and regional conflicts, a modern-day pandemic and all other kinds of unforeseeable blows. Through it all, America has endured, and we have every reason to believe she will continue to do so.

Mellody Hobson is co-CEO and president, and John W. Rogers Jr. is founder, co-CEO and chief investment officer, of Ariel Investments.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Impact investing is becoming more mainstream as larger, institutional asset owners drive more money into the sector, according to the nonprofit Global Impact Investing Network in New York.

In the GIIN’s State of the Market 2024 report, published late last month, researchers found that assets allocated to impact-investing strategies by repeat survey responders grew by a compound annual growth rate (CAGR) of 14% over the last five years.

These 71 responders to both the 2019 and 2024 surveys saw their total impact assets under management grow to US$249 billion this year from US$129 billion five years ago.

Medium- and large-size investors were largely responsible for the strong impact returns: Medium-size investors posted a median CAGR of 11% a year over the five-year period, and large-size investors posted a median CAGR of 14% a year.

Interestingly, the CAGR of assets held by small investors dropped by a median of 14% a year.

“When we drill down behind the compound annual growth of the assets that are being allocated to impact investing, it’s largely those larger investors that are actually driving it,” says Dean Hand, the GIIN’s chief research officer.

Overall, the GIIN surveyed 305 investors with a combined US$490 billion under management from 39 countries. Nearly three-quarters of the responders were investment managers, while 10% were foundations, and 3% were family offices. Development finance institutions, institutional asset owners, and companies represented most of the rest.

The majority of impact strategies are executed through private-equity, but public debt and equity have been the fastest-growing asset classes over the past five years, the report said. Public debt is growing at a CAGR of 32%, and public equity is growing at a CAGR of 19%. That compares to a CAGR of 17% for private equity and 7% for private debt.

According to the GIIN, the rise in public impact assets is being driven by larger investors, likely institutions.

Private equity has traditionally served as an ideal way to execute impact strategies, as it allows investors to select vehicles specifically designed to create a positive social or environmental impact by, for example, providing loans to smallholder farmers in Africa or by supporting fledging renewable energy technologies.

Future Returns: Preqin expects managers to rely on family offices, private banks, and individual investors for growth in the next six years

But today, institutional investors are looking across their portfolios—encompassing both private and public assets—to achieve their impact goals.

“Institutional asset owners are saying, ‘In the interests of our ultimate beneficiaries, we probably need to start driving these strategies across our assets,’” Hand says. Instead of carving out a dedicated impact strategy, these investors are taking “a holistic portfolio approach.”

An institutional manager may want to address issues such as climate change, healthcare costs, and local economic growth so it can support a better quality of life for its beneficiaries.

To achieve these goals, the manager could invest across a range of private debt, private equity, and real estate.

But the public markets offer opportunities, too. Using public debt, a manager could, for example, invest in green bonds, regional bank bonds, or healthcare social bonds. In public equity, it could invest in green-power storage technologies, minority-focused real-estate trusts, and in pharmaceutical and medical-care company stocks with the aim of influencing them to lower the costs of care, according to an example the GIIN lays out in a separate report on institutional strategies.

Influencing companies to act in the best interests of society and the environment is increasingly being done through such shareholder advocacy, either directly through ownership in individual stocks or through fund vehicles.

“They’re trying to move their portfolio companies to actually solving some of the challenges that exist,” Hand says.

Although the rate of growth in public strategies for impact is brisk, among survey respondents investments in public debt totaled only 12% of assets and just 7% in public equity. Private equity, however, grabs 43% of these investors’ assets.

Within private equity, Hand also discerns more evidence of maturity in the impact sector. That’s because more impact-oriented asset owners invest in mature and growth-stage companies, which are favored by larger asset owners that have more substantial assets to put to work.

The GIIN State of the Market report also found that impact asset owners are largely happy with both the financial performance and impact results of their holdings.

About three-quarters of those surveyed were seeking risk-adjusted, market-rate returns, although foundations were an exception as 68% sought below-market returns, the report said. Overall, 86% reported their investments were performing in line or above their expectations—even when their targets were not met—and 90% said the same for their impact returns.

Private-equity posted the strongest results, returning 17% on average, although that was less than the 19% targeted return. By contrast, public equity returned 11%, above a 10% target.

The fact some asset classes over performed and others underperformed, shows that “normal economic forces are at play in the market,” Hand says.

Although investors are satisfied with their impact performance, they are still dealing with a fragmented approach for measuring it, the report said. “Despite this, over two-thirds of investors are incorporating impact criteria into their investment governance documents, signalling a significant shift toward formalising impact considerations in decision-making processes,” it said.

Also, more investors are getting third-party verification of their results, which strengthens their accountability in the market.

“The satisfaction with performance is nice to see,” Hand says. “But we do need to see more about what’s happening in terms of investors being able to actually track both the impact performance in real terms as well as the financial performance in real terms.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.