The Primary Breadwinner Is Disappearing From More Homes

The economics of marriage are changing, but women still take on more of the unpaid labour

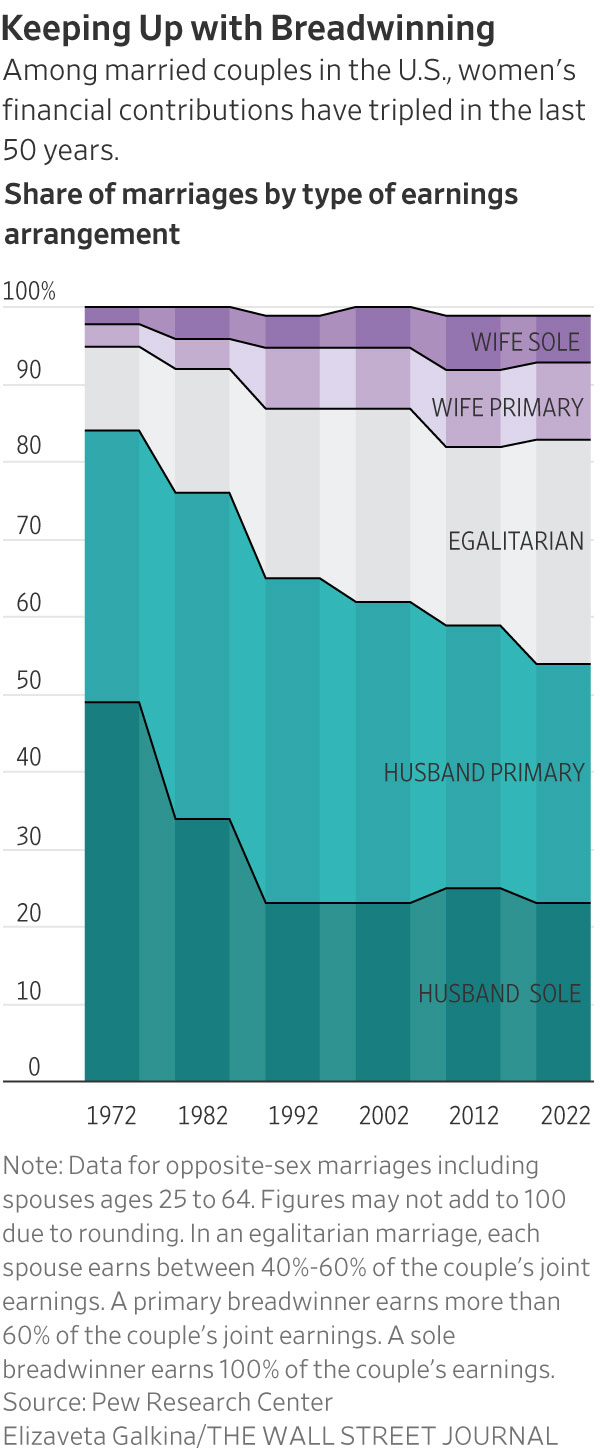

Nearly a third of marriages today have no primary breadwinner, as women continue to make strides toward greater equality at work and home.

About 30% of U.S. opposite-sex marriages are egalitarian in earnings, according to new data from Pew Research Center, meaning each spouse earns somewhere between 40% and 60% of the couples’ joint earnings. One of the main drivers of the shift is younger women making more money, said Pew.

The share of women earning more than their husbands has more than tripled from 5% to 16% over the last 50 years. In 1972, 49% of husbands were the sole breadwinner, meaning the husband had positive earnings and the wife had no earnings. By 2022, that share had dropped to 23% of opposite-sex marriages.

But the larger financial contributions by women don’t mean that relationships are more equal or women are better off in every realm of life, said Richard Fry, senior researcher at Pew Research Center.

Even when women earn as much as their husbands, they still put in around two more hours a week on caregiving than their husbands do, plus another 2.5 hours more on housework, according to Pew. In those same relationships, men spend nearly 3.5 more hours on leisure activities, such as watching television or playing video games, than their wives do.

Women’s economic role in marriages continues to rise despite a persistent gender pay gap and declining labor-force participation, Mr. Fry said. “In spite of some trends that would suggest to me that women’s economic role would not be growing, what we found was ‘No, it still is,’” he said.

Financial advisers and researchers say the changing money dynamic can cause marital strife, or in some cases, divorce.

Changes in breadwinner status “can lead to a lot of frustrations and arguments and resentment,” said Stacy Francis, president and chief executive of wealth-management firm Francis Financial and founder of a financial-education nonprofit.

When Ms. Francis, who often works with breadwinning women, surpassed her husband in earnings, she said the pair celebrated. After years of bearing the burden of bringing home most of the bacon, her husband was somewhat relieved to turn the job over to her, she said.

But Ms. Francis, now 48, soon found herself spending more time in the kitchen, throwing herself into the local parent-teacher association and planning her son’s prom—all, she said, in an effort to somehow compensate for other work and time spent away.

“It made me feel less feminine to earn more than my husband,” she said. “I realised, looking back, that I myself had to get comfortable with that role.”

Men remain the breadwinner in most marriages, meaning they earn more than 60% of the total earnings, Pew found.

The marriages with the highest total income are those in which both spouses are bringing in money. Marriages in which women are the primary breadwinners earn more than those in which men hold the same role: $145,000 in median income compared with $121,000 for marriages overall, according to the Pew data. A primary breadwinner in Pew’s research occurs when one spouse earns more than 60% of the household earnings.

Sole-breadwinner couples, or marriages in which one spouse has earnings and the other has none, make significantly less, with median incomes of around $75,000. Such couples also are more likely to be below the poverty line.

When women are the sole breadwinners, men spend more time on caregiving and a more equal amount of housework, compared with egalitarian marriages. But women still spend roughly the same amount of time on caregiving and household work, regardless of whether they are in egalitarian marriages or are sole or primary breadwinners, Pew found. Women without children are more likely to be the primary breadwinner than those with children.

Spouses within same-sex couples, however, tend to split the domestic labor more equally than their heterosexual counterparts, research shows.

Some researchers say one reason for the housework divide is that most of these gender roles have been built up over generations. There is a fear from some women that stopping this work could risk their marriage.

“We still see that there are remnants and large cultural issues associated with the sensitivity of women’s economic success, as a thing that destroys relationships,” said Johanna Rickne, professor of economics at the Swedish Institute for Social Research at Stockholm University.

Both husbands and wives can work to address these imbalances, said Jennifer Clark, a 34-year-old digital marketer based outside Chicago.

While her husband, a director of an audio-production company, has earned more than Ms. Clark for much of their 10-year marriage, she sets the monthly budget and manages household finances.

“It doesn’t feel like he has a larger share of the finances even though he is earning that money,” she said.

Throughout their marriage, Ms. Clark worked in freelance and part-time roles while her husband had full-time jobs. During those periods, she said, she bore a greater share of the household and caregiving responsibilities for their two children. But talking about their finances and making decisions together helped them remain equal partners.

“I would say I’ve always had a pretty good sense of financial autonomy, even with money I didn’t necessarily earn, because we make those decisions collaboratively,” she said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Governments around the world are offering incentives to reverse a downward spiral that could threaten economic growth

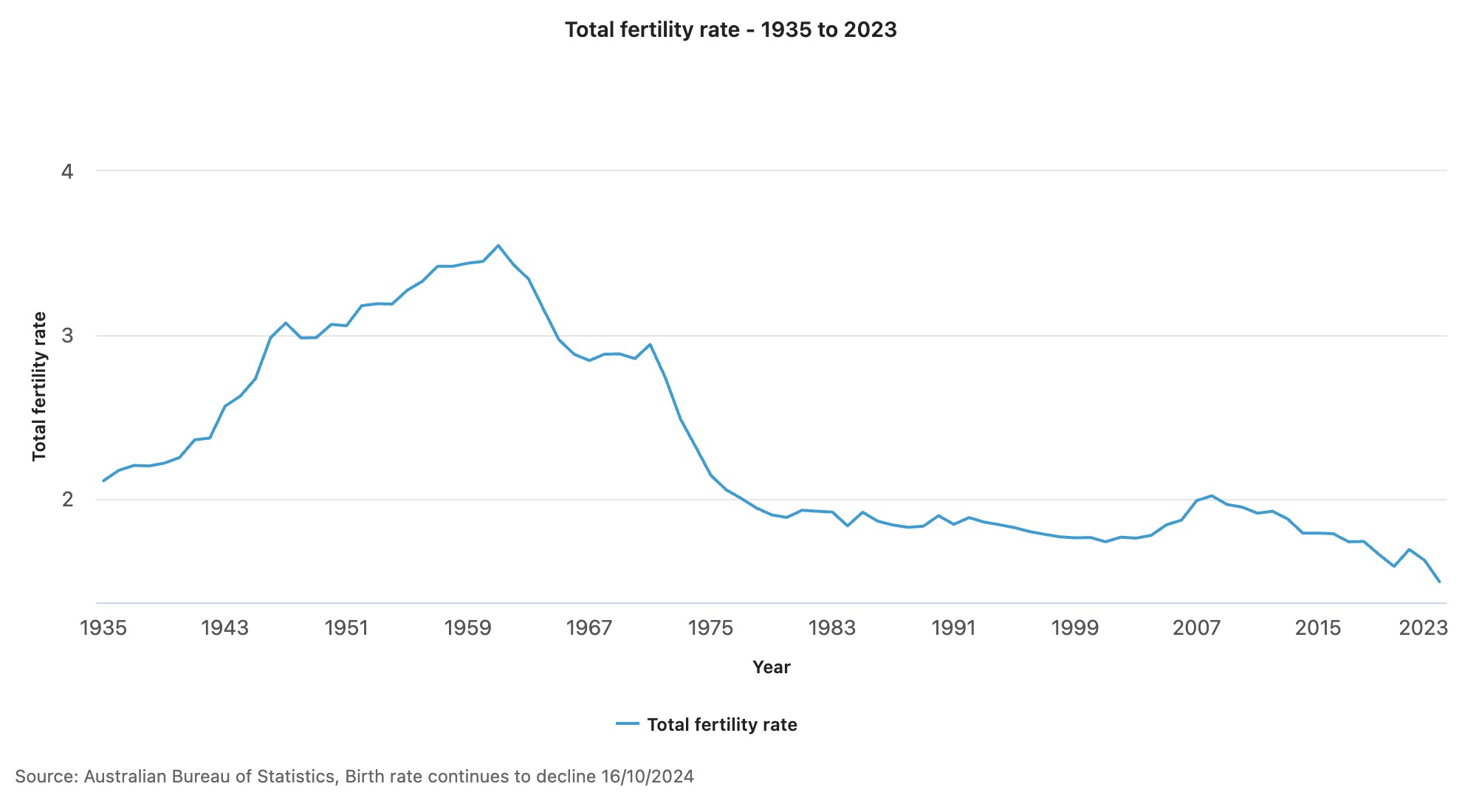

The Australian birth rate is at a record low, new data has shown.

Figures from the Australian Bureau of Statistics have revealed there were 286,998 births registered around the country last year, or 1.5 babies per woman.

Birth rates in Australia have been in a slow decline since the 1990s, down from 1.86 births per woman in 1993. Declining fertility rates among girls and women aged 15 to 19 years was most stark, down two thirds, while for women aged 40 to 44 years, the rate had almost doubled.

“The long-term decline in fertility of younger mums as well as the continued increase in fertility of older mums reflects a shift towards later childbearing,” said Beidar Cho, ABS head of demography statistics. “Together, this has resulted in a rise in median age of mothers to 31.9 years, and a fall in Australia’s total fertility rate.”

The fall in the Australian birth rate is in keeping with worldwide trends, with the United States also seeing fertility rates hit a 32-year low. The Lancet reported earlier this year that, based on current trends, by 2100 more than 97 percent of the world’s countries and territories “will have fertility rates below what is necessary to sustain population size over time”.

On a global scale, the Lancet reported that the total fertility rate had “more than halved over the past 70 years” from about five children per female in the 1950s to 2.2 children in 2021. In countries such as South Korea and Serbia, the rate is already less than 1.1 child for each female.

Governments around the world have tried to incentivise would-be parents, offering money, increased access to childcare and better paid maternity leave.

Experts have said without additional immigration, lower birth rates and an ageing population in Australia could put further pressure on young people, threaten economic growth and create economic uncertainty. However, a study released earlier this year by the University of Canberra showed the cost of raising a child to adulthood was between $474,000 and $1,097,000.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.