Investments in Solar Power Eclipse Oil for First Time

Government spending, including Biden’s Inflation Reduction Act, has helped drive a gap between clean-energy spending and fossil-fuel investments

Investments in solar power are on course to overtake spending on oil production for the first time, the foremost example of a widening gap between renewable-energy funding and stagnating fossil-fuel industries, according to the head of the International Energy Agency.

More than $1 billion a day is expected to be invested in solar power this year, which is higher than total spending expected for new upstream oil projects, the IEA said in its annual World Energy Investment report.

Spending on so-called clean-energy projects—which includes renewable energy, electric vehicles, low-carbon hydrogen and battery storage, among other things—is rising at a “striking” rate and vastly outpacing spending on traditional fossil fuels, Fatih Birol, the IEA’s executive director said in an interview. The figures should raise hopes that worldwide efforts to keep global warming within manageable levels are heading in the right direction, he said.

Birol pointed to a “powerful alignment of major factors,” driving clean-energy spending higher, while spending on oil and other fossil fuels remains subdued. This includes mushrooming government spending aimed at driving adherence to global climate targets such as President Biden’s Inflation Reduction Act.

“A new clean global energy economy is emerging,” Birol told The Wall Street Journal. “There has been a substantial increase in a short period of time—I would consider this to be a dramatic shift.”

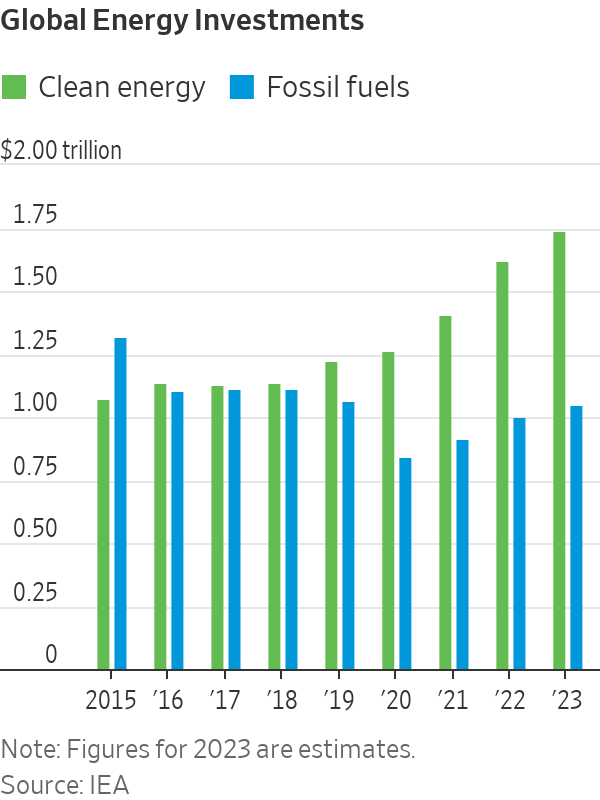

A total of $2.8 trillion will be invested in global energy supplies this year, of which $1.7 trillion, or more than 60% will go toward clean-energy projects. The figure marks a sharp increase from previous years and highlights the growing divergence between clean-energy spending and traditional fossil-fuel industries such as oil, gas and coal. For every $1 spent on fossil-fuel energy this year, $1.70 will be invested into clean-energy technologies compared with five years ago when the spending between the two was broadly equal, the IEA said.

While investments in clean energy have been strong, they haven’t been evenly split. Ninety percent of the growth in clean-energy spending occurs in the developed world and China, the IEA said. Developing nations have been slower to embrace renewable-energy sources, put off by the high upfront price tag of emerging technologies and a shortage of affordable financing. They are often financially unable to dole out large sums on subsidies and state backing, as the U.S., European Union and China have done.

The Covid-19 pandemic appears to have marked a turning point for global energy spending, the IEA’s data shows. The powerful economic rebound that followed the end of lockdown measures across most of the globe helped prompt the divergence between spending on clean energy and fossil fuels.

The energy crisis that followed Russia’s invasion of Ukraine last year has further driven the trend. Soaring oil and gas prices after the war began made emerging green-energy technologies comparatively more affordable. While clean-energy technologies have recently been hit by some inflation, their costs remain sharply below their historic levels. The war also heightened attention on energy security, with many Western nations, particularly in Europe, seeking to remove Russian fossil fuels from their economies altogether, often replacing them with renewables.

While clean-energy spending has boomed, spending on fossil fuels has been tepid. Despite earning record profits from soaring oil and gas prices, energy companies have shown a reluctance to invest in new fossil-fuel projects when demand for them appears to be approaching its zenith.

Energy forecasters are split on when demand for fossil fuels will peak, but most have set out a timeline within the first half of the century. The IEA has said peak fossil-fuel demand could come as soon as this decade. The Organization of the Petroleum Exporting Countries, a cartel of the world’s largest oil-producing nations, has said demand for crude oil could peak in developed nations in the mid-2020s, but that demand in the developing world will continue to grow until at least 2045.

Investments in clean energy and fossil fuels were largely neck-and-neck in the years leading up to the pandemic, but have diverged sharply since. While spending on fossil fuels has edged higher over the last three years, it remains lower than pre pandemic levels, the IEA said.

Only large state-owned national oil companies in the Middle East are expected to spend more on oil production this year than in 2022. Almost half of the extra spending will be absorbed by cost inflation, the IEA said. Last year marked the first one where oil-and-gas companies spent more on debt repayments, dividends and share buybacks than they did on capital expenditure.

The lack of spending on fossil fuels raises a question mark around rising prices. Oil markets are already tight and are expected to tighten further as demand grows following the pandemic, with seemingly few sources of new supply to compensate. Higher oil prices could further encourage the shift toward clean-energy sources.

“If there is not enough investment globally to reduce the oil demand growth and there is no investment at the same time [in] upstream oil we may see further volatility in global oil prices,” Birol said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

We’re thinking about productivity at work all wrong, Cal Newport says. But how do we tell the boss that?

You’re oh so busy. You’re on Slack and email and back-to-back Zoom calls , sometimes all at once . Are you actually getting real work done?

Cal Newport doesn’t think so.

“It’s like, wait a second, none of this mattered,” says the Georgetown University computer science professor and crusader for focus in a distracted age.

Newport, 41, says we can accomplish more by shedding the overload. He calls his solution “slow productivity”—and has a book by the same name —a way for high achievers to say yes to fewer things, do them better and even slack off in strategic doses. Top-notch quality is the goal, and frenetic activity the enemy.

This, he told me, is the thing that can save our jobs from AI and layoffs, and even make shareholders happy.

I had questions. Can we really be less is more at work, or have we grown addicted to constantly crossing endless tasks off our to-do lists? What will our bosses think?

After all, so many of us yearn for a burnout cure-all that will preserve our high-achiever status, and this isn’t the first you-can-have-it-all proposition we’ve heard. Champions of the four-day workweek promise we can ditch an entire workday just by working smarter. Remote-work die-hards swear it’s a win for employers and employees. Few dreams are more seductive than bidding goodbye to hustle culture, while still reaping the benefits of said hustle.

Newport acknowledges that saying no to preserve our productivity can be a delicate act. He knows that entrepreneurs have more flexibility, but says those of us who answer to managers can carve this out too. We might even find we have more power and value to our employers.

“You should take that value out for a little bit of a spin,” he suggests. He offers some pointers.

Less is more

The way we work now is a “serious economic drag,” Newport says. Knowledge workers have devolved into a form of productivity that’s more about the vibes—stressed!—than actually making money for the company. Data from Microsoft finds that lots of us spend the equivalent of two workdays a week on meetings and email alone.

One mistake we make, Newport says, is taking on too many projects, then getting bogged down in the administrative overload—talking about the work, coordinating with others—that each requires. Work becomes a string of planning meetings, waiting on someone from another department to give us a go-ahead.

Newport recommends giving priority to a couple projects, then bumping the others to a waiting list in order of importance. Make that list public, say, in a Google doc you share with bosses and colleagues.

“When workloads are obfuscated behind black boxes, it’s just people throwing stuff at each other, it’s very dangerous to say no,” Newport says.

If someone comes to you with more work, have them consider where it should go on your list, Newport says.

When you do say yes, double the estimated timelines you set to complete a project. That’s how long it’ll take to do it well, he says. And try what he calls a “one for you, one for me strategy.” Every time you book an hour-long meeting, block an hour for independent work on your calendar.

Be the one to trust

It’s a foreign and bracing approach for those of us who reflexively say yes to work requests. Newport’s philosophy requires transparency and confidence. Instead of “let me see how fast I can turn that around!”, try, “This request will take six hours. I’ll have that time in three weeks.”

This could be heresy at some companies. The trick is in the delivery, he says. Never make it seem like work tasks are a burden you shouldn’t have to face. Instead, stress that you’re trying to be as effective as you can for the team and the company. Be positive, and deliver on the timelines you promise. You’ll be seen as someone who’s organised and on top of your game.

We think bosses want someone who’s always accessible—fast to respond, fast to jump into action, Newport says. But what bosses really want is to know that a project they hand you will get done.

Bite-size shirking

Quiet quitting permanently is a bad idea, Newport says, but a little bit is good.

Don’t feel guilty, he adds. You’re working under a new, better system. We weren’t meant to work all out , every day, without seasonal shifts and pauses.

Pick a time—say, the month of July—to slow down. Don’t volunteer for extra work. Don’t offer Mondays as a possibility for meetings. Take on an easier project for cover.

He also recommends taking yourself out to a monthly movie during the workday. Say it’s a personal appointment, and enjoy the sense of control and creativity it brings.

You don’t have to nail a manifesto to the wall, he adds, or try to change the whole company culture. Instead, quietly carve out change for yourself.

Coming into your power

The catch: You have to be really good at the part of your job that matters. And you have to get big stuff done. Remember, this is about being a happier high performer, not slacking.

“There’s no hiding,” Newport says.

I suspect this terrifies a lot of people. They’ve gotten good at being always on and typing up yet another meeting agenda. Tackling a major project or goal is often harder, and comes without a guarantee that you’re going to nail it.

Scary or not, real work is becoming imperative. AI is coming for the rote parts of our jobs. Leaders are sussing out the “nonsense” projects and roles in their ranks as they cut jobs, Newport says. No boss wants to be left with a team of people who are aces at responding to emails.

Mastering a valuable skill puts you in control. Newport writes of people who leave corporate America behind and move where they want , working remotely as contractors, charging wild fees for fewer hours of work. The more you shed the work that doesn’t matter, and spend that time getting better at the stuff that does, the more leeway you’ll get.

“The marketplace doesn’t care about your personal interest in slowing down,” Newport writes. “If you want more control over your schedule, you need something to offer in return.”

Figure that puzzle out, and you might just be able to have it all—high achievement, and your sanity.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts