Europeans Are Becoming Poorer. ‘Yes, We’re All Worse Off.’

An ageing population that values its free time set the stage for economic stagnation. Then came Covid-19 and Russia’s war in Ukraine.

Europeans are facing a new economic reality, one they haven’t experienced in decades. They are becoming poorer.

Life on a continent long envied by outsiders for its art de vivre is rapidly losing its shine as Europeans see their purchasing power melt away.

The French are eating less foie gras and drinking less red wine. Spaniards are stinting on olive oil. Finns are being urged to use saunas on windy days when energy is less expensive. Across Germany, meat and milk consumption has fallen to the lowest level in three decades and the once-booming market for organic food has tanked. Italy’s economic development minister, Adolfo Urso, convened a crisis meeting in May over prices for pasta, the country’s favourite staple, after they jumped by more than double the national inflation rate.

With consumption spending in free fall, Europe tipped into recession at the start of the year, reinforcing a sense of relative economic, political and military decline that kicked in at the start of the century.

Europe’s current predicament has been long in the making. An ageing population with a preference for free time and job security over earnings ushered in years of lacklustre economic and productivity growth. Then came the one-two punch of the Covid-19 pandemic and Russia’s protracted war in Ukraine. By upending global supply chains and sending the prices of energy and food rocketing, the crises aggravated ailments that had been festering for decades.

Governments’ responses only compounded the problem. To preserve jobs, they steered their subsidies primarily to employers, leaving consumers without a cash cushion when the price shock came. Americans, by contrast, benefited from inexpensive energy and government aid directed primarily at citizens to keep them spending.

In the past, the continent’s formidable export industry might have come to the rescue. But a sluggish recovery in China, a critical market for Europe, is undermining that growth pillar. High energy costs and rampant inflation at a level not seen since the 1970s are dulling manufacturers’ price advantage in international markets and smashing the continent’s once-harmonious labor relations. As global trade cools, Europe’s heavy reliance on exports—which account for about 50% of eurozone GDP versus 10% for the U.S.—is becoming a weakness.

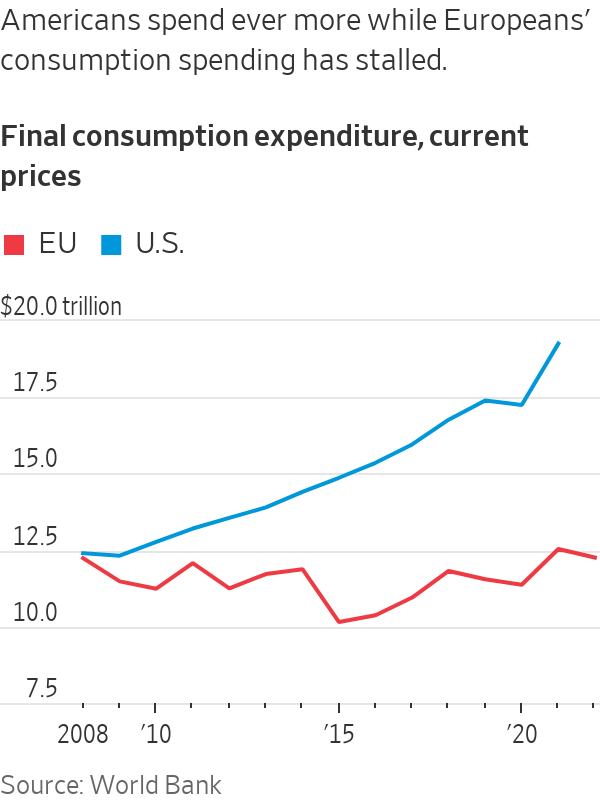

Private consumption has declined by about 1% in the 20-nation eurozone since the end of 2019 after adjusting for inflation, according to the Organization for Economic Cooperation and Development, a Paris-based club of mainly wealthy countries. In the U.S., where households enjoy a strong labor market and rising incomes, it has increased by nearly 9%. The European Union now accounts for about 18% of all global consumption spending, compared with 28% for America. Fifteen years ago, the EU and the U.S. each represented about a quarter of that total.

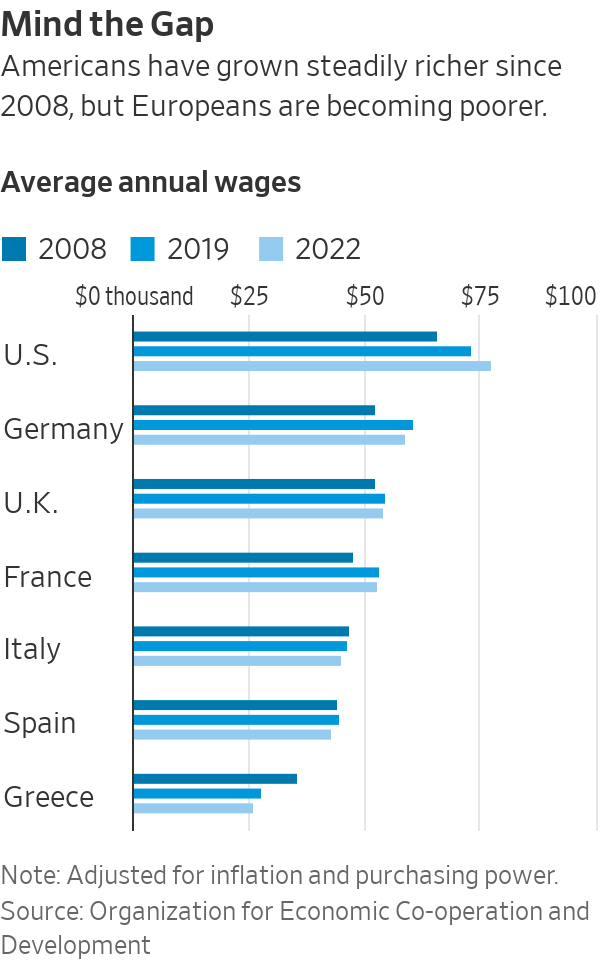

Adjusted for inflation and purchasing power, wages have declined by about 3% since 2019 in Germany, by 3.5% in Italy and Spain and by 6% in Greece. Real wages in the U.S. have increased by about 6% over the same period, according to OECD data.

The pain reaches far into the middle classes. In Brussels, one of Europe’s richest cities, teachers and nurses stood in line on a recent evening to collect half-price groceries from the back of a truck. The vendor, Happy Hours Market, collects food close to its expiration date from supermarkets and advertises it through an app. Customers can order in the early afternoon and collect their cut-price groceries in the evening.

“Some customers tell me, because of you I can eat meat two or three times per week,” said Pierre van Hede, who was handing out crates of groceries.

Karim Bouazza, a 33-year-old nurse who was stocking up on half-price meat and fish for his wife and two children, complained that inflation means “you almost need to work a second job to pay for everything.”

Similar services have sprung up across the region, marketing themselves as a way to reduce food waste as well as save money. TooGoodToGo, a company founded in Denmark in 2015 that sells leftover food from retailers and restaurants, has 76 million registered users across Europe, roughly three times the number at the end of 2020. In Germany, Sirplus, a startup created in 2017, offers “rescued” food, including products past their sell-by date, on its online store. So does Motatos, created in Sweden in 2014 and now present in Finland, Germany, Denmark and the U.K.

Spending on high-end groceries has collapsed. Germans consumed 52 kilograms of meat per person in 2022, about 8% less than the previous year and the lowest level since calculations began in 1989. While some of that reflects societal concerns about healthy eating and animal welfare, experts say the trend has been accelerated by meat prices which increased by up to 30% in recent months. Germans are also swapping meats such as beef and veal for less-expensive ones such as poultry, according to the Federal Information Center for Agriculture.

Thomas Wolff, an organic-food supplier near Frankfurt, said his sales fell by up to 30% last year as inflation surged. Wolff said he had hired 33 people earlier in the pandemic to handle strong demand for pricey ecological foodstuffs, but he has since let them all go.

Ronja Ebeling, a 26-year-old consultant and author based in Hamburg, said she saves about one-quarter of her income, partly because she worries about having enough money for retirement. She spends little on clothes or makeup and shares a car with her partner’s father.

Weak spending and poor demographic prospects are making Europe less attractive for businesses ranging from consumer-goods giant Procter & Gamble to luxury empire LVMH, which are making an ever-larger share of their sales in North America.

“The U.S. consumer is more resilient than in Europe,” Unilever’s chief financial officer, Graeme Pitkethly, said in April.

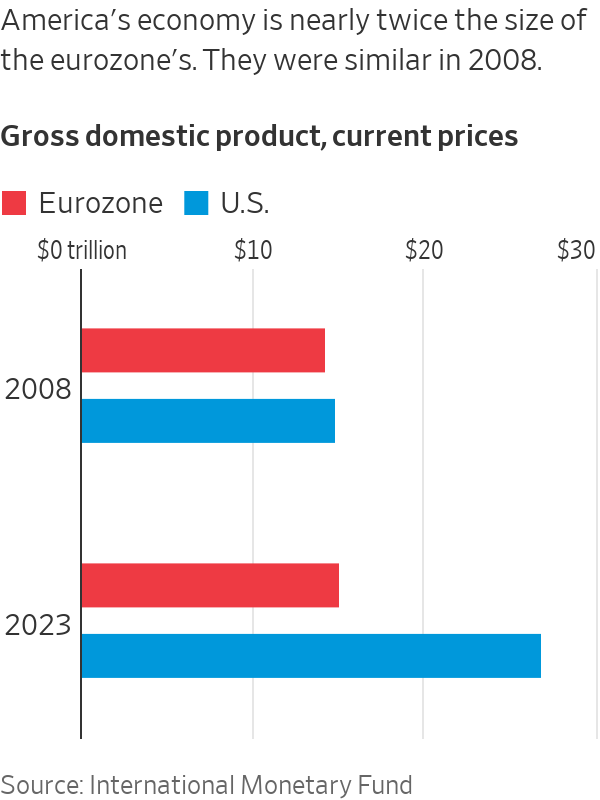

The eurozone economy grew about 6% over the past 15 years, measured in dollars, compared with 82% for the U.S., according to International Monetary Fund data. That has left the average EU country poorer per head than every U.S. state except Idaho and Mississippi, according to a report this month by the European Centre for International Political Economy, a Brussels-based independent think tank. If the current trend continues, by 2035 the gap between economic output per capita in the U.S. and EU will be as large as that between Japan and Ecuador today, the report said.

On the Mediterranean island of Mallorca, businesses are lobbying for more flights to the U.S. to increase the number of free-spending American tourists, said Maria Frontera, president of the Mallorca Chamber of Commerce’s tourism commission. Americans spend about €260 ($292) per day on average on hotels compared with less than €180 ($202) for Europeans.

“This year we have seen a big change in the behaviour of Europeans because of the economic situation we are dealing with,” said Frontera, who recently traveled to Miami to learn how to better cater to American customers.

Weak growth and rising interest rates are straining Europe’s generous welfare states, which provide popular healthcare services and pensions. European governments find the old recipes for fixing the problem are either becoming unaffordable or have stopped working. Three-quarters of a trillion euros in subsidies, tax breaks and other forms of relief have gone to consumers and businesses to offset higher energy costs—something economists say is now itself fuelling inflation, defeating the subsidies’ purpose.

Public-spending cuts after the global financial crisis starved Europe’s state-funded healthcare systems, especially the U.K.’s National Health Service.

Vivek Trivedi, a 31-year-old anaesthesiologist living in Manchester, England, earns about £51,000 ($67,000) per year for a 48-hour workweek. Inflation, which has been about 10% or higher in the U.K. for nearly a year, is devouring his monthly budget, he says. Trivedi said he shops for groceries in discount retailers and spends less on meals out. Some colleagues turned off their heating entirely over recent months, worried they wouldn’t be able to afford sharply higher costs, he said.

Noa Cohen, a 28-year old public-affairs specialist in London, says she could quadruple her salary in the same job by leveraging her U.S. passport to move across the Atlantic. Cohen recently got a 10% pay raise after switching jobs, but the increase was completely swallowed by inflation. She says friends are freezing their eggs because they can’t afford children anytime soon, in the hope that they have enough money in future.

“It feels like a perma-freeze in living standards,” she said.

Huw Pill, the Bank of England’s chief economist, warned U.K. citizens in April that they need to accept that they are poorer and stop pushing for higher wages. “Yes, we’re all worse off,” he said, saying that seeking to offset rising prices with higher wages would only fuel more inflation.

With European governments needing to increase defence spending and given rising borrowing costs, economists expect taxes to increase, adding pressure on consumers. Taxes in Europe are already high relative to those in other wealthy countries, equivalent to around 40-45% of GDP compared with 27% in the U.S. American workers take home almost three-quarters of their pay checks, including income taxes and Social Security taxes, while French and German workers keep just half.

The pauperisation of Europe has bolstered the ranks of labor unions, which are picking up tens of thousands of members across the continent, reversing a decades long decline.

Higher unionisation may not translate into fuller pockets for members. That’s because many are pushing workers’ preference for more free time over higher pay, even in a world of spiralling skills shortages.

IG Metall, Germany’s biggest trade union, is calling for a four-day work week at current salary levels rather than a pay raise for the country’s metalworkers ahead of collective bargaining negotiations this November. Officials say the shorter week would improve workers’ health and quality of life while at the same time making the industry more attractive to younger workers.

Almost half of employees in Germany’s health industry choose to work around 30 hours per week rather than full time, reflecting tough working conditions, said Frank Werneke, chairman of the country’s United Services Trade Union, which has added about 110,000 new members in recent months, the biggest increase in 22 years.

Kristian Kallio, a games developer in northern Finland, recently decided to reduce his working week by one-fifth to 30 hours in exchange for a 10% pay cut. He now makes about €2,500 per month. “Who wouldn’t want to work shorter hours?” Kallio said. About one-third of his colleagues took the same deal, although leaders work full-time, said Kallio’s boss, Jaakko Kylmäoja.

Kallio now works from 10 a.m. to 4.30 p.m. He uses his extra free time for hobbies, to make good food and take long bike rides. “I don’t see a reality where I would go back to normal working hours,” he said.

Igor Chaykovskiy, a 34-year-old IT worker in Paris, joined a trade union earlier this year to press for better pay and conditions. He recently received a 3.5% pay increase, about half the level of inflation. He thinks the union will give workers greater leverage to press managers. Still, it isn’t just about pay. “Maybe they say you don’t have an increase in salary, you have free sports lessons or music lessons,” he said.

At the Stellantis auto factory in Melfi, southern Italy, employees have worked shorter hours for years recently due to the difficulty of procuring raw materials and high energy costs, said Marco Lomio, a trade unionist with the Italian Union of Metalworkers. Hours worked have recently been reduced by around 30% and wages decreased proportionally.

“Between high inflation and rising energy costs for workers,” said Lomio, “it is difficult to bear all family expenses.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.