Global Executives Say Greenwashing Remains Rife

Nearly three-quarters of corporate leaders say most organisations in their industry would be caught greenwashing if they were investigated thoroughly

Most global executives think greenwashing is widespread in their industry, and despite customers becoming more vocal about preferring sustainable brands, many companies are cutting corners on their environmental, social and corporate governance initiatives.

Nearly three-quarters of executives said most organisations in their industry would be caught greenwashing if they were investigated thoroughly, according to a survey of nearly 1,500 executives across 17 countries and seven industries conducted in January by the Harris Poll on behalf of Google Cloud.

The risk of greenwashing is increasing with crackdowns on overstated green claims on both sides of the Atlantic. Despite that threat, the figures are consistent with last year’s findings: Nearly 60% say their own organisation is overstating its sustainability methods. While for some it may be intentional, most say it is instead often due to setting sustainability goals or pledges without a concrete plan to reach them.

“There are actors that are maybe intentionally overstating what they’re doing, but I honestly think for the most part, companies are sincere—they’ve set their goals, they’re working towards them, but they don’t always have the data to be transparent,” said Kate Brandt, chief sustainability officer at Google.

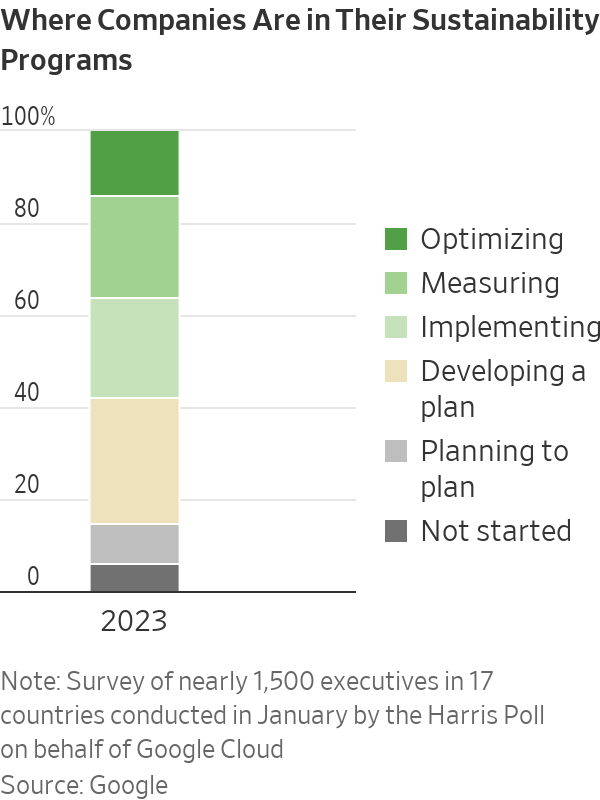

The survey gives insight into where companies are in their sustainability efforts. A little more than a quarter are developing their sustainability programs, 22% have a plan they are implementing, another 22% are able to measure its impact, and 14% are in the final stage of optimising their plan based on measured outcomes. In contrast, nearly a tenth plan to start developing their sustainability plan in the near future, while the remaining 6% don’t have a plan or any intention to come up with one soon.

Nearly three-quarters of executives said they want to advance sustainability efforts but don’t actually know how to go about doing it. Top tools identified to improve their ability were having a dedicated sustainability leader, support from senior management, advanced measurement tools, and education for employees and executives. And the two main ways they expect advancement is through technology innovation as well as investment in sustainable operations or services.

With nearly a decade of experience as a CSO, Ms. Brandt said the survey findings reinforced her point of view on how a company can set itself up to be successful. Businesses need strong governance powered by good data and metrics and a dedicated sustainability leader to be the center of gravity but one who can also embed sustainability inside business functions.

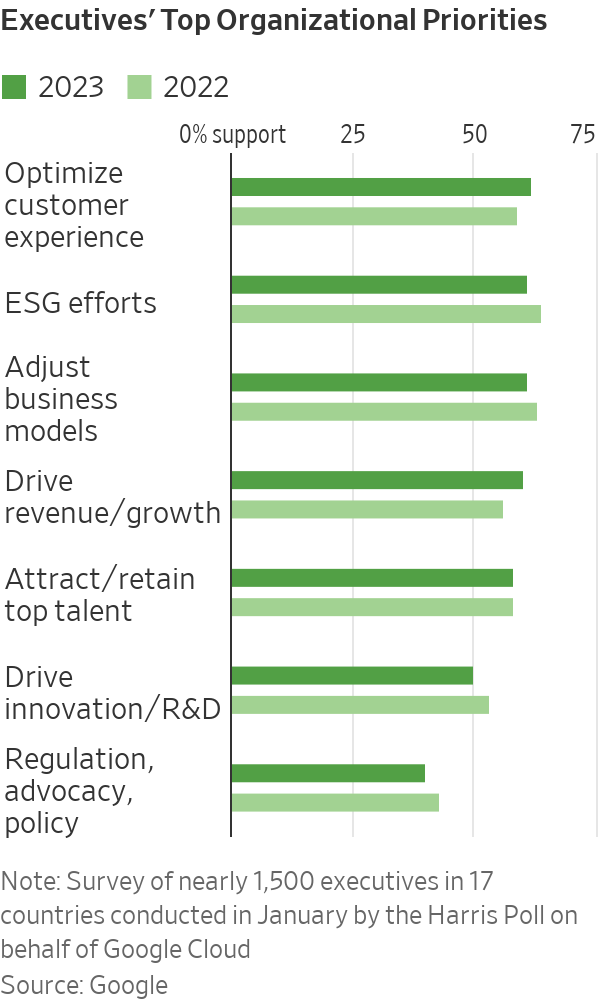

Most executives surveyed—85%—said customers and clients are becoming more vocal about their preference for engaging with sustainable brands. However, economic uncertainty means that business leaders have increased their focus on customers, revenue and growth, although ESG issues remain one of businesses’ top three priorities.

While an earlier survey by industrial conglomerate Honeywell International Inc. found that sustainability budgets at most companies were relatively insulated from cuts, the more recent Google Cloud survey indicates things may have changed. Two-thirds of executives in the latest survey said they are having to cut corners on sustainability initiatives and 45% said the economy is negatively affecting their organisations’ sustainability efforts.

“Essentially when times are getting hard, you get to see who’s serious about this agenda and those who are paying lip service or perhaps accidentally overstating their efforts,” said Justin Keeble, managing director of global sustainability at Google Cloud.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.