More Americans Than Ever Own Stocks

Pandemic, zero-commission trading ‘created a whole generation of investors’

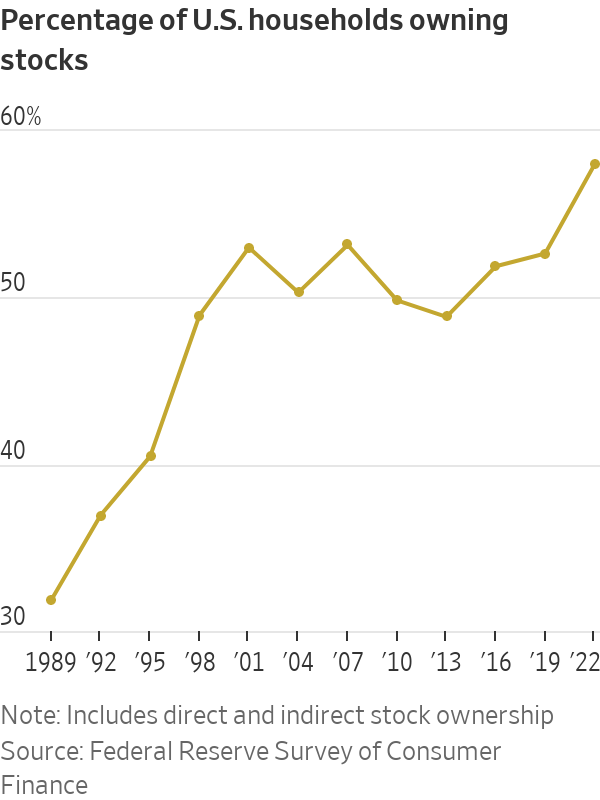

The share of Americans who own stocks has never been so high.

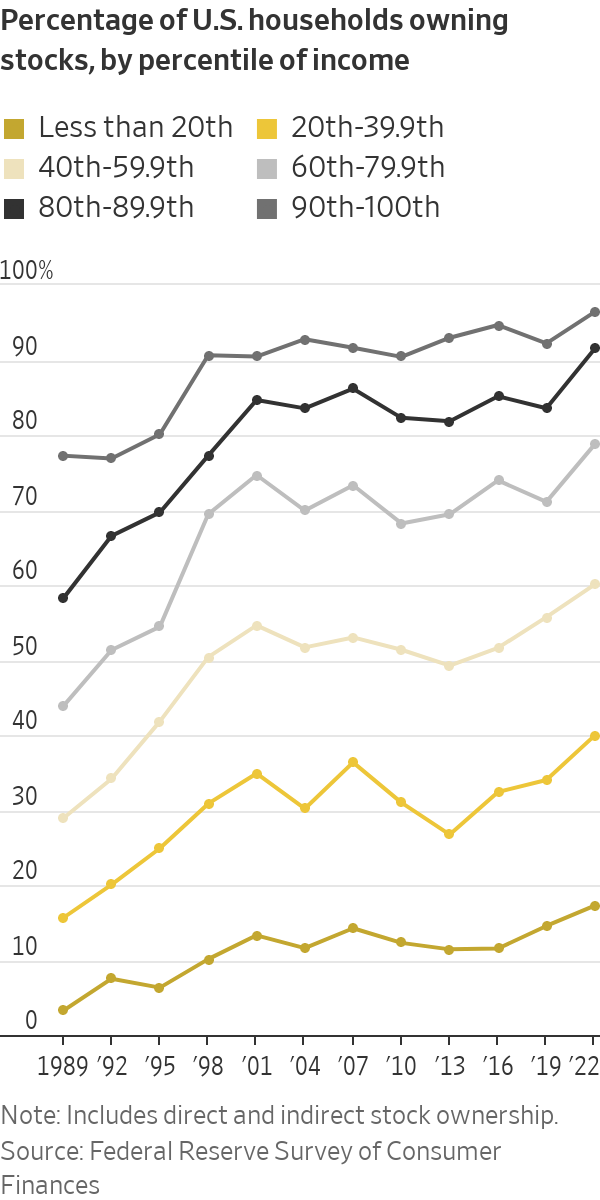

About 58% of U.S. households owned stocks in 2022, according to the Federal Reserve’s survey of consumer finances released this fall. That is up from 53% in 2019 and marks the highest household stock-ownership rate recorded in the triennial survey. The cohort includes families holding individual shares directly and those owning stocks indirectly through funds, retirement accounts or other managed accounts.

The data provide the most comprehensive snapshot yet of how the Covid-era explosion in investing has reshaped Americans’ personal finances. Stuck at home during the pandemic with extra cash, millions jumped into the stock market for the first time. The elimination of commission fees on stock trading across U.S. brokerages made investing cheaper than ever.

“It created a whole generation of investors,” said Anthony Denier, chief executive of mobile brokerage Webull U.S.

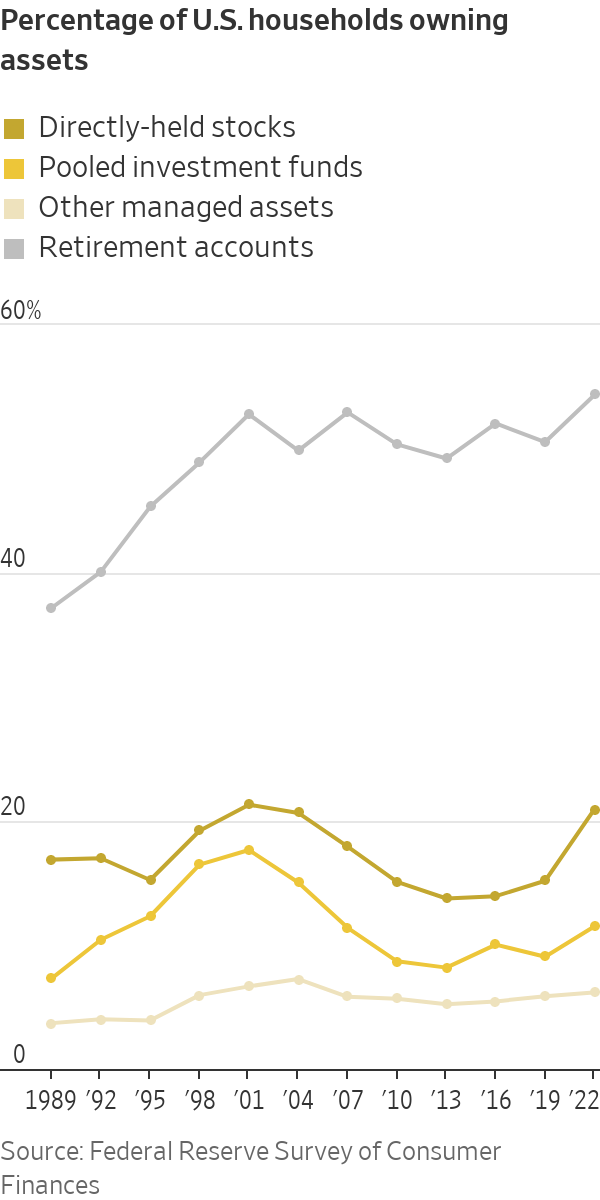

Most households own stocks through a retirement account, such as a 401(k), but more Americans in the past few years have invested in individual shares directly. Direct stock ownership increased to 21% of families in 2022 from 15% in 2019—the largest increase on record since the survey began in 1989.

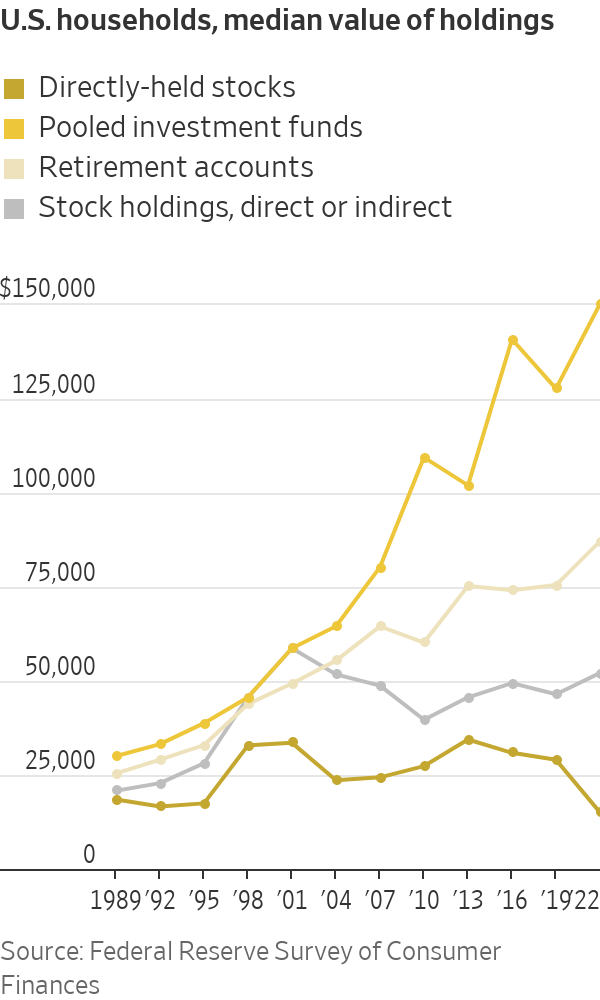

As more households bought individual shares, those newer entrants invested with less money than longtime stockholders. The median value of households’ direct stockholdings nearly halved from 2019 to about $15,000 in 2022, adjusted for inflation.

When the stock market crashed in early 2020, Nick Luczak, then a sophomore at the University of Michigan, used the $57 in his checking account to open a brokerage account on Robinhood and buy whichever stocks he could afford. Once the pandemic forced him off campus to live with his parents, he began researching the market and buying more stocks.

“I said, ‘Well, I have all this spare time. There’s no reason at all I shouldn’t be trying to make the most money possible from this,’” Luczak said.

Luczak and his fraternity brothers started a group chat to discuss markets and stock picks. He said he made a profit investing in Amazon.com and watched his friends make, then lose, thousands of dollars trading meme stocks such as GameStop and AMC Entertainment Holdings in 2021. At one point, he considered becoming a day trader.

Now, Luczak, 24 years old, is focused on long-term investing. A salesman in Dallas, he is studying to become a certified financial planner.

Brokerages in recent years have made trading free and easy. Newer apps like Robinhood and Webull helped popularise zero-commission stock trading on smartphones. Charles Schwab, TD Ameritrade and E*Trade all eliminated commission fees for stocks at the end of 2019. Fidelity and Schwab introduced fractional stock trading in 2020, allowing individuals to buy and sell slivers of shares.

“It’s become more accessible,” said Ashley Feinstein Gerstley, a certified financial planner and founder of The Fiscal Femme. “We’ve been debunking in the last few years the myth that you have to be rich or work on Wall Street to invest.”

The share of households owning stocks increased across all income levels from 2019 to 2022. Upper-middle-income families recorded the biggest jump in stock ownership.

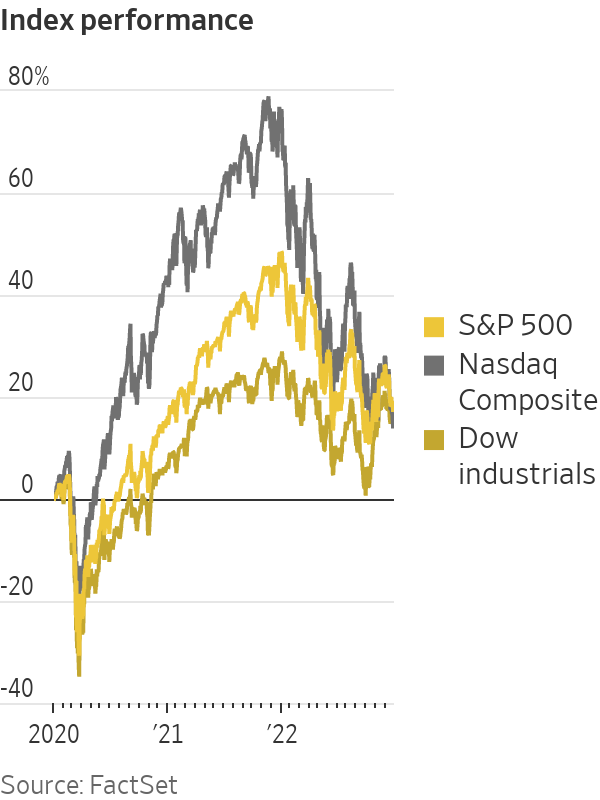

Over those three years, stocks climbed to new highs. The S&P 500 rose 16% in 2020 and 27% in 2021. Even after a 19% drop last year, the benchmark stock index notched gains over the three-year period. The S&P 500 is up 23% in 2023.

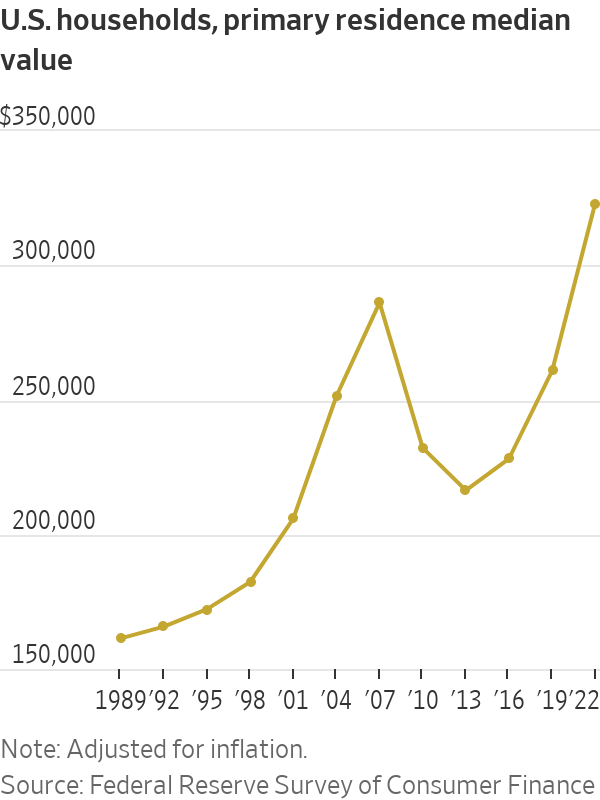

Stock-market gains and rising home prices helped boost household wealth. Households’ median net worth climbed 37% from 2019 to 2022, adjusted for inflation, the largest increase in the survey’s history. The median value of a U.S. household’s primary residence surged to $323,200 in 2022, surpassing levels from before the 2007 housing market crash.

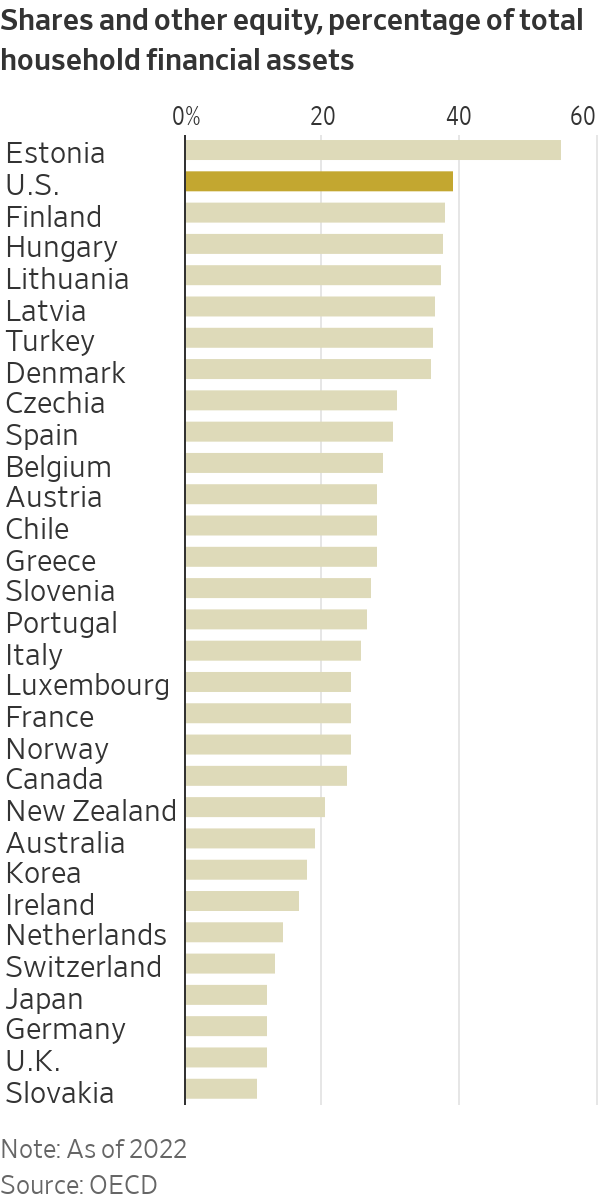

Americans’ penchant for stocks is distinct. U.S. households held about 39% of their financial assets in equities in 2022, according to Organization for Economic Cooperation and Development data, a higher allocation than most other countries in the data set.

That appetite for stocks has been tested since the Fed began raising interest rates last year at the fastest clip since the 1980s and pledged to keep rates higher for longer. Investors have been flocking to assets with little risk such as money-market funds that are now offering some of the highest yields in years. Everyday investors, who rarely own bonds directly, are taking a second look at assets such as Treasurys and corporate bonds.

Fernando Soto, head of private banking in Chicago at Brown Brothers Harriman, said he has fielded more questions from clients about fixed-income investing and more requests from clients to buy bonds in 2023. In his personal portfolio, he increased his allocation to fixed-income this year.

“There’s a big shift,” Soto said. “This is the new normal.”

How has the higher rate environment shifted American household finances? The Fed consumer finance survey in 2025 will likely paint the fullest picture.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.