Rediscovered John Lennon Guitar Heads to Auction, Expected to Set Records

Lost for decades, an acoustic guitar John Lennon used at the height of the Beatles’ fame is going up for auction after being found in the attic of a home in the British countryside.

The 1965 Framus Hootenanny is arguably one of the most historically important guitars in the history of the Beatles, and was used on some of the group’s classic songs and played by Lennon in the movie Help! , released the same year.

The 12-string acoustic guitar will headline Julien’s Auctions Music Icons event on May 29 and 30 at the Hard Rock Cafe in New York, the auction house announced Tuesday morning in London.

Darren Julien, the firm’s co-founder and executive director, expects the Framus to exceed its presale estimate of between US$600,000 and US$800,000 and says it could set a new record for the highest-selling Beatles guitar, a record his auction house set nearly a decade ago.

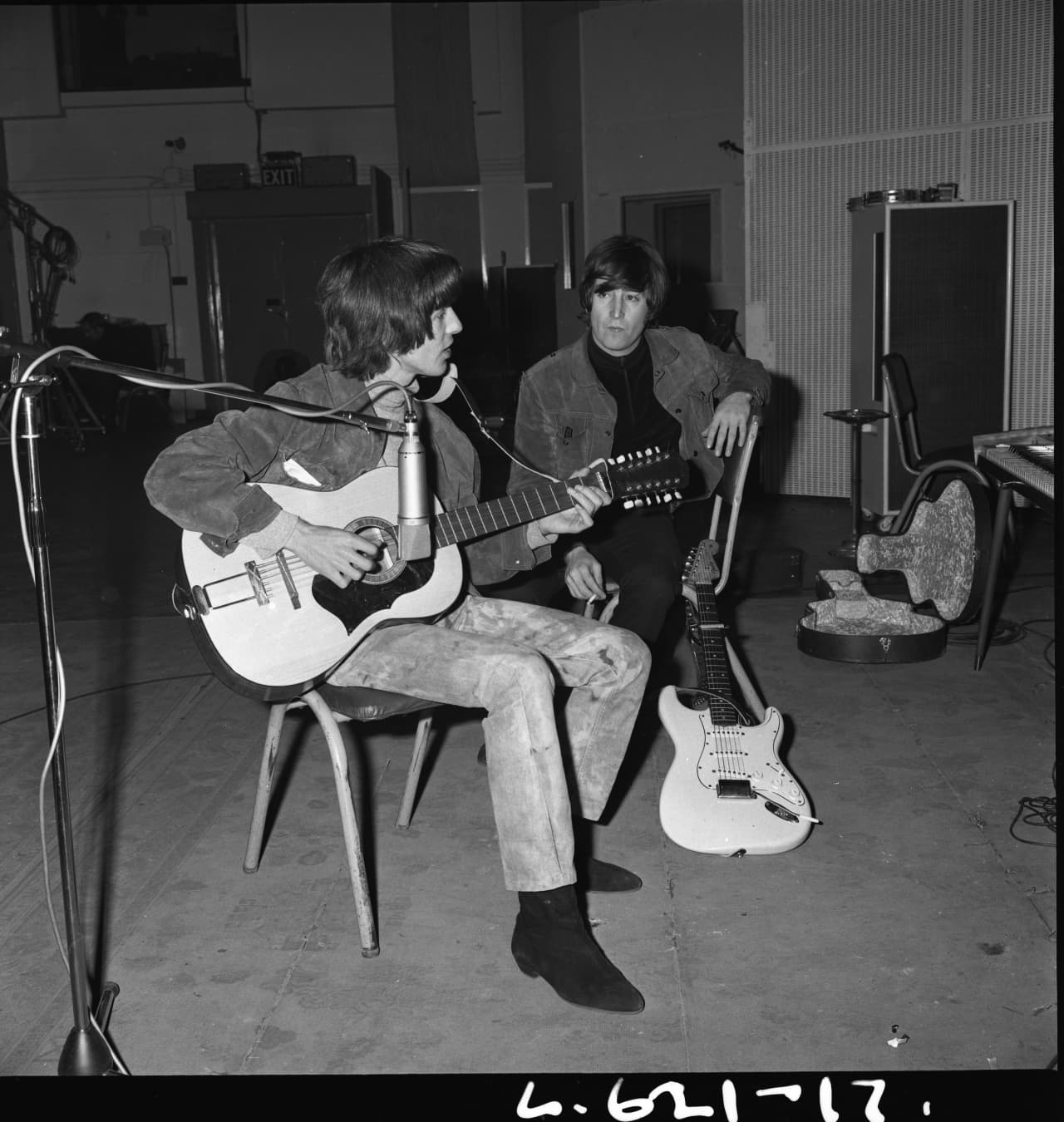

Rupert Hitchcox/Julien’s auctions

“Julien’s sold a John Lennon [Gibson J-160E] guitar in 2015 for US$2.4 million, and because this, historically speaking, is a more significant guitar, our expectation is that this guitar—played by John Lennon and George Harrison on the Help! album and other recordings—will be in the top five most expensive guitars ever sold at auction,” Julien says. “It’s likely the last chance for someone to buy and personally own an iconic John Lennon/George Harrison guitar.”

While equating its discovery to that of a “lost Rembrandt or Picasso,” Julien believes this is the greatest find of a Beatles guitar since Paul McCartney ’s lost 1961 Höfner bass, which was returned to him in February after it had been stolen in 1972.

The rediscovered Framus was famously seen in the 1965 film Help! , and was used in recording sessions for classics such as “You’ve Got To Hide Your Love Away,” “It’s Only Love” and “I’ve Just Seen A Face.” It was also played by George Harrison on the rhythm track for “Norwegian Wood” on the 1966 album Rubber Soul .

According to the auction house, by the late-1960s the guitar was in the possession of Gordon Waller of the British pop duo Peter & Gordon, who later gave it to their road managers. The instrument was recently discovered in an attic in rural Britain where it sat forgotten and unplayed for more than 50 years. After finding the guitar in the midst of a move, the homeowners contacted Julien’s.

Along with co-founder Martin Nolan, Julien traveled to the U.K. and immediately recognised that it was the storied Help! guitar. While on the premises, they also discovered the original guitar case in the trash and rescued it. It’s an Australian-made Maton case that can be seen in photos taken of The Beatles in 1965 The sale of the guitar is accompanied by the case and a copy of the book The Beatles: Photographs From The Set of Help by Emilo Lari.

In addition to Lennon’s acoustic Gibson J-160E—which fetched three times its presale estimate—Julien’s has broken multiple Beatles records, including Ringo Starr’s Ludwig drum kit (which sold for US$2.2 million), the drumhead played on the Ed Sullivan Show (US$2.2 million), and a personal copy of the White Album , (US$790,000), all of which sold in 2015.

Julien’s also holds the record for the world’s most expensive guitar ever sold at auction: Kurt Cobain’s MTV Unplugged 1959 Martin D-18E acoustic electric guitar, which sold in 2020 for US$6 million.

More than 1,000 pieces of music memorabilia will also be part of the auction, including items used by the likes of AC/DC, Nirvana, Guns N’ Roses, Judas Priest, Heart, Queen, and Tupac Shakur.

Sartorial highlights include custom dresses worn by Tina Turner (Versace) and Amy Winehouse (Fendi), both of which are expected to sell for between US$4,000 and $6,000, and Michael Jackson’s stage-worn “Billie Jean” jacket from 1984’s Victory Tour (presale estimate: US$80,000 to $100,000).

Bidders will have the chance to buy items benefitting a pair of U.K. charities. Several collectibles from The Who and other British musicians will be sold to benefit the Teenage Cancer Trust, and an assortment of memorabilia—ranging from a Stella McCartney dress worn by Helen Mirren and an Armani jacket stage-worn by Phil Collins to artwork created and signed by Pierce Brosnan—will be offered to help fund the King’s Trust.

Rounding out the two-day auction is Randy Bachman’s collection of more than 200 museum-quality guitars. Known for his role in The Guess Who and Bachman-Turner Overdrive, the Canadian rock star used the instruments on hits such as “These Eyes,” “Takin’ Care of Business,” “You Ain’t Seen Nothin’ Yet,” and “American Woman.”

The public can view the Help! guitar and other auction highlights at Hard Rock Cafes in London (April 23-29) and New York City (May 22-28).

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.