The Best Stock Funds of 2023

The ‘Magnificent Seven’ tech stocks helped drive a rebound at many large-cap funds after a dismal 2022. The winner surged 65.2%.

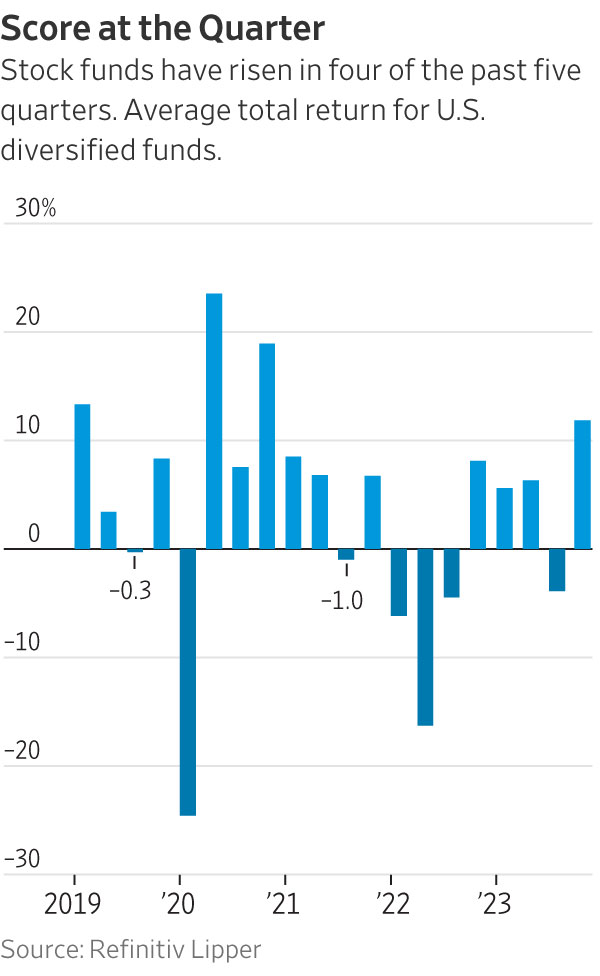

Large-cap companies led the way in 2023, benefiting the money managers who believed in them.

Driven by a rebound in large and megacap stocks, in particular the “Magnificent Seven” technology companies, mutual-fund managers who saw double-digit losses in the market rout in 2022 found themselves rewarded for their patience this past year.

Nine of the top 10 stock funds in The Wall Street Journal’s Winners’ Circle survey of mutual funds, which covers the 12-month period ended Dec. 31, are in Morningstar’s large-cap growth category—often with big weightings in outperforming sectors such as technology, communications services and consumer discretionary. Those S&P 500 sectors notched total returns, including dividends, of 57.8%, 55.8% 42.4%, respectively, easily topping the broader market’s 26.3% result.

Still, the Magnificent Seven paced the market. These stocks—Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia and Tesla—all gained more than 48% last year.

Nvidia, whose chips have become synonymous with exploding interest in artificial intelligence, was the biggest winner among those stocks with a gain of 239%. It was followed by Facebook parent Meta at 194% and Tesla at 102%. These were popular holdings among the top-performing funds in the latest survey, though it varied by the individual manager.

Excluding those stocks, the S&P 500’s return was only 9.9%, according to S&P Dow Jones Indices. In other words, the Magnificent Seven accounted for more than half of the index’s 2023 performance and boosted the returns of many funds as well.

Still, there was plenty of good performance across mutual funds, and it wasn’t always contingent on those seven stocks. A rising tide lifts most boats.

Survey parameters

For the latest 12-month period, more than 1,000 of the 1,191 funds tracked in the Journal’s survey made double-digit gains. The average fund returned 19.7%, and only four funds registered declines.

To qualify for inclusion in the Winners’ Circle, funds must be actively managed U.S.-stock funds with more than $50 million in assets and a record of three years or more, as well as meet a handful of other criteria. The survey excludes index and sector funds, funds that employ leverage strategies and most quantitative funds. The results are calculated by Morningstar Direct.

As always, this quarterly competition isn’t designed to create a “buy list” of funds for readers, but to demonstrate the ways that specific investment strategies benefited from recent market trends. Some of the funds that were highlighted a year ago have fallen in the rankings just as growth portfolios have grabbed the limelight—and that phenomenon isn’t uncommon.

Moreover, not all funds cited in these quarterly surveys may be available to investors, and they may have elements that make them unsuitable for some investors, ranging from their fee structure to their longer-term performance or volatility.

Take the latest No. 1 fund, for example. The $500 million Virtus Zevenbergen Innovative Growth Stock Fund (SAGAX) lost 55.4% in 2022 and 10.1% in 2021 as tech stocks tumbled amid the Federal Reserve’s rate-hike campaign and recession worry.

The fund returned 65.2% last year, however, thanks to the big turnaround for the large-cap growth stocks.

Patience paid off

“Markets and management teams spent all of 2022 fearing and preparing for a recession that has so far failed to appear, but that excess pessimism really swung the pendulum too far in terms of market sentiment,” says Joe Dennison, a portfolio manager of the Virtus fund. “That has created some great opportunities for patient long-term investors.”

It holds five of the Magnificent Seven, three of which—Tesla, Nvidia and Amazon—are among its top 10 holdings. Tesla, its largest holding, stands at 7.7% of the fund.

These stocks aren’t new to Dennison and his co-managers. The fund first bought shares of Nvidia in 2017. Its holdings in Tesla and Amazon date to 2010 and 2008, respectively.

Dennison says the biggest contributors to the fund’s 2023 performance besides Tesla and Nvidia were MercadoLibre, an e-commerce company in Latin America, and Shopify, an e-commerce business platform. Those stocks gained 86% and 124% last year, respectively.

The Virtus fund doesn’t shy away from high valuations. As of Dec. 29, the trailing price-to-earnings ratio of stocks it holds was 70.4, excluding negative earnings. This approach, however, can be volatile.

Indeed, Dennison acknowledges “there will be volatility and periods of underperformance,” but he adds that it’s important to focus on longer-term performance and stick with companies that the managers believe in.

Best of the rest

No. 2 in the latest survey, with a return of 59.1%, is the $290 million Value Line Larger Companies Focused Fund (VALLX), which holds all of the Magnificent Seven. They were initially put into the fund before 2023—though it did add to Amazon, Google parent Alphabet, Microsoft and Tesla in the first nine months of last year.

It trimmed its positions in Apple and Meta over that stretch.

The fund’s manager, Cindy Starke, says that 2023 was all about “adding to names that we had more conviction in,” rather than trying to unearth new stocks.

Starke looks for companies she thinks can increase sales at a three-year annualised compound rate of 10% or more and annualised earnings growth of at least 15% for three to five years.

She points out that the fund had broad stock appreciation last year: 25 of the holdings gained at least 50% over the year’s first three quarters. (That fund and others release quarterly holdings with a lag after the quarter ends, but performance is updated daily.)

Besides the Magnificent Seven, the fund’s winners included Uber Technologies, which appreciated 149% in 2023. It was put in the portfolio in the fourth quarter of 2021 and was the fund’s largest holding, at 6.5%, as of Sept. 30. Starke increased her holding in 2023.

When she added Uber to the fund in 2021, she recalls, “I just thought it was very undervalued” and that “the growth model would mature.”

Other top holdings include Nvidia, initially put into the fund in 2018; Microsoft (2020); Alphabet (2011) and Tesla (2021).

Two other big gainers for that fund: Advanced Micro Devices, which leapt 127% last year, and cybersecurity firm CrowdStrike Holdings, which rose 143%.

At the same time, Starke did plenty of selling. She trimmed the fund to 39 names from 47 over the first three quarters of 2023, jettisoning stocks such as Goldman Sachs, Walt Disney, Bank of America, Estée Lauder and Devon Energy. “I just got out of the names that didn’t offer me the same kind of growth opportunity,” she says.

Rounding out the top four funds are the $500 million Baron Fifth Avenue Growth Fund (BFTHX), which returned 57.2%, and the $11 billion Fidelity Blue Chip Growth K6 Fund (FBCGX), up 55.6%.

An outlier

A party crasher at No. 5 is the Morgan Stanley Inception Portfolio (MSSGX)—the lone fund in the top 10 outside of the large-cap growth category.

It toils in small-cap issues, which lagged behind large-caps last year. The Russell 2000 index of small stocks returned 16.9% in 2023, trailing the S&P 500 by nearly 10 percentage points.

But the Inception portfolio punched well above its weight, notching a return of 54.4%.

The fund’s managers aren’t afraid to make outsize bets. As of Sept. 30, its information-technology weighting was 38%, compared with 21.4% for the Russell 2000 Growth Index—the fund’s benchmark.

One of its best holdings as of Sept. 30 was Affirm Holdings, which runs a buy now, pay later platform. The stock gained more than 400 % last year.

But that small-cap fund is an outlier in the Winners’ Circle. It is the only one outside of the large-cap growth category among the top 24 finishers in the survey.

At No. 6 is the $25 billion Harbor Capital Appreciation Fund (HACAX), returning 53.7%. As of Sept. 30, the Magnificent Seven accounted for six of its top 10 holdings.

The fund’s managers did make some hay in healthcare, an unloved S&P 500 sector that otherwise eked out a 2.1% return last year, including dividends.

One such healthcare winner it held is Eli Lilly. The pharmaceutical company’s stock returned 61%, helped by its strong position in a nascent class of drugs for weight loss.

“We’re trying to find companies that can generate above-average growth rates sustainably over an investment cycle,” says Blair Boyer, a co-manager of the fund.

Another healthcare company that fit the bill for the fund is Novo Nordisk. Its portfolio includes the Wegovy weight-loss drug. The stock was up more than 50% last year.

The fund unloaded its positions in Thermo Fisher Scientific, which sells testing equipment and measurement tools to laboratories, and life-sciences company Danaher. Thermo Fisher Scientific’s stock fell 4%, and Danaher dropped by 2%.

One of the fund’s biggest sector bets last year was consumer discretionary, representing 25% of the fund at the end of the third quarter, compared with a 16% representation in the Russell 1000 Growth Index.

Shares of vacation-rental company Airbnb, another of the fund’s holdings, surged by 59%.

Ultimately, while large-caps mutual funds enjoyed the Magnificent Seven-led rebound last year, it’s impossible to say how they will fare in 2024 given uncertainty about the economy and the path of the Fed’s monetary policy.

But despite fickle market sentiment, managers of top-performing funds say the key to their success is patience and staying true to their strategy even when things look bleak, as in 2022.

“It was about staying the course, having the conviction and adhering to our investment philosophy in good times and bad,” says Starke of the Value Line fund.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

It’s easy to buy clunkers when you’re caught up in the moment. But regrettable purchases aren’t inevitable.

Trying to buy just the right souvenir on a trip is a risky business. You can wind up with a lifetime treasure—or an albatross you feel stuck with forever.

Consider the giant painting of a chicken flying out of Cuba that has been hanging over our couch in Palos Verdes, Calif., for the past 15 years. Buying it cheaply seemed to make sense when we were in Havana, since my husband’s family had fled the country after the revolution.

But the flying chicken just didn’t seem as, well, poignant by the time we returned home and hung the 4-by-7-foot painting. No guest has ever said a word about it. “I can’t help you with the chicken,” an art dealer told me long ago when I asked for help in selling it.

So, how do you find the right souvenir? Or is there even any such thing?

An everyday reminder

For many people, the answer to the second question is an unqualified “No,” and they have stopped trying. “Souvenirs never look as enticing or beautiful as they did at the time of purchase once you get them home,” warns Patricia Schultz, the author of “1,000 Places to See Before You Die.”

After collecting rugs on her trips, then Christmas ornaments, before running out of room at home for both, Schultz says, “I have gone cold turkey. I collect memories.”

But for others, surrendering just won’t do. “It’s intrinsic when people travel that they wind up bringing a keepsake of the journey,” says Rolf Potts, the author of “Souvenir,” a book that traces the history of travel souvenirs back to the earliest recorded journeys.

“It can be a way to show off,” he says. “Much like the envy-inducing travel posts on Instagram.” But for many people, he says, “It’s proof you were there, not only to show other people but also for yourself.”

For those who lean in this direction, there are ways to help avoid regrets. Tara Button , founder of the Buy Me Once website, and the author of “A Life Less Throwaway: The Lost Art of Buying for Life,” suggests focusing on practical items that fit your lifestyle and double as mementos.

As an example, she once bought a “very affordable” baby blanket made from alpaca fiber on a trip to Peru and now uses it every day. The blanket not only reminds her of “the time pre-children when I was traveling,” she says. “It goes over my 2-year-old son every night. It’s always soft and always gorgeous.”

She has a friend who collects one cup from each destination. “Those are perfect memory keepers,” she says. “A small item that is used every day.”

Finding the right scale

One obstacle to finding the right souvenir is that it can be hard to think practically when you are swept up in the excitement of a new culture. Consider the Burmese puppet, 15 inches tall, that has spent about two decades in the closet of Liz Einbinder , head of public relations for Backroads, an adventure-tour company.

“We saw a lot of puppets everywhere and just got caught up in all of the Burmese art and culture,” she says. Now she wonders, “Why did I bring this back? It sits in the back of my closet and I can’t seem to get rid of it. It creeps me out when I see it.”

When that buying urge sweeps over you, Button and other travel experts suggest pausing to consider your lifestyle, taste, needs, and the scale of your home—you’re going back to the reality of your everyday life, after all.

But that doesn’t necessarily mean being entirely practical. Einbinder collects miniatures, mostly miniature houses, from every country, and has more than a hundred. Most are in storage, but she keeps a little London bus and a little Egyptian pyramid on her desk. For her, souvenirs aren’t just about memories, they’re also about the hunt. “It gives me something to search for” on each trip, she says. “That’s half the fun.”

Ignore the hard sell

Another way travelers often go wrong is by giving in to pressure, or at least persistence, from salespeople.

When Kimba Hills, an interior designer, went to Morocco, she hired a guide who took her to a rug store in Fez, where the dealers delivered a whirlwind sales pitch while serving tea. She wound up buying a $4,000 flat-weave Turkish rug, measuring about 13 feet by 9 feet.

“No one in my group could believe I got seduced,” she says.

When the rug finally arrived at her home in Santa Monica, “It smelled like cow dung,” she says. Washing the rug was going to change the color.

When she called the dealer in Fez and demanded her money back, he refused, offering to send her a different rug instead. “We got into a yelling match,” says Hills. “All my skills went out the window.”

Looking back, she says, “You are in a buying mode because you are there and feel like you should buy something.” On a recent trip to Mexico, she bought nothing, explaining, “I’m wiser.”

Sometimes, magic

Spontaneity can cut both ways. There’s the chicken painting. But waiting for inspiration to strike, rather than planning to go home with a souvenir, can still help.

Henry Zankov, a sweater designer, says that when he travels, he explores his destinations with the idea that he won’t buy anything unless he comes across something he loves. He still buys plenty, but says “I don’t have regrets.” At his home in Brooklyn, he has ceramics, vases and glassware from shops he found randomly in Spain, Greece, and Italy. “I buy what I have to have,” he says.

There are times he doesn’t find anything. “So I just give up,” he says. “It’s OK.”

Some souvenirs do become the treasure of a lifetime.

Annie Lucas , the co-owner of MIR, which offers tours to less-traveled destinations, became captivated by a mirror on a trip to Morocco. It was made with hand-pounded silver and pieces of camel bones.

She went back to the store three or four times, debating the cost and whether she would regret it once she got home. It was heavy and measured 24 inches by 40 inches.

“That was 15 years ago, and I still treasure it,” she says. “If I had to get out of my house and had only five minutes to pack, I would grab that off the wall.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.