The Loneliness of the American Worker

More meetings and faceless chats. Fewer work friends. How the modern workday is fueling an epidemic of isolation.

More Americans are profoundly lonely, and the way they work—more digitally linked but less personally connected—is deepening that sense of isolation.

Nick Skarda , 29 years old, works two jobs in logistics and office administration in San Diego to keep up with his bills. After a couple of years at the logistics job, he has one friend there. He says hi to co-workers at his office job but doesn’t really know any.

“I feel sort of an emptiness or lack of belonging,” he says. Juggling two jobs leaves Skarda exhausted, with little energy or time to grab drinks with co-workers . “It makes it harder to go in and give it your all if you don’t feel like anyone is there rooting for you,” he adds.

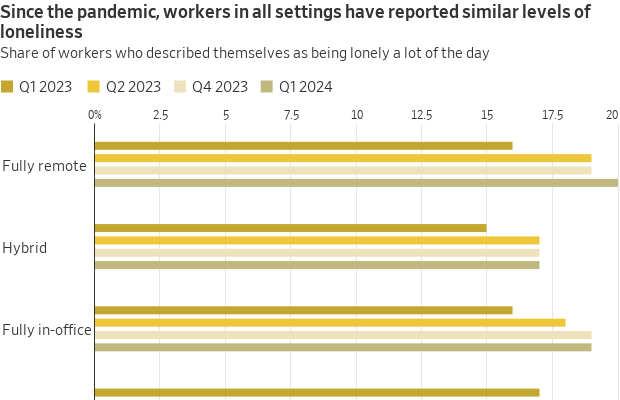

Employers and researchers are just beginning to understand how workplace shifts over the past four years are contributing to what the U.S. surgeon general declared a loneliness health epidemic last year. The alienation affects remote and in-person workers alike. Among 1-800-Flowers.com ’s 5,000 hybrid and fully on-site employees, for instance, the most popular community chat group offered by a company mental-health provider is simply called “Loneliness.”

Consider these phenomena of modern work:

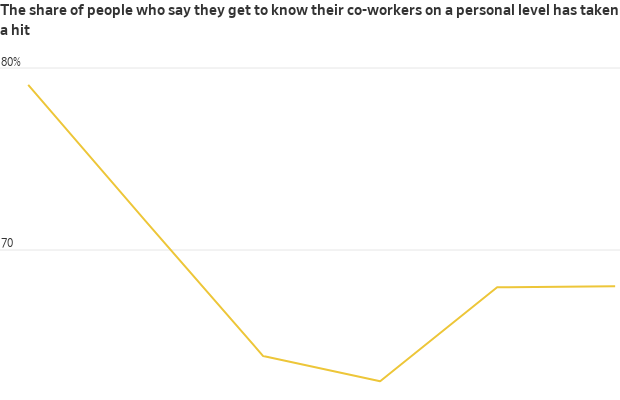

It is a marked shift from even a decade ago, when bonds fostered at work helped compensate for declining participation in church , community groups and other social institutions. As the American workday becomes more faceless and scheduled , the number of U.S. adults who call themselves lonely has climbed to 58% from 46% in 2018, according to a recent Cigna poll of 10,000 Americans.

The faceless workday

The disconnection is driving up staff turnover and worker absences, making it a business issue for more employers, executives and researchers say. Cigna, the health-insurance company, estimates that loneliness is costing companies $154 billion a year in absenteeism alone.

“Work is social, it’s a lot more than a paycheck,” says James McCann , founder and chairman of 1-800-Flowers.com.

Earlier this year, 1-800-Flowers.com moved from three days in the office to four to boost a sense of connectivity among workers. It has also begun tapping workers across teams to serve as designated hosts during lunchtime, encouraging people to sit with colleagues they don’t know in common areas and chat, and suggesting conversation topics.

While today’s workers have more ways to connect than ever, “there are only so many memes and jokes you can send over Slack,” says Maëlle Gavet , chief executive of Techstars, a pre-seed fund that has invested in 4,100 startups. “We tend to have more and more people with back-to-back calendars, more meetings and less connections.”

Gavet says that is especially the case for hybrid workers on in-office days, which they tend to use to dash from one meeting to the next.

Paradoxically, meetings can make people feel lonelier—and even more so if the meetings are virtual, behavioural researchers say. A 2023 survey by employee experience and analytics company Perceptyx found people who described themselves as “very lonely” tended to have heavier meeting loads than less-lonely staffers. More than 40% of those people spent more than half their work hours in meetings.

In Cincinnati, Kelly Roehm says she came to chafe at the meetings—sometimes as many as 12—consuming her day after joining a consulting company in 2021. She would often feel her eyes glazing over as she multitasked on other screens.

“It’s like you’re a zombie, there but not there,” says Roehm, who lived 10 minutes from the office but worked mostly remotely because she says few colleagues typically came in. It is a more common setup as companies distribute teams across more locations: At Microsoft , 27% of the company’s teams all worked in the same location last year, compared with 61% in 2019.

She compares that experience with her time more than a decade ago at a company now owned by AstraZeneca . There, she enjoyed lots of social outlets at work: a Weight Watchers group and a lunchtime crochet club.

“Now if I were to think about asking, ‘Hey, do you want to participate in something like this,’ it would just sound weird,” says Roehm, who left this year to focus on her own career-consulting business. “There wasn’t that emotional attachment that made it difficult to say, it’s time to move on.”

The power of small talk

Office chitchat, sometimes an unwanted distraction, seems to provide more benefits than many people realise, says Jessica Methot , an associate professor at Rutgers University who studies social ties at work.

In a study of 100 employees at different workplaces, Methot and fellow researchers surveyed participants at points throughout the day. They found those who had engaged in small talk reported less stress and more positivity toward co-workers.

Even exchanging pleasantries with a co-worker you barely know can help, says Sarah Wright , an associate professor at New Zealand’s University of Canterbury who studies worker loneliness.

“We used to think loneliness has to be overcome by developing meaningful relationships and having that degree of intimacy,” Wright says. “More and more, though, we’re seeing it’s these day-to-day weak ties and frequency of [interactions] with people that matters.”

Such interactions are substantially harder to replicate in a virtual environment. “The default now is, I have to schedule time with you, even if it’s five minutes, instead of just picking up the phone,” says Katie Tyson , president of Hive Brands, an online food retailer founded in 2020 as a fully remote company.

The frictions add up, she says. Last fall, the company added an office in New York where employees voluntarily gather a couple of times a week to foster more cohesion.

Coming to the office, even on a hybrid basis, tends to yield a roughly 20% to 30% boost in serendipitous connections, according to Syndezo, which analysed survey data and email and messaging traffic from more than two dozen large companies.

Yet there are diminishing returns to time in person, says Philip Arkcoll , founder of Worklytics, which analyses workforce data for Fortune 500 companies. Coming in once a month provides a significant boost in ties; two or three times a month adds a little more, Worklytics data show. Once or twice a week results in a smaller increase, though, and working in-person four or five days a week makes almost no difference.

A business priority

Ernst & Young has asked managers to use the first five minutes of team calls to engage in conversation “as real human beings,” says Frank Giampietro , whose title, chief well-being officer for the Americas, was created in 2021 to help support employees during the pandemic.

The professional-services firm is also training employees to spot and reach out to co-workers struggling with issues such as isolation. To date, more than 1,600 employees have taken the training.

One challenge is that American workers have sacrificed connection for productivity, says Julie Rice , co-founder of fitness chain SoulCycle. These days, with more business contacts preferring video calls, she finds breakfast meetings and coffee dates on her calendar have been replaced with Zoom. Though efficient, such video calls are less likely to yield conversations that can turn into useful professional connections or lasting friendships, she says.

“Even people I’m meeting with here in New York, we’ll just Zoom,” she says.

Last year, Rice co-founded Peoplehood, a company that runs “gathers” to improve connectivity and relationship skills, and employers are signing up. One, a beauty-services business with hundreds of field employees who never see each other, asked Peoplehood to host a series of gatherings for workers to meet and share job advice. Another, a marketing company with far-flung employees, requested help after surveys showed staff wanted to feel more connected.

“Whatever relationships we had pre-Covid have sort of run out of gas,” Rice says.

Good luck prodding employees to socialise, though. Nearly all the 150-odd staff at the Pleasanton, Calif., headquarters of Shaklee, the nutrition-supplements company, used to attend annual Earth Day gatherings, which involved community service, lunch and breaking early for the day, says Jonathan Ramot , the company’s North American human-resources director. Office happy hours, bowling outings and “mix and mingles” were also robustly attended.

Now that the workforce has gone remote, last year’s Earth Day event attracted 20 staffers, even though most workers live nearby.

“We have a lot of people asking for in-person events, but when we plan them, they don’t show up,” Ramot says. “Then they complain they’re lonely.”

This past April, Shaklee instead held a mandatory get-together with the chief executive, who had relocated to Florida during the pandemic and was in town. About 100 employees gathered at a brewery for food, drinks and conversation—and no speeches from the bosses.

There was a buzz in the air, Ramot says, as staff hugged and delighted in seeing each other, some for the first time. “People were saying, I miss this,” he says.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.