The Money and Drugs That Tie Elon Musk to Some Tesla Directors

Board members have reaped hundreds of millions from stock awards and separate investments, even as some have done drugs with Musk; former Tesla director Larry Ellison offered him a chance to dry out

Board members at Elon Musk’s electric-car maker, Tesla, were facing a dilemma.

One longtime director, the venture capitalist Steve Jurvetson, had left his firm after an internal investigation found he had slept with multiple women in the tech industry and used illegal drugs.

Some of the details had been splashed across the press in 2017, and Tesla directors informally discussed how they should handle it, according to people familiar with the situation. Some urged him to resign.

Luckily, Jurvetson, even though the company designated him an independent director, had a good friend with whom he had deep financial ties and also attended parties with, using ecstasy and LSD: Musk.

Musk pushed directors in private conversations to allow Jurvetson to take an unusual leave of absence from the board of the public company, and then step down on his own accord in 2020, the people said. Jurvetson remains a director at Musk’s privately held rocket company, SpaceX.

“The answer was do nothing and see what happens,” said another former independent Tesla director and good friend of Musk’s, Antonio Gracias, in a 2021 court deposition, when asked how the board handled the Jurvetson situation. Gracias and his venture-capital firm held investments recently valued at about $1.5 billion in Musk companies.

Multiple other directors of Musk companies have deep personal and financial ties to the billionaire entrepreneur, and have profited enormously from the relationship. The connections are an extreme blurring of friendship and fortune and raise questions among some shareholders about the independence of the board members charged with overseeing the chief executive. Such conflicts could run afoul of the loose rules governing what qualifies as independence at publicly traded companies.

On Tuesday, a Delaware judge struck down Musk’s multibillion-dollar pay package at Tesla, saying board members who signed off on it in 2018 were beholden to Musk.

Several current or former directors at Tesla and SpaceX attend parties with him, go on exotic vacations and hang out at Burning Man, the Nevada arts and music festival.

Musk and these directors, including venture capitalists Gracias and Ira Ehrenpreis, tech mogul Larry Ellison, former media executive James Murdoch, as well as Musk’s brother, Kimbal Musk, have invested tens of millions of dollars in each other’s companies—Ellison held billions of dollars in Tesla shares with about a 1.5% holding in 2022. Some also received career support and help from Elon Musk.

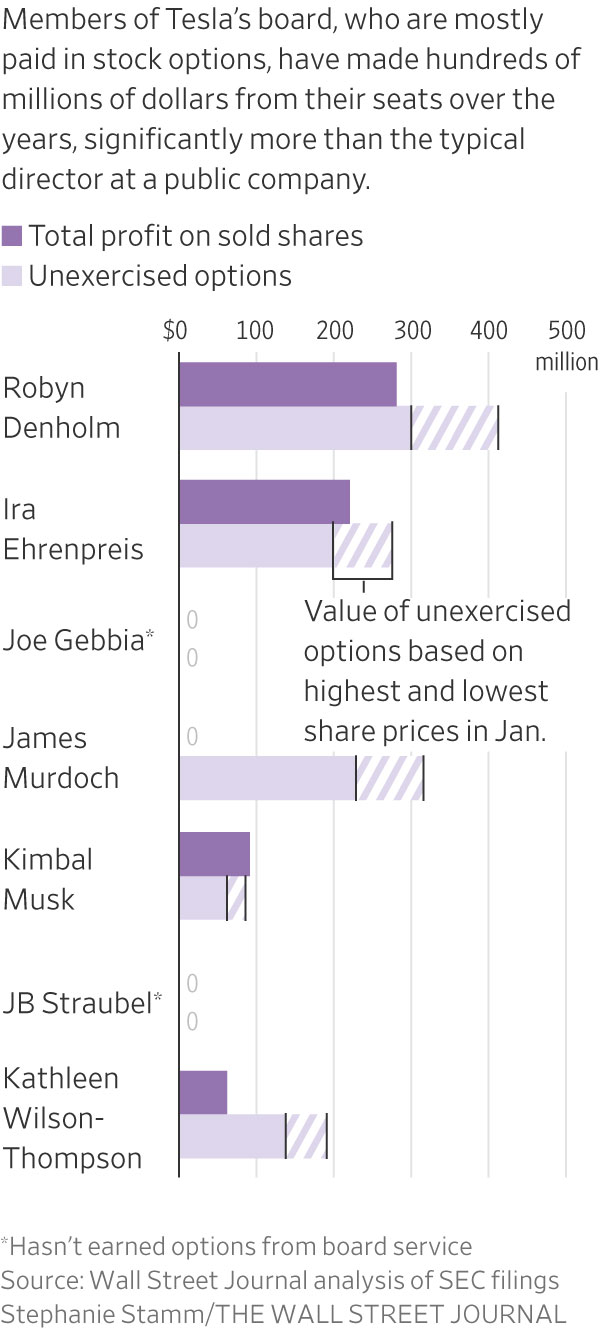

Most members of Tesla’s current eight-person board have amassed shares worth hundreds of millions of dollars from their seats over the years, significantly more than what board members at other companies make for their service.

Tesla pays its directors mostly in stock options, and the current board, not including Musk himself, collectively has made more than $650 million selling shares from those options. They hold additional options valued at nearly $1 billion. Some directors agreed to return a portion of that compensation to Tesla to resolve a shareholder lawsuit about their compensation while denying any wrongdoing. A judge has yet to approve the settlement.

Some current and former Tesla and SpaceX directors have knowledge of Musk’s illegal drug use but haven’t taken public action, according to people who have witnessed the drug use or were briefed on it.

The Wall Street Journal reported in January that Musk has used drugs including cocaine, ecstasy, LSD and magic mushrooms, and that leaders at Tesla and SpaceX were concerned about it, particularly his recreational use of ketamine, for which Musk has said he has a prescription. The illegal drugs violate strict anti drug policies at Musk’s companies and could put SpaceX’s federal contracts and Musk’s security clearance at risk.

At the upscale Austin Proper Hotel, Musk has attended social gatherings in recent years with Tesla board member Joe Gebbia, the Airbnb co-founder and a friend of his, where Musk took ketamine recreationally through a nasal spray bottle multiple times, according to people familiar with the drug use and the parties.

Other directors, Gracias, Jurvetson and Kimbal Musk, have consumed drugs with him, according to people who have witnessed the drug use and others with knowledge of it.

Musk and some people close to him, including Kimbal Musk, attend parties at Hotel El Ganzo, a boutique hotel in San José del Cabo, Mexico, known for its art and music scene as well as drug-fueled events, according to people familiar with the parties.

The volume of drug use by Musk and with board members has become concerning, some of these people said.

In the culture Musk has created around him, some friends, including directors, feel there is an expectation to consume drugs with him because they think refraining could upset the billionaire, who has made them a lot of money, some of the people said. More so, they don’t want to risk losing the social capital that comes from being close to Musk, which for some feels akin to having proximity to a king.

Musk and his lawyer, Alex Spiro, didn’t respond to requests for comment.

In response to the Journal article in January about Musk’s illegal drug use, Spiro said Musk is “regularly and randomly drug tested at SpaceX and has never failed a test.”

After that article, Musk tweeted that in three years of undergoing random drug testing after a pot-smoking incident in 2018, “Not even trace quantities were found of any drugs or alcohol. @WSJ is not fit to line a parrot cage for bird [poop emoji].” He later tweeted: “If drugs actually helped improve my net productivity over time, I would definitely take them!”

Tesla’s general counsel and a SpaceX spokesman didn’t respond to requests for comment.

Ellison offer

Some board members worry about the negative effects of Musk’s behaviour on the six companies he oversees and the roughly $800 billion in assets held by investors, according to people close to Musk.

Despite the concerns, the Tesla board hasn’t investigated his drug use or recorded their worries into official board minutes, which could become public.

Around the winter of 2022, Musk’s good friend and former Tesla board member, Ellison, urged him to come to his Hawaiian island to relax from work and dry out from the drugs, according to people familiar with the offer.

The outreach came as friends and others close to Musk worried that his drug use was getting worse, and some asked him to go to rehab, some of the people said.

Around the same time as the Ellison offer, Musk attended a party in the Hollywood Hills where he consumed a liquid form of ecstasy from a water bottle, according to a person who was there. Musk’s security guards asked people to leave the floor of the house for privacy before Musk took the drug.

Across Silicon Valley, executives sometimes invest in each others’ companies and ventures, and might have one or two personal friendships on a company board, especially before it goes public.

Musk, because of the extent of his personal and professional board ties and the enormous amount of money involved, is the most prominent example of a chief executive who is intertwined with directors. The Journal traced connections by reviewing hundreds of pages of court documents and depositions, Securities and Exchange Commission filings and other public records.

The amount Tesla pays its directors is far more than the average compensation for boards at most U.S. companies. The average total compensation for board members in the largest 200 U.S. companies was $329,351 in 2023, according to a new report from the National Association of Corporate Directors and compensation consultant Pearl Meyer. By comparison, current Alphabet board members hold stock valued at about $8 million, and received an average annual compensation for board service of about $475,000 since 2015.

Beyond board pay, some Tesla and SpaceX directors have tens of millions of dollars in additional investments in Musk’s companies, including his brain implant startup, Neuralink, and his tunneling venture, The Boring Co.

Musk, in turn, invests in some directors’ companies. Board members also have invested in Kimbal Musk’s Kitchen Restaurant Group and in SolarCity, a company run by Musk’s cousins that was acquired by Tesla.

Governance experts, such as longtime board members and advisers to boards, say the personal and financial ties could muddy directors’ views, and that it is highly unusual at U.S. public companies.

According to the rules of Nasdaq, where Tesla trades, an independent director can’t be an employee, a family member or someone whose relationship “would interfere with the exercise of independent judgment.” Nasdaq requires a majority independent board.

While rules governing independent directors across the country are murky, financial entanglement is one area where courts have sometimes found public companies at fault for claiming directors’ independence while they hold investments tied to one another.

Amalgamated Bank, which managed around $180 million of investments in Tesla as of September, signed a shareholder letter last year asking Tesla board members to step up their “meagre oversight” of Musk.

The investors expressed concern that the close ties between Musk and several Tesla directors make the board ill-equipped to act in the best interest of shareholders.

CEO with leeway

Some directors view Musk as a once-in-a-generation genius, with a brilliant mind and unusual methods. In depositions and courtroom testimony, directors have said they think Musk’s leadership is crucial to both Tesla and SpaceX, and believe in his long-held mission to colonize Mars. He is seen as the soul of his companies and intertwined with their success. Tesla’s stock is up more than 300% in the past four years, but has dropped about 25% since the beginning of January.

When striking down Musk’s pay package on Tuesday, the Delaware Court of Chancery judge called the process for approving it “deeply flawed” and cited Musk’s “extensive ties” to some of the directors who negotiated it. A Tesla shareholder had sued, alleging Musk played too big a role in deciding his own pay.

Musk “enjoyed thick ties with the directors tasked with negotiating on behalf of Tesla, and dominated the process that led to board approval of his compensation plan,” wrote Chancellor Kathaleen McCormick in the opinion. She described board Chair Robyn Denholm’s approach to her oversight obligations as “lackadaisical.”

Tesla board members can appeal the decision to the Delaware Supreme Court. After the ruling, Musk posted on X saying, “Never incorporate your company in the state of Delaware” and said Tesla would hold a shareholder vote about incorporating in Texas.

Board members had signed off on the pay deal in 2018, with Tesla valuing it at a maximum of $55.8 billion. It was the biggest pay package ever to the chief executive of a U.S. public company, according to governance-data firm Equilar.

While negotiating the pay package, Musk emailed the company’s top lawyer explaining how he would use the additional compensation. “The added comp is just so that I can put as much as possible towards minimising existential risk by putting the money towards Mars,” Musk wrote. Ehrenpreis, a yearslong friend, was head of the board’s compensation committee.

Company directors frequently allowed Musk an unusual amount of leeway on issues big and small.

After he bought Twitter in 2022, for example, Musk tapped Tesla employees to review the social-media platform’s engineering talent. Also around that time, SpaceX signed off on an unusual $1 billion loan to its chief executive, the Journal has reported.

A 2018 settlement with the SEC, following Musk’s tweet about plans to take Tesla private, required Tesla to establish more controls and form a new committee of independent board members to oversee Musk’s communications. But according to court documents, Denholm said Musk “does self-regulate” compliance, and some directors said they don’t review his tweets.

Tesla disclosed in 2022 that it had received a subpoena from the SEC seeking information about how the company was complying with the settlement.

Musk’s freewheeling commentary on Twitter, now X, and in interviews has injected volatility into Tesla’s share price and affected his other companies. In 2020, Tesla’s stock closed down more than 7% for the day after Musk tweeted, “Tesla stock price is too high imo.” Last year, major companies stopped advertising on X after he described an antisemitic post on X as “the actual truth.”

Investors have for decades pressed for independent directors, especially at public companies, because it allows them to push back against management and closely monitor what is happening inside the business.

The sweeping set of rules known as Sarbanes-Oxley in 2002 mandated that public companies have independent directors, including on the audit committee. The rules came after the collapse of energy trading giant Enron, which later was found to have hidden its financials amid improper board oversight.

Stock exchanges generally spell out how they define independence on boards and other expectations. At private companies, there are no requirements for the number of independent directors, or what constitutes one. At Nasdaq, if a company doesn’t comply with its majority independent board rule, it gives the company one year or until its next shareholder meeting to make a change; if not, it may be delisted.

Questions about a public director’s independence have gone to the courts, with judges sometimes finding problems with deep financial ties.

The Delaware Supreme Court in 2016 ruled that the majority of videogame developer Zynga’s board weren’t independent. Among the reasons was that a venture-capital firm two directors worked for had invested in a startup the CEO’s wife co-founded and that another director and her husband co-owned a private plane with the CEO.

Following the court’s decision, Zynga expanded its board and formed a special litigation committee to investigate insider trading allegations. Zynga settled the suit in 2019 for $11 million.

“To me, it’s really: Are you capable of making a disinterested, objective decision uninfluenced by the relationship?” said Lawrence Hamermesh, former director of the Widener Institute of Delaware Corporate and Business Law, who has also served as senior special counsel in the SEC’s corporate finance division.

Surrounded by friends

When Tesla was looking to replace a departing director, it turned to a familiar face in JB Straubel. The board believed the company’s former chief technology officer, whom Tesla considers a co-founder, was someone Musk would listen to, could fill Ellison’s shoes and had technical expertise, according to people with knowledge of the board’s thinking.

Last year, ahead of a vote to approve Straubel, some shareholders pushed back over his close ties to the company, saying if he were added to the board then at least five of the eight members would lack independence. Straubel was elected anyway. A Nasdaq spokesman said it doesn’t comment on specific companies and referred a Journal question on how Straubel can be classified as an independent director to Tesla.

Musk has long surrounded himself with close friends as he built his business empire. He has turned to them for advice on new business ventures and on daily operational help.

In addition to Musk on the Tesla board, his brother, Kimbal Musk, is a member. He previously served on the SpaceX board and has counselled Musk on numerous ventures, including whether to start OpenAI and Neuralink. He and Musk are also close personally, often attending the same events and parties.

Ehrenpreis, who chairs two of four committees on the Tesla board, is designated independent by the company and has been close to Musk for years.

The venture capitalist held the right to buy the first Tesla Model 3—which some covet for bragging rights. Around Musk’s 46th birthday in 2017, he gave it to Musk, tweeting, “Much love and respect for everything you do.”

Ehrenpreis has personally or through his venture-capital firm, DBL Partners, invested in many of Musk’s ventures, totalling about $70 million.

On the Tesla board, he has made more than $220 million on stock sales earned through board service and has additional options worth more than $200 million at recent prices.

James Murdoch, former chief executive of 21st Century Fox, also is classified independent by Tesla. His friendship with Musk dates back to around 2006, and he has vacationed with Musk and their families, including on trips to Israel and Mexico.

In court testimony in 2022, Musk said he didn’t know Murdoch well, though Murdoch in an earlier deposition affirmed his friendship with Musk.

Murdoch, who is the younger son of Rupert Murdoch, chairman emeritus of News Corp, which owns The Wall Street Journal, has said in court testimony he considers himself independent and has described a director as “having an ability to exercise independence of thought in governance and oversight as a member of a public company.”

Murdoch poured $20 million into SpaceX, and a company controlled by him invested about $50 million in the space company, court records show.

Denholm, who is designated independent, is based in Australia and doesn’t socialize with Musk. She has said in court testimony she doesn’t have personal investments in Musk’s other companies.

Her decade-long position on the Tesla board has been lucrative, earning her more than $625 million in the company’s equity. Denholm has exercised about half her options, profiting more than $280 million from the sales.

Denholm runs Tesla board meetings as informal, family-style occasions. Directors sometimes ask softball questions of Musk, such as future Tesla product colours, according to people familiar with the board.

Musk, meanwhile, would sometimes arrive two hours late, or hours early, and then blame his staff for not getting him there at the appropriate time, according to one of the people.

Musk said he handpicked Denholm, who replaced him as board chair in 2018 under an agreement with the SEC, according to an interview on “60 Minutes” that year.

The idea Denholm would watch over him was “not realistic” given his status as the company’s largest shareholder, he said in the interview, adding: “I can just call for a shareholder vote and get anything done that I want.” Musk later tweeted that the show had edited the interview in a misleading way. A “60 Minutes” spokeswoman said the show stands by its reporting.

Gebbia, the Airbnb co-founder and friend of Musk’s, joined the Tesla board in 2022, lives in Texas and is designated an independent director.

Former Walgreens Boots Alliance executive Kathleen Wilson-Thompson, who joined the board in 2018, is designated independent and doesn’t have public ties to Musk.

Deal with ex-girlfriend

Three current and former Tesla and SpaceX board members have been among Musk’s closest personal and financial partners.

Ellison, the co-founder and current chief technology officer of Oracle, was designated independent during his board tenure at Tesla between 2018 and 2022. He has said “I’m very close friends” with Musk and has hosted him multiple times at his Hawaiian island, Lanai.

When Musk revealed his plans to buy Twitter, Ellison committed $1 billion in 2022, while still on the Tesla board, to help fund it, surpassing the investments of many of the venture-capital firms involved in the deal.

Gracias, whom Tesla classified as the company’s lead independent director from 2010 until 2019, has been close friends with Musk for more than two decades. Musk turned to Gracias for support after his baby son died in the early 2000s, according to a 2021 court deposition.

He is also one of the friends who attends private parties around the world and sometimes consumes illegal drugs with Musk.

In court testimony in 2022, he called Musk “extraordinary,” “an amazing engineer” and “a product genius.”

For his work on the Tesla board, he has made more than $100 million by selling shares he earned.

When Musk needed cash, Gracias lent him $1 million, Gracias said in a court deposition, though it is unclear when he gave the money or what it was for. Musk has also personally invested about $10 million in Gracias’s Valor Equity Partners.

When asked in a court deposition whether his close friendship and business relationships with Musk affected his ability to act as an independent director at Tesla, particularly related to Musk’s 2018 pay package, Gracias said it didn’t. “Otherwise, I wouldn’t have done it,” he said.

Gracias stepped down from the Tesla board after more than a decade in 2021 in response to the pressure to improve its corporate governance. He remains a SpaceX director.

Jurvetson is one of Musk’s closest friends, and the two have mixed friendship and business for years. Jurveston was an early investor in SpaceX, and the two have used LSD and ecstasy together.

Jurvetson, who is an amateur rocket enthusiast, often hosts Elon and Kimbal Musk for parties at his house at Half Moon Bay, a small beachside city south of San Francisco.

One episode, soon after the 2017 scandal that led to Musk and Jurvetson working to keep his Tesla board seat, shows the extreme intertwining of personal and business relationships around Musk.

Tesla’s general counsel at the time, Todd Maron—who had been a divorce lawyer for Musk—helped negotiate an understanding with one of Jurvetson’s ex-girlfriends, Keri Kukral, according to emails between the company and Kukral reviewed by the Journal.

As part of the 2018 arrangement, Kukral was given permission by Maron to review and approve public messaging, such as press releases, related to Jurvetson and his Tesla board seat, the emails show. After Maron left Tesla, his successor general counsel, Jonathan Chang, continued to communicate with her, the emails show.

In return, Kukral wrote a professional recommendation of Jurvetson to Tesla as he campaigned to keep his board seat.

It is highly unusual for a company’s general counsel to get involved in such personal matters of board members, or to give an outside person the power to review company messaging, corporate governance experts said.

Musk also tried to persuade board members to let Jurvetson vote while he was on a leave of absence, people familiar with the conversations said. Kimbal Musk, Murdoch and Denholm pushed back, the people said.

Jurvetson made more than $9 million selling Tesla shares received as a director before leaving the board in 2020, according to the documents reviewed by the Journal.

At least two former board members have bristled at the company’s lack of corporate governance and deference to Musk.

Former Tesla board member Linda Johnson Rice wasn’t close with Musk or other directors outside of work, although she sometimes saw fellow director Gracias at work events in Chicago, where they are both based.

She didn’t stand for re-election to the board in 2019 after serving less than two years over frustration with Musk’s volatile behavior, including his drug use, the Journal reported. She informally asked whether the board should investigate and was brushed off.

“She served her term and that was it,” Musk tweeted about Rice, following the Journal’s January article about his drug use. “No negativity at all with Linda!”

Similarly, Hiromichi Mizuno, a former chief investment officer of Japan’s Government Pension Investment Fund, left the Tesla board in 2023 after three years in part because of the lack of ability he felt he had to work on improving the company’s governance-related practices. At issue was the board’s deference to Musk, who had different priorities for Tesla, according to people familiar with the board.

Mizuno found the board to operate more like a family company with fiefdoms, rather than a public company with stringent rules and regulations, even if it did usually perform well. He has made a practice of avoiding close relationships with others in the workplace to remain objective. While Mizuno was sometimes invited for a drink with Musk, he never attended his private parties or events, according to the people.

Musk has been recently pushing for even greater control over Tesla. He currently owns around 13% of the company.

In mid-January, before the Delaware court ruling on his pay package, he wrote in a post on X that he was uncomfortable transforming the electric vehicle giant into a leader in artificial intelligence and robotics without voting control over roughly 25% of the company.

“Unless that is the case, I would prefer to build products outside of Tesla,” Musk wrote.

The tweet was effectively an ultimatum for Tesla board members to revisit his compensation. The board so far hasn’t acted.

—Berber Jin, Lisa Schwartz and Jim Oberman contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Impact investing is becoming more mainstream as larger, institutional asset owners drive more money into the sector, according to the nonprofit Global Impact Investing Network in New York.

In the GIIN’s State of the Market 2024 report, published late last month, researchers found that assets allocated to impact-investing strategies by repeat survey responders grew by a compound annual growth rate (CAGR) of 14% over the last five years.

These 71 responders to both the 2019 and 2024 surveys saw their total impact assets under management grow to US$249 billion this year from US$129 billion five years ago.

Medium- and large-size investors were largely responsible for the strong impact returns: Medium-size investors posted a median CAGR of 11% a year over the five-year period, and large-size investors posted a median CAGR of 14% a year.

Interestingly, the CAGR of assets held by small investors dropped by a median of 14% a year.

“When we drill down behind the compound annual growth of the assets that are being allocated to impact investing, it’s largely those larger investors that are actually driving it,” says Dean Hand, the GIIN’s chief research officer.

Overall, the GIIN surveyed 305 investors with a combined US$490 billion under management from 39 countries. Nearly three-quarters of the responders were investment managers, while 10% were foundations, and 3% were family offices. Development finance institutions, institutional asset owners, and companies represented most of the rest.

The majority of impact strategies are executed through private-equity, but public debt and equity have been the fastest-growing asset classes over the past five years, the report said. Public debt is growing at a CAGR of 32%, and public equity is growing at a CAGR of 19%. That compares to a CAGR of 17% for private equity and 7% for private debt.

According to the GIIN, the rise in public impact assets is being driven by larger investors, likely institutions.

Private equity has traditionally served as an ideal way to execute impact strategies, as it allows investors to select vehicles specifically designed to create a positive social or environmental impact by, for example, providing loans to smallholder farmers in Africa or by supporting fledging renewable energy technologies.

Future Returns: Preqin expects managers to rely on family offices, private banks, and individual investors for growth in the next six years

But today, institutional investors are looking across their portfolios—encompassing both private and public assets—to achieve their impact goals.

“Institutional asset owners are saying, ‘In the interests of our ultimate beneficiaries, we probably need to start driving these strategies across our assets,’” Hand says. Instead of carving out a dedicated impact strategy, these investors are taking “a holistic portfolio approach.”

An institutional manager may want to address issues such as climate change, healthcare costs, and local economic growth so it can support a better quality of life for its beneficiaries.

To achieve these goals, the manager could invest across a range of private debt, private equity, and real estate.

But the public markets offer opportunities, too. Using public debt, a manager could, for example, invest in green bonds, regional bank bonds, or healthcare social bonds. In public equity, it could invest in green-power storage technologies, minority-focused real-estate trusts, and in pharmaceutical and medical-care company stocks with the aim of influencing them to lower the costs of care, according to an example the GIIN lays out in a separate report on institutional strategies.

Influencing companies to act in the best interests of society and the environment is increasingly being done through such shareholder advocacy, either directly through ownership in individual stocks or through fund vehicles.

“They’re trying to move their portfolio companies to actually solving some of the challenges that exist,” Hand says.

Although the rate of growth in public strategies for impact is brisk, among survey respondents investments in public debt totaled only 12% of assets and just 7% in public equity. Private equity, however, grabs 43% of these investors’ assets.

Within private equity, Hand also discerns more evidence of maturity in the impact sector. That’s because more impact-oriented asset owners invest in mature and growth-stage companies, which are favored by larger asset owners that have more substantial assets to put to work.

The GIIN State of the Market report also found that impact asset owners are largely happy with both the financial performance and impact results of their holdings.

About three-quarters of those surveyed were seeking risk-adjusted, market-rate returns, although foundations were an exception as 68% sought below-market returns, the report said. Overall, 86% reported their investments were performing in line or above their expectations—even when their targets were not met—and 90% said the same for their impact returns.

Private-equity posted the strongest results, returning 17% on average, although that was less than the 19% targeted return. By contrast, public equity returned 11%, above a 10% target.

The fact some asset classes over performed and others underperformed, shows that “normal economic forces are at play in the market,” Hand says.

Although investors are satisfied with their impact performance, they are still dealing with a fragmented approach for measuring it, the report said. “Despite this, over two-thirds of investors are incorporating impact criteria into their investment governance documents, signalling a significant shift toward formalising impact considerations in decision-making processes,” it said.

Also, more investors are getting third-party verification of their results, which strengthens their accountability in the market.

“The satisfaction with performance is nice to see,” Hand says. “But we do need to see more about what’s happening in terms of investors being able to actually track both the impact performance in real terms as well as the financial performance in real terms.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.