Underwhelming Chinese Stock Markets Show Concern Over Recovery

China’s stocks have underperformed this year as questions linger on durability of economic rebound

One mystery in global markets this year is that while China’s economy appears to be rebounding strongly, its stock market hasn’t been doing as well.

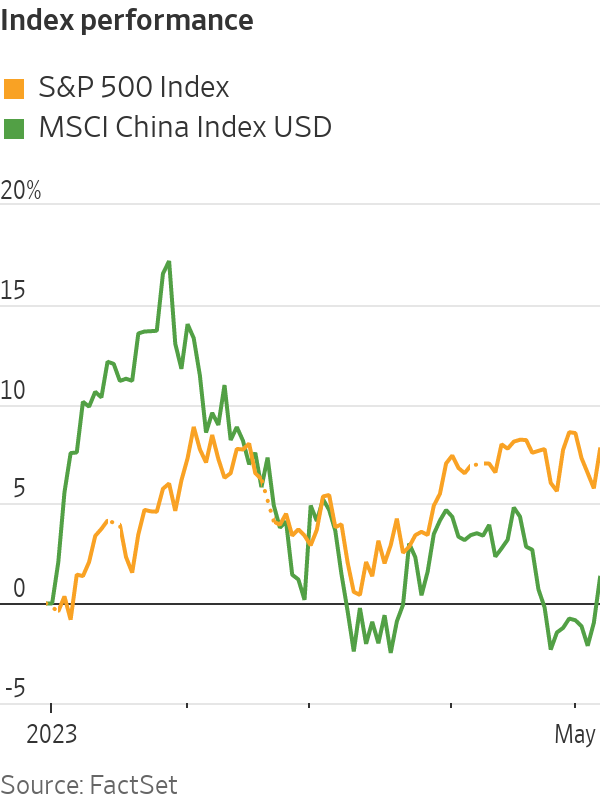

The MSCI China index has risen only 1.8% so far this year, underperforming many of the major markets. The S&P 500 index, for example, has gained 7.7%. Stocks listed in Shanghai and Shenzhen have done a bit better—the CSI 300 index has gone up 4.9% in 2023. That seems to be in contrast to the rebounding economy, after China scrapped its strict “zero-Covid” pandemic restrictions in December and scaled back its regulatory crackdown on its technology companies.

China’s gross domestic product grew 4.5% from a year earlier in the first quarter and, more significantly, consumption has also come back strongly: retail sales jumped more than 10% in March from a year earlier. Crowds were everywhere in Chinese scenic spots in the recent five-day “Golden Week” holiday. Total domestic trips during the holiday rose 19% from the same period in 2019, according to official figures. Tourism revenue also recovered to pre pandemic levels.

Of course, the rally in Chinese stocks late last year already priced in a big part of the recovery. The MSCI China index surged 34% in the last two months in 2022, after rumours of reopening started to circulate.

Yet earnings growth so far has been disappointing. For nearly 80% of Chinese listed companies that have reported their first-quarter results, profits only grew an average 1% year on year, with around 69% of them having missed consensus earnings estimates, according to Goldman Sachs. About 77% of A-share shares—companies listed in Shanghai and Shenzhen—revised down their earnings guidance for 2023, according to Bank of America.

Earnings growth will likely improve ahead, especially against a lower base last year, when lockdowns across the country battered the economy. The struggling housing sector also seems to have stabilised. But a big question that remains is how long the consumption bounce could last. The export sector may suffer with a potential recession looming in the U.S. and Europe. China’s job market, especially for younger workers, is still quite weak. That partly explains why investors have jumped back into shares of state-owned enterprises—a more stable choice in an uncertain time.

Chinese stocks have rebounded substantially from their lows last year, but are still way off their peaks in early 2021, when China appeared to have avoided the worst of the pandemic. A more sustained market recovery would require a more broad-based revival of earnings growth.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.