‘Envy of the World’—U.S. Economy Expected to Keep Powering Higher

Economists lift their growth forecasts in latest Wall Street Journal survey

It has been two years since forecasters felt this good about the economic outlook.

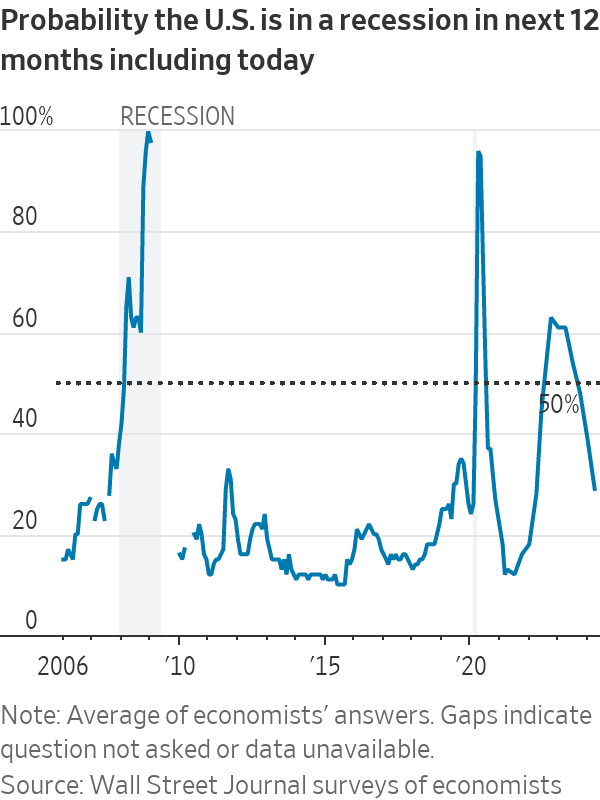

In the latest quarterly survey by The Wall Street Journal, business and academic economists lowered the chances of a recession within the next year to 29% from 39% in the January survey . That was the lowest probability since April 2022, when the chances of a recession were set at 28%.

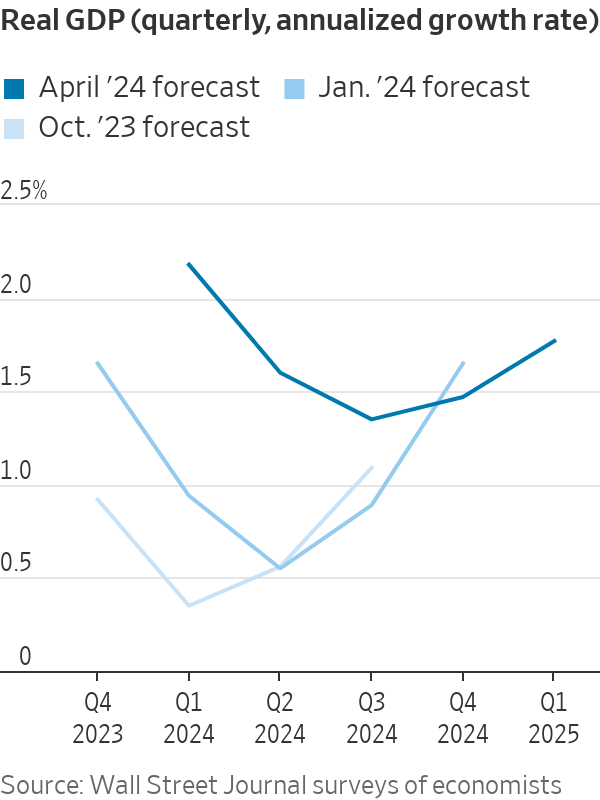

Economists, in fact, don’t think the economy will get even close to a recession. In January, they on average forecast sub-1% growth in each of the first three quarters of this year. Now, they expect growth to bottom out this year at an inflation-adjusted 1.4% in the third quarter.

Just 10% of survey respondents think the economy will experience at least one quarter of negative growth over the next 12 months, down from 33% in January.

The Wall Street Journal survey was conducted from April 5 to 9, just before the release of March consumer-price index data showing inflation running hotter than economists had anticipated.

The U.S. economy has far outperformed expectations over the past year and a half. Instead of stumbling under the weight of the Federal Reserve’s most aggressive interest-rate-raising campaign in four decades, it has continued expanding at a robust clip.

Few think that the economy can do quite as well as last year’s 3.1% growth, as measured by the seasonally adjusted fourth-quarter change from a year earlier. That figure might have been boosted by one-time factors such as federal infrastructure and semiconductor legislation and an uptick in immigration , which also might not last.

Still, economists have had to rethink forecasts for a major slowdown as more time has passed and one still doesn’t seem imminent. Economists on average think the economy grew at a 2.2% rate in the first three months of the year, up from a 0.9% forecast in January.

“The U.S. economy is performing very well,” EconForecaster economist James Smith said in the survey. “We’re truly the envy of the world.”

Much has changed since economists were last this optimistic. Two years ago, the Fed’s benchmark federal-funds rate was set between 0.25% and 0.5%. Inflation was high but economists still generally thought that it could come down without too much help from the Fed. They forecast steady growth and the midpoint of the range for the fed-funds rate topping out at just above 2.5%.

Now, the fed-funds rate is sitting between 5.25% and 5.5%, and economists don’t see a bunch of cuts coming soon. Many analysts trimmed their rate-cut forecasts after last week’s hot inflation report. But even before the report, survey respondents predicted that rates would end the year at 4.67%, implying three cuts. In January, their responses suggested that they thought four or five cuts were likely.

Economists now think the economy can withstand higher rates than they did not long ago.

They expect the 10-year Treasury yield—a key borrowing benchmark that was around 4.4% at the time of the survey—to end 2024 at 3.97%. Looking further into the future, they expect the yield to end 2026 at 3.78%. That is slightly above even their forecast last October, when the yield was higher than it is now.

Many economists have long thought that the economy can handle higher interest rates when it is capable of growing faster, and particularly when worker productivity has increased.

To that end, economists expect the Labor Department’s measure of productivity to rise at an annual rate of 1.9% over the next decade. That matches the annual increase in productivity over the last 40 years. But it is above the 1.2% pace of the 2010s, when the 10-year Treasury yield was typically stuck between 1.5% and 2.5%.

Some economists are now enthusiastic about the economy’s longer-term potential.

“We think that the American economy has entered a virtuous cycle where strong productivity results in growth above the long-term trend, inflation between 2% and 2.5% and an unemployment rate between 3.5% and 4%,” RSM US chief economist Joe Brusuelas said in the survey.

Many aren’t quite as optimistic. One downside of a better growth outlook is that a stronger economy could make it harder for inflation to fall all the way back to the Fed’s 2% target.

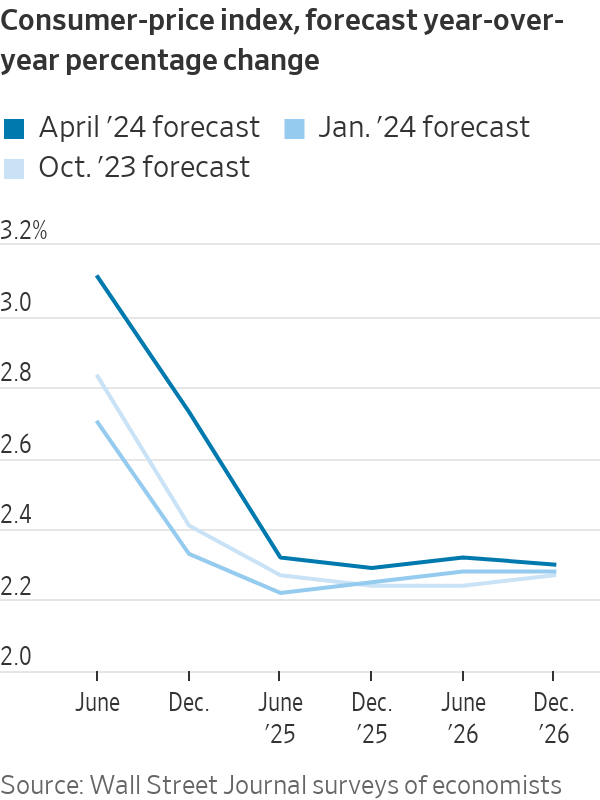

An inflation gauge that is closely watched by the Fed, the core personal-consumption expenditures price index, was 2.8% in February, its most recent reading. Economists now expect it to end the year at 2.5%, after having forecast 2.3% in January.

Economists, on average, believe that core PCE inflation will fall to 2.1% by the end of next year without a recession. However, their projections might already have ticked higher after last week’s price data, and some continue to worry that the Fed’s efforts to control inflation still present a major threat to the economy.

“The risks are clearly skewed toward more hawkish Fed outcomes, which could drag on our growth forecasts,” Deutsche Bank economists Brett Ryan and Matthew Luzzetti said in the survey.

The Wall Street Journal survey was answered by 69 economists. Not every economist responded to every question.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

An original watercolour illustration for the cover of Harry Potter and the Philosopher’s Stone, 1997 — the first book in J.K. Rowling’s hit series—could sell for US$600,000 at a Sotheby’s auction this summer.

The illustration is headlining a June 26 sale in New York that will also feature big-ticket items from the collection of the late Dr. Rodney P. Swantko, a surgeon and collector from Indiana, including manuscripts by poet Edgar Allan Poe and Arthur Conan Doyle, author of the Sherlock Holmes books

The Harry Potter illustration, which introduced the young wizard character to the world, is expected to sell for between US$400,000 to US$600,000, which would make it the highest-priced item ever sold related to the Harry Potter world. This is the second time the illustration has been sold, however—it was on the auction block at Sotheby’s in London in 2001, where it achieved £85,750 (US$107,316).

The artist of the illustration, Thomas Taylor, was 23 years old at the time and a graduate student working at a children’s bookshop. According to Sotheby’s, Taylor took a “professional commission from an unknown author to visualise a unique wizarding world,” Sotheby’s said in a news release. He depicted Harry Potter boarding the train to Hogwarts on platform9 ¾ platform, and the illustration became the “universal image” of the Harry Potter series, Sotheby’s said.

“It is exciting to see the painting that marks the very start of my career, decades later and as bright as ever! It takes me back to the experience of reading Harry Potter for the first time—one of the first people in the world to do so—and the process of creating what is now an iconic image,” Taylor said in the release.

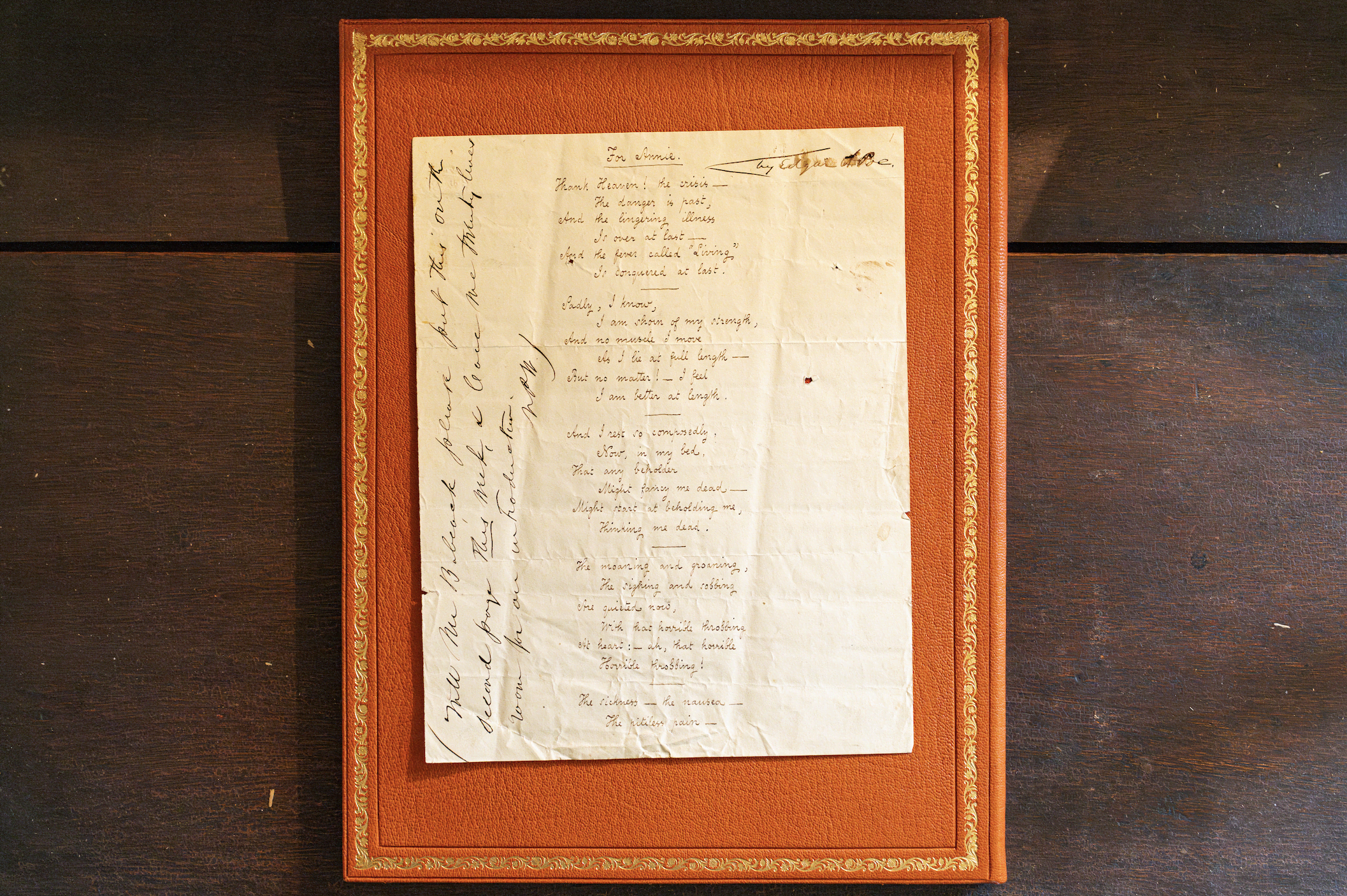

Meanwhile, to commemorate the 175th anniversary of Edgar Allan Poe’s For Annie , 1849, Sotheby’s recently reunited the autographed manuscript of the poem with the author’s home, Poe Cottage, in the Bronx.

The cottage is where the author lived with his wife, Virginia, and mother-in-law, Maria Clemm, from 1846 until he died in 1849. The manuscript, also from the Swantko collection, will remain at the home until it is offered at auction at Sotheby’s on June 26 with an estimate between US$400,000 and US$600,000.

Matthew Borowick for Sotheby’s

Poe Cottage, preserved and overseen by the Bronx County Historical Society, is home to many of the author’s famous works, including Eureka , 1948, and Annabel Lee , 1927.

“To reunite the For Annie manuscript with the Poe Cottage nearly two centuries after it was first composed brought to life literary history for a truly special and unique occasion,” Richard Austin , Sotheby’s Global Head of Books & Manuscripts, said in a news release.

For Annie was one of Poe’s most important compositions, and was addressed to Nancy “Annie” L. Richmond, one of the several women Poe pursued after his wife Viriginia’s death from tuberculosis in 1847.

In a letter to Richmond herself, Poe proclaimed For Annie was his best work: “I think the lines For Annie much the best I have ever written.”

The poem was composed in 1849, only months before Poe’s death, Sotheby’s said in the piece, Poe highlights the romantic comfort he feels from a woman named Annie while simultaneously grappling with the darkness of death, with lines like “And the fever called ‘living’ is conquered at last.”

Matthew Borowick for Sotheby’s

In the margins of the manuscript are the original handwritten instructions by Nathaniel P. Willis, co-editor of the New York Home Journal, where Poe published other poems such as The Raven and submitted For Annie on April 20, 1849.

Willis added Poe’s name in the top right and instructions about printing and presenting the poem on the side. The poem was also published in the Boston Weekly that same month.

Another piece of literary history included in the Swantko sale could surpass US$1 million. Conan Doyle’s autographed manuscript of the Sherlock Holmes tale The Sign of Four , 1889, is estimated to achieve between US$800,000 and US$1.2 million.

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts