The U.S. and IMF Disagree About China. That’s a Problem.

The IMF doesn’t share U.S. view that China’s massive trade surpluses are hurting the world, and that tension is likely to grow

Eighty years ago world leaders meeting in Bretton Woods, N.H., created the International Monetary Fund to prevent the sorts of economic imbalances that had brought on the Great Depression.

Today, imbalances once again threaten global harmony. China’s massive trade surplus is fuelling a backlash. The U.S. attributes those surpluses to China holding down consumption while subsidising manufacturing and exports, inflicting collateral damage on its trading partners. And it would like the IMF to say so.

The IMF, though, has steered a more neutral path. It has prodded Beijing to change its economic model while playing down any harm from that model for the world.

Decades ago, U.S. leaders thought bringing China into the postwar economic institutions such as the IMF and World Trade Organization would make Beijing more market-oriented and the world more stable. They now think the opposite. China has doubled down on an authoritarian, state-driven economic model that many in the West see as incompatible with their own.

The IMF, the world’s most influential international economic institution, may find itself torn between irreconcilable visions of the global economy, especially if former President Donald Trump is re-elected next month.

Trump has prioritised reducing the trade deficit, especially with China, through tariffs, an approach the IMF has criticised. Many of his advisers are deeply suspicious of both Beijing and international institutions. Project 2025, an agenda for a second Trump term that includes many Trump advisers as authors, has suggested the U.S. should leave the IMF, though there is no sign Trump agrees.

The U.S. has been upset about the growth in China’s trade surplus since it joined the World Trade Organization in 2001, wiping out U.S. factory jobs in what became known as the China shock .

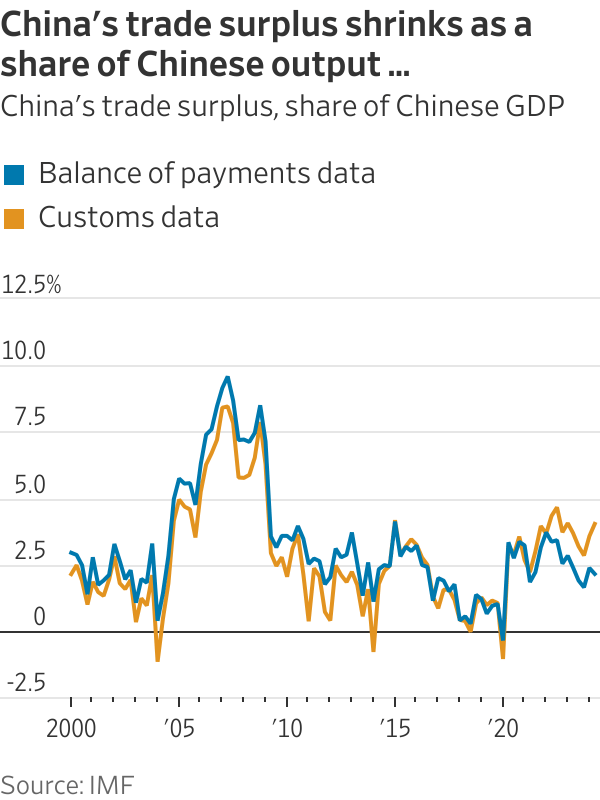

China’s surpluses have since shrunk as a share of its gross domestic product. But because China’s economy is now so large, that surplus has grown as share of world GDP, to 0.7%. Other countries are alarmed at a growing flood of cheap manufacturing imports, dubbed “China Shock 2.0 .”

Jake Sullivan , President Biden’s national security adviser, said at the Brookings Institution Wednesday that China “is producing far more than domestic demand, dumping excess onto global markets at artificially low prices, driving manufacturers around the world out of business, and creating a chokehold on supply chains.”

Treasury Undersecretary Jay Shambaugh told me at a panel organised by the Atlantic Council two weeks ago that China is “already 30% of global manufacturing. You can’t grow at a massive rate when you start from 30% of the world without displacing not just us, but lots of countries.”

Pointing out such tensions is part of the IMF’s job, Shambaugh said at the event. While the IMF has said China’s industrial policies may be hurting its trading partners, “I would like to see them pay more attention…to the aggregate external imbalance.”

The IMF’s architects believed a breakdown in economic cooperation contributed to the Depression. Countries such as the U.S. that ran large trade surpluses felt no pressure to help those with deficits, like Britain. Depressed countries sought to limit imports and boost exports by devaluing their currencies or imposing tariffs, in effect seeking to export their unemployment.

To end such “beggar-thy-neighbour” policies, British economist John Maynard Keynes proposed that trade be conducted through a global bank and currency that would prevent big deficits and surpluses. Instead, at Bretton Woods, delegates agreed to peg their currencies to the dollar with the IMF overseeing periodic revaluations.

By the 1970s, inflation and growing trade deficits caused fixed exchange rates to collapse. Cross-border capital flows soared, enabling poor countries to borrow from western banks and investors. When they defaulted, the IMF had a new mission: helping them restructure their debts, usually on the condition of strict budget austerity. IMF, a popular joke ran, stood for “It’s Mostly Fiscal.”

Even today, while the IMF does still monitor trade deficits and surpluses, it rarely attributes those to cross-border influences, focusing instead on fiscal and other domestic factors.

In a blog post last month, IMF staff investigated the U.S. deficit and Chinese surplus and found little connection.

The U.S. deficit reflected strong government and household spending, while China’s surplus resulted from slumping property markets and domestic confidence. They “are mostly homegrown,” they wrote. In an implicit rebuke to the U.S., they wrote, “Worries that China’s external surpluses result from industrial policies reflect an incomplete view.”

This benign view of Chinese surpluses has drawn criticism. Brad Setser , a former U.S. Treasury official now at the Council on Foreign Relations, said the IMF has relied on data that understates the surplus.

Setser also raps the IMF’s advice to Beijing to let interest rates and the exchange rate fall while tightening fiscal policy—that is, raising taxes or cutting spending. That, he said, will weaken imports, boost exports and thus widen the trade surplus.

“Their analysis is all about how bad the fiscal situation is, with no real analysis of the balance of payments position,” Setser said.

Pierre-Olivier Gourinchas , the IMF’s chief economist, disagreed. He noted the IMF has consistently urged China to boost household consumption such as by strengthening the social safety net and shifting more of the tax burden from the high-consuming poor to the high-saving rich. He also noted that the IMF has argued for fiscal stimulus now and consolidation later.

Does the IMF’s opinion make a difference? Most countries—the big ones especially—will never need to borrow from the IMF and can thus ignore its advice. The IMF has long urged the U.S. to rein in its budget deficit, noting this contributes to its trade deficit, and the U.S. has just as long ignored it.

And yet when the IMF speaks, it does so with an authority and credibility that no private analyst or individual country commands.

China’s approach to boosting exports is “killing jobs elsewhere, and that’s something the IMF should call out,” said Martin Mühleisen , a former senior IMF official now at The Atlantic Council. “China doesn’t want bad publicity from the IMF, in part because the criticism would resonate in many countries.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

There has rarely, if ever, been so much tech talent available in the job market. Yet many tech companies say good help is hard to find.

What gives?

U.S. colleges more than doubled the number of computer-science degrees awarded from 2013 to 2022, according to federal data. Then came round after round of layoffs at Google, Meta, Amazon, and others.

The Bureau of Labor Statistics predicts businesses will employ 6% fewer computer programmers in 2034 than they did last year.

All of this should, in theory, mean there is an ample supply of eager, capable engineers ready for hire.

But in their feverish pursuit of artificial-intelligence supremacy, employers say there aren’t enough people with the most in-demand skills. The few perceived as AI savants can command multimillion-dollar pay packages. On a second tier of AI savvy, workers can rake in close to $1 million a year .

Landing a job is tough for most everyone else.

Frustrated job seekers contend businesses could expand the AI talent pipeline with a little imagination. The argument is companies should accept that relatively few people have AI-specific experience because the technology is so new. They ought to focus on identifying candidates with transferable skills and let those people learn on the job.

Often, though, companies seem to hold out for dream candidates with deep backgrounds in machine learning. Many AI-related roles go unfilled for weeks or months—or get taken off job boards only to be reposted soon after.

Playing a different game

It is difficult to define what makes an AI all-star, but I’m sorry to report that it’s probably not whatever you’re doing.

Maybe you’re learning how to work more efficiently with the aid of ChatGPT and its robotic brethren. Perhaps you’re taking one of those innumerable AI certificate courses.

You might as well be playing pickup basketball at your local YMCA in hopes of being signed by the Los Angeles Lakers. The AI minds that companies truly covet are almost as rare as professional athletes.

“We’re talking about hundreds of people in the world, at the most,” says Cristóbal Valenzuela, chief executive of Runway, which makes AI image and video tools.

He describes it like this: Picture an AI model as a machine with 1,000 dials. The goal is to train the machine to detect patterns and predict outcomes. To do this, you have to feed it reams of data and know which dials to adjust—and by how much.

The universe of people with the right touch is confined to those with uncanny intuition, genius-level smarts or the foresight (possibly luck) to go into AI many years ago, before it was all the rage.

As a venture-backed startup with about 120 employees, Runway doesn’t necessarily vie with Silicon Valley giants for the AI job market’s version of LeBron James. But when I spoke with Valenzuela recently, his company was advertising base salaries of up to $440,000 for an engineering manager and $490,000 for a director of machine learning.

A job listing like one of these might attract 2,000 applicants in a week, Valenzuela says, and there is a decent chance he won’t pick any of them. A lot of people who claim to be AI literate merely produce “workslop”—generic, low-quality material. He spends a lot of time reading academic journals and browsing GitHub portfolios, and recruiting people whose work impresses him.

In addition to an uncommon skill set, companies trying to win in the hypercompetitive AI arena are scouting for commitment bordering on fanaticism .

Daniel Park is seeking three new members for his nine-person startup. He says he will wait a year or longer if that’s what it takes to fill roles with advertised base salaries of up to $500,000.

He’s looking for “prodigies” willing to work seven days a week. Much of the team lives together in a six-bedroom house in San Francisco.

If this sounds like a lonely existence, Park’s team members may be able to solve their own problem. His company, Pickle, aims to develop personalised AI companions akin to Tony Stark’s Jarvis in “Iron Man.”

Overlooked

James Strawn wasn’t an AI early adopter, and the father of two teenagers doesn’t want to sacrifice his personal life for a job. He is beginning to wonder whether there is still a place for people like him in the tech sector.

He was laid off over the summer after 25 years at Adobe , where he was a senior software quality-assurance engineer. Strawn, 55, started as a contractor and recalls his hiring as a leap of faith by the company.

He had been an artist and graphic designer. The managers who interviewed him figured he could use that background to help make Illustrator and other Adobe software more user-friendly.

Looking for work now, he doesn’t see the same willingness by companies to take a chance on someone whose résumé isn’t a perfect match to the job description. He’s had one interview since his layoff.

“I always thought my years of experience at a high-profile company would at least be enough to get me interviews where I could explain how I could contribute,” says Strawn, who is taking foundational AI courses. “It’s just not like that.”

The trouble for people starting out in AI—whether recent grads or job switchers like Strawn—is that companies see them as a dime a dozen.

“There’s this AI arms race, and the fact of the matter is entry-level people aren’t going to help you win it,” says Matt Massucci, CEO of the tech recruiting firm Hirewell. “There’s this concept of the 10x engineer—the one engineer who can do the work of 10. That’s what companies are really leaning into and paying for.”

He adds that companies can automate some low-level engineering tasks, which frees up more money to throw at high-end talent.

It’s a dynamic that creates a few handsomely paid haves and a lot more have-nots.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.