Will ‘Decentralized Finance’ Be the Next Disruptive Technology?

The International Monetary Fund’s (IMF) latest Global Financial Stability Report highlights myriad risks for the global financial system.

The International Monetary Fund’s (IMF) latest Global Financial Stability Report highlights myriad risks for the global financial system. They include the war in Ukraine, high debt, and soaring inflation.

But the report also warned about the impact of decentralized finance, or DeFi, an emerging set of financial services applications that are based on blockchain and other crypto technologies and don’t involve banks other traditional financial intermediaries

Citing possible systemic risk, the IMF wants governments to impose regulations because, the report says, DeFi results in the “buildup of leverage, and is particularly vulnerable to market, liquidity, and cyber risks.”

DeFi may not be a mainstream vehicle yet, but that doesn’t mean financial advisors don’t need to know about it.

What is DeFi?

It’s a kind of financial application that uses “smart contracts,” to operate on a blockchain platform, usually Ethereum. These software programs allow for fully automated, peer-to-peer financial transactions without intermediaries like banks or brokers, which generally means faster settlements of trades.

“With DeFi, users are able to perform most functions that a bank can,” says Jeremy Almond, founder and CEO of Paystand, a B2B payments platform. “This includes earning interest, borrowing, lending, buying insurance, trading derivatives, and trading assets.”

Supporters of DeFi say it offers the potential to democratize financial services for the unbanked. This is a key reason the Federal Reserve is looking at creating a digital currency.

The world currently has around 1.7 billion people who are unbanked, according to Yubo Ruan, founder and CEO of DeFi provider Parallel Finance. “Some of the reasons include a lack of government-issued IDs, problems with credit history, restrictive bank requirements, or a lack of banking infrastructure within a country.”

How easy is it to use?

It can actually be cumbersome. You need several applications to accomplish what may seem like routine transactions if done at a bank, and the jargon and concepts can get complicated.

“A combination of highly technical requirements, high fees, and confusing user interfaces are putting off potential users,” says Jackie Bona, CEO of Valora, a mobile crypto wallet. “This is making it difficult for people to get started in DeFi, scaring away those who need these apps the most.”

What are the risks?

According to Archie Ravishankar, CEO and founder of mobile banking app Cogni: “Regular consumers in this space lack the regulatory protections they’re accustomed to in traditional finance.” So if you lose money, you have no consumer protection, such as the Federal Deposit Insurance Corp. True, you could bring a lawsuit, but the target DeFi organization may be an offshore entity.

Another issue is volatility. Just look at so-called stablecoins such as Luna. Within a week, its value plunged from $80 to virtually zero, tantamount to a run on the bank.

So should financial advisors suggest clients avoid these applications?

Generally, the answer is yes. DeFi is an emerging category of finance and it can be difficult to perform due diligence on new and decentralized technologies. Even those applications that are backed by venture capitalists have seen breaches.

When it comes to clients, DeFi is for those that have a high tolerance for risk. And if they are interested in investing, they should allocate a small part of their portfolio to it.

Can DeFi disrupt traditional financial services?

Even if it takes only a relatively small portion of the global market, the impact would be substantial.

“DeFi certainly has the potential to disrupt traditional finance across the board, and in some ways it already has—on a small scale so far,” says Liam Kelly, Europe news editor for Decrypt, a cryptocurrency news site. But he adds, “a lot of this hinges on breakthroughs in scalability and cutting reasonable lines between things like centralization and decentralization or opaqueness and transparency. Another possibility is that these technologies simply get absorbed by financial institutions to a point where to the consumer, nothing has changed at your brokerage account, except now on the back end it’s running on Ethereum or another blockchain network.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

An original watercolour illustration for the cover of Harry Potter and the Philosopher’s Stone, 1997 — the first book in J.K. Rowling’s hit series—could sell for US$600,000 at a Sotheby’s auction this summer.

The illustration is headlining a June 26 sale in New York that will also feature big-ticket items from the collection of the late Dr. Rodney P. Swantko, a surgeon and collector from Indiana, including manuscripts by poet Edgar Allan Poe and Arthur Conan Doyle, author of the Sherlock Holmes books

The Harry Potter illustration, which introduced the young wizard character to the world, is expected to sell for between US$400,000 to US$600,000, which would make it the highest-priced item ever sold related to the Harry Potter world. This is the second time the illustration has been sold, however—it was on the auction block at Sotheby’s in London in 2001, where it achieved £85,750 (US$107,316).

The artist of the illustration, Thomas Taylor, was 23 years old at the time and a graduate student working at a children’s bookshop. According to Sotheby’s, Taylor took a “professional commission from an unknown author to visualise a unique wizarding world,” Sotheby’s said in a news release. He depicted Harry Potter boarding the train to Hogwarts on platform9 ¾ platform, and the illustration became the “universal image” of the Harry Potter series, Sotheby’s said.

“It is exciting to see the painting that marks the very start of my career, decades later and as bright as ever! It takes me back to the experience of reading Harry Potter for the first time—one of the first people in the world to do so—and the process of creating what is now an iconic image,” Taylor said in the release.

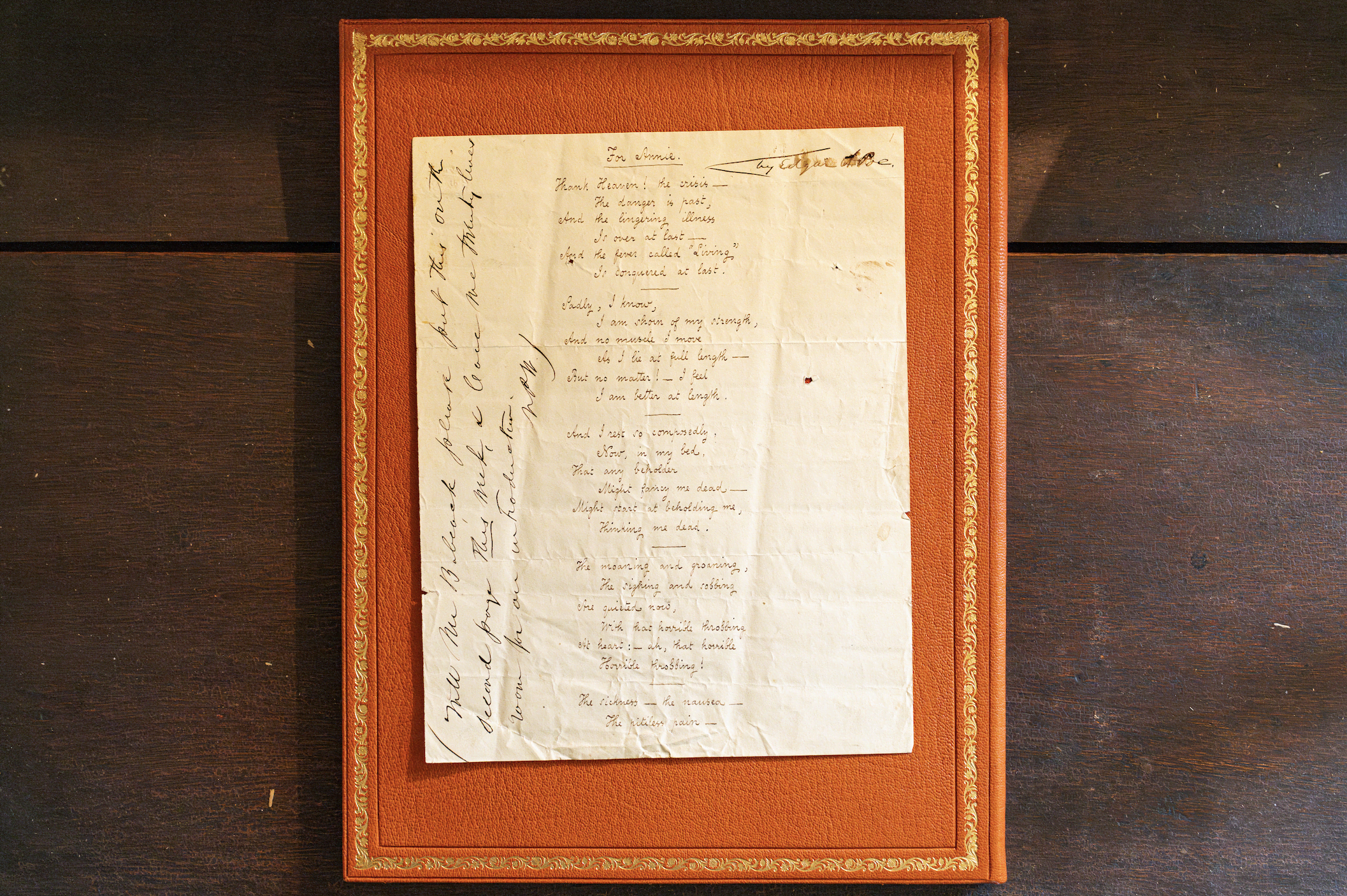

Meanwhile, to commemorate the 175th anniversary of Edgar Allan Poe’s For Annie , 1849, Sotheby’s recently reunited the autographed manuscript of the poem with the author’s home, Poe Cottage, in the Bronx.

The cottage is where the author lived with his wife, Virginia, and mother-in-law, Maria Clemm, from 1846 until he died in 1849. The manuscript, also from the Swantko collection, will remain at the home until it is offered at auction at Sotheby’s on June 26 with an estimate between US$400,000 and US$600,000.

Matthew Borowick for Sotheby’s

Poe Cottage, preserved and overseen by the Bronx County Historical Society, is home to many of the author’s famous works, including Eureka , 1948, and Annabel Lee , 1927.

“To reunite the For Annie manuscript with the Poe Cottage nearly two centuries after it was first composed brought to life literary history for a truly special and unique occasion,” Richard Austin , Sotheby’s Global Head of Books & Manuscripts, said in a news release.

For Annie was one of Poe’s most important compositions, and was addressed to Nancy “Annie” L. Richmond, one of the several women Poe pursued after his wife Viriginia’s death from tuberculosis in 1847.

In a letter to Richmond herself, Poe proclaimed For Annie was his best work: “I think the lines For Annie much the best I have ever written.”

The poem was composed in 1849, only months before Poe’s death, Sotheby’s said in the piece, Poe highlights the romantic comfort he feels from a woman named Annie while simultaneously grappling with the darkness of death, with lines like “And the fever called ‘living’ is conquered at last.”

Matthew Borowick for Sotheby’s

In the margins of the manuscript are the original handwritten instructions by Nathaniel P. Willis, co-editor of the New York Home Journal, where Poe published other poems such as The Raven and submitted For Annie on April 20, 1849.

Willis added Poe’s name in the top right and instructions about printing and presenting the poem on the side. The poem was also published in the Boston Weekly that same month.

Another piece of literary history included in the Swantko sale could surpass US$1 million. Conan Doyle’s autographed manuscript of the Sherlock Holmes tale The Sign of Four , 1889, is estimated to achieve between US$800,000 and US$1.2 million.

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts