Investors See Far Out Profits in Psychedelic Medicine

A former hedge-fund portfolio manager raises millions from scientists, financiers and crypto bros eager to buy into treatments that aren’t even legal yet.

It’s been a long strange trip for Brom Rector to become one of the few venture capitalists investing exclusively in psychedelic medicine. The 31-year-old has been experimenting with drugs like LSD for a decade but he never imagined he could turn that interest into a career.

Now Mr. Rector, a former hedge-fund portfolio manager, is raising millions of dollars from scientists, financiers and crypto bros eager to buy into treatments that aren’t even legal yet. They are betting that hallucinogens will eventually be approved for medical treatment and recreational use, spurring a boom from biotech to the entertainment industry that will far outstrip the fitful growth of legal cannabis.

Mr. Rector burned out from his job as a quantitative researcher for Los Angeles-based Crabel Capital Management in December 2020 and launched a podcast a few months later to delve into the budding psychedelics market. Listeners began asking him for investment ideas, prompting him to open his VC firm—Empath Ventures—in the fall.

Empath has since raised US$2.1 million of a $10 million target for its first fund and made 10 investments. Portfolio companies include Mindstate Design Labs, which develops new psychedelics, and Wavepaths, a company that designs smart music software to help therapists steer clients’ trips. The firm is one of a small but growing cadre of investors, including JLS Fund and billionaire Peter Thiel, taking interest in psychedelics.

Psychedelics are making the jump from party drugs to prescription drugs because some clinical research shows they are effective at treating conditions like depression, post traumatic stress disorder and addictions. Investors are also backing research and development in new drugs with other applications, like treating traumatic brain injuries. Much of how psychedelics affect the brain is unknown and critics worry about potential long-term damage or psychosis from excessive use.

The Food and Drug Administration approved the use of a drug similar to ketamine for treatment-resistant depression several years ago, and is expected to rule on an application for MDMA-assisted therapy in 2023. MDMA is more commonly known as the main ingredient in Ecstasy. Psilocybin, the hallucinogenic compound in mushrooms, could also see action from the FDA in the next few years.

The Wall Street Journal spoke to Mr. Rector about his return targets, legalization and convincing his mom to trip.

What are the returns you are looking for in your investments?

It’s just like a traditional biotech play. There’s a high probability of failure and potential upside of 10, 20, maybe 50 times.

I also invest in the infrastructure and accessories around psychedelics. The clinics where the stuff is delivered, the companies that make software to support the clinics. A lot of those businesses are not going to have that 50 times potential but they have a lot higher probability of becoming cash flow positive.

When most people think of psychedelic therapy they think magic mushrooms, maybe ayahuasca, both of which grow in nature. What about man-made drugs?

The final frontier is the exciting world of novel psychedelic molecules. It blows my mind that LSD was invented in 1938—before computers. We have all these amazing tools at our disposal now, and we’re entering a time where it’s culturally acceptable to apply those tools to the discovery of new psychedelic drugs.

LSD is amazing, as are classic cars from the 1930s. The Tesla Model S of psychedelics is yet to be created.

What is socially acceptable psychedelic use in the industry? Do you trip with your investors?

I’ve had a lot of people tell me that if I want to raise capital I should just start passing out psychedelics to my investors. I think there’s a moral issue with that. No, I have not tripped with my investors and I don’t plan on tripping with any of my investors. I haven’t tripped with any of my portfolio companies either.

There are some other investment groups out there that do not have the same answer that I just gave you. I know that it happens.

Are there medical applications of psychedelics other than mental health coming down the road?

Mental-health indications and addiction treatment will likely be the dominant applications of psychedelic medicine in the short term.

That said, psychedelics are really good at inducing neuroplasticity and reducing inflammation, so it makes sense to research them as treatments for any indication that could theoretically benefit from either of those things.

There are in-progress Phase 1 trials of psychedelics as treatment for ischemic stroke, alzheimers and TBI [traumatic brain injury]. I also know someone who personally used psychedelics as part of a treatment program to regain cognitive and motor function after suffering a severe TBI. It’s too early to say for sure, but it seems like there might be something there.

Why are cryptocurrency traders now investing in psychedelics companies?

To really get into crypto you have to be a big believer in crazy bold new ideas. Psychedelics is similar to crypto in the sense that it is a crazy big sort of bold new investment thing.

But, I think that the underlying technology and application of psychedelics is much more proven than that of crypto. In crypto the upside is enormous because it doesn’t seem like anyone is actually policing it in these exchanges. I think in the long run the upside of psychedelics is more similar to the upside of any other sort of revolutionary biotech play.

What about recreational use of psychedelics? Is that also coming?

One of the things I emphasize in my pitch deck for investors is that I want to invest in companies that are not threatened by de-regulated recreational-use regimes because I think they are inevitable. In the long run, I think we’ll see a few states that will have fully recreationally legal psychedelics

When you look at what Oregon is doing [decriminalized psilocybin and legalized therapeutic use] they’re being very open minded about the use of psychedelics. It wouldn’t surprise me to see concerts or other events there in the future where everyone gets a low dose of psilocybin to make the colors brighter and the music sound better.

Are there any potential risks in wider recreational use, among young people?

The more that users are educated on the importance of “set and setting” [mindset and environment] and know about potential interactions of psychedelics with other drugs and other contraindications, the better outcomes will be. When things become legal, the stigma around them lifts, and it becomes easier to share this information openly—so I think that recreational legalization would actually be a harm-reduction method.

I hope the industry ends up being proactive and responsible with its messaging. There is still stigma around the use of psychedelics and a single, high-profile case of a bad trip could rob the industry of a lot of social credibility, even though many people die from socially acceptable drugs like alcohol and cigarettes each day.

Could there be a political backlash against liberalizing use of psychedelics?

Conservatives are much more open minded about psychedelics than you might think because of the narrative of psychedelics treating PTSD. Who gets PTSD a lot? It’s veterans. [Former Texas Gov.] Rick Perry has gone on the record saying Texas should fund studies on it.

Psychedelics are gaining ground all over the place even amongst the midwestern housewife subsegment of the population.

And you mentioned your mom has tried them?

My mom, who never really did any sort of substance or alcohol consumption, ended up deciding that she wanted to try it. As I started the fund she started paying more attention to it and read all the articles she could find about it, including the one in Good Housekeeping.

You hear enough experiences from people that are in your own demographic and soon enough you’re like “Maybe I should try it. It’s not just for those weird hippies after all. It’s for me too.”

Reprinted by permission of The Wall Street Journal, Copyright 2021 Dow Jones & Company. Inc. All Rights Reserved Worldwide. Original date of publication: July 13, 2022.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

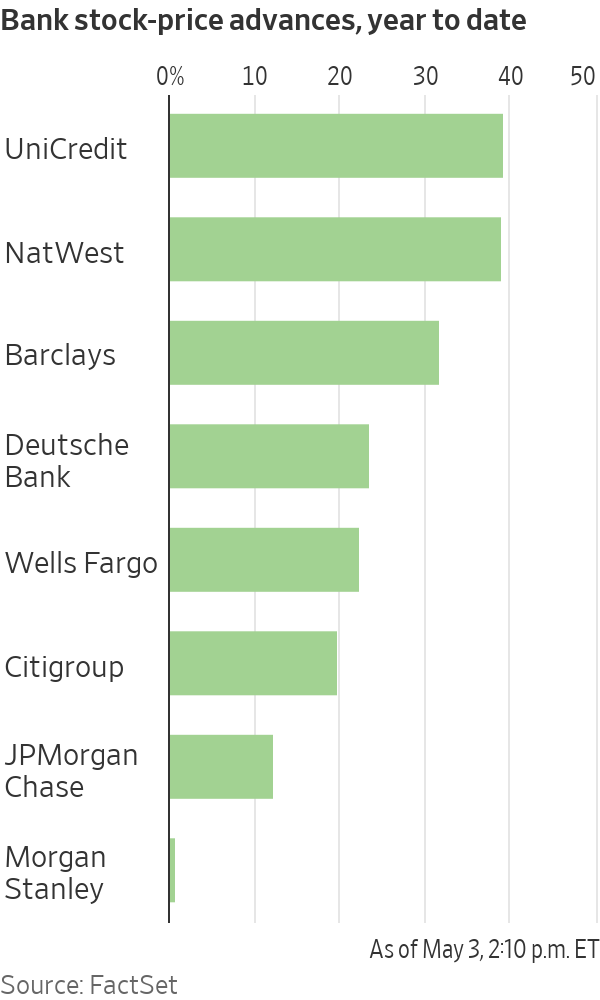

Shares in European banks such as UniCredit have been on a tear

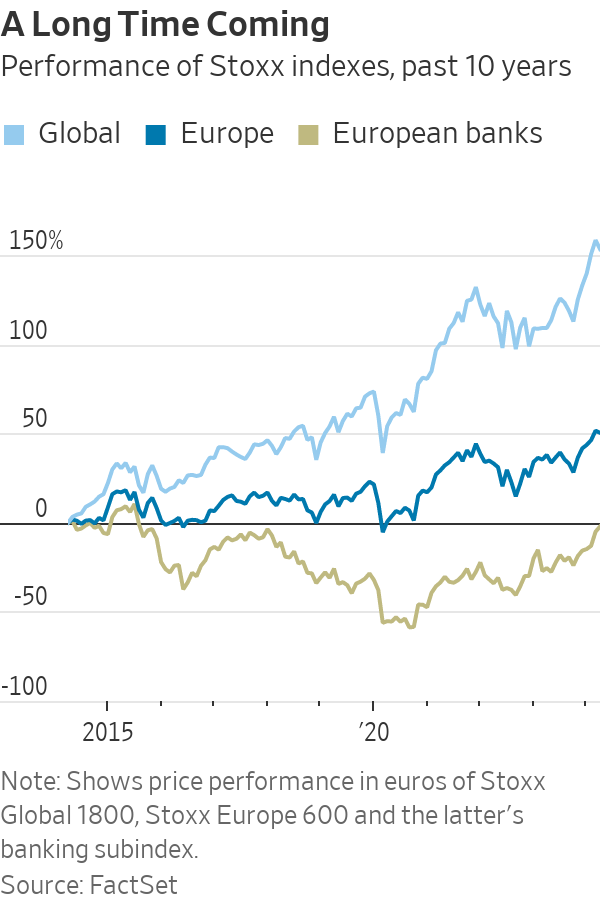

After years in the doldrums, European banks have cleaned up their balance sheets, cut costs and started earning more on loans.

The result: Stock prices have surged and lenders are preparing to hand back some $130 billion to shareholders this year. Even dealmaking within the sector, long a taboo topic, is back, with BBVA of Spain resurrecting an approach for smaller rival Sabadell .

The resurgence is enriching a small group of hedge funds and others who started building contrarian bets on European lenders when they were out of favour. Beneficiaries include hedge-fund firms such as Basswood Capital Management and so-called value investors such as Pzena Investment Management and Smead Capital Management.

It is also bringing in new investors, enticed by still-depressed share prices and promising payouts.

“There’s still a lot of juice left to squeeze,” said Bennett Lindenbaum, co-founder of Basswood, a hedge-fund firm based in New York that focuses on the financial sector.

Basswood began accumulating positions around 2018. European banks were plagued by issues including political turmoil in Italy and money-laundering scandals . Meanwhile, negative interest rates had hammered profits.

Still, Basswood’s team figured valuations were cheap, lenders had shored up capital and interest rates wouldn’t stay negative forever. The firm set up a European office and scooped up stock in banks such as Deutsche Bank , UniCredit and BNP Paribas .

Fast forward to 2024, and European banking stocks are largely beating big U.S. banks this year. Shares in many, such as Germany’s largest lender Deutsche Bank , have hit multiyear highs .

A long-only version of Basswood’s European banks and financials strategy—which doesn’t bet on stocks falling—has returned approximately 18% on an annualised basis since it was launched in 2021, before fees and expenses, Lindenbaum said.

The industry’s turnaround reflects years spent cutting costs and jettisoning bad loans, plus tougher operating rules that lifted capital levels. That meant banks were primed to profit when benchmark interest rates turned positive in 2022.

On a key measure of profitability, return on equity, the continent’s 20 largest banks overtook U.S. counterparts last year for the first time in more than a decade, Deutsche Bank analysts say.

Reflecting their improved health, European banks could spend almost as much as 120 billion euros, or nearly $130 billion, on dividends and share buybacks this year, according to Bank of America analysts.

If bank mergers pick up, that could mean takeover offers at big premiums for investors in smaller lenders. European banks were so weak for so long, dealmaking stalled. Acquisitive larger banks like BBVA could reap the rewards of greater scale and cost efficiencies, assuming they don’t overpay.

“European banks, in general, are cheaper, better capitalised, more profitable and more shareholder friendly than they have been in many years. It’s not surprising there’s a lot of new investor interest in identifying the winners in the sector,” said Gustav Moss, a partner at the activist investor Cevian Capital, which has backed institutions including UBS .

As central banks move to cut interest rates, bumper profits could recede, but policy rates aren’t likely to return to the negative levels banks endured for almost a decade. Stock prices remain modest too, with most far below the book value of their assets.

Among the biggest winners are investors in UniCredit . Shares in the Italian lender have more than quadrupled since Andrea Orcel became chief executive in 2021, reaching their highest levels in more than a decade.

Under the former UBS banker, UniCredit has boosted earnings and started handing large sums back to shareholders , after convincing the European Central Bank the business was strong enough to make large payouts.

Orcel said European banks are increasingly attracting investors like hedge funds with a long-term view, and with more varied portfolios, like pension funds.

He said that investor-relations staff initially advised him that visiting U.S. investors was important to build relationships—but wasn’t likely to bear fruit, given how they viewed European banks. “Now Americans ask you for meetings,” Orcel said.

UniCredit is the second-largest position in Phoenix-based Smead Capital’s $126 million international value fund. It started investing in August 2022, when UniCredit shares traded around €10. They now trade at about €35.

Cole Smead , the firm’s chief executive, said the stock has further to run, partly because UniCredit can now consider buying rivals on the cheap.

Sentiment has shifted so much that for some investors, who figure the biggest profits are to be made betting against the consensus, it might even be time to pull back. A recent Bank of America survey found regional investors had warmed to European banks, with 52% of respondents judging the sector attractive.

And while bets on banks are now paying off, trying to bottom-fish in European banking stocks has burned plenty of investors over the past decade. Investments have tied up money that could have made far greater returns elsewhere.

Deutsche Bank, for instance, underwent years of scandals and big losses before stabilising under Chief Executive Christian Sewing . Rewarding shareholders, he said, is now the bank’s priority.

U.S. private-equity firm Cerberus Capital Management built stakes in Deutsche Bank and domestic rival Commerzbank in 2017, only to sell a chunk when shares were down in 2022. The investor struggled to make changes at Commerzbank.

A Cerberus spokesman said it remains “bullish and committed to the sector,” with bank investments in Poland and France. It retains shares in both Deutsche and Commerzbank, and is an investor in another German lender, the unlisted Hamburg Commercial Bank.

Similarly, Capital Group also invested in both Deutsche Bank and Commerzbank, only to sell roughly 5% stakes in both banks in 2022—at far below where they now trade. Last month, Capital Group disclosed buying shares again in Deutsche Bank, lifting its holding above 3%. A spokeswoman declined to comment.

U.S.-based Pzena, which manages some $64 billion in assets, has backed banks such as UBS and U.K.-listed HSBC , NatWest and Barclays .

Pzena reckoned balance sheets, capital positions and profitability would all eventually improve, either through higher interest rates or as business models shifted. Still, some changes took longer than expected. “I don’t think anyone would have thought the ECB would keep rates negative for eight or nine years,” said portfolio manager Miklos Vasarhelyi.

Some Pzena investments date as far back as 2009 and 2010, Vasarhelyi said. “We’ve been waiting for this to turn for a long time.”

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

This stylish family home combines a classic palette and finishes with a flexible floorplan