The World Added 412 Billionaires in 2020, Bringing the Total to 3,288

The billionaires’ combined wealth rose 32% year over year.

The billionaires’ combined wealth rose 32% year over year to US$14.7 trillion, a sum that falls between the GDP of the world’s two biggest economies, the U.S. (with US$19.5 trillion) and China (with $12.2 trillion).

“A stock market boom, driven partly by quantitative easing, and flurry of new listings have minted eight new dollar billionaires a week for the past year,” Rupert Hoogewerf, Hurun Report chairman and chief researcher, said in a statement. “The world has never seen this much wealth created in just one year, much more than perhaps could have been expected for a year so badly disrupted by Covid-19.”

Three individuals added more than $50 billion in a single year, led by Tesla’s Elon Musk who added US$151 billion and climbed to the top spot of the Hurun Global Rich List with a net worth of US$197 billion. Amazon’s Jeff Bezos dropped to the second place, despite his wealth growing US$50 billion last year to a total of US$189 billion.

Colin Zheng Huang of Pinduoduo, China’s e-commerce giant, also saw his net worth grow more than $50 billion to US$69 billion, earning him the title of 19th richest billionaire in the world.

China jumped way ahead of the U.S. with 1,058 billionaires, up 259 from a year ago. The U.S. added 70 billionaires to take the total to 696 billionaires, according to the report, which calculates the billionaires’ wealth based on market data as of Jan. 15.

Other key findings in the report include:

- Five people have more than US$100 billion, including Musk, Bezos, LVMH’s Bernard Arnault (US$114 billion), Bill Gates (US$110 billion), and Facebook’s Mark Zuckerberg (US$101 billion);

- California-based Austin Russell of car sensor maker Luminar Technologies was the youngest self-made billionaire, at 25 years old, with US$3.5 billion;

- Beijing had the largest number of billionaires, with 145; Shanghai (113) overtook New York (112) as the runner-up. Six of the top 10 cities with the highest concentration of billionaires were in China;

- Healthcare and real estate tied as the main source of wealth for the world’s billionaires, each accounting for 8.7% of total billionaire wealth;

- There were 231 self-made female billionaires, an increase of 51 from a year ago. China dominated with 69% of the world’s self-made women billionaires.

Last year saw a net addition of 17 cryptocurrency billionaires, who derived their wealth from holding currency tokens. Blockchain also had 17 billionaires, whose wealth was predominantly from crypto exchanges, according to the report.

“We are currently right in the heart of a new industrial revolution, with the ABCDEs—that is AI, blockchain, cloud, data, and e-commerce—creating new opportunities for entrepreneurs and leading to a concentration of wealth and economic power on a scale never seen before,” Hoogewerf said in the report.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

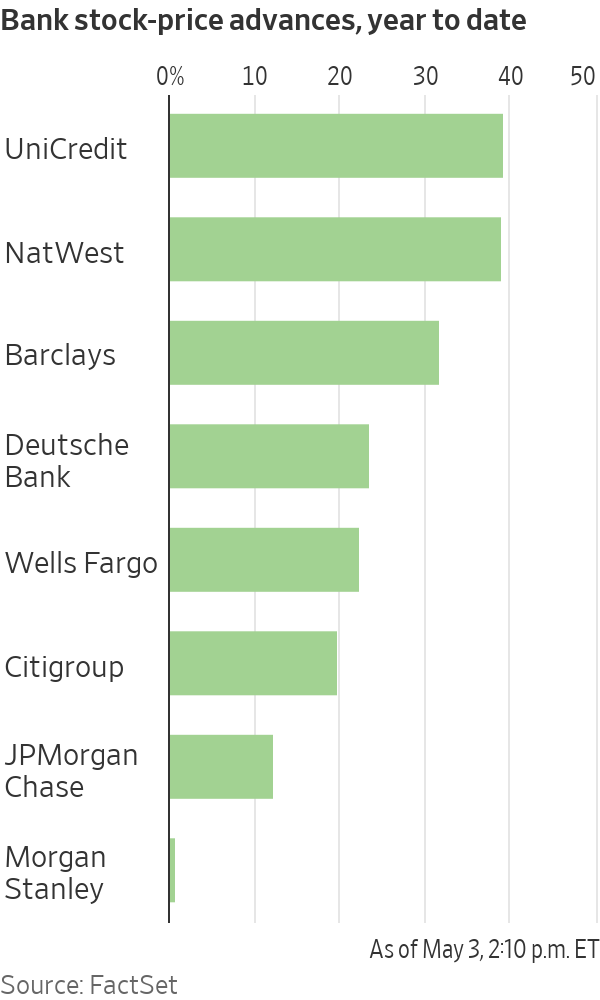

Shares in European banks such as UniCredit have been on a tear

After years in the doldrums, European banks have cleaned up their balance sheets, cut costs and started earning more on loans.

The result: Stock prices have surged and lenders are preparing to hand back some $130 billion to shareholders this year. Even dealmaking within the sector, long a taboo topic, is back, with BBVA of Spain resurrecting an approach for smaller rival Sabadell .

The resurgence is enriching a small group of hedge funds and others who started building contrarian bets on European lenders when they were out of favour. Beneficiaries include hedge-fund firms such as Basswood Capital Management and so-called value investors such as Pzena Investment Management and Smead Capital Management.

It is also bringing in new investors, enticed by still-depressed share prices and promising payouts.

“There’s still a lot of juice left to squeeze,” said Bennett Lindenbaum, co-founder of Basswood, a hedge-fund firm based in New York that focuses on the financial sector.

Basswood began accumulating positions around 2018. European banks were plagued by issues including political turmoil in Italy and money-laundering scandals . Meanwhile, negative interest rates had hammered profits.

Still, Basswood’s team figured valuations were cheap, lenders had shored up capital and interest rates wouldn’t stay negative forever. The firm set up a European office and scooped up stock in banks such as Deutsche Bank , UniCredit and BNP Paribas .

Fast forward to 2024, and European banking stocks are largely beating big U.S. banks this year. Shares in many, such as Germany’s largest lender Deutsche Bank , have hit multiyear highs .

A long-only version of Basswood’s European banks and financials strategy—which doesn’t bet on stocks falling—has returned approximately 18% on an annualised basis since it was launched in 2021, before fees and expenses, Lindenbaum said.

The industry’s turnaround reflects years spent cutting costs and jettisoning bad loans, plus tougher operating rules that lifted capital levels. That meant banks were primed to profit when benchmark interest rates turned positive in 2022.

On a key measure of profitability, return on equity, the continent’s 20 largest banks overtook U.S. counterparts last year for the first time in more than a decade, Deutsche Bank analysts say.

Reflecting their improved health, European banks could spend almost as much as 120 billion euros, or nearly $130 billion, on dividends and share buybacks this year, according to Bank of America analysts.

If bank mergers pick up, that could mean takeover offers at big premiums for investors in smaller lenders. European banks were so weak for so long, dealmaking stalled. Acquisitive larger banks like BBVA could reap the rewards of greater scale and cost efficiencies, assuming they don’t overpay.

“European banks, in general, are cheaper, better capitalised, more profitable and more shareholder friendly than they have been in many years. It’s not surprising there’s a lot of new investor interest in identifying the winners in the sector,” said Gustav Moss, a partner at the activist investor Cevian Capital, which has backed institutions including UBS .

As central banks move to cut interest rates, bumper profits could recede, but policy rates aren’t likely to return to the negative levels banks endured for almost a decade. Stock prices remain modest too, with most far below the book value of their assets.

Among the biggest winners are investors in UniCredit . Shares in the Italian lender have more than quadrupled since Andrea Orcel became chief executive in 2021, reaching their highest levels in more than a decade.

Under the former UBS banker, UniCredit has boosted earnings and started handing large sums back to shareholders , after convincing the European Central Bank the business was strong enough to make large payouts.

Orcel said European banks are increasingly attracting investors like hedge funds with a long-term view, and with more varied portfolios, like pension funds.

He said that investor-relations staff initially advised him that visiting U.S. investors was important to build relationships—but wasn’t likely to bear fruit, given how they viewed European banks. “Now Americans ask you for meetings,” Orcel said.

UniCredit is the second-largest position in Phoenix-based Smead Capital’s $126 million international value fund. It started investing in August 2022, when UniCredit shares traded around €10. They now trade at about €35.

Cole Smead , the firm’s chief executive, said the stock has further to run, partly because UniCredit can now consider buying rivals on the cheap.

Sentiment has shifted so much that for some investors, who figure the biggest profits are to be made betting against the consensus, it might even be time to pull back. A recent Bank of America survey found regional investors had warmed to European banks, with 52% of respondents judging the sector attractive.

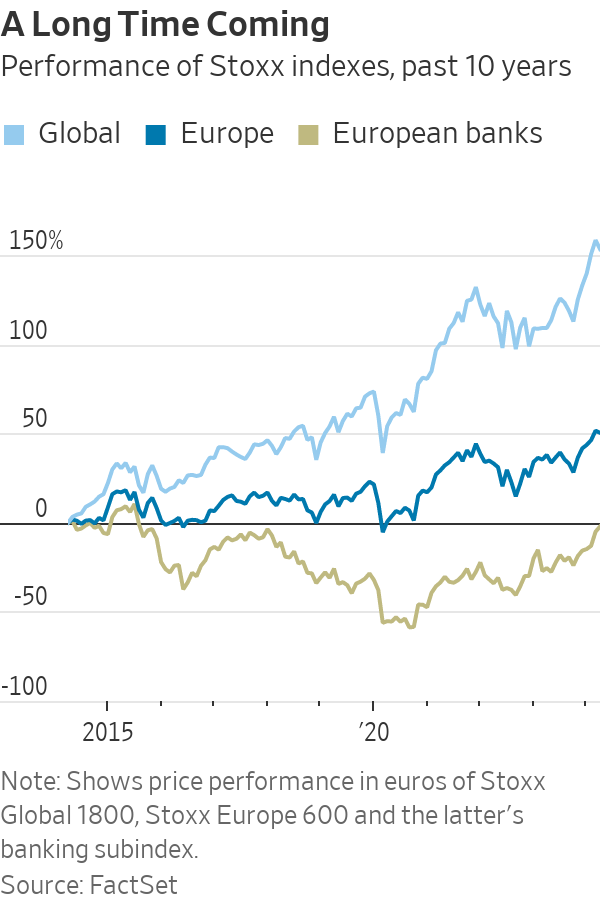

And while bets on banks are now paying off, trying to bottom-fish in European banking stocks has burned plenty of investors over the past decade. Investments have tied up money that could have made far greater returns elsewhere.

Deutsche Bank, for instance, underwent years of scandals and big losses before stabilising under Chief Executive Christian Sewing . Rewarding shareholders, he said, is now the bank’s priority.

U.S. private-equity firm Cerberus Capital Management built stakes in Deutsche Bank and domestic rival Commerzbank in 2017, only to sell a chunk when shares were down in 2022. The investor struggled to make changes at Commerzbank.

A Cerberus spokesman said it remains “bullish and committed to the sector,” with bank investments in Poland and France. It retains shares in both Deutsche and Commerzbank, and is an investor in another German lender, the unlisted Hamburg Commercial Bank.

Similarly, Capital Group also invested in both Deutsche Bank and Commerzbank, only to sell roughly 5% stakes in both banks in 2022—at far below where they now trade. Last month, Capital Group disclosed buying shares again in Deutsche Bank, lifting its holding above 3%. A spokeswoman declined to comment.

U.S.-based Pzena, which manages some $64 billion in assets, has backed banks such as UBS and U.K.-listed HSBC , NatWest and Barclays .

Pzena reckoned balance sheets, capital positions and profitability would all eventually improve, either through higher interest rates or as business models shifted. Still, some changes took longer than expected. “I don’t think anyone would have thought the ECB would keep rates negative for eight or nine years,” said portfolio manager Miklos Vasarhelyi.

Some Pzena investments date as far back as 2009 and 2010, Vasarhelyi said. “We’ve been waiting for this to turn for a long time.”

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

This stylish family home combines a classic palette and finishes with a flexible floorplan