The Improbably Strong Economy

A lot had to go right for the U.S. to avoid a recession. So far, it has.

The economy is still generating jobs. A year ago, a lot of economists and Federal Reserve policy makers thought that it would be shedding them by now.

On Friday, the Labor Department reported that the U.S. added a seasonally 150,000 jobs in October from the previous month, versus September’s gain of 297,000 jobs. Some of that step down was due to auto workers’ strikes, which have since been resolved but temporarily caused workers to not draw pay checks.

Average hourly earnings rose 0.2% from a month earlier, putting them 4.1% higher than a year earlier. That was the smallest year-over-year gain since June 2021, though unlike then wages are now outpacing inflation.

One takeaway is that the job market is moderating, but not buckling—a message reinforced by a variety of other data, including low levels of weekly unemployment claims and layoffs. Another is that the Federal Reserve is probably through with tightening: Futures markets on Friday morning indicated that the chance of the central bank raising its target range on overnight rates at its December meeting was below 10%. The yield on the 10-year Treasury note, which briefly hit 5% less than two weeks ago, continued to retreat Friday, falling to 4.53% midmorning.

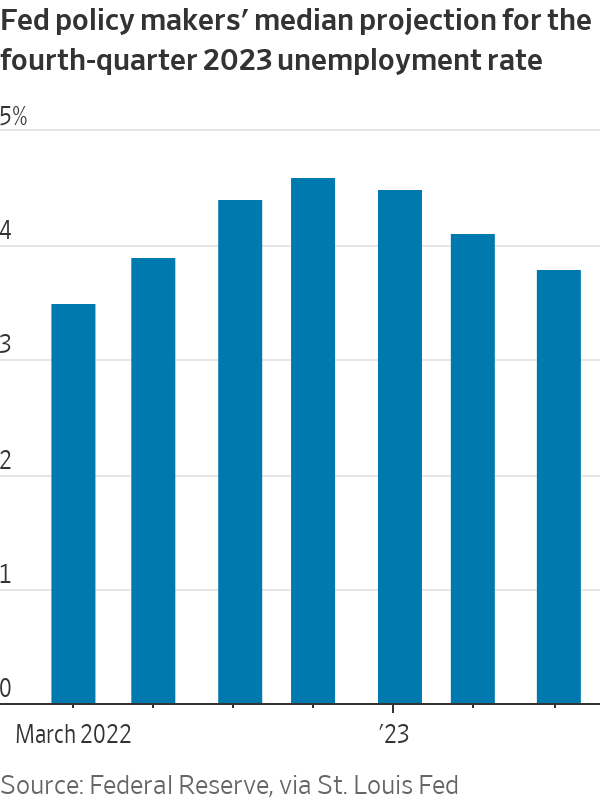

This wasn’t the sort of job market the Fed expected. When policy makers offered projections last December, they forecast that the unemployment rate would average 4.6% in this year’s fourth quarter, versus the 3.7% rate (since revised to 3.6%) they had seen in the November 2022 job report. That was tantamount to a recession forecast, though they didn’t put it that way, since such a large increase in the unemployment rate would count as a strong signal the U.S. is in a downturn. Friday’s report showed the October unemployment rate at 3.9%.

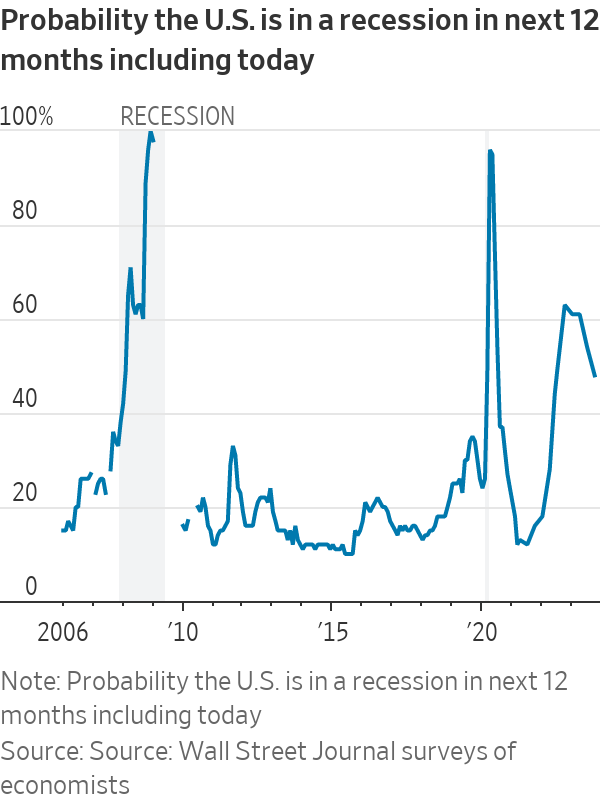

Economists got it wrong, too. In October of last year, forecasters polled by The Wall Street Journal estimated the unemployment rate at the end of 2023 to be at 4.7%, on average. They also put the chances of a recession within the next 12 months at 63%. By last month, they dropped the recession chance to 48%. Available data show that, as a group, economists have never forecast a recession before it has actually started. Now it looks as if the one time they did forecast one, they were either wrong or early.

It is easy to make fun of other people’s past forecasts, but considering the hurdles the economy has had to clear, it really is striking that it has done so well. A year ago there was some hope that the continued recovery in the service sector, and service-sector jobs, might help take up the slack as the goods sector adjusted to slowing demand. But there was also the concern that the service sector could run out of steam before the goods sector found its footing.

Another worry: That the excess savings that Americans had built up after the pandemic struck would run out, and that would cut into their ability to spend. But recent revisions to the available data suggest there was more money left in the tank than thought.

To these, add that inflation has cooled despite the addition of 2.4 million jobs so far this year, and gross domestic product is expanding much faster than economists expected. Plus, at least so far this year, the economy has made it through a regional bank crisis, a sharp increase in both short- and long-term borrowing costs, and the resumption of student-debt payments.

The jury is out on what happens next. The cooling in the job market could turn into a lurch lower, for example, as the full effect of the Fed’s past rate increases begins to take hold. Inflation, which is still too high, could accelerate, prompting the central bank to further tighten the screws.

But the chances of the economy avoiding a recession seem stronger now than they did even a few months ago. A lot of that would be down to luck, but it would nonetheless be something worth celebrating.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The auction house plans for sales to proceed, including for a Warhol ‘Flowers’ estimated at $20 million

Christie’s remained in the grip of an ongoing cyberattack on Tuesday, a crisis that has hobbled the auction house’s website and altered the way it can handle online bids. This could disrupt its sales of at least $578 million worth of art up for bid this week, starting tonight with a pair of contemporary art auctions amid New York’s major spring sales.

Christie’s said it has been grappling with the fallout of what it described as a technology security incident since Thursday morning—a breach or threat of some kind, though the auction house declined to discuss details because of its own security protocols. Christie’s also declined to say whether any of the private or financial data it collects on its well-heeled clientele had been breached or stolen, though it said it would inform customers if that proves to be the case.

“We’re still working on resolving the incident, but we want to make sure we’re continuing our sales and assuring our clients that it’s safe to bid,” said Chief Executive Guillaume Cerutti.

Sotheby’s and Phillips haven’t reported any similar attacks on their sites.

Christie’s crisis comes at a particularly fragile moment for the global art market. Heading into these benchmark spring auctions, market watchers were already wary, as broader economic fears about wars and inflation have chipped away at collectors’ confidence in art values. Christie’s sales fell to $6.2 billion last year, down 20% from the year before.

Doug Woodham, managing partner of Art Fiduciary Advisors and a former Christie’s president, said people don’t want to feel the spectre of scammers hovering over what’s intended to be an exciting pastime or serious investment: the act of buying art. “It’s supposed to be a pleasurable activity, so anything that creates an impediment to enjoying that experience is problematic because bidders have choices,” Woodham said.

Aware of this, Cerutti says the house has gone into overdrive to publicly show the world’s wealthiest collectors that they can shop without a glitch—even as privately the house has enlisted a team of internal and external technology experts to resolve the security situation. Currently, it’s sticking to its schedule for its New York slate of six auctions of impressionist, modern and contemporary art, plus two luxury sales, though one watch sale in Geneva scheduled for Monday was postponed to today.

The first big test for Christie’s comes tonight with the estimated $25 million estate sale of top Miami collector Rosa de la Cruz, who died in February and whose private foundation offerings include “Untitled” (America #3),” a string of lightbulbs by Félix González-Torres estimated to sell for at least $8 million.

Cerutti said no consignors to Christie’s have withdrawn their works from its sales this week as a result of the security incident. After the De la Cruz sale, Christie’s 21st Century sale on Tuesday will include a few pricier heavyweights, including a Brice Marden diptych, “Event,” and a Jean-Michel Basquiat from 1982, “The Italian Version of Popeye Has no Pork in his Diet,” each estimated to sell for at least $30 million.

But the cyberattack has already altered the way some collectors might experience these bellwether auctions at Christie’s. Registered online bidders used to be able to log into the main website before clicking to bid in sales. This week, the house will email them a secure link redirecting them to a private Christie’s Live site where they can watch and bid in real time. Everyone else will be encouraged to call in or show up to bid at the house’s saleroom in Rockefeller Center in Midtown Manhattan.

If more bidders show up in person, the experience might prove to be a squeeze. During the pandemic, Christie’s reconfigured its main saleroom from a vast, well-lit space that could fit several hundred people into a spotlit set that more closely evokes a television studio, with far fewer seats and more roving cameras—all part of the auction industry’s broader effort to entice more collectors as well as everyday art lovers to tune in, online.

Once this smaller-capacity saleroom is filled, Christie’s said it will direct people into overflow rooms elsewhere in the building. Those who want to merely watch the sale can’t watch on Christie’s website like usual but can follow along via Christie’s YouTube channel.

Art adviser Anthony Grant said he typically shows up to bid on behalf of his clients in these major sales, though he said his collectors invariably watch the sales online as well so they can “read the room” in real time and text him updates. This week, Grant said a European collector who intends to vie for a work at Christie’s instead gave Grant a maximum amount to spend.

Grant said the cyberattack popped up in a lot of his conversations this past weekend. “There’s a lot of shenanigans going on, and people have grown so sensitive to their banks and hospitals getting hacked,” he said. “Now, their auction house is going through the same thing, and it’s irksome.”

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

This stylish family home combines a classic palette and finishes with a flexible floorplan