A Killer Golf Swing Is a Hot Job Skill Now

Companies are eager to hire strong players who use hybrid work schedules to schmooze clients on the course

Standout golfers who aren’t quite PGA Tour material now have somewhere else to play professionally: Corporate America.

People who can smash 300-yard drives and sink birdie putts are sought-after hires in finance, consulting, sales and other industries, recruiters say. In the hybrid work era, the business golf outing is back in a big way.

Executive recruiter Shawn Cole says he gets so many requests to find ace golfers that he records candidates’ handicaps, an index based on average number of strokes over par, in the information packets he submits to clients. Golf alone can’t get you a plum job, he says—but not playing could cost you one.

“I know a guy that literally flies around the world in a private jet loaded with French wine, and he golfs and lands hundred-million-dollar deals,” Cole says.

Tee times and networking sessions have long gone hand-in-golf-glove. Despite criticism that doing business on the course undermines diversity, equity and inclusion efforts—and the fact that golf clubs haven’t always been open to women and minorities —people who mix golf and work say the outings are one of the last reprieves from 30-minute calendar blocks

Stars like Tiger Woods and Michelle Wie West helped expand participation in the sport. Still, just 22% of golfers are nonwhite and 26% are women, according to the National Golf Foundation.

To lure more people, clubs have relaxed rules against mobile-phone use on the course, embracing white-collar professionals who want to entertain clients on the links without disconnecting from the office. It’s no longer taboo to check email from your cart or take a quick call at the halfway turn.

With so much other business conducted virtually, shaking hands on the green and schmoozing over clubhouse beers is now seen as making an extra effort, not slacking off.

Americans played a record 531 million rounds last year. Weekday play has nearly doubled since 2019, with much of the action during business hours , according to research by Stanford University economist Nicholas Bloom .

“It would’ve been scandalous in 2019 to be having multiple meetings a week on the golf course,” Bloom says. “In 2024, if you’re producing results, no one’s going to see anything wrong with it.”

A financial adviser at a major Wall Street bank who competes on the amateur circuit told me he completes 90% of his tasks by 10 a.m. because he manages long-term investment plans that change infrequently. The rest of his workday often involves golfing with clients and prospects. He’s a member of a private club with a multiyear waiting list, and people jump at the chance to join him on a course they normally can’t access.

There is an art to bringing in business this way. He never initiates shoptalk, telling his playing partners the round is about having fun and getting to know each other. They can’t resist asking about investment strategies by the back nine, he says.

Work hard, play hard

Matt Parziale golfed professionally on minor-league tours for several years, but when his dream of making the big time ended, he had to get a regular job. He became a firefighter, like his dad.

A few years later he won one of the biggest amateur tournaments in the country, earning spots in the 2018 Masters and U.S. Open, where he tied for first among non-pros.

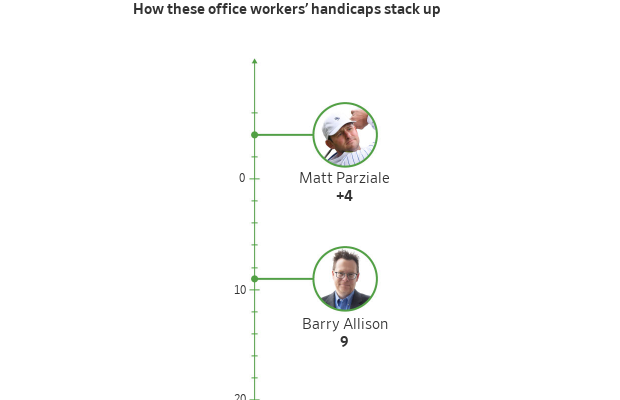

The brush with celebrity brought introductions to business types that Parziale, 35 years old, says he wouldn’t have met otherwise. One connection led to a job with a large insurance broker. In 2022 he jumped to Deland, Gibson Insurance Associates in Wellesley, Mass., which recognised his golf game as a tool to help win large accounts.

He rescheduled our interview because he was hosting clients at a private club on Cape Cod, and squeezed me in the next morning, before teeing off with a business group in Newport, R.I.

A short time ago, Parziale couldn’t imagine making a living this way. Now he’s the norm in elite amateur golf circles.

“I look around at the guys at the events I play, and they all have these jobs ,” he says.

His boss, Chief Executive Chip Gibson, says Parziale is good at bringing in business because he puts as much effort into building relationships as honing his game. A golf outing is merely an opportunity to build trust that can eventually lead to a deal, and it’s a misconception that people who golf during work hours don’t work hard, he says.

Barry Allison’s single-digit handicap is an asset in his role as a management consultant at Accenture , where he specialises in travel and hospitality. He splits time between Washington, D.C., and The Villages, Fla., a golf mecca that boasts more than 50 courses.

It can be hard to get to know people in distributed work environments, he says. Go golfing and you’ll learn a lot about someone’s temperament—especially after a bad shot.

“If you see a guy snap a club over his knee, you don’t know what he’s going to snap next,” Allison says.

Special access

On a recent afternoon I was a lunch guest at Brae Burn Country Club, a private enclave outside Boston that was the site of U.S. Golf Association championships won by legends like Walter Hagen and Bobby Jones. I parked in the second lot because the first one was full—on a Wednesday.

My host was Cullen Onstott, managing director of the Onstott Group executive search firm and a former collegiate golfer at Fairfield University. He explained one reason companies prize excellent golfers is they can put well-practiced swings on autopilot and devote most of their attention to chitchat.

It’s hard to talk with potential customers about their needs and interests when you’re hunting for errant shots in the woods. It’s also challenging if you show off.

The first hole at Brae Burn is a 318-yard par 4 that slopes down, enabling big hitters like Onstott to reach the putting green in a single stroke. But to stay close to his playing partners and keep the conversation flowing, he sometimes hits a shorter shot.

Having an “in” at an exclusive club can make you a catch. Bo Burch, an executive recruiter in North Carolina, says clubs in his region tend to attract members according to their business sectors. One might be chock-full of real-estate investors while another has potential buyers of industrial manufacturing equipment.

Burch looks for candidates who are members of clubs that align with his clients’ industries, though he stresses that business acumen comes first when filling positions.

Tami McQueen, a former Division I tennis player and current chief marketing officer at Atlanta investment firm BIP Capital, signed up for private golf lessons this year. She had noticed colleagues were wearing polos with course logos and bringing their clubs to work. She wanted in.

McQueen joined business associates on the golf course for the first time in March at the PGA National Resort in Palm Beach Gardens, Fla. She has lowered her handicap to a respectable 26 and says her new skill lends a professional edge.

“To be able to say, ‘I can play with you and we can have those business meetings on the course’ definitely opens a lot more doors,” she says.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

More than one fifth of Australians are cutting back on the number of people they socialise with

Australian social circles are shrinking as more people look for ways to keep a lid on spending, a new survey has found.

New research from Finder found more than one fifth of respondents had dropped a friend or reduced their social circle because they were unable to afford the same levels of social activity. The survey questioned 1,041 people about how increasing concerns about affordability were affecting their social lives. The results showed 6 percent had cut ties with a friend, 16 percent were going out with fewer people and 26 percent were going to fewer events.

Expensive events such as hens’ parties and weddings were among the activities people were looking to avoid, indicating younger people were those most feeling the brunt of cost of living pressures. According to Canstar, the average cost of a wedding in NSW was between $37,108 to $41,245 and marginally lower in Victoria at $36, 358 to $37,430.

But not all age groups are curbing their social circle. While the survey found that 10 percent of Gen Z respondents had cut off a friend, only 2 percent of Baby Boomers had done similar.

Money expert at Finder, Rebecca Pike, said many had no choice but to prioritise necessities like bills over discretionary activities.

“Unfortunately, for some, social activities have become a luxury they can no longer afford,” she said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.