China’s Inflation Problem? It Has None

Falling prices at the factory gate and subdued increases in the costs of consumer goods contrast with searing inflation in many countries

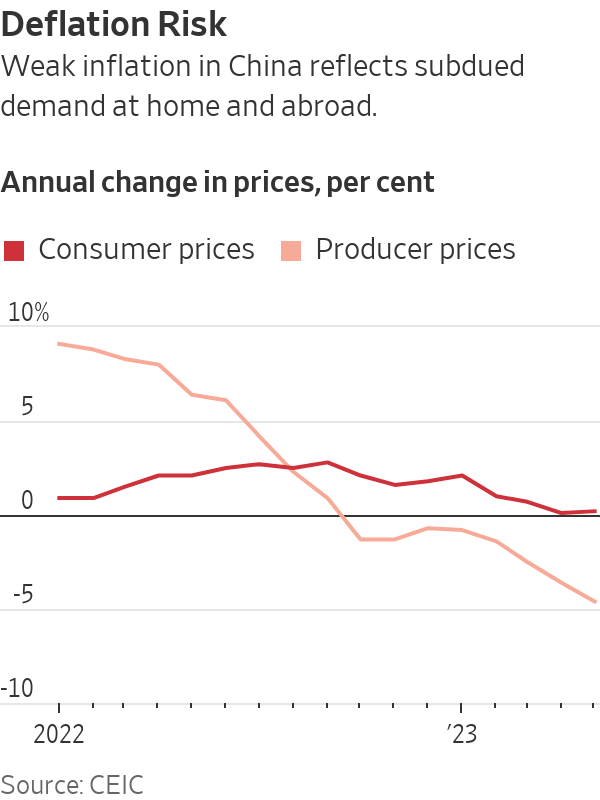

SINGAPORE—As Western central banks continue to jack up interest rates in an effort to douse stubbornly high inflation, China faces a growing risk of the opposite problem—deflation.

Prices charged by Chinese factories tumbled in May at their steepest annual pace in seven years, while consumer prices barely budged, fresh signs of the challenges faced by the world’s second-largest economy both at home and abroad.

Economists say the absence of inflationary pressure means China could experience a spell of deflation—a widespread fall in prices—if the economy doesn’t pick up soon.

Persistent deflation tends to throttle growth and can be difficult to escape. While a prolonged period of falling prices probably isn’t in the cards, Chinese policy makers will nonetheless need to do more to stave off that risk and get the economy motoring again, economists say, perhaps by trimming interest rates, weakening the currency or offering cash or other spending inducements to households and businesses.

Ting Lu, chief China economist at Nomura in Hong Kong, said in a note to clients Friday that he expects local banks to cut key lending rates as soon as next week.

In remarks made at a meeting Wednesday and published by China’s central bank after the release of monthly inflation data Friday, central-bank Gov. Yi Gang said he expects consumer-price inflation to edge up in the second half of the year and exceed 1% in December. He said the People’s Bank of China would use its tools to support the economy and promote employment.

Falling prices in China aren’t necessarily bad news for the global economy, as lower costs to import Chinese goods should help bring down inflation rates that for many economies are still uncomfortably high.

“In a sense, China is already exporting deflation to the world,” said Carlos Casanova, senior Asia economist at Union Bancaire Privée in Hong Kong. That could help ease the pressure on the U.S. Federal Reserve and other central banks that are battling to bring down inflation, he said.

China’s producer prices—what companies charge at the factory gate—fell 4.6% from a year earlier in May, the weakest reading since early 2016 and the eighth straight month of declines.

Consumer prices rose just 0.2%, China’s National Bureau of Statistics said Friday, slightly higher than the 0.1% annual gain recorded in April but still well below the 3% ceiling for annual inflation set by the government and central bank.

In the U.S., consumer-price inflation in April slowed to a 4.9% annual rate, but that was still more than double the Federal Reserve’s 2% goal. In the 20 nations that use the euro, annual inflation was 6.1% in May.

After soaring last year in the wake of Russia’s invasion of Ukraine, prices of crude oil, food and some other commodities have pulled back, partly leading to China’s subdued inflation.

But also behind China’s predicament, which stands in contrast to the experience of most other economies as they emerged from the Covid-19 pandemic, is a shortfall in spending both domestically and from overseas.

Chinese factories are cutting prices because foreigners aren’t buying their goods with the same gusto as before central banks started ratcheting up borrowing costs. A hoped for consumer spending binge that was supposed to propel growth in China hasn’t materialised. Real estate is in the doldrums, crushing investment.

Western policy makers and economists are exploring whether fat corporate profit margins are stoking inflation in their economies. In China, industrial profits are sinking.

The inflation data adds to a string of disappointing signals on the strength of China’s recovery, which had been expected to power global growth this year after Beijing ditched its draconian Covid controls at the close of 2022.

Chinese exports fell in May from a year earlier, the first annual decline in overseas shipments in three months. Business surveys showed factory activity shrank in May and services-sector activity softened. More than a fifth of young people are unemployed.

Still, most economists think China will meet or exceed the government’s goal of growing the economy by 5% or more this year, given the weak base of comparison with 2022, when sporadic lockdowns in major cities hammered the economy.

Zichun Huang, China economist at Capital Economics, said she doesn’t think China will experience broad deflation and expects consumer price growth to pick up in the coming months thanks to support from policy makers and an improving labor market.

—Grace Zhu in Beijing contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Pure Amazon has begun journeys deep into Peru’s Pacaya-Samiria National Reserve, combining contemporary design, Indigenous craftsmanship and intimate wildlife encounters in one of the richest ecosystems on Earth.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Selloff in bitcoin and other digital tokens hits crypto-treasury companies.

The hottest crypto trade has turned cold. Some investors are saying “told you so,” while others are doubling down.

It was the move to make for much of the year: Sell shares or borrow money, then plough the cash into bitcoin, ether and other cryptocurrencies. Investors bid up shares of these “crypto-treasury” companies, seeing them as a way to turbocharge wagers on the volatile crypto market.

Michael Saylor pioneered the move in 2020 when he transformed a tiny software company, then called MicroStrategy , into a bitcoin whale now known as Strategy. But with bitcoin and ether prices now tumbling, so are shares in Strategy and its copycats. Strategy was worth around $128 billion at its peak in July; it is now worth about $70 billion.

The selloff is hitting big-name investors, including Peter Thiel, the famed venture capitalist who has backed multiple crypto-treasury companies, as well as individuals who followed evangelists into these stocks.

Saylor, for his part, has remained characteristically bullish, taking to social media to declare that bitcoin is on sale. Sceptics have been anticipating the pullback, given that crypto treasuries often trade at a premium to the underlying value of the tokens they hold.

“The whole concept makes no sense to me. You are just paying $2 for a one-dollar bill,” said Brent Donnelly, president of Spectra Markets. “Eventually those premiums will compress.”

When they first appeared, crypto-treasury companies also gave institutional investors who previously couldn’t easily access crypto a way to invest. Crypto exchange-traded funds that became available over the past two years now offer the same solution.

BitMine Immersion Technologies , a big ether-treasury company backed by Thiel and run by veteran Wall Street strategist Tom Lee , is down more than 30% over the past month.

ETHZilla , which transformed itself from a biotech company to an ether treasury and counts Thiel as an investor, is down 23% in a month.

Crypto prices rallied for much of the year, driven by the crypto-friendly Trump administration. The frenzy around crypto treasuries further boosted token prices. But the bullish run abruptly ended on Oct. 10, when President Trump’s surprise tariff announcement against China triggered a selloff.

A record-long government shutdown and uncertainty surrounding Federal Reserve monetary policy also have weighed on prices.

Bitcoin prices have fallen 15% in the past month. Strategy is off 26% over that same period, while Matthew Tuttle’s related ETF—MSTU—which aims for a return that is twice that of Strategy, has fallen 50%.

“Digital asset treasury companies are basically leveraged crypto assets, so when crypto falls, they will fall more,” Tuttle said. “Bitcoin has shown that it’s not going anywhere and that you get rewarded for buying the dips.”

At least one big-name investor is adjusting his portfolio after the tumble of these shares. Jim Chanos , who closed his hedge funds in 2023 but still trades his own money and advises clients, had been shorting Strategy and buying bitcoin, arguing that it made little sense for investors to pay up for Saylor’s company when they can buy bitcoin on their own. On Friday, he told clients it was time to unwind that trade.

Crypto-treasury stocks remain overpriced, he said in an interview on Sunday, partly because their shares retain a higher value than the crypto these companies hold, but the levels are no longer exorbitant. “The thesis has largely played out,” he wrote to clients.

Many of the companies that raised cash to buy cryptocurrencies are unlikely to face short-term crises as long as their crypto holdings retain value. Some have raised so much money that they are still sitting on a lot of cash they can use to buy crypto at lower prices or even acquire rivals.

But companies facing losses will find it challenging to sell new shares to buy more cryptocurrencies, analysts say, potentially putting pressure on crypto prices while raising questions about the business models of these companies.

“A lot of them are stuck,” said Matt Cole, the chief executive officer of Strive, a bitcoin-treasury company. Strive raised money earlier this year to buy bitcoin at an average price more than 10% above its current level.

Strive’s shares have tumbled 28% in the past month. He said Strive is well-positioned to “ride out the volatility” because it recently raised money with preferred shares instead of debt.

Cole Grinde, a 29-year-old investor in Seattle, purchased about $100,000 worth of BitMine at about $45 a share when it started stockpiling ether earlier this year. He has lost about $10,000 on the investment so far.

Nonetheless, Grinde, a beverage-industry salesman, says he’s increasing his stake. He sells BitMine options to help offset losses. He attributes his conviction in the company to the growing popularity of the Ethereum blockchain—the network that issues the ether token—and Lee’s influence.

“I think his network and his pizzazz have helped the stock skyrocket since he took over,” he said of Lee, who spent 15 years at JPMorgan Chase, is a managing partner at Fundstrat Global Advisors and a frequent business-television commentator.

When the Writers Festival was called off and the skies refused to clear, one weekend away turned into a rare lesson in slowing down, ice baths included.

Australia’s market is on the move again, and not always where you’d expect. We’ve found the surprise suburbs where prices are climbing fastest.