Corporate Layoffs Spread Beyond High-Growth Tech Giants

Dow, IBM and SAP say they will lay off thousands of workers as belt-tightening becomes the new business priority

Dow Inc., International Business Machines Corp. and SAP SE announced plans to cut thousands of jobs to prepare for a darkening economic outlook, as the current wave of corporate layoffs spreads beyond high-growth technology companies.

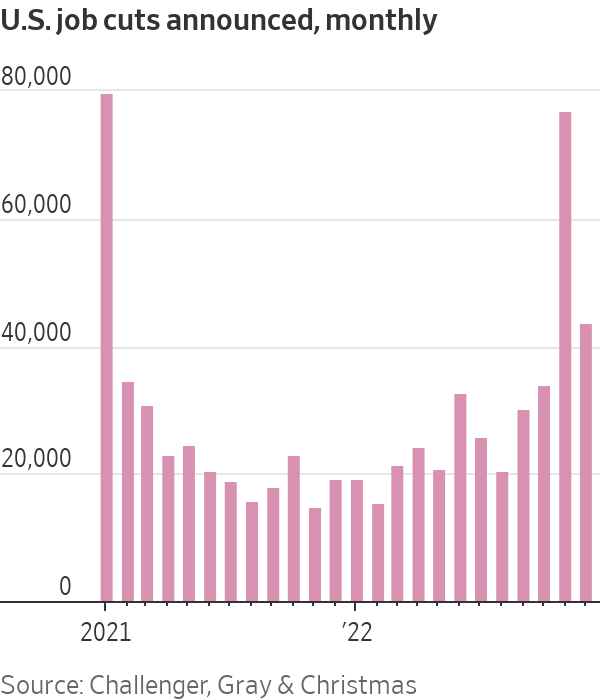

Together with layoffs announced by manufacturer 3M Co. this week, these companies are trimming more than 10,000 jobs, just a fraction of their total workforces. Still, the decisions mark a shift in sentiment inside executive suites, where many leaders have been holding on to workers after struggling to hire and retain them in recent years when the pandemic disrupted workplaces.

Unlike Microsoft Corp. and Google parent Alphabet Inc., which announced larger layoffs this month, these companies haven’t expanded their workforces dramatically during the pandemic. Instead, the leaders of these global giants said they were shrinking to adjust to slowing growth, or responding to weaker demand for their products.

“We are taking these actions to further optimise our cost structure,” Jim Fitterling, Dow chief executive, said in announcing the cuts, noting the company was navigating “macro uncertainties and challenging energy markets, particularly in Europe.”

The U.S. job market remains historically tight, with unemployment in December at 3.5% matching multi decade lows. The number of job openings still far outpaces the number of people looking for work. The Federal Reserve has been raising interest rates to tame growth and combat high inflation. But CEOs say many companies are beginning to scrutinise hiring more closely.

Slower hiring has already lengthened the time it takes Americans to land a new job. In December, 826,000 unemployed workers had been out of a job for about 3½ to 6 months, up from 526,000 in April 2022, according to the Labor Department.

“Employers are hovering with their feet above the brake. They’re more cautious. They’re more precise in their hiring,” said Jonas Prising, chief executive of ManpowerGroup Inc., a provider of temporary workers. “But they’ve not stopped hiring.”

Additional signs of a cooling economy emerged on Thursday when the Commerce Department said U.S. gross domestic product growth slowed to a 2.9% annual rate in the fourth quarter, down from a 3.2% annual rate in the third quarter.

Not all companies are in layoff mode. Walmart Inc., the country’s biggest private employer, said this week it was raising its starting wages for hourly U.S. workers to $14 from $12, amid a still tight job market for front line workers. Chipotle Mexican Grill Inc. said Thursday it plans to hire 15,000 new employees to work in its restaurants, while plane maker Airbus SE said it is recruiting over 13,000 new staffers this year. Airbus said 9,000 of the new jobs would be based in Europe with the rest spread among the U.S., China and elsewhere.

General Electric Co., which slashed thousands of aerospace workers in 2020 and is currently laying off 2,000 workers from its wind turbine business, is hiring in other areas. “If you know any welders or machinists, send them my way,” Chief Executive Larry Culp said this week.

Annette Clayton, CEO of North American operations at Schneider Electric SE, a Europe-headquartered energy-management and automation company, said the U.S. needs far more electricians to install electric-vehicle chargers and perform other tasks. “The shortage of electricians is very, very important for us,” she said.

Railroad CSX Corp. told investors on Wednesday that after sustained effort, it had reached its goal of about 7,000 train and engine employees around the beginning of the year, but plans to hire several hundred more people in those roles to serve as a cushion and to accommodate attrition that remains higher than the company would like.

Freeport-McMoRan Inc. executives said Wednesday they expect U.S. labor shortages to continue to crimp production at the mining giant. The company has about 1,300 job openings in a U.S. workforce of about 10,000 to 12,000, and many of its domestic workers are new and need training and experience to match prior expertise, President Kathleen Quirk told analysts.

“We could have in 2022 produced more if we were fully staffed, and I believe that is the case again this year,” Ms. Quirk said.

The latest layoffs are modest relative to the size of these companies. For example, IBM’s plan to eliminate about 3,900 roles would amount to a 1.4% reduction in its head count of 280,000, according to its latest annual report.

The planned 3,000 job cuts at SAP affect about 2.5% of the business-software maker’s global workforce. Finance chief Luka Mucic said the job cuts would be spread across the company’s geographic footprint, with most of them happening outside its home base in Germany. “The purpose is to further focus on strategic growth areas,” Mr. Mucic said. The company employed around 111,015 people on average last year.

Chemicals giant Dow said on Thursday it was trimming about 2,000 employees. The Midland, Mich., company said it currently employs about 37,800 people. Executives said they were targeting $1 billion in cost cuts this year and shutting down some assets to align spending with the macroeconomic environment.

3M, which had about 95,000 employees at the end of 2021, cited weakening consumer demand for its plans to eliminate 2,500 manufacturing jobs. The maker of Scotch tape, Post-it Notes and thousands of other industrial and consumer products said it expects lower sales and profit in 2023.

“We’re looking at everything that we do as we manage through the challenges that we’re facing in the end markets,” 3M Chief Executive Mike Roman said during an earnings conference call. “We expect the demand trends we saw in December to extend through the first half of 2023.”

Some companies still hiring now say the job cuts across the economy are making it easier to find qualified candidates. “We’ve got the pick of the litter,” said Bill McDermott, CEO of business-software provider ServiceNow Inc. “We have so many applicants.”

At Honeywell International Inc., CEO Darius Adamczyk said the job market remains competitive. With the layoffs in technology, though, Mr. Adamczyk said he anticipated that the labor market would likely soften, potentially also expanding the applicants Honeywell could attract.

“We’re probably going to be even more selective than we were before because we’re going to have a broader pool to draw from,” he said.

Across the corporate sphere, many of the layoffs happening now are still small relative to the size of the organisations, said Denis Machuel, CEO of global staffing firm Adecco Group AG.

“I would qualify it more as a recalibration of the workforce than deep cuts,” Mr. Machuel said. “They are adjusting, but they are not cutting the muscle.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.