Dating Apps Once Ran on Novelty. For Some Users, the Fun Is Over.

Ad campaigns for online dating companies have become flashpoints for frustrated online daters

As online-dating apps court new and younger audiences, some of their marketing efforts are turning off daters instead.

Bumble last month apologised for ads making light of women so frustrated with online dating that they would consider celibacy. The League, a dating app targeting “the overly ambitious,” was called “ick-inducing” for its recent ad campaign, which included taglines like “Date someone with a 5-year-plan that makes you want to ovulate.” And Hinge’s years-long “Designed to Be Deleted” campaign has started to fall flat for longtime users still looking for love on their phones.

Online dating continues to play a lead role in the romantic lives of millions of Americans. Around half of all U.S. adults under 30 have used a dating site or app at some point in their lives, and one in 10 adults with partners say they met their significant other by dating online, according to Pew Research Center data. And the industry’s biggest players, Match Group and Bumble, now generate annual revenues north of $3.4 billion and $1.1 billion, respectively.

But the ad campaigns have high stakes for online dating companies trying to achieve the right mix of user acquisition and pricing power to re-interest Wall Street in a saturated sector.

Online-dating growth has been slowing. Paying users declined 6% in the first quarter of the year at Match Group, whose portfolio includes the League, Tinder and Hinge, compared with a 3% dip in the first quarter of 2023. The Bumble app grew paying users 18% in the first quarter, compared with 31% growth in the period a year earlier.

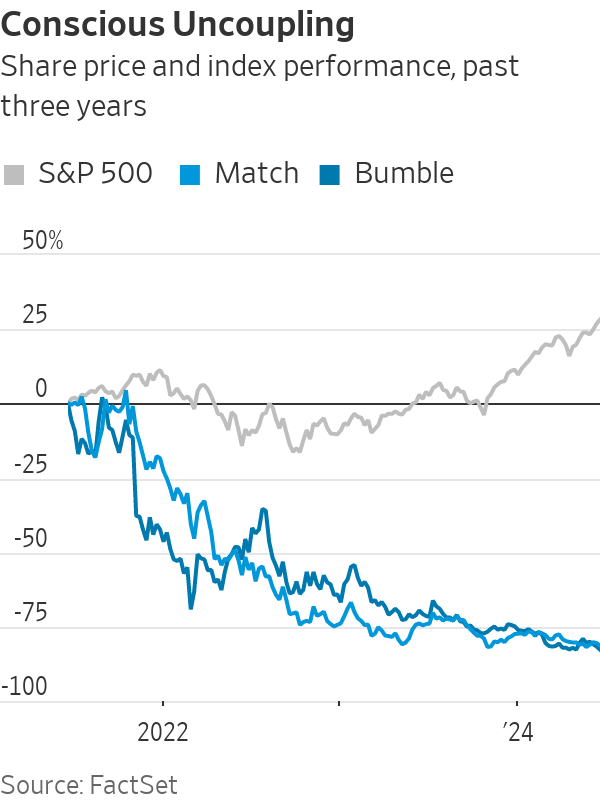

Shares in both have fallen this year even as the S&P 500 rose. And some singles have become perhaps as wary as investors.

Nearly half of all online daters and more than half of female daters say their experiences have been negative, according to Pew , and a growing tide of users are sharing their dissatisfaction in popular Facebook forums and on TikTok. People bemoan a perceived rise in bad dating etiquette such as “ghosting” and the sending of unsolicited sexual messages, and blame the way online romance makes it easier to discard potential partners at a touch of a button. “Hacks,” or tricks designed to game the apps for better dates, abound, demonstrating the shortcomings of their designs.

And the companies’ growing emphasis on pricier premium services is giving users new reasons to scrutinise the algorithmically driven path to romance.

Bumble made its name as a free app that only let women make the first move, for example. But since 2016, it has charged for advantages such as unlimited “swipes” to connect with prospects. The most expensive plan today costs $80 a month. Nonpaying users on Bumble and other apps can hit a limit, which some say leaves them taunted by the nagging fear that their perfect partners are hidden just on the other side of a paywall.

In this environment, new ad campaigns have become a release valve for the tension.

Failure to launch

Bumble users had hoped change was on the way after a teaser campaign depicted a discouraged dater joining a convent but happily leaving after being handed the Bumble app. “We’ve changed so you don’t have to,” one of the ads promised.

“At this point, it’s the app’s responsibility not to rebrand, but to pivot technologically,” said Michelle Khouri , the founder of creator platform Recordical , who has been using dating apps on and off for 10 years following her divorce from a man she met through online dating service eHarmony.

But Bumble’s big move wasn’t a fundamental overhaul: The company was letting women put questions on their profiles to which men they matched with could respond without a specific invitation.

Disappointment became backlash when the full ad campaign included billboards that declared, “Thou shalt not give up on dating and become a nun” and “You know full well a vow of celibacy is not the answer.”

Female daters often thinly disguise their dissatisfaction with modern dating by joking about giving it up for a life of spinsterhood, and Bumble had done what all marketers try to do—joined the conversation .

The problem for many was that Bumble’s quips about nunneries located the problem in daters’ resilience, as opposed to the dating apps themselves, and the unfavourable dating culture some users say the apps’ owners have been complicit in fuelling.

“Bumble was a brand that built its identity on empowering women and then they absolutely laughed in our faces,” said Michelle Wintersteen, the founder and chief executive of branding and marketing agency MKW Creative and a former Bumble user who grew frustrated by its paywalls.

Bumble took down the billboards and made several public apologies.

“We just made a mistake in how that landed. It was not good and we felt really terrible about it,” Bumble CEO Lidiane Jones said at a Wall Street Journal event last month.

Jones added in an emailed statement that the company is enhancing its internal and external review processes, and “actively engaging in conversations to ensure our marketing tone matches the 10 years Bumble has dedicated to championing women and creating safe, respectful, and empowering spaces for connection.”

Some online-dating executives and observers think the gripes with dating apps are largely an extension of age-old ennui over the search for lasting love.

“This is not a new phenomenon, and I think that dating apps have crystallised and brought those concerns to the fore, primarily because the prior institutions that were responsible for connecting individuals—such as family, friends, churches, other homes of worship—were not able to assume blame in the same way,” said Jess Carbino, a sociologist who has worked as a consultant for Bumble and Tinder.

Pickup lines

When the League introduced its “Be a GoalDigger” brand campaign in 2023, its first big marketing effort since being acquired by Match Group in 2022, some had visceral reactions.

“Whoever is behind this truly thought they were like, hitting Gen -Z, being super edgy and cool,” said the TikTok user who reported getting the “ick” from its campaign. “In reality, it is the most millennial, cringy thing that makes you want to actually convulse.”

The app has “never been afraid of speaking up or speaking out about the kind of people that The League attracts,” said Lisa Kraynak, senior vice president of marketing for the League, in a statement. In addition to its ad mentioning ovulation, others read: “Find Your Goal Mate” and “Date Someone With Big Goal Energy.”

“We know that we aren’t for everyone, and that is a core part of our value proposition,” Kraynak added, noting that a number of people responded well to it.

Unlike apps such as Tinder and Bumble, the League requires profile approval to join. On the app, users get three to five prospects a day unless they upgrade to become a paying member, which runs $99 a week or $399 for a three-month subscription. Once a match is made in the app, users have 14 days to initiate a conversation before the matches expire.

Fighting flakes

These components, as well as features such as a “flakiness score” indicating which users have a habit of matching but not chatting, are why Kraynak said the League is “designed to combat the dissatisfaction with apps today .”

Tinder has leaned away from the celebration of singledom that it embraced in a 2018 brand campaign that called single “a terrible thing to waste.” While the app has long been associated with hookups, the company has more recently emphasised the various relationships that can result from its app. Its marketing now romanticizes “a toothbrush at their place” and “comfortable silences,” all while it seeks to upsell users.

“It was about shedding a perception that was too narrow and not accurate,” said Melissa Hobley, chief marketing officer at Tinder.

Hinge, the Match Group brand that has long positioned itself as an app for finding relationships rather than hookups, continues to iterate on its “Designed to Be Deleted” campaign launched in 2019. The company has refreshed the campaign every year since then with the same tagline.

On social media, some dissatisfied users say they have deleted the app—not because they found love but because the app didn’t work for them. Hinge said every feature is designed to help daters be intentional and that it is looking for ways to address dating burnout.

Chief Marketing Officer Jackie Jantos said Hinge is the fastest-growing major dating app.

“‘Designed to Be Deleted,’ as an idea and a marketing program, continues to help us build our base of users,” Jantos said.

Match Group said Hinge’s direct revenue grew 50% in the first quarter of the year as paying members increased 31% and revenue per payer rose 14%. It offers two types of subscriptions, Hinge+ and HingeX, which start at $14.99 and $24.99, respectively, a week.

More recently, the company partnered with a social-media brand that interviews couples on the street, to circulate their love stories that involve Hinge.

“We know that our best growth comes from organic success stories of people meeting on Hinge,” added Jantos.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Impact investing is becoming more mainstream as larger, institutional asset owners drive more money into the sector, according to the nonprofit Global Impact Investing Network in New York.

In the GIIN’s State of the Market 2024 report, published late last month, researchers found that assets allocated to impact-investing strategies by repeat survey responders grew by a compound annual growth rate (CAGR) of 14% over the last five years.

These 71 responders to both the 2019 and 2024 surveys saw their total impact assets under management grow to US$249 billion this year from US$129 billion five years ago.

Medium- and large-size investors were largely responsible for the strong impact returns: Medium-size investors posted a median CAGR of 11% a year over the five-year period, and large-size investors posted a median CAGR of 14% a year.

Interestingly, the CAGR of assets held by small investors dropped by a median of 14% a year.

“When we drill down behind the compound annual growth of the assets that are being allocated to impact investing, it’s largely those larger investors that are actually driving it,” says Dean Hand, the GIIN’s chief research officer.

Overall, the GIIN surveyed 305 investors with a combined US$490 billion under management from 39 countries. Nearly three-quarters of the responders were investment managers, while 10% were foundations, and 3% were family offices. Development finance institutions, institutional asset owners, and companies represented most of the rest.

The majority of impact strategies are executed through private-equity, but public debt and equity have been the fastest-growing asset classes over the past five years, the report said. Public debt is growing at a CAGR of 32%, and public equity is growing at a CAGR of 19%. That compares to a CAGR of 17% for private equity and 7% for private debt.

According to the GIIN, the rise in public impact assets is being driven by larger investors, likely institutions.

Private equity has traditionally served as an ideal way to execute impact strategies, as it allows investors to select vehicles specifically designed to create a positive social or environmental impact by, for example, providing loans to smallholder farmers in Africa or by supporting fledging renewable energy technologies.

Future Returns: Preqin expects managers to rely on family offices, private banks, and individual investors for growth in the next six years

But today, institutional investors are looking across their portfolios—encompassing both private and public assets—to achieve their impact goals.

“Institutional asset owners are saying, ‘In the interests of our ultimate beneficiaries, we probably need to start driving these strategies across our assets,’” Hand says. Instead of carving out a dedicated impact strategy, these investors are taking “a holistic portfolio approach.”

An institutional manager may want to address issues such as climate change, healthcare costs, and local economic growth so it can support a better quality of life for its beneficiaries.

To achieve these goals, the manager could invest across a range of private debt, private equity, and real estate.

But the public markets offer opportunities, too. Using public debt, a manager could, for example, invest in green bonds, regional bank bonds, or healthcare social bonds. In public equity, it could invest in green-power storage technologies, minority-focused real-estate trusts, and in pharmaceutical and medical-care company stocks with the aim of influencing them to lower the costs of care, according to an example the GIIN lays out in a separate report on institutional strategies.

Influencing companies to act in the best interests of society and the environment is increasingly being done through such shareholder advocacy, either directly through ownership in individual stocks or through fund vehicles.

“They’re trying to move their portfolio companies to actually solving some of the challenges that exist,” Hand says.

Although the rate of growth in public strategies for impact is brisk, among survey respondents investments in public debt totaled only 12% of assets and just 7% in public equity. Private equity, however, grabs 43% of these investors’ assets.

Within private equity, Hand also discerns more evidence of maturity in the impact sector. That’s because more impact-oriented asset owners invest in mature and growth-stage companies, which are favored by larger asset owners that have more substantial assets to put to work.

The GIIN State of the Market report also found that impact asset owners are largely happy with both the financial performance and impact results of their holdings.

About three-quarters of those surveyed were seeking risk-adjusted, market-rate returns, although foundations were an exception as 68% sought below-market returns, the report said. Overall, 86% reported their investments were performing in line or above their expectations—even when their targets were not met—and 90% said the same for their impact returns.

Private-equity posted the strongest results, returning 17% on average, although that was less than the 19% targeted return. By contrast, public equity returned 11%, above a 10% target.

The fact some asset classes over performed and others underperformed, shows that “normal economic forces are at play in the market,” Hand says.

Although investors are satisfied with their impact performance, they are still dealing with a fragmented approach for measuring it, the report said. “Despite this, over two-thirds of investors are incorporating impact criteria into their investment governance documents, signalling a significant shift toward formalising impact considerations in decision-making processes,” it said.

Also, more investors are getting third-party verification of their results, which strengthens their accountability in the market.

“The satisfaction with performance is nice to see,” Hand says. “But we do need to see more about what’s happening in terms of investors being able to actually track both the impact performance in real terms as well as the financial performance in real terms.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.