Europe Is Still In The Throes Of Covid-19, But Its Stocks Are Rallying

Certain shares surge as investors look for beaten-down stocks.

European stocks have been on the rise as international investors reposition their portfolios for the global economy to return to normal—a trade that hinges on smooth reopenings in the region.

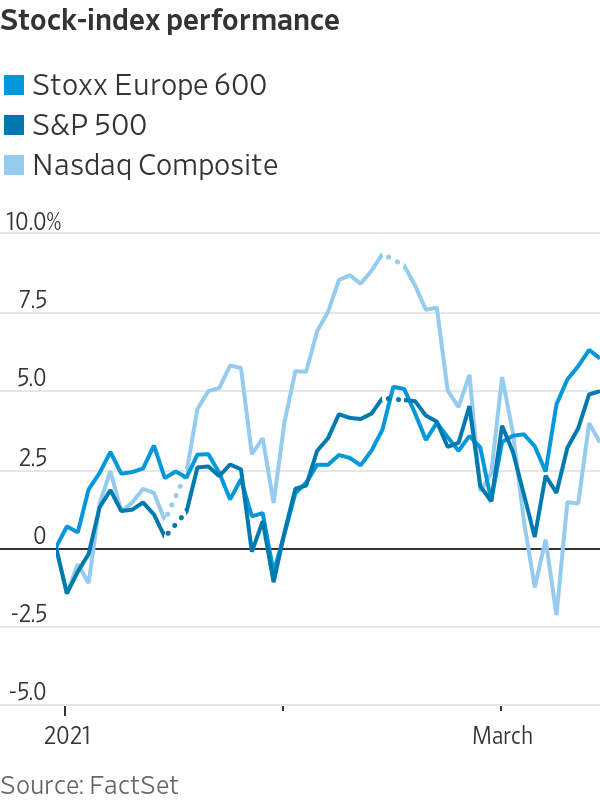

The pan-continental Stoxx Europe 600 index has gained 4.5% so far this month, pulling ahead of major U.S. gauges, and on Friday hovered close to its highest point in more than a year. The S&P 500 has added 3.5% in the same period and the Russell 2000, an index of small-cap U.S. companies, has increased 6.9%. The Nasdaq Composite has gained 1% so far this month.

Analysts say this is due to a rotation from growth to value stocks: Investors have been snapping up shares of companies hit hard by the pandemic and selling those that benefited from stay-at-home orders. Europe is emerging as a beneficiary of this trade, which banks on a strong economic rebound.

“Europe is predominantly a value market, the U.S. is predominantly a growth market,” said Kasper Elmgreen, head of equity investing at Amundi. “This rotation benefits Europe disproportionately.”

Value stocks are thought to be trading below what they are currently worth. They are typically in established industries and pay dividends, and include banks, energy and industrial companies, which are also more sensitive to the economic cycle. Growth companies are younger and perceived to be innovative, with potential to do well in the future, such as technology.

But delays to the European Union’s procurement of vaccines is likely to result in its member states keeping social-distancing and travel restrictions in place for longer than countries that are inoculating their populations faster, such as the U.S. and Israel. This might mean that Europe’s economic rebound is slower and weaker. Italy reimposed stricter curbs in several regions last week and plans to lock down nationally over Easter.

“We are finding a little bit more opportunity outside of the U.S. [Value stocks] look cheaper and more undervalued overseas,” said Brent Fredberg, director of investments at Brandes Investment Partners in San Diego. “Now you’ve still got a long way to go in many of these companies, even though they’ve rallied hard.”

A key reason for Europe’s recent strong stock-market performance is the composition of indexes. The Stoxx Europe 600 is more heavily weighted toward industries that are considered to be value, such as financials at 17%, industrials at 16% and energy companies at 5%. Its weighting for technology and communications is 10%, compared with 37% for the S&P 500.

Amundi’s Mr Elmgreen has bought shares of European auto makers and companies that produce construction materials recently, and said he is “significantly underweight” U.S. tech, meaning he owns less than the benchmark he tracks.

Another driver of Europe’s performance is the bond market. The sense of optimism about economic growth has also driven fund managers to dump safe-haven assets such as sovereign debt, causing yields to rise and prices to drop. Government bond yields are used as a reference for the cost of debt in the broader market, including loans to companies. That rise in yields implies higher financing costs, benefiting lenders.

European banks have been among the best performers so far this year. Investors have been expecting the recent rise in yields to improve their net interest income, a key source of revenue. French bank Natixis SA has surged 47%, while Amsterdam-based ING Groep NV and Spain’s Banco de Sabadell SA have both risen 32%.

The Vanguard FTSE Europe ETF is up 5.6% for the year and the iShares Europe ETF has also risen 5.5%. Another iShares ETF that invests in European financial firms has climbed 12%.

Companies in sectors still curbed by government restrictions have also jumped. German travel company TUI AG is the biggest winner on the Stoxx Europe 600 this year, soaring 56%. International Consolidated Airlines SA has added 39% and InterContinental Hotels Group PLC has risen 15%.

But whether these gains are justifiable is still a question, according to Simon Webber, a portfolio manager at Schroders with a focus on global equities. “Travel has fundamentally changed, people are used to working productively, meeting and supporting customers remotely,” he said. Aviation stocks in particular “will be heavily scrutinized,” he added.

He has increased his holdings of European banks, but is also looking at buying more growth stocks such as electric-vehicle companies.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.