Fed Raises Interest Rates by 0.75 Percentage Point for Third Straight Meeting

Officials project short-term rates will rise above 4.25% by year’s end, signal further large increases at coming meetings

WASHINGTON—The Federal Reserve approved its third consecutive interest-rate rise of 0.75 percentage point and signalled additional large increases were likely even though they are raising the risk of recession.

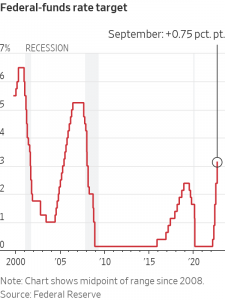

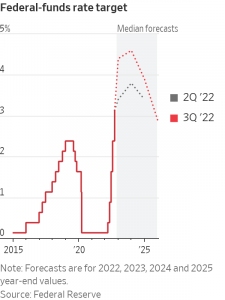

Fed officials voted unanimously to lift their benchmark federal-funds rate to a range between 3% and 3.25%, a level last seen in early 2008. Nearly all of them expect to raise rates to between 4% and 4.5% by the end of this year, according to new projections released Wednesday, which would call for sizeable rate increases at policy meetings in November and December.

“We have got to get inflation behind us. I wish there were a painless way to do that. There isn’t,” Fed Chairman Jerome Powell said at a news conference after the rate decision.

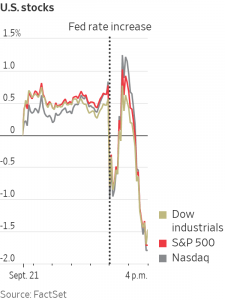

Stock markets tumbled after a volatile trading day. The broad S&P 500 index fell 66 points, or 1.7%, to 3789.93. The yield on the two-year U.S. Treasury note settled around 3.993%, according to Tradeweb, from 3.962% Tuesday, nearly a 15-year high. Just after the Fed’s announcement, it had touched as high as 4.12%. Meanwhile, yields on longer-term Treasurys fell, since higher rates could lead to a sharper economic downturn.

Officials projected that rate rises will continue into 2023, with most expecting the fed-funds rate to rest around 4.6% by the end of next year. That was up from 3.8% in their projections this past June.

Analysts said they hadn’t expected the Fed to show quite so high an endpoint for the rate. Given how persistently elevated inflation has been, “I wouldn’t be surprised to see them go even higher than what they’ve written down—say, to 5%,” said Ellen Meade, an economist at Duke University who is a former senior adviser at the Fed.

The projections showed considerable divergence over what might happen after next year. Around one third of officials expect to hold the fed-funds rate above 4% through 2024, while others anticipate more rate cuts.

“There is a message here that rates will stay higher for longer, and this message is really sticking with market participants,” said Blerina Uruci, U.S. economist at T. Rowe Price.

Even though the economy isn’t yet showing the full effects of Fed rate increases, “all of this volatility and uncertainty makes it hard for businesses to make plans. There are some benefits to having this hiking of interest rates over and done with sooner,” she said.

One year ago, the Fed was signalling rates might stay near zero for another year, and it was purchasing Treasury and mortgage securities to provide additional stimulus. Officials misjudged the strength of the economy’s rebound from the pandemic and how high inflation would rise.

They are now raising rates at the most rapid pace since the 1980s and have approved increases at five consecutive policy meetings, starting in March when they lifted the fed-funds rate from near zero. Until June, the Fed hadn’t raised rates by 0.75 point since 1994.

Officials made a second such increase in July but signalled more concerns about overdoing rate rises, which, together with investor optimism about how quickly inflation might decline, fuelled a market rally.

The rally threatened to undercut the Fed’s steps to slow the economy and weaken price pressures, and Mr. Powell delivered a blunt speech last month in Jackson Hole, Wyo., designed to underscore the Fed’s commitment to reducing inflation.

To limit further confusion on Wednesday, Mr. Powell prefaced his answers to reporters’ questions with a disclaimer. “My main message has not changed at all since Jackson Hole,” he said.

Throughout his press conference, “what Chair Powell was trying to do was keep to a minimum the biggest risks to getting inflation to come down—which was market participants getting ahead of themselves and actually easing financial conditions,” said Vincent Reinhart, chief economist at Dreyfus and Mellon.

The higher the Fed raises rates, the greater the risk that it will go too far, tipping the economy into a recession. But Mr. Powell repeatedly emphasised the need to bring inflation down now to avoid an even worse recession later.

“No one knows whether this process will lead to a recession or, if so, how significant that recession will be,” he said. “We certainly haven’t given up the idea that we can have a relatively modest increase in unemployment. Nonetheless, we need to complete this task.”

The economy slowed in May and June but appeared to regain momentum through the summer. Mr. Powell said Wednesday that the Fed wanted to see more evidence that the labor market was cooling off. The economy has added an average of 380,000 jobs monthly over the past six months, far above the rate of about 50,000 that economists think would keep the unemployment rate steady.

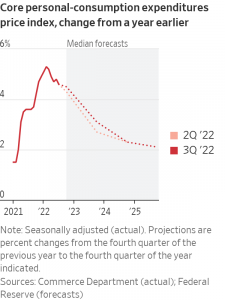

Meanwhile, inflation readings haven’t worsened this summer but also haven’t shown the kind of improvement that the Fed and many economists have wanted to see. Falling gasoline prices caused overall inflation to ease in July and August, but climbing housing costs and prices for services such as dental and hospital visits, haircuts and car repairs have kept inflation elevated.

The consumer-price index rose 8.3% in August from a year earlier, down from June’s increase of 9.1%, a four-decade high. Mr. Powell pointed to how inflation using a separate gauge has consistently run at a pace of 4.5% or higher, despite diminishing supply-chain problems.

“That’s not where we expected or wanted to be,” he said. “Our expectation has been that we would begin to see inflation come down largely because of supply-side healing. By now we would have thought that we would have seen some of that. We haven’t.”

Fed officials projected the unemployment rate rising to 4.4% next year, from 3.7% in August and 3.5% in July. Historically, an increase of that much in that span has coincided with a recession.

Several analysts, including Ms. Meade and Ms. Uruci, said they found it implausible that Fed officials projected they might bring inflation down to 3% next year and 2% by 2025 without doing more damage to the labor market.

At the same time, Mr. Powell appeared to be more candid about the risks. “He is using words that are open to recession,” said Ms. Meade.

The U.S. mortgage market has been slammed by the prospect of tighter money, and the average 30-year fixed-rate mortgage jumped to 6.25% last week from 6.01% the week before, the Mortgage Bankers Association said Wednesday. That was the highest level since October 2008. Applications for loans to purchase homes were down 30% from the same week last year.

Mr. Powell said it was likely the housing market, which boomed during the pandemic, driving prices to new highs, would weaken significantly. Mr. Reinhart said the admission was notable because the economy has always entered a recession when the housing sector has contracted.

“They want to convey that policy will be firm and that the economy will suffer as a result. It’s hard for them to say how much it will suffer,” said Mr. Reinhart.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.