For Apple, India Is the Next China

Apple’s move to open its famed retail store in India signals the market is a high priority

Apple’s playbook in India is evolving, from testing the country as a counterweight to China’s supply-chain dominance to viewing it as an emerging growth hub for demand.

Both of these strategies are working off each other.

Last week, Apple unveiled the look of its first retail store in India that is set to open this month, signalling India’s growing importance for the Cupertino, Calif.-based company. Until now Apple has sold iPhones and other products in the country mostly through resellers, e-commerce websites and large format retail chains. With the opening of its own famed brick-and-mortar store, it is adding another critical layer to this wide distribution.

The move isn’t surprising given Chief Executive Tim Cook in February called India a major focus for Apple, adding that the company is putting a lot of emphasis on the market. On the call, Apple said it posted record iPhone revenue in India in the December quarter, though they didn’t give a specific figure, even as overall revenue declined.

It is no secret that Apple has been growing its manufacturing base in India as it works on a China + 1 strategy. But this narrative has overshadowed India’s steady climb up the luxury ladder over the past few years, and the opportunity it presents for Apple to find the next lucrative market similar to China.

Making iPhones and then selling them in India ensures a smooth supply chain—a page directly out of Apple’s massive success in China over the past decade. Daniel Ives, an analyst with Wedbush Securities, believes that now the company will have “skin in the game” building out production in India with retail success along the way.

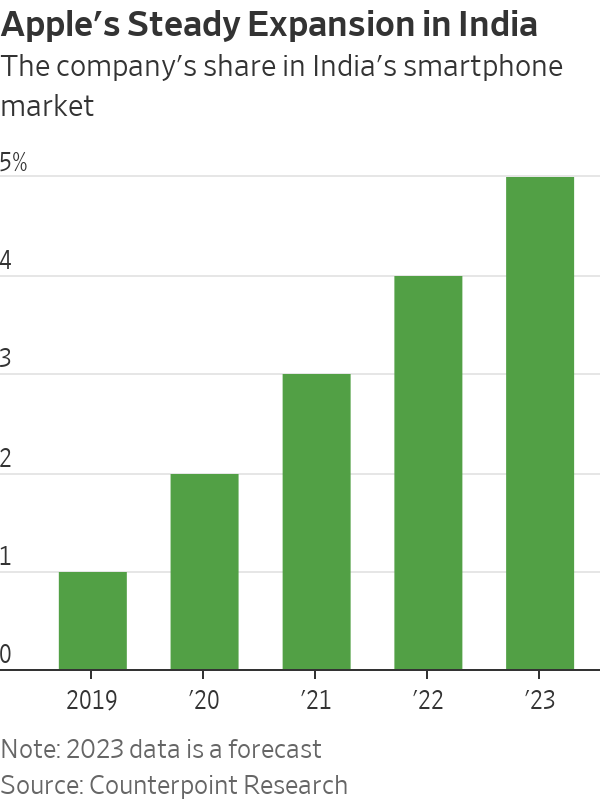

For several years, Apple struggled to make a dent in the Indian market and compete against more affordable Chinese models. Only now is it gaining traction. Apple had a mere 1% market share in 2019 and may cross a 5% share this year in the country’s overall smartphone market, according to Counterpoint Research. To be sure, that contrasts with Apple’s market share in China of 22% in the last quarter of 2022.

Still the market has potential, even if prices of iPhones may have to come down further. According to another research firm, Canalys, India’s premium smartphone segment, defined by sale prices above $500, has doubled to 6% of overall market share last year from 3.1% in 2019, and Apple’s share of this segment was at 60.13% last year.

Harsh Kumar, an analyst at Piper Sandler, argues that India and China are quite similar in their demographics and even in their potential buying power, at least in large cities—and that India can show large numbers for Apple with some effort.

India is the second-largest smartphone market globally, both in terms of annual shipments and sales, accounting for almost 12% of the global market, according to market intelligence firm IDC. Despite this, smartphone penetration is still less than 50%—providing an unmatched potential for growth for Apple.

Navkendar Singh, an analyst at tech researcher IDC, believes that Apple’s work on channel expansion, focus on affordability through attractive trade-in programs, discounts, cash-back offers and better pricing on prior-generation models are finally bearing fruit. But the gap between Apple and other models is still quite wide—the average selling price of a smartphone in India was $206 last year, excluding taxes, vs. $898 for an iPhone, according to Canalys.

But the price of Apple’s cheapest model can go below $500 with discounts. A larger manufacturing base with a thriving component ecosystem in India could bring prices down a bit further.

India is at the forefront of Apple’s efforts to decouple from China’s factory floor but may even prove itself as a growth market—with some conditions applied, of course.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.