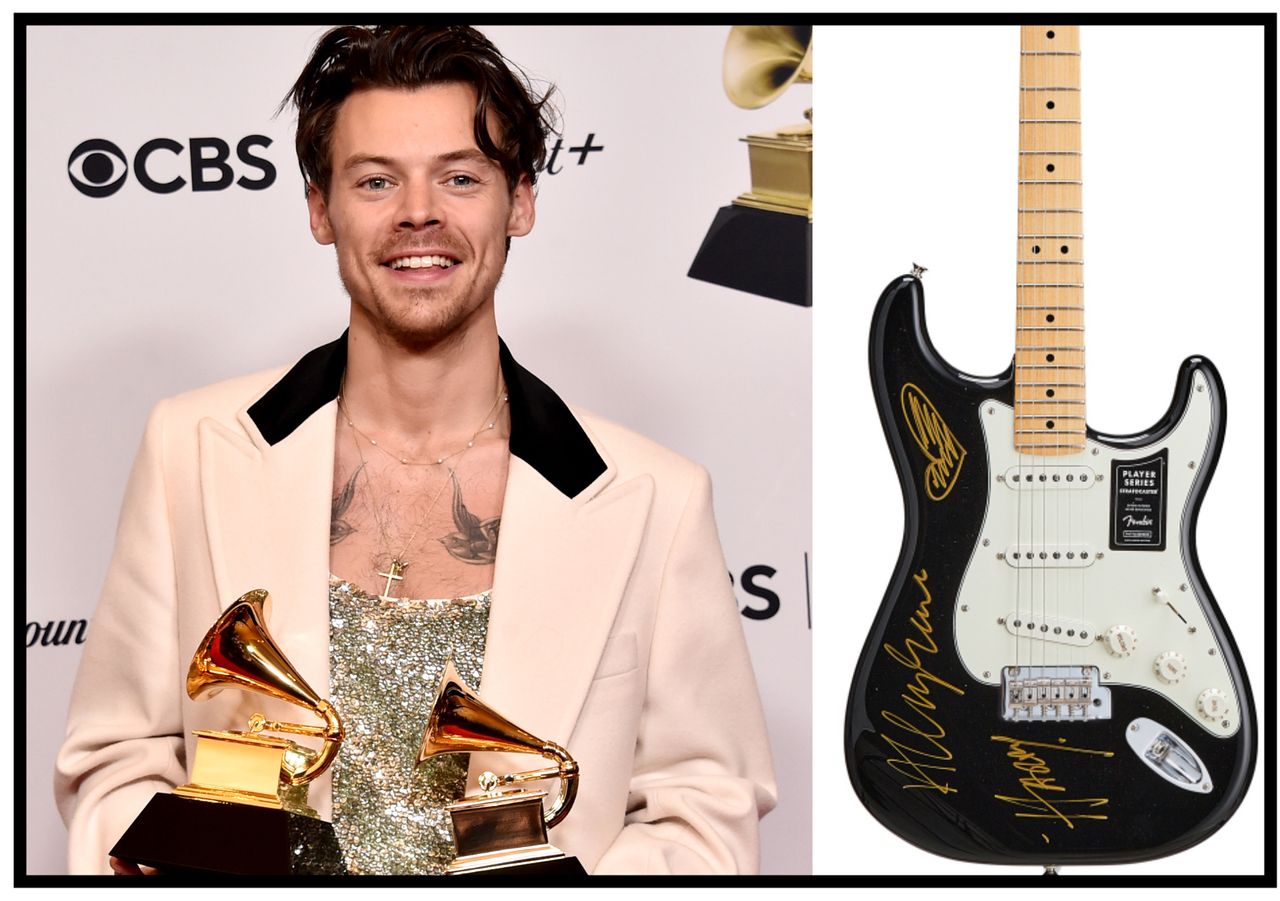

Harry Styles-Signed Guitar Sells for $19,200 Right Before the Grammy Awards

A Harry Styles-signed electric guitar sold for US$19,200 on Sunday in Los Angeles, hours before his surprise album of the year win at the Grammy Awards.

The 2022 black Fender Player Series Stratocaster electric guitar was inscribed by Styles with the words “Always love” beside a doodle of heart in a gold marker. Styles’ album Harry’s House defeated Beyoncé’s Renaissance and eight other nominees to win the album of the year at music’s most prestigious awards show on Sunday night.

The guitar was valued between US$2,000 and US$4,000, prior to the auction.

The instrument was among 50 items owned or signed by the music’s biggest stars that were auctioned by Julien’s Auctions over the weekend to raise funds for MusiCares, which supports the health and welfare of members of the music community.

The auction house, which was expecting to raise between US$200,000 and US$400,000 from this sale, said the sale realised more than US$500,000. Many items sold multiple times their pre-sale estimates.

“This year’s edition was one of our best and most successful auctions to date,” according to Martin Nolan, executive director of Julien’s Auctions.

The top-selling lot was a pair of white Nike Air Max sneakers owned, worn, and signed by Eminem, which sold for US$40,625, which was 20 times its presale estimate. The sneakers were sold to Margaritavillain, an anonymous rapper who’s often compared to Banksy of the contemporary art world. His fans raised money through a GoFundMe page to help him successfully bid and win the shoes, according to Julien’s.

An ensemble worn by J-Hope of South Korean boy band BTS, including a black utility-style jumpsuit, a buckle belt, a black cotton T-shirt, and a black ribbed bunny ear beanie, attracted 22 bids and sold for US$21,875, more than 10 times its original estimate of US$2,000.

Additionally, a 2020 Epiphone DR-100EB acoustic guitar signed by Taylor Swift fetched US$25,000, five times its original estimate. The guitar features custom graphics from Swift’s Grammy-nominated album evenmore.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.