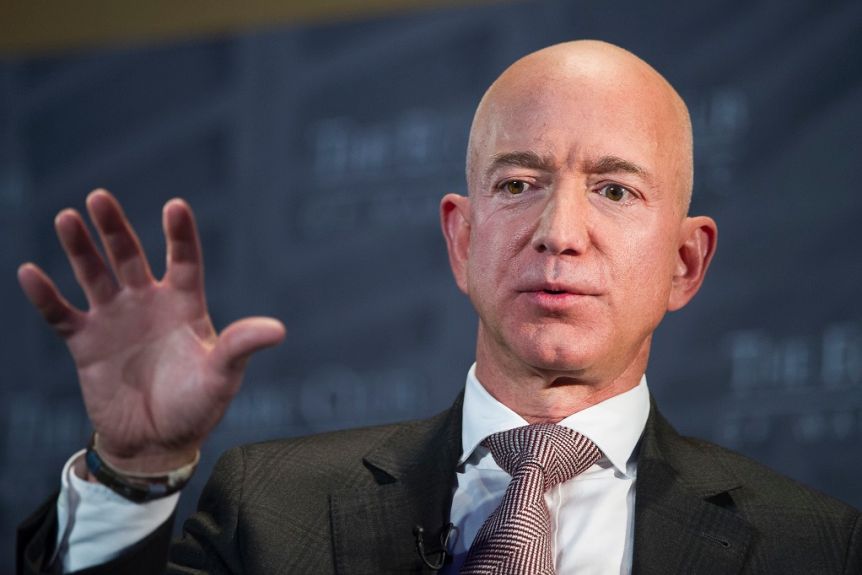

Jeff Bezos To Step Down As Amazon CEO; Andy Jassy To Take Over

The company announced changing roles as it reported that revenue in the fourth quarter soared 44% to US$125.56 billion.

Jeff Bezos is stepping down as chief executive of Amazon.com Inc. to become executive chairman, marking the biggest change in leadership of the tech giant since he started it in a Washington state garage more than 26 years ago.

Amazon said on Tuesday that he will be succeeded as CEO in the third quarter by Andy Jassy, Mr Bezos’s closest lieutenant and the longtime head of the company’s booming cloud-computing business.

Mr Bezos, 57 years old, is handing over the day-to-day reins, as Amazon’s core businesses of online retail and business-computing services are booming during the Covid-19 pandemic, which has shifted work and life to the internet more than ever. The company announced his changing role as it reported that revenue in the fourth quarter soared 44% to US$125.56 billion—surpassing US$100 billion for the first time in a three-month span—and profit more than doubled.

But Amazon also faces the biggest regulatory challenges in its history, with multiple federal investigations into its competitive practices and lawmakers drafting legislation that could force Amazon to restructure its business. Tension with regulators and lawmakers has directly embroiled Mr Bezos, who was called to testify in front of Congress last summer for the first time.

Mr Bezos’s leadership of Amazon has made him one of the most respected, and feared, leaders in business, as well as fantastically wealthy. He is currently neck-and-neck with his rival rocket entrepreneur, Tesla Inc. CEO Elon Musk, as the world’s wealthiest person. Forbes lists Mr Bezos’s wealth at more than $196 billion.

In an email to employees made public Tuesday, Mr Bezos said he plans to focus his energy now on new products and early initiatives as well as his outside interests. “Being the CEO of Amazon is a deep responsibility, and it’s consuming,” Mr Bezos wrote. “When you have a responsibility like that, it’s hard to put attention on anything else.”

Mr Bezos’s move makes Amazon the latest of today’s tech giants to transition leadership away from the people who started them. The co-founders of Google stepped back from their management roles at its parent Alphabet Inc. in 2019, and both Apple Inc. and Microsoft Corp. have long been run by successors to their founders.

Mr Bezos left a career on Wall Street to start Amazon.com in 1994 as a scrappy online bookseller during a time when most Americans didn’t own computers. Amazon became an against-all-odds success story that would go on to completely disrupt the bookselling industry along with nearly every other industry in its path, from logistics to advertising. The company today is America’s largest online retailer, the leading provider of cloud-computing services, a significant player in Hollywood, a competitor in bricks-and-mortar groceries through its Whole Foods subsidiary, and a growing rival to United Parcel Service Inc. and FedEx Corp. in logistics. Amazon employs nearly 1.3 million people.

The executive imbued the Seattle-based company with a “Day 1” philosophy of always maintaining an underdog startup ethos. However, in recent years, Mr Bezos has stepped back from day-to-day management of the tech giant—with a brief pause when he became more actively involved in the early days of the pandemic. Many in his inner circle describe Mr Bezos’s role over the past few years as akin to that of an executive chairman. The executive famously tries to not schedule meetings before 10 a.m. and to make all of his tough decisions before 5 p.m. Amazon employees say the billionaire is elusive, with many saying they have never spotted him on the company’s sprawling downtown Seattle campus.

In 2016, he appointed two of his top deputies to oversee management of daily operations. Jeff Wilke was named CEO of world-wide consumer at Amazon, overseeing everything from Amazon’s retail arm and warehouses to its advertising and devices business. Mr Jassy was CEO of the cloud business, called Amazon Web Services.

The appointments freed up Mr Bezos to devote time to innovations and moonshots. He took on pet projects such as Amazon’s voice assistant product, the Echo, and spent time with Amazon’s studio executives on what movies and television programs it had in the pipeline.

Mr Bezos’s tightknit group of top lieutenants at Amazon has seen its ranks thin out in the past few years. In addition to Mr Wilke’s departure at the beginning of the year, Jeff Blackburn, a 20-year veteran and member of Mr Bezos’s team of top executives, took a sabbatical in 2020. Steve Kessel, another member of Mr. Bezos’s top executives, retired from the company last year.

Beyond Amazon, Mr Bezos bought the Washington Post in 2013 and has spent a sizable chunk of his time at Blue Origin LLC, the space company he founded. While the coronavirus pandemic re-engaged Mr Bezos, as the company had to deal with unprecedented demand, he remained involved with Blue Origin’s mission. Just last week Mr Bezos posted a photo on Instagram of a “hotfire test” of a Blue Origin engine.

Mr Bezos, a father of four children, also has experienced a major transition in his personal life recently. In 2019, Mr Bezos and his wife divorced and the National Enquirer tabloid reported his affair with a former television reporter who was the wife of a Hollywood executive.

The leadership transition at Amazon will take place as it grapples with unprecedented scrutiny.

The company is currently the subject of probes from the Justice Department, the Federal Trade Commission, the European Union and other governing agencies about whether it participates in anticompetitive practices.

In October, the House Judiciary Committee’s Antitrust Subcommittee—before which Mr Bezos testified in July—concluded its 16-month investigation into the biggest U.S. tech companies. Its report accused Amazon of exerting “monopoly power” over sellers on its website and suggested legislation that could cause Amazon to exit business lines—like its private-label or devices businesses—that compete with sellers on its platform.

In response to the Congressional report, Amazon said: “All large organisations attract the attention of regulators, and we welcome that scrutiny. But large companies are not dominant by definition, and the presumption that success can only be the result of anticompetitive behaviour is simply wrong.”

On Tuesday, a member of the committee, Ken Buck (R., Colo.), tweeted Amazon’s announcement saying: “I have some questions for Mr Jassy,” indicating that the new CEO will inherit much of the regulatory scrutiny from his predecessor.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.