Surging Nvidia Stock Keeps Drawing In More Believers

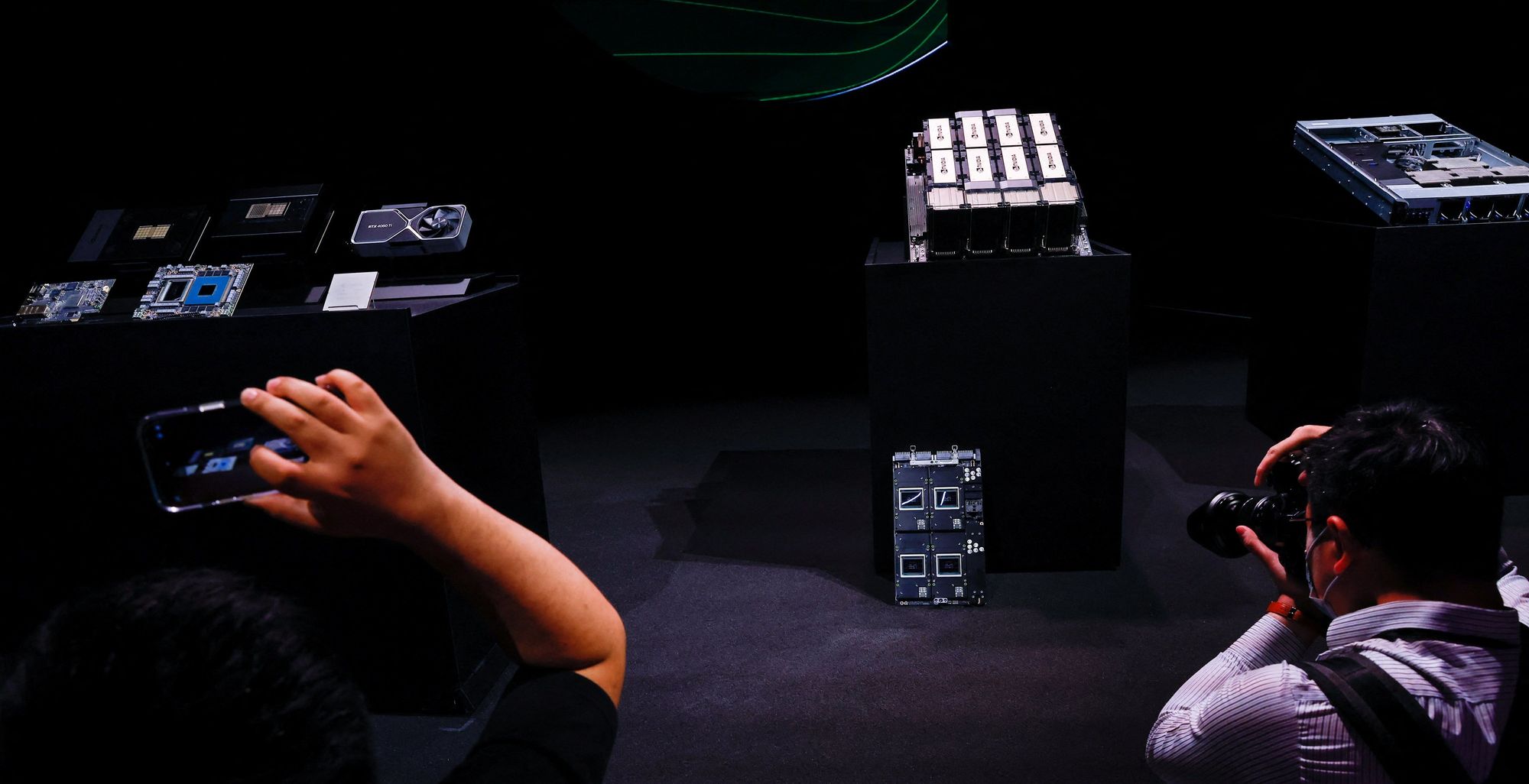

The chip company that is cashing in on the market’s artificial-intelligence obsession seems to many investors like an unstoppable force

Nvidia ’s historic run is minting profits for investors big and small . Many are betting the boom is just beginning.

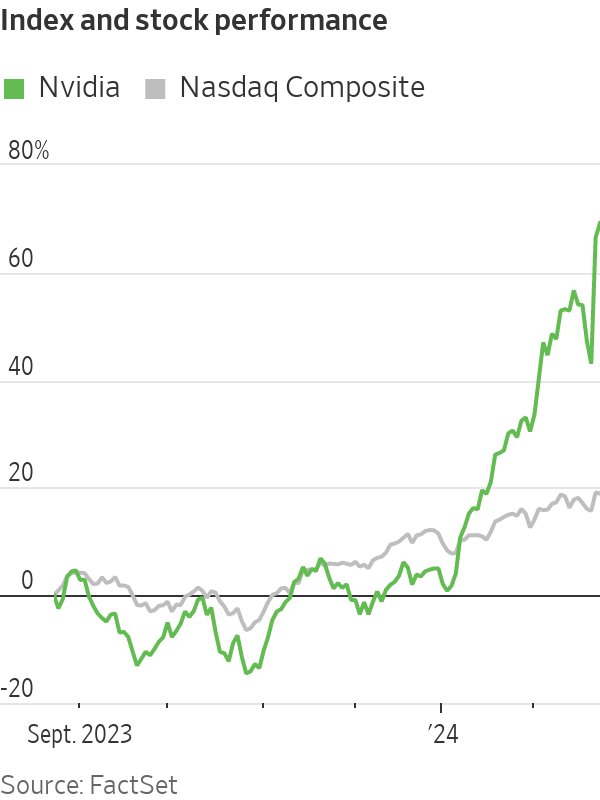

They are piling into trades that the chipmaker’s shares, which have more than tripled over the past year , are headed still higher. Some have turned to the options market to look for ways to turbocharge their bets on artificial intelligence after a blockbuster earnings report sent the stock up 17% over the past two days.

The exuberance reflects hope that the company is the vanguard of wide adoption of artificial intelligence—and an intense fear of missing out among investors who have sat on the sidelines while the company’s valuation has eclipsed $2 trillion .

With the help of Nvidia, stocks have stormed into 2024 . The S&P 500, which has chalked up fresh records in recent weeks, is up 6.7%. That is the index’s second-best performance for this time period over the past 10 years. The gains were only surpassed by an 11% increase in 2019.

Nvidia has contributed to about a quarter of those gains, according to S&P Dow Jones Indices.

The Nasdaq, too, is up 6.6% this year and neared a record Friday. The tech-heavy index has been boosted by Nvidia, which this week tacked on $277 billion in additional market value, along with six other tech titans collectively known as the Magnificent Seven.

The Dow Jones Industrial Average is up 3.8% this year and has hit repeated records in recent weeks.

“You look at these numbers and what this company’s done—it’s almost without precedent,” said Mike Ogborne, founder of San Francisco-based hedge fund Ogborne Capital Management, who counts Nvidia among his top five biggest holdings . “It is nothing short of amazing.”

Ogborne compared AI with the launch of the internet more than two decades ago, which kick-started a technology craze that lasted years.

“It’s exciting,” Ogborne said. “It’s great for America.”

Unfazed by questions about AI

Tamar June in Reno, Nev., is one investor along for Nvidia’s furious stock-market ascent. Since the 1990s, the 61-year-old software-company chief executive has been buying shares of tech firms, including Apple , Microsoft , Cisco, Intel and Oracle . June had been familiar with Nvidia for some time but in recent years kept reading about the chip company in the news. She liked that it was profitable and growing.

June decided to purchase some shares in 2022 at about $260, then watched the stock erase more than half of its value later that year. She held on, knowing that Nvidia’s graphics processing units were in high demand for cloud computing. Then, an AI frenzy hit the stock market in 2023, sending Nvidia’s stock soaring.

Now, Nvidia shares are closing in on $800, and June is looking for opportunities to buy more. She isn’t fazed by worries that the AI boom is bound to come crashing down. June experienced the bursting of the dot-com bubble and the 2008 financial crisis—and watched stocks bounce back to new highs.

“I think it’s still in the beginning stages,” June said of AI developments. “There’s still a lot of headroom for technology because our whole future depends on it.”

$20 billion in options

A herd of investors chased Nvidia while it raced toward its $2 trillion valuation.

At Robinhood Markets , Nvidia was the most purchased stock by customers on a net basis and received the heaviest notional trading volumes over the past month, according to Stephanie Guild, head of investment strategy at the digital brokerage.

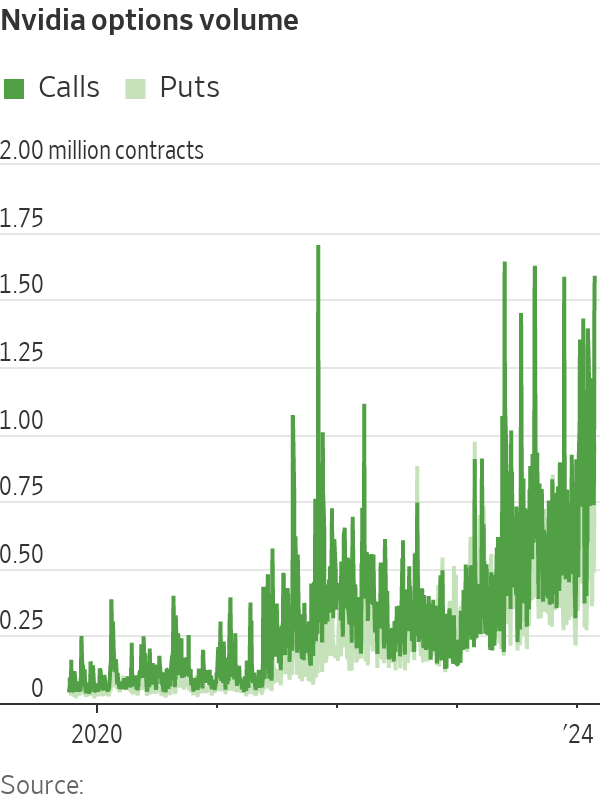

The rise drove many traders to pile into the company’s options, a risky corner of the market notorious for boom-and-bust trades.

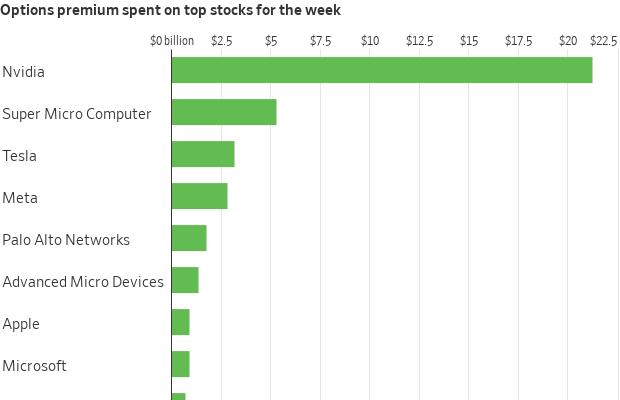

Nvidia has also morphed into one of the most popular trades in this market, with traders placing more than $20 billion in stock-options bets tied to the company over the past week, according to Cboe Global Markets data. That was more than what they spent on Tesla , Meta Platforms , Microsoft, Apple, Amazon and Alphabet combined.

Call options, contracts that confer the right to buy shares at a specific price, were particularly popular. And many of the trades appeared to suggest that investors were fearful of missing out on bigger gains to come. Some of the most active trades Friday were calls pegged to the shares jumping to $800 or $850, up from their closing price of $788.17. Betting against the shares has been a losing game , leading many investors to throw in the towel on bearish wagers.

The values of many of these options bets exploded while Nvidia soared, rewarding those who piled in. The big gains also enticed others to join in the trades while the stock’s rally continued.

“There’s a snowball effect,” said Henry Schwartz, a vice president at exchange-operator Cboe Global Markets, of the options activity surrounding Nvidia.

Ahead of the tech behemoth’s earnings report Wednesday, options pegged to the shares jumping to $1,300 —around double where they were trading at the time—were some of the most popular trades.

And for some investors, the 16% one-day jump in Nvidia’s share price Thursday wasn’t enough. They sought even bigger returns and piled into several niche exchange-traded funds that offer magnified exposure to Nvidia stock.

The GraniteShares 2x Long NVDA Daily ETF has taken in almost half a billion dollars from investors on a net basis since launching late in 2022. The fund’s shares have more than doubled in 2024 and have surged nearly 650% since inception.

There have been few signs of profit-taking so far. Investors added a net $263 million to the fund in the past month. The fund’s cousin, which turbocharges bearish bets against Nvidia, has been much less popular.

The euphoria surrounding Nvidia has spread to other stocks, too. Shares of Super Micro Computer , a much smaller company worth less than $50 billion, popped more than 30% Thursday after Nvidia’s earnings report. Traders spent more than $5 billion on options tied to the company, more than what they spent on Tesla this week. Tesla is worth about 13 times as much as the company.

Software that is eating the world

Nvidia’s continued, rapid ascent has stunned even early bulls on semiconductors and generative AI.

Atreides Management founder Gavin Baker, who started covering Nvidia as an analyst at Fidelity in 2000, reminded investors in his Boston hedge fund in an early 2021 letter of Marc Andreessen ’s adage that software was eating the world. “Today, AI is replacing software,” he wrote.

Atreides started buying Nvidia shares in the fourth quarter of 2022, according to regulatory filings.

The wager proved profitable. But as Nvidia shares kept soaring, Baker started selling. Atreides was out of Nvidia by the end of the second quarter of 2023. “This has been a painful mistake,” Baker wrote in a June 2023 letter to his clients, when Nvidia was trading north of $420 a share.

Atreides’s stake in competitor Advanced Micro Devices has helped alleviate the pain from missing out on larger gains. The firm made nearly a quarter billion last year alone on AMD, which it continues to hold along with several other related bets.

Michael Hannosh, a 20-year-old college student in Chicago, said he first purchased shares of Nvidia in August 2022, when the stock traded below $180. Nvidia was one of his first-ever stock purchases. He had built a custom computer for videogaming and used a lot of Nvidia parts.

Hannosh said he kept the shares until last March, then sold them for a roughly 30% profit. He later bought a few more shares at about $230 and sold them over the course of the next several days at a profit.

The shares have tripled since.

“It’s blown my f—ing mind to bits. It’s insane,” said Hannosh. “I really wish I held it, obviously.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Impact investing is becoming more mainstream as larger, institutional asset owners drive more money into the sector, according to the nonprofit Global Impact Investing Network in New York.

In the GIIN’s State of the Market 2024 report, published late last month, researchers found that assets allocated to impact-investing strategies by repeat survey responders grew by a compound annual growth rate (CAGR) of 14% over the last five years.

These 71 responders to both the 2019 and 2024 surveys saw their total impact assets under management grow to US$249 billion this year from US$129 billion five years ago.

Medium- and large-size investors were largely responsible for the strong impact returns: Medium-size investors posted a median CAGR of 11% a year over the five-year period, and large-size investors posted a median CAGR of 14% a year.

Interestingly, the CAGR of assets held by small investors dropped by a median of 14% a year.

“When we drill down behind the compound annual growth of the assets that are being allocated to impact investing, it’s largely those larger investors that are actually driving it,” says Dean Hand, the GIIN’s chief research officer.

Overall, the GIIN surveyed 305 investors with a combined US$490 billion under management from 39 countries. Nearly three-quarters of the responders were investment managers, while 10% were foundations, and 3% were family offices. Development finance institutions, institutional asset owners, and companies represented most of the rest.

The majority of impact strategies are executed through private-equity, but public debt and equity have been the fastest-growing asset classes over the past five years, the report said. Public debt is growing at a CAGR of 32%, and public equity is growing at a CAGR of 19%. That compares to a CAGR of 17% for private equity and 7% for private debt.

According to the GIIN, the rise in public impact assets is being driven by larger investors, likely institutions.

Private equity has traditionally served as an ideal way to execute impact strategies, as it allows investors to select vehicles specifically designed to create a positive social or environmental impact by, for example, providing loans to smallholder farmers in Africa or by supporting fledging renewable energy technologies.

Future Returns: Preqin expects managers to rely on family offices, private banks, and individual investors for growth in the next six years

But today, institutional investors are looking across their portfolios—encompassing both private and public assets—to achieve their impact goals.

“Institutional asset owners are saying, ‘In the interests of our ultimate beneficiaries, we probably need to start driving these strategies across our assets,’” Hand says. Instead of carving out a dedicated impact strategy, these investors are taking “a holistic portfolio approach.”

An institutional manager may want to address issues such as climate change, healthcare costs, and local economic growth so it can support a better quality of life for its beneficiaries.

To achieve these goals, the manager could invest across a range of private debt, private equity, and real estate.

But the public markets offer opportunities, too. Using public debt, a manager could, for example, invest in green bonds, regional bank bonds, or healthcare social bonds. In public equity, it could invest in green-power storage technologies, minority-focused real-estate trusts, and in pharmaceutical and medical-care company stocks with the aim of influencing them to lower the costs of care, according to an example the GIIN lays out in a separate report on institutional strategies.

Influencing companies to act in the best interests of society and the environment is increasingly being done through such shareholder advocacy, either directly through ownership in individual stocks or through fund vehicles.

“They’re trying to move their portfolio companies to actually solving some of the challenges that exist,” Hand says.

Although the rate of growth in public strategies for impact is brisk, among survey respondents investments in public debt totaled only 12% of assets and just 7% in public equity. Private equity, however, grabs 43% of these investors’ assets.

Within private equity, Hand also discerns more evidence of maturity in the impact sector. That’s because more impact-oriented asset owners invest in mature and growth-stage companies, which are favored by larger asset owners that have more substantial assets to put to work.

The GIIN State of the Market report also found that impact asset owners are largely happy with both the financial performance and impact results of their holdings.

About three-quarters of those surveyed were seeking risk-adjusted, market-rate returns, although foundations were an exception as 68% sought below-market returns, the report said. Overall, 86% reported their investments were performing in line or above their expectations—even when their targets were not met—and 90% said the same for their impact returns.

Private-equity posted the strongest results, returning 17% on average, although that was less than the 19% targeted return. By contrast, public equity returned 11%, above a 10% target.

The fact some asset classes over performed and others underperformed, shows that “normal economic forces are at play in the market,” Hand says.

Although investors are satisfied with their impact performance, they are still dealing with a fragmented approach for measuring it, the report said. “Despite this, over two-thirds of investors are incorporating impact criteria into their investment governance documents, signalling a significant shift toward formalising impact considerations in decision-making processes,” it said.

Also, more investors are getting third-party verification of their results, which strengthens their accountability in the market.

“The satisfaction with performance is nice to see,” Hand says. “But we do need to see more about what’s happening in terms of investors being able to actually track both the impact performance in real terms as well as the financial performance in real terms.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.