The Best Stock Funds of 2023

The ‘Magnificent Seven’ tech stocks helped drive a rebound at many large-cap funds after a dismal 2022. The winner surged 65.2%.

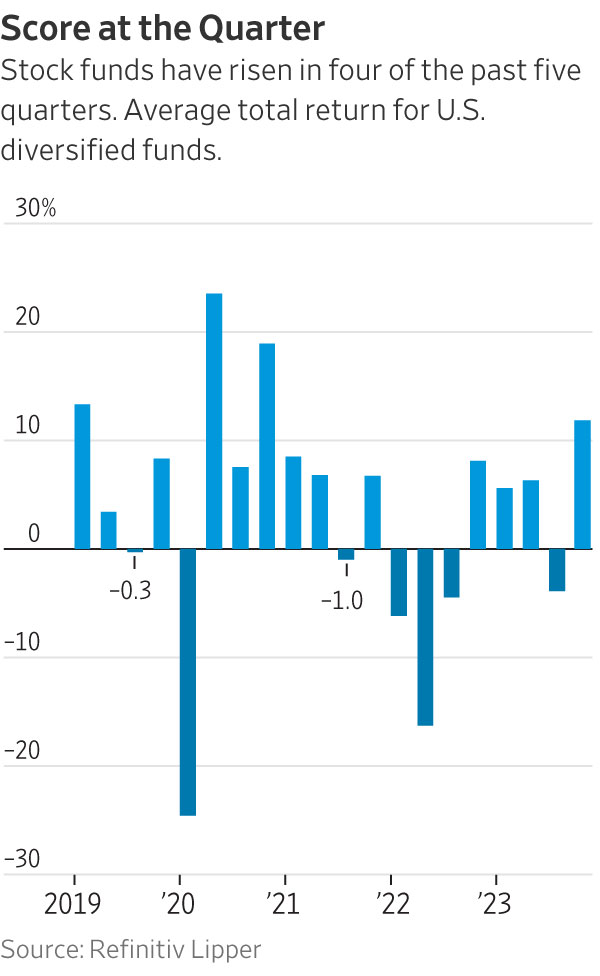

Large-cap companies led the way in 2023, benefiting the money managers who believed in them.

Driven by a rebound in large and megacap stocks, in particular the “Magnificent Seven” technology companies, mutual-fund managers who saw double-digit losses in the market rout in 2022 found themselves rewarded for their patience this past year.

Nine of the top 10 stock funds in The Wall Street Journal’s Winners’ Circle survey of mutual funds, which covers the 12-month period ended Dec. 31, are in Morningstar’s large-cap growth category—often with big weightings in outperforming sectors such as technology, communications services and consumer discretionary. Those S&P 500 sectors notched total returns, including dividends, of 57.8%, 55.8% 42.4%, respectively, easily topping the broader market’s 26.3% result.

Still, the Magnificent Seven paced the market. These stocks—Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia and Tesla—all gained more than 48% last year.

Nvidia, whose chips have become synonymous with exploding interest in artificial intelligence, was the biggest winner among those stocks with a gain of 239%. It was followed by Facebook parent Meta at 194% and Tesla at 102%. These were popular holdings among the top-performing funds in the latest survey, though it varied by the individual manager.

Excluding those stocks, the S&P 500’s return was only 9.9%, according to S&P Dow Jones Indices. In other words, the Magnificent Seven accounted for more than half of the index’s 2023 performance and boosted the returns of many funds as well.

Still, there was plenty of good performance across mutual funds, and it wasn’t always contingent on those seven stocks. A rising tide lifts most boats.

Survey parameters

For the latest 12-month period, more than 1,000 of the 1,191 funds tracked in the Journal’s survey made double-digit gains. The average fund returned 19.7%, and only four funds registered declines.

To qualify for inclusion in the Winners’ Circle, funds must be actively managed U.S.-stock funds with more than $50 million in assets and a record of three years or more, as well as meet a handful of other criteria. The survey excludes index and sector funds, funds that employ leverage strategies and most quantitative funds. The results are calculated by Morningstar Direct.

As always, this quarterly competition isn’t designed to create a “buy list” of funds for readers, but to demonstrate the ways that specific investment strategies benefited from recent market trends. Some of the funds that were highlighted a year ago have fallen in the rankings just as growth portfolios have grabbed the limelight—and that phenomenon isn’t uncommon.

Moreover, not all funds cited in these quarterly surveys may be available to investors, and they may have elements that make them unsuitable for some investors, ranging from their fee structure to their longer-term performance or volatility.

Take the latest No. 1 fund, for example. The $500 million Virtus Zevenbergen Innovative Growth Stock Fund (SAGAX) lost 55.4% in 2022 and 10.1% in 2021 as tech stocks tumbled amid the Federal Reserve’s rate-hike campaign and recession worry.

The fund returned 65.2% last year, however, thanks to the big turnaround for the large-cap growth stocks.

Patience paid off

“Markets and management teams spent all of 2022 fearing and preparing for a recession that has so far failed to appear, but that excess pessimism really swung the pendulum too far in terms of market sentiment,” says Joe Dennison, a portfolio manager of the Virtus fund. “That has created some great opportunities for patient long-term investors.”

It holds five of the Magnificent Seven, three of which—Tesla, Nvidia and Amazon—are among its top 10 holdings. Tesla, its largest holding, stands at 7.7% of the fund.

These stocks aren’t new to Dennison and his co-managers. The fund first bought shares of Nvidia in 2017. Its holdings in Tesla and Amazon date to 2010 and 2008, respectively.

Dennison says the biggest contributors to the fund’s 2023 performance besides Tesla and Nvidia were MercadoLibre, an e-commerce company in Latin America, and Shopify, an e-commerce business platform. Those stocks gained 86% and 124% last year, respectively.

The Virtus fund doesn’t shy away from high valuations. As of Dec. 29, the trailing price-to-earnings ratio of stocks it holds was 70.4, excluding negative earnings. This approach, however, can be volatile.

Indeed, Dennison acknowledges “there will be volatility and periods of underperformance,” but he adds that it’s important to focus on longer-term performance and stick with companies that the managers believe in.

Best of the rest

No. 2 in the latest survey, with a return of 59.1%, is the $290 million Value Line Larger Companies Focused Fund (VALLX), which holds all of the Magnificent Seven. They were initially put into the fund before 2023—though it did add to Amazon, Google parent Alphabet, Microsoft and Tesla in the first nine months of last year.

It trimmed its positions in Apple and Meta over that stretch.

The fund’s manager, Cindy Starke, says that 2023 was all about “adding to names that we had more conviction in,” rather than trying to unearth new stocks.

Starke looks for companies she thinks can increase sales at a three-year annualised compound rate of 10% or more and annualised earnings growth of at least 15% for three to five years.

She points out that the fund had broad stock appreciation last year: 25 of the holdings gained at least 50% over the year’s first three quarters. (That fund and others release quarterly holdings with a lag after the quarter ends, but performance is updated daily.)

Besides the Magnificent Seven, the fund’s winners included Uber Technologies, which appreciated 149% in 2023. It was put in the portfolio in the fourth quarter of 2021 and was the fund’s largest holding, at 6.5%, as of Sept. 30. Starke increased her holding in 2023.

When she added Uber to the fund in 2021, she recalls, “I just thought it was very undervalued” and that “the growth model would mature.”

Other top holdings include Nvidia, initially put into the fund in 2018; Microsoft (2020); Alphabet (2011) and Tesla (2021).

Two other big gainers for that fund: Advanced Micro Devices, which leapt 127% last year, and cybersecurity firm CrowdStrike Holdings, which rose 143%.

At the same time, Starke did plenty of selling. She trimmed the fund to 39 names from 47 over the first three quarters of 2023, jettisoning stocks such as Goldman Sachs, Walt Disney, Bank of America, Estée Lauder and Devon Energy. “I just got out of the names that didn’t offer me the same kind of growth opportunity,” she says.

Rounding out the top four funds are the $500 million Baron Fifth Avenue Growth Fund (BFTHX), which returned 57.2%, and the $11 billion Fidelity Blue Chip Growth K6 Fund (FBCGX), up 55.6%.

An outlier

A party crasher at No. 5 is the Morgan Stanley Inception Portfolio (MSSGX)—the lone fund in the top 10 outside of the large-cap growth category.

It toils in small-cap issues, which lagged behind large-caps last year. The Russell 2000 index of small stocks returned 16.9% in 2023, trailing the S&P 500 by nearly 10 percentage points.

But the Inception portfolio punched well above its weight, notching a return of 54.4%.

The fund’s managers aren’t afraid to make outsize bets. As of Sept. 30, its information-technology weighting was 38%, compared with 21.4% for the Russell 2000 Growth Index—the fund’s benchmark.

One of its best holdings as of Sept. 30 was Affirm Holdings, which runs a buy now, pay later platform. The stock gained more than 400 % last year.

But that small-cap fund is an outlier in the Winners’ Circle. It is the only one outside of the large-cap growth category among the top 24 finishers in the survey.

At No. 6 is the $25 billion Harbor Capital Appreciation Fund (HACAX), returning 53.7%. As of Sept. 30, the Magnificent Seven accounted for six of its top 10 holdings.

The fund’s managers did make some hay in healthcare, an unloved S&P 500 sector that otherwise eked out a 2.1% return last year, including dividends.

One such healthcare winner it held is Eli Lilly. The pharmaceutical company’s stock returned 61%, helped by its strong position in a nascent class of drugs for weight loss.

“We’re trying to find companies that can generate above-average growth rates sustainably over an investment cycle,” says Blair Boyer, a co-manager of the fund.

Another healthcare company that fit the bill for the fund is Novo Nordisk. Its portfolio includes the Wegovy weight-loss drug. The stock was up more than 50% last year.

The fund unloaded its positions in Thermo Fisher Scientific, which sells testing equipment and measurement tools to laboratories, and life-sciences company Danaher. Thermo Fisher Scientific’s stock fell 4%, and Danaher dropped by 2%.

One of the fund’s biggest sector bets last year was consumer discretionary, representing 25% of the fund at the end of the third quarter, compared with a 16% representation in the Russell 1000 Growth Index.

Shares of vacation-rental company Airbnb, another of the fund’s holdings, surged by 59%.

Ultimately, while large-caps mutual funds enjoyed the Magnificent Seven-led rebound last year, it’s impossible to say how they will fare in 2024 given uncertainty about the economy and the path of the Fed’s monetary policy.

But despite fickle market sentiment, managers of top-performing funds say the key to their success is patience and staying true to their strategy even when things look bleak, as in 2022.

“It was about staying the course, having the conviction and adhering to our investment philosophy in good times and bad,” says Starke of the Value Line fund.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.