The Biggest Winners in America’s Climate Law: Foreign Companies

U.S. seeks to build domestic supply chains but needs overseas expertise

The 2022 climate law unleashed a torrent of government subsidies to help the U.S. build clean-energy industries. The biggest beneficiaries so far are foreign companies.

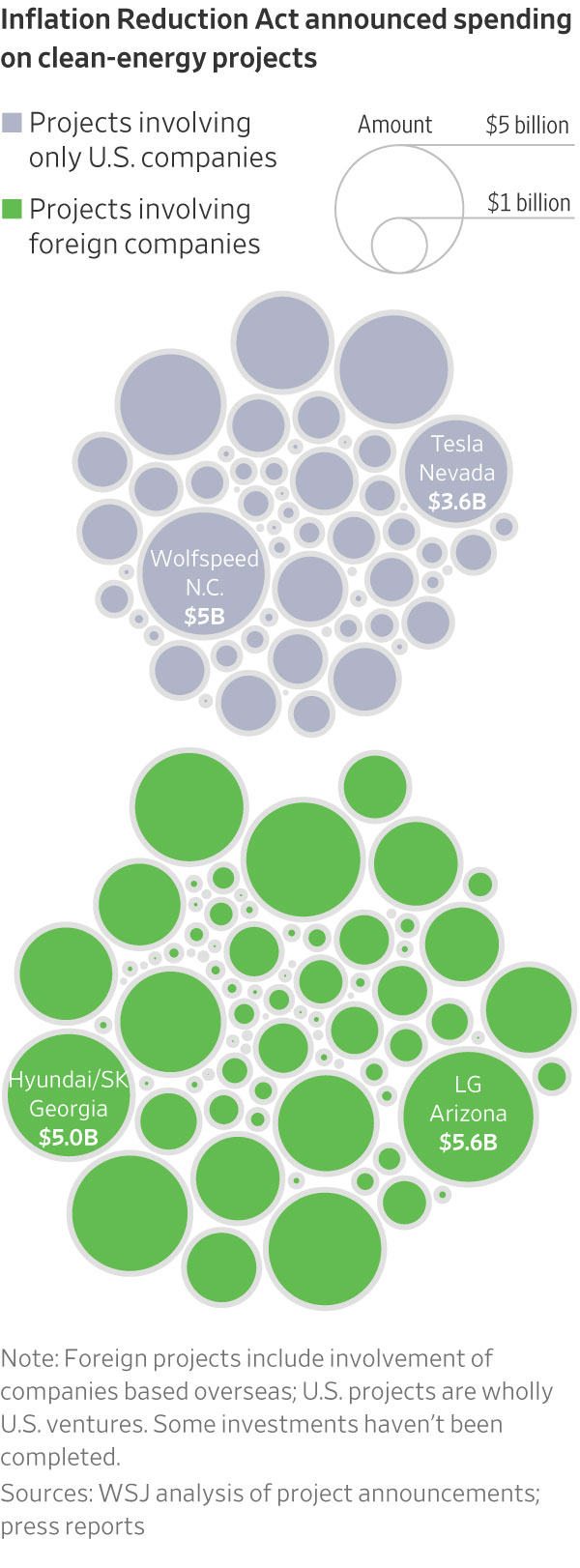

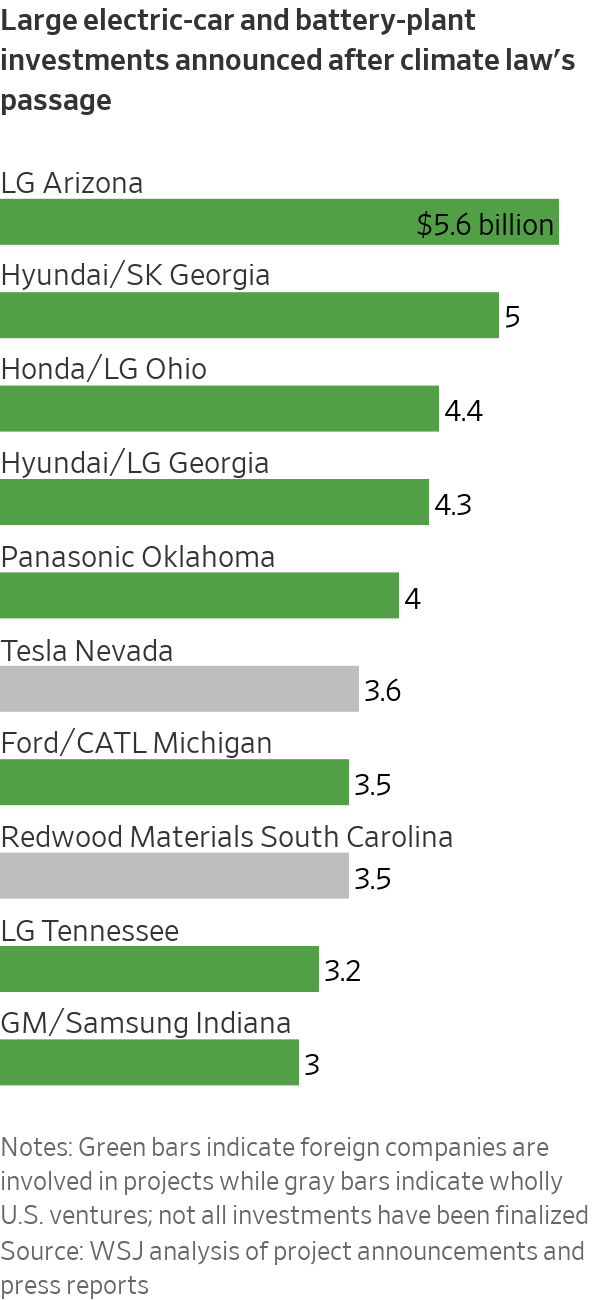

The Inflation Reduction Act has spurred nearly $110 billion in U.S. clean-energy projects since it passed almost a year ago, a Wall Street Journal analysis shows. Companies based overseas, largely from South Korea, Japan and China, are involved in projects accounting for more than 60% of that spending. Fifteen of the 20 largest such investments, nearly all in battery factories, involve foreign businesses, the Journal’s analysis shows.

These overseas manufacturers will be able to claim billions of dollars in tax credits, making them among the biggest winners from the climate law. The credits are often tied to production volume, rewarding the largest investors.

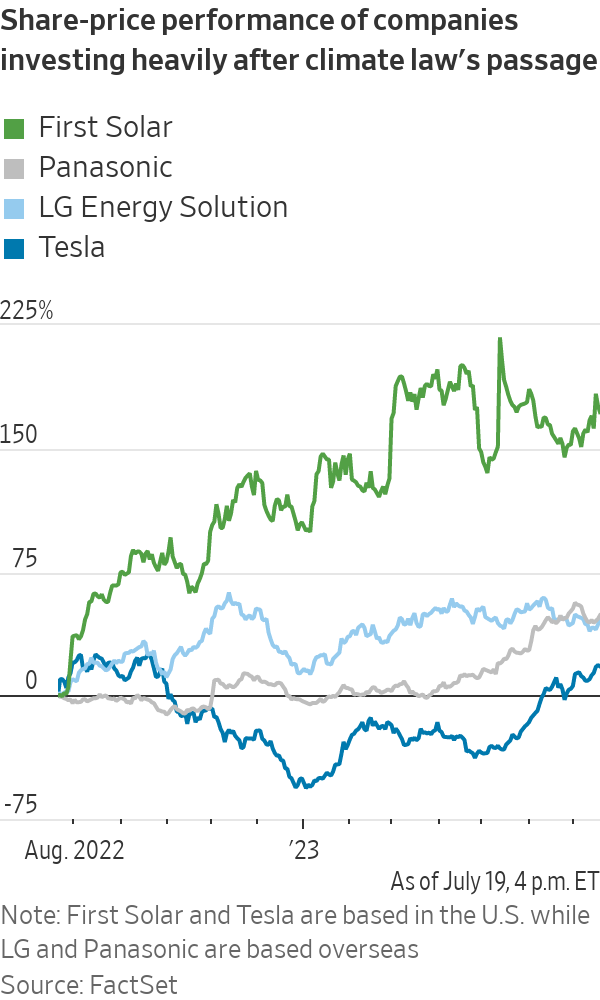

Japan’s Panasonic, one of the few companies to publicly estimate the impact of the law, could earn more than $2 billion in tax credits a year based on the capacity of battery plants it is operating or building in Nevada and Kansas. The company, which supplies batteries to electric-vehicle maker Tesla, is considering a third factory in the U.S. that would lift that total.

The climate law is designed to build up domestic supply chains for green-energy industries, but the reality is that the technology for building batteries and renewable-energy equipment resides overseas. The incentives are leading these companies to invest in the U.S., often alongside domestic businesses.

“It’s a testament to the fact that we still live in a globalised economy,” said Aniket Shah, head of environmental, social and corporate governance—or ESG—strategy at investment bank Jefferies. “You can’t just out of nowhere put up borders and say, ‘It has to be made in America by American companies.’ ”

The Journal looked at roughly 210 clean-energy projects and company initiatives spurred by the law, including projects tracked by industry groups American Clean Power and E2 (Environmental Entrepreneurs); announcements from companies and state and local governments; and media reports. Of those, about 140 disclosed investment amounts totalling roughly $110 billion.

Projects were characterised as either wholly U.S. ventures or foreign if overseas companies are contributing significant investment or technology. Renewable-power facilities and projects already in the works before the law passed were excluded.

Forecasters estimate the climate law could unleash some $3 trillion in total clean-energy investments over the next decade. U.S. companies are also investing heavily, including Tesla, solar-panel maker First Solar and hydrogen producer Air Products and Chemicals.

Full domestic supply chains for batteries or solar panels are still years away because foreign companies dominate nearly every step in the process, from raw materials to sophisticated parts.

The large investments by overseas businesses have generally been welcomed by U.S. communities, many of which have benefited for decades from spending and jobs created by foreign automakers and other companies. But some investments from Chinese companies have fuelled a backlash as tensions between the two countries escalate.

At least 10 of the projects representing nearly $8 billion in investments included in the Journal’s analysis involve companies either based in China or with substantial ties to China through their core operations or large investors.

Some projects are facing resistance, including two in Michigan: a $3.5 billion battery factory that Ford Motor is building with technology and expertise from China’s CATL; and a $2.4 billion battery-component factory from China-based Gotion. Ford is keeping 100% ownership of the battery factory—in part to sidestep the issue of public funds flowing to CATL, according to a person with knowledge of the deal. Ford is licensing the battery-making know-how and services from CATL, the companies said.

But China hawks say the payments Ford makes to CATL mean the Chinese company reaps indirect benefits from government support.

“What we’re seeing is foreign policy conflict with climate policy and trade policy,” Shah said. “We’re going to have to decide as a country what matters more: our enmity with China or our desire to decarbonise quickly.”

Microvast, a startup that was planning to build a more than $500 million battery-component plant in Kentucky, was named as a potential recipient of a $200 million grant from the Energy Department last year. The department later rejected the application. The move followed criticism from Republicans about the company’s ties to China, which include a China subsidiary that accounts for more than 60% of its revenue.

The Energy Department didn’t give a reason for withdrawing the grant. The department takes a number of factors into account when evaluating such projects, including technology risks and the potential for foreign influence, a spokeswoman said.

Microvast, based in Stafford, Texas, says it is a U.S. company and that Chief Executive Yang Wu is an American citizen. The company recently scrapped plans for the Kentucky plant.

“We must be assured that these taxpayer dollars are not being funnelled to the Chinese,” said Cathy McMorris Rodgers (R., Wash.), chair of the House of Representatives committee on energy and commerce, during a June hearing.

Microvast is committed to its goals of investing in the U.S. through other facilities, a spokeswoman said.

The issue is expected to come to a head when the Treasury Department completes rules for electric-car tax credits. The department has proposed that cars using battery materials that were produced by a “foreign entity of concern” such as a Chinese company wouldn’t qualify for tax credits beginning in 2025.

Many expect Treasury to use a loose standard so that some cars qualify, potentially fuelling criticism from some politicians who crafted the climate law such as Sen. Joe Manchin (D., W.Va.), who has argued more lenient criteria go against the intent of the Inflation Reduction Act. Treasury is monitoring shifting markets and supply chains while making rules that advance the law’s goals, a spokeswoman said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.