The Highest Paid CEOs of 2023

Stock awards push median package to a record $15.7 million; tech executives top the list

The chiefs of America’s biggest companies reached new pay heights in 2023 as stock awards swelled the value of compensation packages.

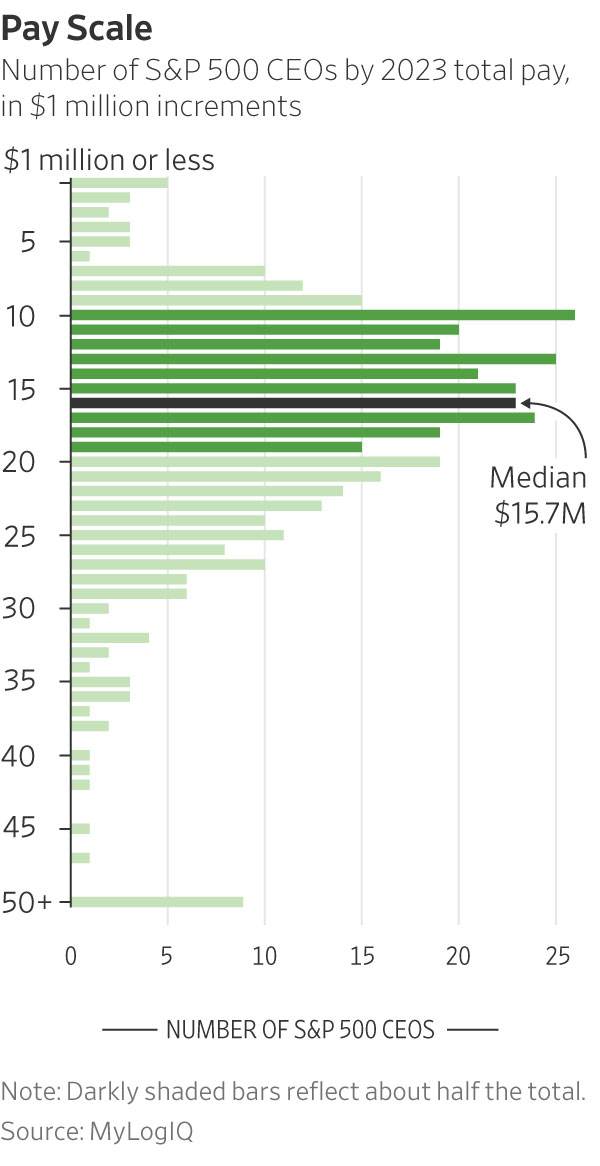

Half of the executives in a Wall Street Journal analysis made at least $15.7 million, a record for median CEO pay in the annual survey, with several making more than $50 million . Median pay for the same companies a year earlier was about $14.5 million.

Most of the executives received year-over-year raises of at least 9%—one in four got 25% or more—and most companies recorded annual shareholder returns of at least 13%, the Journal found in an analysis of data on more than 400 companies from MyLogIQ , a provider of public-company data and analysis. (See the full ranking below.)

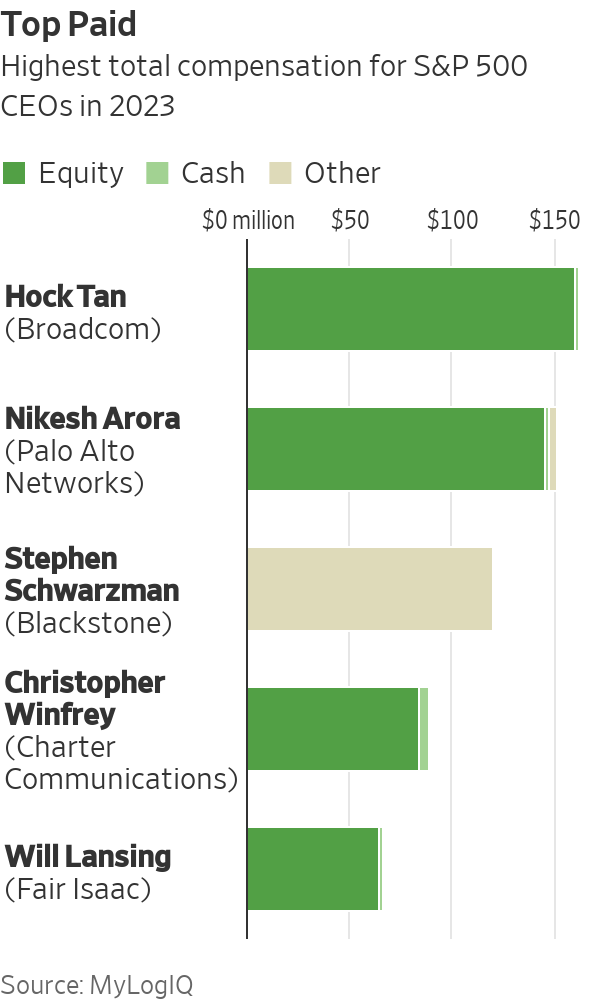

Eight tech executives ranked among the 25 top earners, as did five each heading financial companies and media or entertainment companies.

Hock Tan , the highest-paid CEO in the Journal’s analysis at $162 million, has to stay on the job for five years and Broadcom ’s share price must reach certain targets after October 2025 to get the full value of most of his pay. Broadcom said the company has outperformed competitors under Tan, its CEO since 2006, and he won’t get more equity or cash bonuses for five years.

Pay for Nikesh Arora at Palo Alto Networks totalled $151 million, mostly in equity awards that included shares granted over three years.

Blackstone , where Steven Schwarzman made $120 million, said the company’s 83% total return surpassed U.S. asset managers last year and described its pay structure as aligning executive incentives with those of investors.

Christopher Winfrey of Charter Communications , the cable operator, received total pay valued at $89.1 million, largely in options and stock vesting over five years, and much of it only if the company’s shares rise 28% to 152% from when the grants were made.

A $30 million one-time retention and leadership award that vests over five years helped boost total pay for Fair Isaac ’s Will Lansing to $66 million. The company said its shareholder returns ranked among the top 1% of companies in the S&P 500 over the past decade.

Stock gains

Equity awards continued to make up the bulk of most executives’ pay, much of it structured to deliver more stock or options if the company meets financial or share-price performance over several years. That means the pay can lose considerable value if the company’s share price falls or operating targets are missed—or soar in value amid market and operating success.

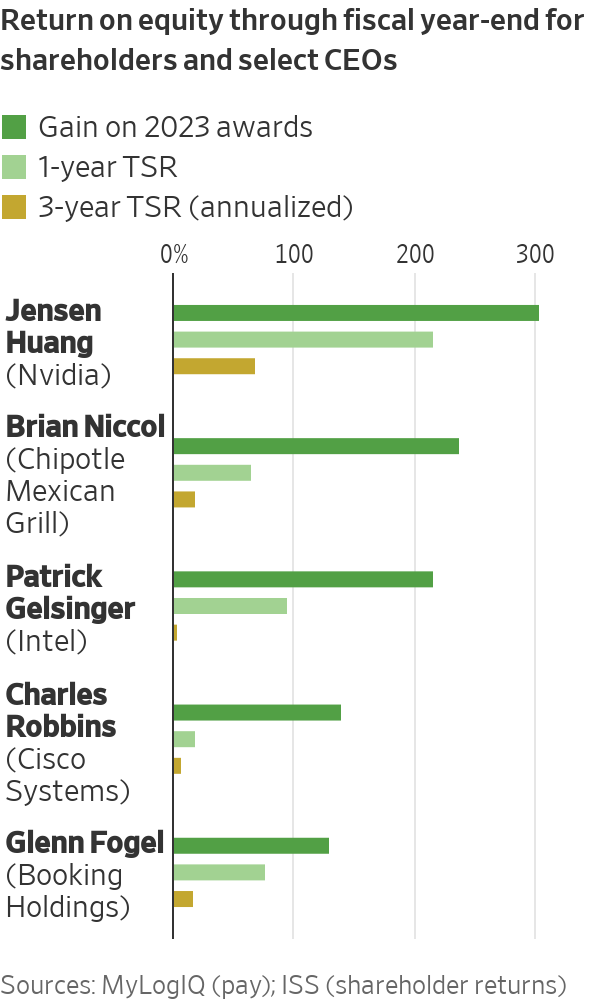

Restricted stock awarded in early March last year to Jensen Huang , CEO of graphics-chip maker Nvidia , quadrupled in value through late January, to $107.5 million. Huang’s pay, originally reported at $34.2 million , included $26.7 million of restricted stock as valued at grant.

Under the terms of the award, Huang could receive 50% to 100% more shares than originally targeted if the company meets performance criteria, according to Nvidia’s proxy.

Nvidia’s share price tripled during the year.

Brian Niccol , CEO of restaurateur Chipotle Mexican Grill , received stock and options valued at $15.5 million when they were granted in February 2023 as part of a $22.5 million pay package. By the end of the year, that equity had more than tripled in value, to $52.2 million, the company said. Chipotle shares returned about 65% during 2023, and 18% a year over three years.

A Chipotle spokeswoman said the growth in Niccol’s equity-award value reflects the company’s strong share-price performance during the year. The company said the value Niccol ultimately realises depends on continued financial, operating and stock-market performance by the company.

Intel CEO Patrick Gelsinger ’s equity awards last year also more than tripled in value by year-end, to $39.3 million. The company said in its securities filings that austerity measures last year reduced Gelsinger’s salary by about 15% to $1.1 million, which in turn reduced his cash bonus target by about 15%, to $2.9 million.

Overall, median cash pay for CEOs, including salary and annual bonuses, remained flat at about $3.8 million.

Top performers

Pay for CEOs running the best- and worst-performing companies didn’t vary dramatically. Median total pay was $14.6 million for the 20% of CEOs whose companies recorded the worst returns compared with other companies in the same sector, and $15.7 million for CEOs at the best-performing companies.

Chip and computer hardware makers accounted for six of the 25 best-performing companies—including Nvidia, the top performer—while four were in the travel or transportation industries. Several of the top performers bounced back from one or more years of poor returns, often tied to the pandemic.

Royal Caribbean Group reported paying Jason Liberty $17.2 million and recorded a total return of 162% last year, after posting minus 36% in 2022 and minus 43% in 2020, when the cruise industry was battered by illness and travel bans. (The company posted a 3% return in 2021.) Ride-sharing giant Uber Technologies recorded a 149% return after posting returns of minus 41% in 2022 and minus 18% in 2021.

Chip maker Advanced Micro Devices , ranked seventh by one-year performance, was headed by Lisa Su , the second-highest-paid woman in the analysis, at just over $30 million, including nearly $28 million in restricted stock and options. The highest-paid woman, at $31.55 million, was Julie Sweet of consultant Accenture , which posted a one-year total return of about 14%.

Thirty-one women ran S&P 500 companies for the full year of 2023, up from around two dozen at the beginning of the decade. None ranked among the top 25 by pay. One other woman ran one of the 25 best performers: Jayshree Ullal at networking company Arista Networks , which posted a 94% return. Ullal’s pay totalled $15.56 million.

Bottom of the pack

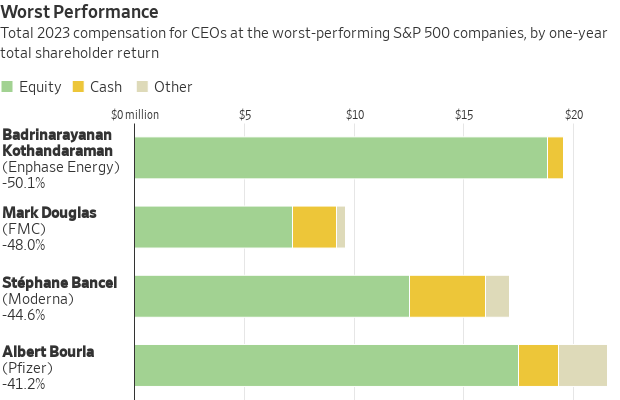

Among the 25 worst-performing companies in the Journal analysis, nearly a third operated in the healthcare sector, including six pharmaceutical or biotech companies. They were joined by four utilities.

Pfizer said it didn’t pay bonuses to top executives last year after weak demand for Covid-related products led the company to miss financial targets. The $17.5 million equity award that made up most of CEO Albert Bourla ’s total pay last year is meant to recognise his leadership and give him an incentive to focus on long-term strategy, the company said.

Poor performance can slash the value of CEO equity awards. Covid-vaccine maker Moderna reported total pay of $17.1 million for CEO Stéphane Bancel last year, including $12.5 million in stock and option awards.

The value of those awards fell 42% to $7.3 million at year-end, the company’s proxy shows, as Moderna’s stock price tumbled about the same amount for the year. In addition, equity awards made to Bancel in prior years fell in value by about $167 million during 2023.

Those losses offset a net $945 million in new equity awards and increases in value reported for Bancel during the prior three years.

Moderna declined to comment.

Methodology

The Wall Street Journal used data from corporate proxy statements filed through May 16 by companies in the S&P 500 index with fiscal years ended after June 30, 2023. The data was collected by MyLogIQ, a provider of public-company data and analysis.

Aggregate pay and shareholder-return figures exclude companies that changed CEOs or fiscal-year-end dates during the year.

Pay reflects the value of equity awards at grant, as reported by companies. Total returns reflect stock-price change and dividends, in most cases calculated from the month end closest to the company’s fiscal-year end.

Sources: MyLogIQ (compensation); Institutional Shareholder Services, FactSet (shareholder return); Standard & Poor’s (industry groups); company filings (pay for select companies)

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.