The Latest Dirty Word in Corporate America: ESG

Executives switch to alternatives like ‘responsible business’ to describe corporate initiatives

Many companies no longer utter these three letters: E-S-G.

Following years of simmering investor backlash, political pressure and legal threats over environmental, social and governance efforts, a number of business leaders are now making a conscious effort to avoid the once widely used acronym for such initiatives.

On earnings calls, many chief executives now employ new approaches. Some companies, including Coca-Cola, are rebranding corporate reports and committees, stripping ESG from titles. Advisers are coaching executives on alternative ways to describe their efforts, proposing new terms like “responsible business.” On Wall Street, meanwhile, some firms are closing once-popular ESG funds as interest fades.

The shift in messaging reflects a reality: “ESG is complicated,” said Daryl Brewster, a former Kraft Foods and Nabisco executive who now heads Chief Executives for Corporate Purpose, a nonprofit of more than 200 companies focused on social impact.

The movement to bake accountability into business decisions stretches back centuries; the term ESG gained momentum after the United Nations used it about 20 years ago. Over time, the effort became divisive—derided by some state officials as “woke capitalism,” and criticised by others for putting too much focus on measurement and disclosure requirements.

Many CEOs stress that they continue to follow sustainability commitments made years ago—even if they are no longer talking about them as often publicly. A December survey by the advisory firm Teneo found that about 8% of CEOs are ramping down their ESG programs; the rest are staying the course but often making changes to how they handle them.

Many leaders are more closely examining disclosures, wanting to avoid regulatory scrutiny or political criticism. In lieu of lofty pronouncements, advisers are telling CEOs to be more precise and to set goals that can be achieved. Saying as little as possible is recommended.

“We’ve seen a great deal of reframing and adjusting by CEOs in the ESG arena. Not only of what they say, but also where they say it and how they characterise it,” said Brad Karp, chair of law firm Paul Weiss who advises a number of CEOs. “Most companies are moving forward operationally with their ESG programs, but not publicly touting them, or describing them in different ways.”

When Thomas Buberl, CEO of Paris-based insurer AXA, met in the U.S. last year with the leaders of an asset manager, a fertiliser maker and a tech company, executives suggested that he reflect the newfound caution. “I used the abbreviation ESG, and people taught me not to use that word,” Buberl said. “I said, ‘What do you want me to call it?’”

Few people had a ready answer. Buberl said the importance of environmental efforts and other goals shouldn’t be underplayed. “We need to move from intentions to actions,” he said.

ESG became even more politicised following a spat in 2022 between Disney and Florida Gov. Ron DeSantis. That opened the door to sharp commentary on ESG efforts broadly by more than a dozen other state officials and a pullback by some asset managers. Investors yanked more than $14 billion from ESG funds in the first nine months of 2023, according to Morningstar.

BlackRock’s Larry Fink wrote a letter to investors in 2023 that didn’t explicitly reference ESG, after some states pulled money in 2022 over the firm’s ESG emphasis. State Street in November announced a new voting policy for investors who may not want to emphasise ESG as heavily. Fidelity last year removed language considering potential ESG impacts from its proxy-review process.

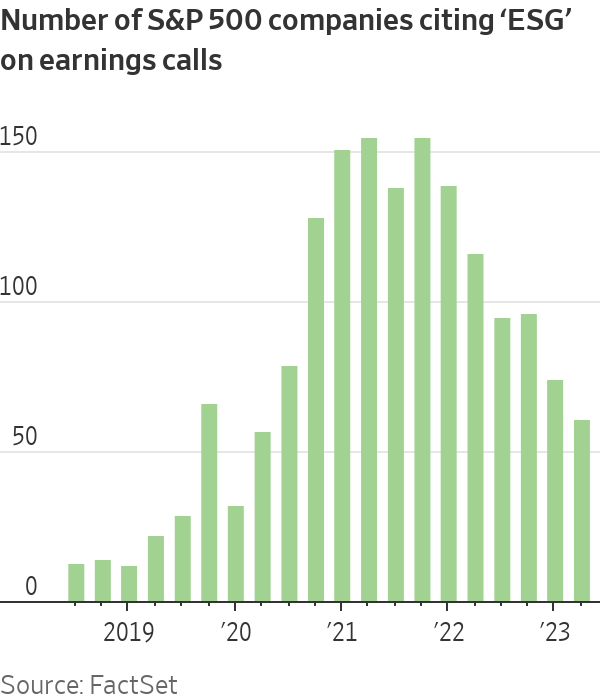

On earnings calls, mentions of ESG rose steadily until 2021 and have declined since, according to a FactSet analysis. In the fourth quarter of 2021, 155 companies in the S&P 500 mentioned ESG initiatives; by the second quarter of 2023, that had fallen to 61 mentions.

Adding to the challenges for companies is that some dimensions of ESG, particularly the social goals, can be difficult to quantify. Corporate diversity programs, often part of an ESG agenda, face new scrutiny following a Supreme Court decision on affirmative action and legal challenges from largely conservative groups.

Executives and their advisers say companies remain more committed to the “E” in ESG, wanting to respond to climate change. Some CEOs say that environmental factors are crucial to their business, one reason many went to Dubai for COP28, the U.N.’s climate conference. Climate change is also likely to be a key theme at the World Economic Forum in Davos, Switzerland, next week.

Revathi Advaithi, CEO of Flex, said the manufacturer has 130 factories across the world and there isn’t a question of whether they need to operate in a sustainable way.

“It’s not as though I got a whole bunch of new investors because we had a sustainability report or we were ESG-focused,” she said. “We didn’t do it for that purpose…. We wanted to focus on water reduction, power reduction, all those things. So I don’t view it as, hey, it’s a trend that came today and it’s gonna go off tomorrow.”

Some of the changes leaders are making are subtle. At Coca-Cola, the company published a “Business & ESG” report in 2022; in 2023, it was released as the “Business and Sustainability” report. The beverage giant also renamed committees on its board of directors.

The fiercest critics of ESG say they welcome less discussion of it. “If this trend is decreasing, these CEOs must have realised that this puts them at greater legal risk and costs them customers,” said Texas Attorney General Ken Paxton, who has pushed back against ESG policies, in a statement.

What to call such efforts now remains a debate. Brewster’s nonprofit CEO group advises leaders to discuss initiatives in clear language, explaining efforts to cut water use, for example, or to use terms such as “our people” or “our natural resources.” Brewster said he wants more leaders to adopt the phrase “responsible business.”

“You can be anti-ESG,” Brewster said. “It’s hard to be anti-responsibility.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.