‘Thrifting’ Extends to Holiday Shopping Too

Roughly 17% of gifts this holiday season will be a resold item, according to Salesforce data

A new kind of present is gaining acceptance this holiday season. More consumers are picking secondhand items to gift each other, finding it to be an environmentally and budget-friendly option.

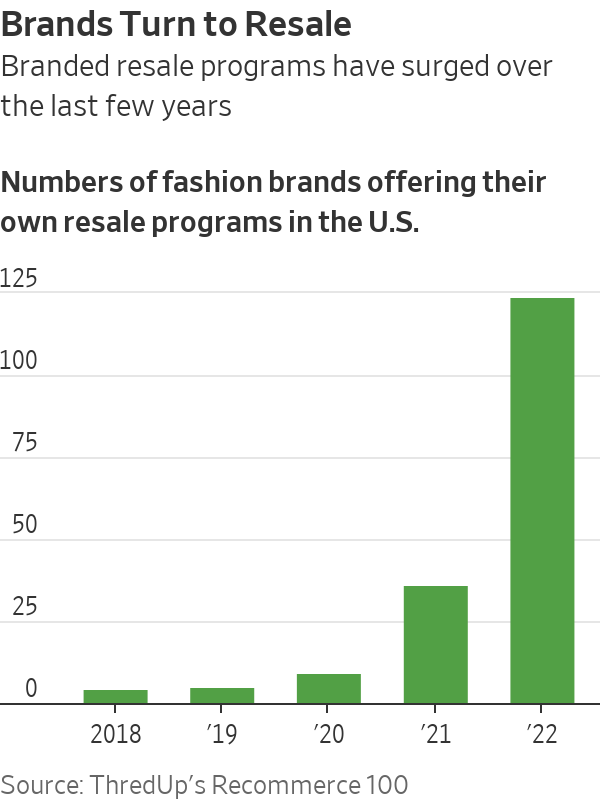

Thrift stores that sell used clothes and goods are springing up online and on street corners. Goodwill Industries International, the nonprofit behind the familiar chain of thrift stores, is ramping up its online efforts. Fashion brands are developing their own resale offering to keep up with clothing-reseller sites such as Depop and Poshmark. Roughly 17% of gifts this holiday season will be a resold item, according to software firm Salesforce.

“Consumers are choosing resale first because of the incredible value, the unique merchandise, and the incredible sustainability benefit,” said Matt Kaness, chief executive of GoodwillFinds, the nonprofit’s online e-commerce platform run in partnership with Salesforce.

Secondhand clothes, once seen as frumpy and embarrassing, are now keenly sought out by the fashion conscious. A popular vintage aesthetic dovetails with consumer calls for goods that do less harm to the world. About 85% of American shoppers have bought or sold preowned items over the past year, nearly a third for the first time, according to online marketplace OfferUp’s Recommerce report. In apparel alone, some 10% of the global market will be secondhand by next year.

GoodwillFinds is the only major nonprofit player in resale.

GoodwillFinds’ online platform allows a smarter operation than the traditional bricks-and-mortar store, said Kaness, formerly an executive with retailers including Walmart and Urban Outfitters. The platform uses artificial intelligence and large data sets to more accurately price and categorise items, creating a much more efficient system, Kaness said.

“In a store, it’s a human looking at the item. They have paper sticker tickets for the price and they have to process such a volume that it is somewhat random,” he said. In contrast, the company’s online system uses computer vision to take a picture, identify the item, create a listing and price it.

Moving online is the logical choice for secondhand sellers, said 25-year-old Brooke Bowlin, who runs lifestyle blog Nuance Required. “Secondhand stores just can’t sell enough,” said Bowlin, who started her own thrift store in Siloam Springs, Ark. “By moving online and expanding the audience, there is an opportunity to re-home more clothes,” she said.

Major fashion brands are also increasingly recognising that secondhand is as much a necessity as it is an opportunity. The fashion industry is responsible for up to 8% of global emissions, relying on resource-intensive raw materials and fast-moving trends that have contributed large amounts of waste. Around 11.3 million tons of textile waste go to landfills in the U.S. every year, according to environmental organisation Earth.Org.

Outdoor-clothing retailer Patagonia established its Worn Wear platform in 2017, one of the first resale channels by a major brand.

As much as adapting to trends, Patagonia Worn Wear aims to change consumer behaviour, said Asha Agrawal, managing director of the Patagonia venture fund that runs the platform.

“A lot of our messaging is around—‘you don’t need to buy something new,’” she said.

Worn Wear buys back used brand gear from consumers by paying higher prices than peer-to-peer apps or other marketplaces, Agrawal said. This strategy contributes to the bulk of the platform’s costs but also boosted its inventory fourfold this year alone, she said, adding Worn Wear has been profitable for the last two years.

Worn Wear is now integrated into the Patagonia brand. “You can now do your main shopping with Patagonia with our resale business in the U.S.,” she said. “That’s a huge evolution for us.”

Resale by brands and third parties is expected to outpace traditional thrift sales and donations in the U.S., rising to 60% of a $70 billion total by 2027 from 15% of the $20 billion secondhand market in 2017, according to online thrift store ThredUp’s recent resale report.

Other fashion players have their versions. Sweden’s Hennes & Mauritz launched H&M Pre-Loved in the U.S. this year, in partnership with ThredUp. Inditex-owned Zara has launched a preowned platform that offers repair services, customer-to-customer sales and donations of used garments in the U.K. and France, with plans for a U.S. rollout by 2025.

Resale remains an imperative for fashion brands as a way to control distribution and retain the trust of shoppers increasingly alert to the fate of their old clothes. However, scaling up resale generates a raft of operational challenges such as authentication, returns and ensuring that secondhand doesn’t look like an afterthought, said Anita Balchandani, fashion lead at consultant firm McKinsey & Co.

Unlike nonprofits, such as Goodwill, that get their inventory from donations and don’t have to be accountable to shareholders, retailers are struggling to make business sense of resales, Balchandani said.

“No one has proven the path to scaling this up profitably,” she said. “You almost have to create a whole new end-to-end supply chain…. The retailer who cracks that journey is going to make a real difference in this space.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

More than one fifth of Australians are cutting back on the number of people they socialise with

Australian social circles are shrinking as more people look for ways to keep a lid on spending, a new survey has found.

New research from Finder found more than one fifth of respondents had dropped a friend or reduced their social circle because they were unable to afford the same levels of social activity. The survey questioned 1,041 people about how increasing concerns about affordability were affecting their social lives. The results showed 6 percent had cut ties with a friend, 16 percent were going out with fewer people and 26 percent were going to fewer events.

Expensive events such as hens’ parties and weddings were among the activities people were looking to avoid, indicating younger people were those most feeling the brunt of cost of living pressures. According to Canstar, the average cost of a wedding in NSW was between $37,108 to $41,245 and marginally lower in Victoria at $36, 358 to $37,430.

But not all age groups are curbing their social circle. While the survey found that 10 percent of Gen Z respondents had cut off a friend, only 2 percent of Baby Boomers had done similar.

Money expert at Finder, Rebecca Pike, said many had no choice but to prioritise necessities like bills over discretionary activities.

“Unfortunately, for some, social activities have become a luxury they can no longer afford,” she said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.