With Negative Rates, Homeowners In Europe Are Paid To Borrow

Covid-19 is widening the pool of mortgage holders who receive interest.

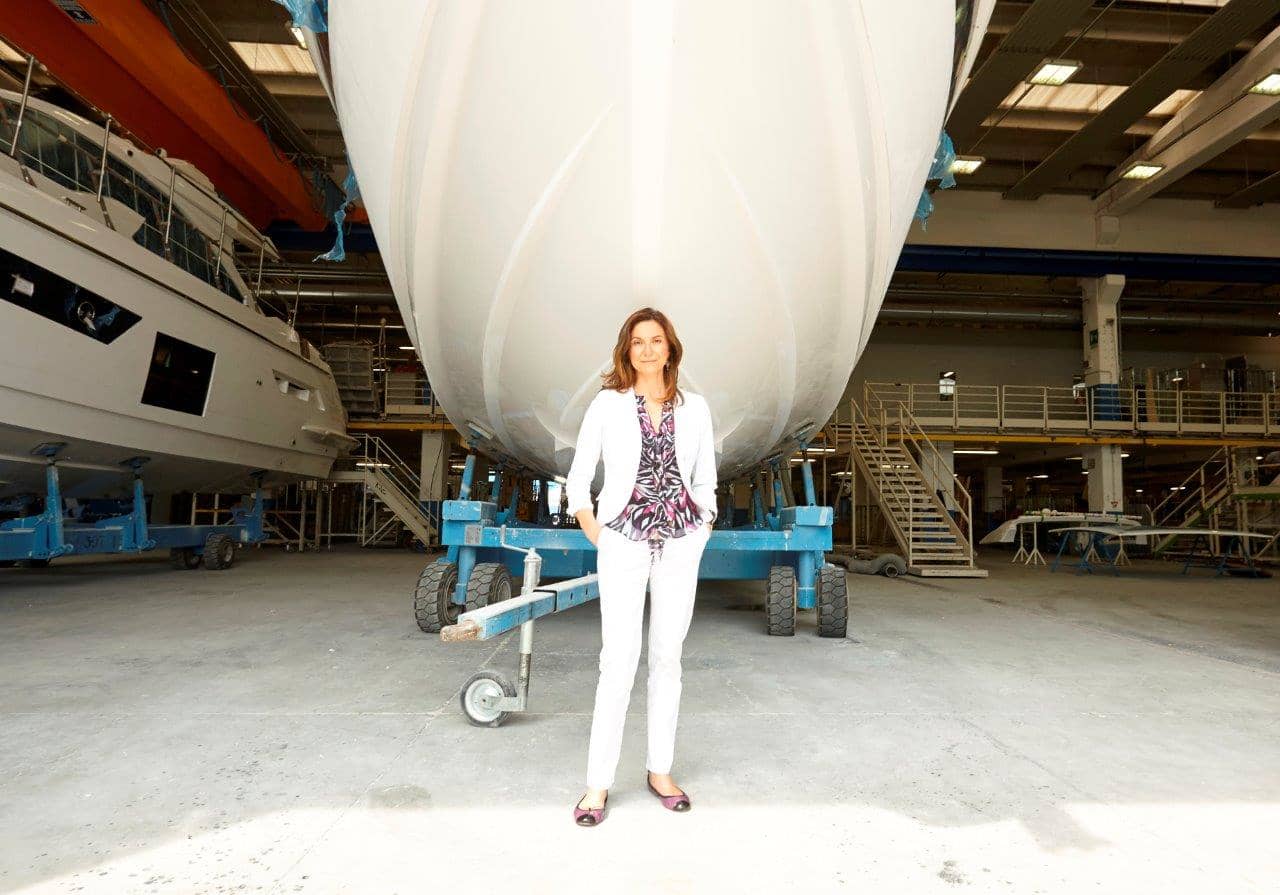

ISBON—Paula Cristina Santos has a dream mortgage: The bank pays her.

Her interest rate fluctuates, but right now it is around minus 0.25%. So every month, Ms. Santos’s lender, Banco BPI SA, deposits in her account interest on the 320,000-euro mortgage, equivalent to roughly $380,000, she took out in 2008. In March, she received around $45. She is still paying principal on the loan.

Ms. Santos’s upside-down relationship with her lender started years ago when the European Central Bank cut interest rates to below zero to reignite the continent’s frail economy in the midst of a sovereign-debt crisis. The negative rates helped everyone get cheap financing, from governments to small companies. It gave an incentive to households to borrow and spend. And it broke the basic rule of credit, allowing banks to owe money to borrowers.

Ms. Santos’s case was supposed to be rare and mostly over by now. After the ECB cut interest rates to below zero in 2014, economies in the eurozone improved and expectations were that rates would rise in a few years. But the coronavirus pandemic changed all that.

As economic pain in Europe drags on, the negative rates remain—and they are getting lower. As a result, more borrowers in Portugal as well as in Denmark, where interest rates turned negative in 2012, are finding themselves in the unusual position of receiving interest on their loans.

“When I took the mortgage, I never imagined this scenario, and neither did the bank,” said Ms. Santos, a 44-year-old business consultant.

Deco, a Lisbon-based consumer-rights group that in 2019 estimated that rates had turned negative on more than 30,000 mortgage contracts in Portugal, said the figure has likely more than doubled since then.

Many European borrowers have variable-rate mortgages tied to interest-rate benchmarks. Like most in Portugal, Ms. Santos’s is tied to Euribor, which is based on how much it costs European banks to borrow from each other. She pays a fixed 0.29% on top of the three-month Euribor rate. When she took out the mortgage in 2008, three-month Euribor was close to 5%. It has been falling in recent months and is now near a record low, at minus 0.54%.

Portugal’s state-owned Caixa Geral de Depósitos SA said about 12% of its mortgage contracts currently carry negative rates. The number of such contracts rose by 50% last year, according to a person familiar with the situation. Ms. Santos’s bank, BPI, said it has so far paid €1 million in interest on mortgage contracts to an undisclosed number of customers.

Spain, where most mortgages are also linked to Euribor, faced a similar situation. But the country passed a law that prevents rates from going below zero. Portugal did the opposite, passing a bill in 2018 that requires banks to reflect negative rates.

“In the event that the decline in interest rates exceeds the mortgage spread, the client would not pay interest, but in no case [would the bank] pay in favour of the borrower,” said a spokesman for Banco Bilbao Vizcaya Argentaria SA, one of Spain’s largest lenders.

There are no official figures available on how many mortgages are currently carrying a zero interest rate in Spain. Banks have declined to disclose their numbers.

In Denmark, more borrowers have seen their rates turn negative, although in most cases they are still paying their banks because of an administration fee charge.

There, mortgages aren’t directly financed by the banks, which don’t set their terms. Instead, they serve as a type of intermediary, selling bonds to investors at a specific rate, lending the same amount to the borrower for the same rate.

Nykredit, Denmark’s biggest mortgage lender, said more than 50% of its loans with an interest period of up to 10 years have a negative interest rate before the fee. That proportion is rising because mortgages tend to have their rates adjusted every few years.

That is the case for Claus Johansen, 41, who works in Nykredit’s mortgage department. In 2016, he took on a five-year adjustable-rate mortgage for 1.2 million Danish kroner, equivalent to roughly $190,000, to buy a house north of Copenhagen. His interest repayments for the first five years were set at 0.06%. In January of this year, the rate was revised to minus 0.26%, which is subtracted from a 0.6% administration fee he has to pay the bank.

“It’s odd, but negative rates have been around for so many years, we just got used to it,” Mr. Johansen said.

A flip side to borrowers receiving interest from their lenders is that banks in Denmark and elsewhere have started charging customers for their deposits, saying they can no longer absorb the negative rates their central bank charges them. Mr. Johansen said he keeps his account balance under the threshold at which his bank would start charging him.

In Lisbon, Ms. Santos said that while it is great to receive interest from her bank, her situation overall isn’t better off because BPI has sharply cut the interest it offered on her business deposit account in recent years, to close to zero, from around 3%. Her plans to buy a new house are on hold because BPI is now charging a much higher spread on new mortgages, to avoid falling into the negative-rates trap again.

“We wanted to move out of the city centre, but it is hard to leave such a good mortgage deal behind,” Ms. Santos said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.