World Bank Warns of Lost Decade for Global Economy

Lender sees demographics, war and pandemic aftereffects holding back growth

Over the past year, governments around the world have announced tax breaks, subsidies and new laws in a bid to accelerate investment, combat climate change and expand their workforces.

That might not be enough.

The World Bank is warning of a “lost decade” ahead for global growth, as the war in Ukraine, the Covid-19 pandemic and high inflation compound existing structural challenges.

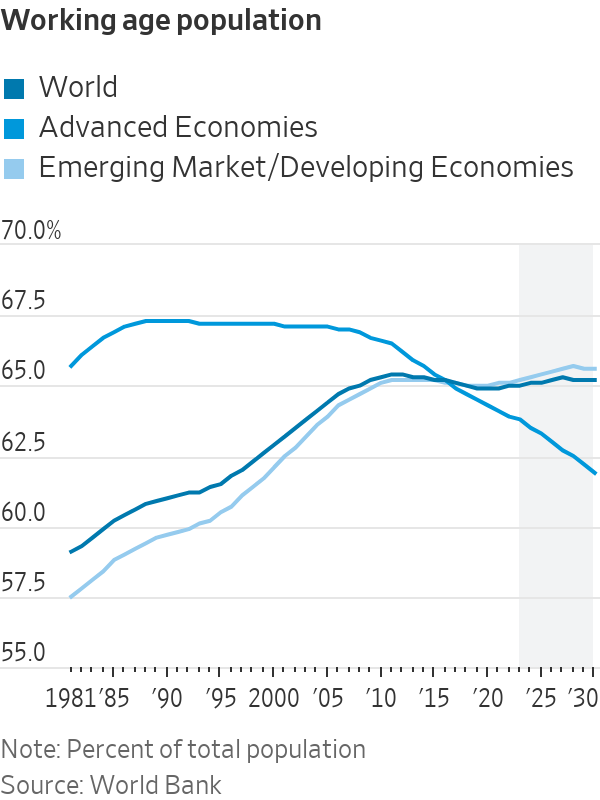

The Washington, D.C.-based international lender says that “it will take a herculean collective policy effort to restore growth in the next decade to the average of the previous one.” Three main factors are behind the reversal in economic progress: an ageing workforce, weakening investment and slowing productivity.

“Across the world, a structural growth slowdown is under way: At current trends, the global potential growth rate—the maximum rate at which an economy can grow without igniting inflation—is expected to fall to a three-decade low over the remainder of the 2020s,” the World Bank said.

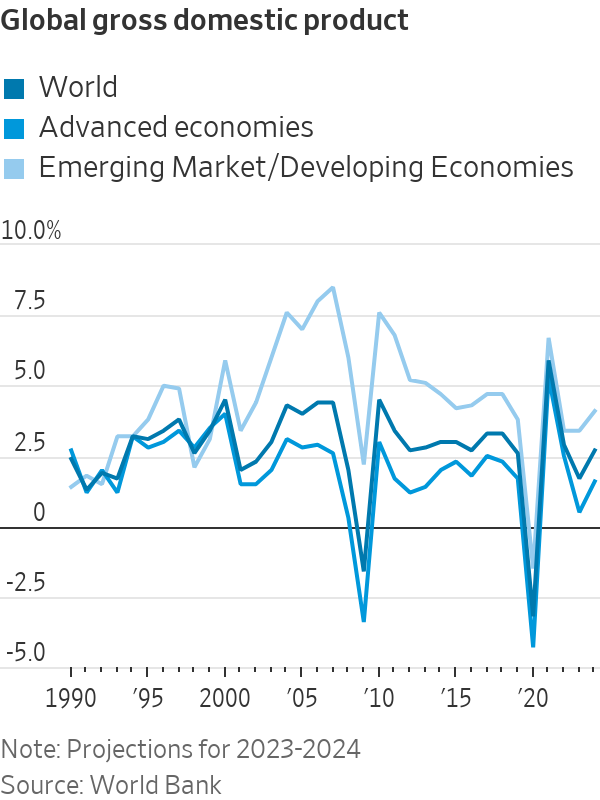

Potential growth was 3.5% in the decade from 2000 to 2010. It dropped to 2.6% a year on average from 2011 to 2021, and will shrink further to 2.2% a year from 2022 to 2030, the bank said. About half of the slowdown is attributable to demographic factors.

The latest alarm bells from the World Bank about the global economy come in the wake of the U.S.’s passing the Inflation Reduction Act, which includes hundreds of billions in incentives and funding for clean energy, as well as a law to ratchet up investments in semiconductors. In response, the European Union is relaxing its rules on government tax breaks and other benefits for clean-tech companies.

Meantime, major economies are trying to boost their workforce numbers, often in the face of steep resistance. In France, protesters responded violently to President Emmanuel Macron’s overhaul of the country’s pension system, while China’s shrinking population has prompted local governments there to offer cash rewards and longer maternity leaves to boost births.

These efforts so far might be too little, too late. Weakness in growth could be even more pronounced if financial crises erupt in major economies and trigger a global recession, the World Bank report cautions. The warning comes just weeks after the collapse of Silicon Valley Bank sparked turmoil in the U.S. and European banking sectors.

Questions surrounding global growth prospects will be in the air in Washington, D.C., alongside the blooming cherry blossoms at the spring meetings of the International Monetary Fund and World Bank from April 10 to 16.

Policy makers and central-bank officials will join economists from around the world to discuss topics including inflation, supply chains, global trade fragmentation, artificial intelligence and human capital.

Earlier this year, the World Bank sharply lowered its short-term growth forecast for the global economy, citing persistently high inflation that has elevated the risk for a worldwide recession. It expects global growth to slow to 1.7% in 2023. Other organisations, such as the International Monetary Fund and the Peterson Institute for International Economics, a Washington-based think tank, expect global GDP growth to expand a more robust 2.9% in 2023.

This isn’t the first time the World Bank has warned of a lost decade. In 2021, the lender said the Covid-19 pandemic raised the prospect owing to lower trade and investment caused by uncertainty over the pandemic. It issued similar warnings after the 2008 financial crisis. Global growth from 2009 to 2018 averaged 2.8% a year, compared with 3.5% in the prior decade.

The World Bank identifies a number of challenges conspiring to push down global growth: weak investment, slow productivity growth, restrictive trade measures such as tariffs and the continuing negative effects—such as learning losses from school closures—because of the pandemic.

It said pro-growth policies would help. Measures to boost labor-force participation among discouraged workers and women can help reverse the negative trend in labor force growth from an older population and lower birthrates, according to the World Bank.

Some view the World Bank’s projection for a lost decade as too pessimistic. Harvard University economist Karen Dynan said that ageing populations in nearly every part of the world will be a drag on global growth, but she was more optimistic on raising productivity—output per worker.

“I expect, outside the demographic effects, output per person to look a lot like it did before the pandemic,” she said.

“The World Bank is right to draw concern to the possibility of a lost decade in sub-Saharan Africa, in Central America, in South Asia—an awful lot of human beings are at risk or are facing very grim situations,” said Adam Posen, president of the Peterson Institute for International Economics.

“But from a global GDP outlook, or even a global population outlook, most of the major emerging markets along with most of the Group of 20 essentially are doing pretty well,” Mr. Posen said. He pointed to economic resilience in Europe and emerging markets in recent years, even as the Federal Reserve has sharply raised interest rates.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.