Stocks Soar, Dollar Jumps as Trump’s Win Reverberates Through Markets

The Dow surges to biggest gain in two years, with bond yields and bitcoin also posting sharp climbs

Donald Trump ’s election victory powered the Dow Jones Industrial Average to its biggest gain in two years, with a broad market rally lifting shares of banks, industrial companies and small-cap firms that are expected to benefit from continued economic expansion.

The gains were widely distributed as Wall Street bet that Trump’s promises of deregulation and tax cuts will further ignite an economy that already has posted strong gains in recent years. But sectors that were expected to benefit from Democratic policies, such as electric-vehicle companies and clean-energy related industries, declined sharply.

The promise of four years of Republican rule drove the latest rise in Treasury yields, reflecting expectations of stronger growth and inflation, while gold prices fell as fears that the election results would be contested and spark social unrest weren’t realised.

“The markets are now trading full-on Trump trade,” said Stephen Dainton , a senior executive at Barclays who oversees the lender’s investment bank including its large trading division.

Big winners included banks, which investors bet were poised to benefit from reduced regulation and a fresh acceleration in growth. Shares of JPMorgan Chase , the nation’s largest lender, climbed 11% to a new record. Wells Fargo and Goldman Sachs both rose more than 12%.

The prospect of lighter regulation and protective tariffs helped drive gains in industrials, with equipment maker Caterpillar rising more than 8% to a new all-time high and 3M adding 5%. Domestic steelmakers Nucor and Steel Dynamics gained 16% and 13%, respectively. Railroads, including Norfolk Southern and CSX , surged.

Bitcoin rose as much as 9% and flirted with $75,000, topping a previous record from March. Trump has said that he wants to make the U.S. the “crypto capital of the planet” and has pledged to create a “strategic bitcoin reserve.”

At the same time, traders also sought out companies and assets they expect to suffer during a second Trump administration.

Fears of trade wars drove down shares of ocean freight firms, including Denmark’s A.P. Moller-Maersk and Germany’s Hapag-Lloyd . Copper prices had their worst day in more than two years, dropping 5.1% as metals traders in New York reconsidered demand forecasts that hinge on the Chinese economy and the clean-energy boom.

Investors’ belief that Trump may break with the Biden administration’s push into renewable energy and electric vehicles hit companies as far away as South Korea. LG Energy Solution fell roughly 7%, as did other local EV battery makers, and Hanwha Solutions, which makes solar panels, dropped by more than 8%. In the U.S., First Solar fell 11% while Enphase Energy lost 17%.

Shares of Tesla , the electric-vehicle maker helmed by Trump ally and donor Elon Musk , bucked the trend, climbing 15%.

Investors sold bonds, driving yields higher and widening the gap between yields on ordinary Treasurys and those on inflation-protected Treasurys. That is a sign they think that the policies of a second Trump term could put upward pressure on inflation.

Many investors also believe that Trump’s tax-cut-heavy policies will add to the deficit, with the threat of a larger supply of Treasurys helping push down bond prices. The yield on the 10-year Treasury topped 4.4% for the first time since July.

That hit firms and investments that are sensitive to higher bond yields. The S&P 500’s consumer-staples sector declined 1.7% and the utilities segment lost 0.6% The real-estate sector sank 3.4%. The country’s largest home builder, D.R. Horton , dropped nearly 5% and Zillow Group fell about 7%.

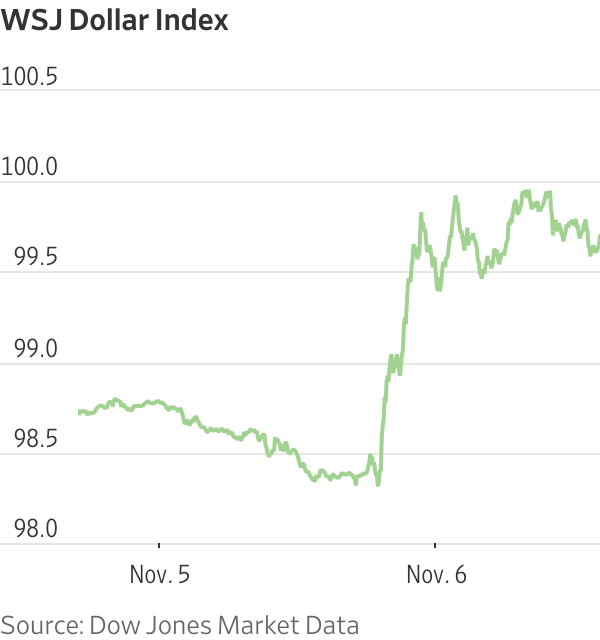

Surging yields intensified a climb in the U.S. dollar, which was also boosted by the prospect of rising tariffs. Economists say tariffs can lift the U.S. currency by hurting the economies of foreign countries and discouraging Americans from spending on imported goods.

The WSJ Dollar Index, which measures the U.S. dollar against a basket of 16 currencies, rose around 1.3%. The Mexican peso lost as much as 3.4% against the dollar to its lowest level since August 2022, according to Dow Jones Market Data, before recovering. Trump recently said he could impose 200% tariffs on vehicles made in the country. The potential for tariffs also drove down the Chinese yuan.

Early wins by Trump in key states assuaged fears that it could take days or weeks for the election to be called. The Cboe Volatility Index—known as the VIX, or the market’s fear gauge—plunged to its lowest level since late September.

The relative calm had investors hoping more gains lie ahead. The S&P 500 had already risen 21% through Election Day, its best performance in a presidential election year since 1936, when Franklin Roosevelt was in office. The Dow Jones Industrial Average was up 12%, its best election-year performance since 1996, when Bill Clinton was in the White House.

“There’s a lot of relief that there’s a clear-cut outcome and that markets can move on to things that are quite frankly more important than who sits in the White House,” said Ross Mayfield, investment strategist at Baird.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A long-standing cultural cruise and a new expedition-style offering will soon operate side by side in French Polynesia.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The boom in casual footware ushered in by the pandemic has ended, a potential problem for companies such as Adidas that benefited from the shift to less formal clothing, Bank of America says.

The casual footwear business has been on the ropes since mid-2023 as people began returning to office.

Analyst Thierry Cota wrote that while most downcycles have lasted one to two years over the past two decades or so, the current one is different.

It “shows no sign of abating” and there is “no turning point in sight,” he said.

Adidas and Nike alone account for almost 60% of revenue in the casual footwear industry, Cota estimated, so the sector’s slower growth could be especially painful for them as opposed to brands that have a stronger performance-shoe segment. Adidas may just have it worse than Nike.

Cota downgraded Adidas stock to Underperform from Buy on Tuesday and slashed his target for the stock price to €160 (about $187) from €213. He doesn’t have a rating for Nike stock.

Shares of Adidas listed on the German stock exchange fell 4.5% Tuesday to €162.25. Nike stock was down 1.2%.

Adidas didn’t immediately respond to a request for comment.

Cota sees trouble for Adidas both in the short and long term.

Adidas’ lifestyle segment, which includes the Gazelles and Sambas brands, has been one of the company’s fastest-growing business, but there are signs growth is waning.

Lifestyle sales increased at a 10% annual pace in Adidas’ third quarter, down from 13% in the second quarter.

The analyst now predicts Adidas’ organic sales will grow by a 5% annual rate starting in 2027, down from his prior forecast of 7.5%.

The slower revenue growth will likewise weigh on profitability, Cota said, predicting that margins on earnings before interest and taxes will decline back toward the company’s long-term average after several quarters of outperforming. That could result in a cut to earnings per share.

Adidas stock had a rough 2025. Shares shed 33% in the past 12 months, weighed down by investor concerns over how tariffs, slowing demand, and increased competition would affect revenue growth.

Nike stock fell 9% throughout the period, reflecting both the company’s struggles with demand and optimism over a turnaround plan CEO Elliott Hill rolled out in late 2024.

Investors’ confidence has faded following Nike’s December earnings report, which suggested that a sustained recovery is still several quarters away. Just how many remains anyone’s guess.

But if Adidas’ challenges continue, as Cota believes they will, it could open up some space for Nike to claw back any market share it lost to its rival.

Investors should keep in mind, however, that the field has grown increasingly crowded in the past five years. Upstarts such as On Holding and Hoka also present a formidable challenge to the sector’s legacy brands.

Shares of On and Deckers Outdoor , Hoka’s parent company, fell 11% and 48%, respectively, in 2025, but analysts are upbeat about both companies’ fundamentals as the new year begins.

The battle of the sneakers is just getting started.

From Italy’s $93,000-a-night villas to a $20,000 Bowral château, a new global ranking showcases the priciest Airbnbs available in 2026.

Formula 1 may be the world’s most glamorous sport, but for Oscar Piastri, it’s also one of the most lucrative. At just 24, Australia’s highest-paid athlete is earning more than US$40 million a year.