How To Face Up To Buying The Dips

Buying stocks as they drop is harder than it sounds. Here’s one strategy that might help keep you on course in turbulent times.

All investors are the prisoners of their past, and that shapes how they face the future.

Until the past few weeks, stocks had resembled a perpetual moneymaking machine, rising smoothly for nearly all of a decade and a half. From March 2009 through the peak this January, U.S. stocks gained more than 800%. The pandemic panic of February and March 2020 lasted only five weeks.

So it’s understandable if you think the nearly 20% collapse so far this year is just a blip. Stocks will soon resume their smooth upward course, right?

I hope so.

But, for all we know, the coming years might resemble 1966 to 1974 or 1929 to 1943, long slogs when stocks kept jolting up and down but finished essentially where they started.

In that case, you will need new weapons in your psychological arsenal. Years on end of poor stock returns would torment anyone who isn’t prepared for a long grind.

One weapon to consider is called value averaging. It’s like buying the dips—purchasing more stocks as prices drop—on steroids.

At its heart, this technique combines two basic ideas: dollar-cost averaging (putting money to work automatically every month or quarter) and rebalancing (selling some of your winners and buying some of your losers).

In value averaging, you set a target amount by which you want your account to grow each period. Say you want to end each month with $1,000 more than you started with.

In periods when stocks fall, you have to add enough to your holdings to hit the target you’ve set.

If, for instance, the value of your portfolio falls $250, you would need to buy $1,250 in stocks to finish the month with $1,000 more than you had at the beginning. If your portfolio’s value drops $500, then you’d add $1,500, and so on.

In a rising market, you’d buy less than $1,000—and even sell some, if stock prices go through the roof.

Value averaging is the brainchild of Michael Edleson, ex-chief economist at the Nasdaq stock exchange and former chief risk officer for the University of Chicago’s endowment.

Most investors say they intend to buy and hold—but many end up buying high and selling low instead.

Investors who use value averaging “have precommitted to bury their demons,” Mr. Edleson says—“the greed demon that makes you buy high and the fear demon that makes you sell low.”

This technique can’t eliminate the risk of underperformance, however. “If you cherry-pick certain periods, value averaging can look horrible,” says Mr. Edleson. “Your success is always going to depend on the starting point and ending point.”

The strategy does better when volatility is high and worse when stocks move smoothly up or down. In a long, steady market, Mr. Edleson says, “there’s nothing better than buy-and-hold, just sitting on it.”

So value averaging is a kind of bet that markets won’t soon return to the abnormally smooth upward slope of, say, the mid-2010s. If you think they will, it might not be for you.

Harald Deppeler, 53 years old, a semiretired physicist in Zurich, has been using the approach since 2013. He built his own spreadsheets to do so; most financial firms aren’t set up to automate value averaging for customers.

The approach “gives you a sense of having a slight edge, but also it tests you,” Mr. Deppeler says.

As stocks rose smoothly between 2013 and 2018, his holdings in an S&P 500 fund exceeded his targets, so Mr. Deppeler had to sell roughly 8% to 12% of that position, he says. (Capital gains are not taxable in Switzerland; as a rule, U.S. investors should consider value averaging only in tax-deferred retirement accounts.)

Mr. Deppeler says he’s aware that having to sell down his holdings during a long bull market probably cost him a small fortune in forgone gains, although he hasn’t calculated that opportunity cost. “I had a pile of cash, which I just couldn’t make any use of,” he says.

On the flip side, in March 2020, value averaging compelled Mr. Deppeler to put a “six-figure amount” into his S&P 500 stock fund during a horrifying decline. “It forced me to say, ‘The market is still falling, and now I have to buy into that,” he recalls.

“At the time, I had to keep telling myself, ‘This is what the plan is actually designed for, to make you buy more when the market dips. Stick to the plan, stick to the plan,’” says Mr. Deppeler.

“If someone really can take the appropriate amount, put it in stocks and then let it ride, rebalancing from time to time but otherwise holding, I’m not going to tell them value averaging is any better,” says Mr. Edleson. “But in practice not many people can do that.”

Then again, if you don’t have the discipline to buy and hold, you might not have the extra discipline to buy even more in a down market.

Few things are harder than buying more when markets fall. That’s why discipline is an investing superpower. Value averaging could help some people stay the course—but it takes work, and it won’t work all the time. Then again, in markets nothing works all the time.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

A sharp rebound in tourism in Europe’s sunbelt powers its economic rebound as core manufacturing centres struggle to recover

Europe’s economy has a north-south divide—and now it’s the poorer south that is powering the region’s return to growth.

Southern Europe, which for decades has had lower growth, productivity and wealth than the north, powered an upside-down recovery on the continent at the start of the year. Buoyant tourism revenue around the Mediterranean helped to offset sluggishness in Europe’s manufacturing heartlands.

The south’s transformation from laggard into growth engine reflects both a rapid rebound in visitor numbers from the collapse during the Covid-19 pandemic and a series of blows the continent’s large manufacturing sector has suffered, from surging energy prices to trade conflicts.

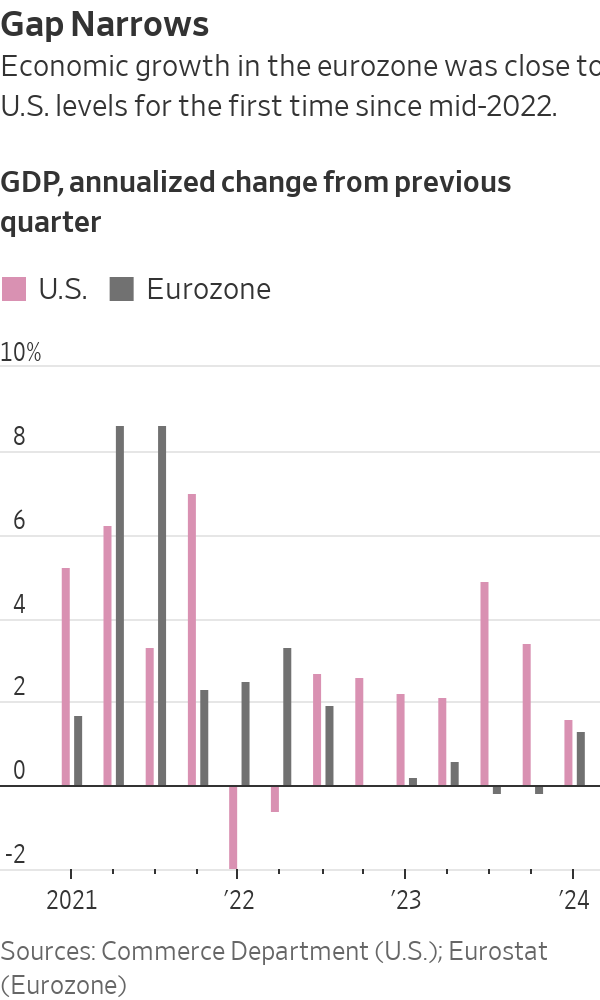

Now growth in the south is more than offsetting the north’s manufacturing malaise: As a whole, the eurozone economy grew at an annualised rate of 1.3% in the first quarter, ending nearly 18 months of economic stagnation in a sign that the currency area is recovering from the damage done by Russia’s invasion of Ukraine.

It was the eurozone’s strongest performance since the third quarter of 2022, and approached the U.S. economy’s 1.6% first-quarter growth rate, which was a slowdown from a racy pace of 3.4% at the end of last year.

In the 2010s, Germany helped to drag the continent out of its debt crisis thanks to strong exports of cars and capital goods. Between 2021 and 2023, Italy, Spain, Greece and Portugal contributed between a quarter and half of the European Union’s annual growth, according to a report last year by French credit insurer Coface —a trend now confirmed and amplified in the latest data.

In the first quarter, Spain was the fastest-growing of the big eurozone economies. It and Portugal recorded growth of 0.7% in the three months through the end of March from the previous quarter, while Italy’s economy grew by 0.3%. France and Germany both grew by 0.2%, the latter rebounding from a 0.5% quarter-on-quarter contraction at the end of last year.

This means Germany’s economy has grown by 0.3% in total since the end of 2019, compared with 8.7% for the U.S., 4.6% for Italy and 2.2% for France, according to UniCredit data.

In Spain, strong growth “seems to have been entirely due to strong tourism numbers,” said Jack Allen-Reynolds, an economist with Capital Economics. Tourism accounts for around 10% of the economies of Spain, Italy, Greece and Portugal.

The euro rose by about a quarter-cent against the dollar, to $1.0725, after the latest growth and inflation data were published.

The recovery comes as the European Central Bank signals it is preparing to reduce interest rates in June after a historic run of increases since mid-2022 that took it the key rate to 4%. Inflation in the eurozone remained at 2.4% in April, while underlying inflation cooled slightly, from 2.9% to 2.7%, according to separate data published Tuesday.

“The ECB hawks will point to the strong GDP number as [an] argument that ECB can take its rates lower gradually,” said Kamil Kovar, senior economist at Moody’s Analytics.

The eurozone economy has flatlined since late 2022 as Russia’s attack on its neighbor sent food and energy prices soaring in Europe and sapped business and household confidence. Gross domestic product fell in both the third and fourth quarters of last year, meeting a definition of recession widely used in Europe, but not in the U.S.

Southern Europe is one of only a handful of regions where international tourist arrivals returned to pre pandemic levels last year, according to United Nations data. Tourism revenue across the EU was one-quarter higher in the three months through the end of last June than in the same period in 2019, according to Coface data.

The recovery in international tourism was “notably driven by the arrival of many Americans who…were able to take advantage of favorable exchange rates,” Coface analysts wrote. “On the other hand, the end of the zero-Covid policy in China has initiated a gradual return of Chinese tourists, although remaining below 2019 levels.”

In Portugal, the number of foreign tourists hit a record of more than 18 million last year, up 11% compared with the prepandemic year of 2019, official data showed in January. American tourists in particular have returned to Europe in force.

Tourist numbers in Asia Pacific and the Americas continued to lag 2019 levels by 35% and 10% last year, respectively, the data show.

It is unclear how much further the tourism boom can run, but economists expect the region’s economic recovery to strengthen later this year as cooling inflation boosts household spending power and lower energy costs aid factory output.

Recent surveys point to an improved outlook for growth. Consumer confidence has risen to its highest level in two years, and a leading business-sentiment index has shown steady improvement from the start of 2024.

“We think that the combination of a robust labor market, comparatively strong wage hikes and lower inflation compared with last year will finally lead to a moderate recovery in consumer spending in the next few quarters,” said Andreas Rees , an economist with UniCredit in Frankfurt.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.