South Doing All the Work in Europe’s Upside-Down Recovery

A sharp rebound in tourism in Europe’s sunbelt powers its economic rebound as core manufacturing centres struggle to recover

Europe’s economy has a north-south divide—and now it’s the poorer south that is powering the region’s return to growth.

Southern Europe, which for decades has had lower growth, productivity and wealth than the north, powered an upside-down recovery on the continent at the start of the year. Buoyant tourism revenue around the Mediterranean helped to offset sluggishness in Europe’s manufacturing heartlands.

The south’s transformation from laggard into growth engine reflects both a rapid rebound in visitor numbers from the collapse during the Covid-19 pandemic and a series of blows the continent’s large manufacturing sector has suffered, from surging energy prices to trade conflicts.

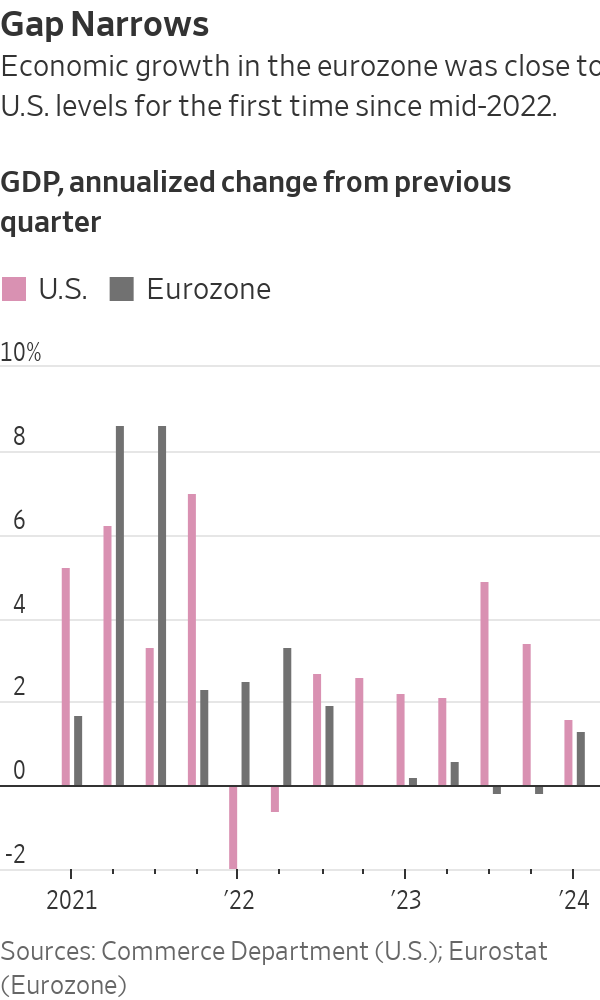

Now growth in the south is more than offsetting the north’s manufacturing malaise: As a whole, the eurozone economy grew at an annualised rate of 1.3% in the first quarter, ending nearly 18 months of economic stagnation in a sign that the currency area is recovering from the damage done by Russia’s invasion of Ukraine.

It was the eurozone’s strongest performance since the third quarter of 2022, and approached the U.S. economy’s 1.6% first-quarter growth rate, which was a slowdown from a racy pace of 3.4% at the end of last year.

In the 2010s, Germany helped to drag the continent out of its debt crisis thanks to strong exports of cars and capital goods. Between 2021 and 2023, Italy, Spain, Greece and Portugal contributed between a quarter and half of the European Union’s annual growth, according to a report last year by French credit insurer Coface —a trend now confirmed and amplified in the latest data.

In the first quarter, Spain was the fastest-growing of the big eurozone economies. It and Portugal recorded growth of 0.7% in the three months through the end of March from the previous quarter, while Italy’s economy grew by 0.3%. France and Germany both grew by 0.2%, the latter rebounding from a 0.5% quarter-on-quarter contraction at the end of last year.

This means Germany’s economy has grown by 0.3% in total since the end of 2019, compared with 8.7% for the U.S., 4.6% for Italy and 2.2% for France, according to UniCredit data.

In Spain, strong growth “seems to have been entirely due to strong tourism numbers,” said Jack Allen-Reynolds, an economist with Capital Economics. Tourism accounts for around 10% of the economies of Spain, Italy, Greece and Portugal.

The euro rose by about a quarter-cent against the dollar, to $1.0725, after the latest growth and inflation data were published.

The recovery comes as the European Central Bank signals it is preparing to reduce interest rates in June after a historic run of increases since mid-2022 that took it the key rate to 4%. Inflation in the eurozone remained at 2.4% in April, while underlying inflation cooled slightly, from 2.9% to 2.7%, according to separate data published Tuesday.

“The ECB hawks will point to the strong GDP number as [an] argument that ECB can take its rates lower gradually,” said Kamil Kovar, senior economist at Moody’s Analytics.

The eurozone economy has flatlined since late 2022 as Russia’s attack on its neighbor sent food and energy prices soaring in Europe and sapped business and household confidence. Gross domestic product fell in both the third and fourth quarters of last year, meeting a definition of recession widely used in Europe, but not in the U.S.

Southern Europe is one of only a handful of regions where international tourist arrivals returned to pre pandemic levels last year, according to United Nations data. Tourism revenue across the EU was one-quarter higher in the three months through the end of last June than in the same period in 2019, according to Coface data.

The recovery in international tourism was “notably driven by the arrival of many Americans who…were able to take advantage of favorable exchange rates,” Coface analysts wrote. “On the other hand, the end of the zero-Covid policy in China has initiated a gradual return of Chinese tourists, although remaining below 2019 levels.”

In Portugal, the number of foreign tourists hit a record of more than 18 million last year, up 11% compared with the prepandemic year of 2019, official data showed in January. American tourists in particular have returned to Europe in force.

Tourist numbers in Asia Pacific and the Americas continued to lag 2019 levels by 35% and 10% last year, respectively, the data show.

It is unclear how much further the tourism boom can run, but economists expect the region’s economic recovery to strengthen later this year as cooling inflation boosts household spending power and lower energy costs aid factory output.

Recent surveys point to an improved outlook for growth. Consumer confidence has risen to its highest level in two years, and a leading business-sentiment index has shown steady improvement from the start of 2024.

“We think that the combination of a robust labor market, comparatively strong wage hikes and lower inflation compared with last year will finally lead to a moderate recovery in consumer spending in the next few quarters,” said Andreas Rees , an economist with UniCredit in Frankfurt.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.