Facebook Parent Meta Platforms Reports First Ever Revenue Drop

Social-media giant missed Wall Street’s sales expectation but added users—defying analysts’ projections.

Facebook parent Meta Platforms Inc. posted its first decline in revenue and issued a muted outlook on digital advertising as it contends with growing competition from rival TikTok.

The company reported quarterly revenue of US$28.8 billion, down almost 1% from a year earlier and slightly below the US$28.9 billion Wall Street was expecting. It marks the first time that the company has posted a quarterly drop in revenue from the year earlier.

“We seem to have entered an economic downturn that will have a broad impact on the digital advertising business,” Chief Executive Mark Zuckerberg said Wednesday. “It’s always hard to predict how deep or how long these cycles will be, but I’d say that the situation seems worse than it did a quarter ago,” he said on an earnings call.

Meta is grappling with a digital advertising market in upheaval from surging inflation and other factors that are causing a slowdown in ad spending. Google parent Alphabet Inc. on Tuesday reported the slowest rate of growth since the second quarter of 2020, when the pandemic crimped demand for advertising in some areas. Rival Snap Inc. reported its weakest-ever quarterly sales growth last week while Twitter Inc. reported a decline in revenue.

Meta also disclosed that Facebook’s daily active user base rose to 1.97 billion users. The figure was 1.96 billion three months ago. The increase defied expectations of analysts surveyed by FactSet who thought user numbers would fall.

The company posted a net profit of US$6.7 billion for the second quarter, the third quarter in a row Meta’s bottom line has fallen. The company hasn’t experienced such a slump since the fourth quarter of 2012.

The weak advertising demand was reflected in Meta’s average price per ad, which fell 14% in the quarter. A year ago, the company reported an increase of 47%, year over year, for its average price per ad.

The company said it continued to face challenges in targeting ads as a result of changes made by Apple Inc. to the iPhone’s operating system. Chief Operating Officer Sheryl Sandberg, on her last earnings call before she departs Meta after 14 years, said the company is adapting its business to do better ad targeting—with less user data—with products such as click-to-message ads, which open a chat with a business whenever a user clicks on the ad.

Such ads are already a multibillion-dollar business growing at double digits, she said. “We are hugely optimistic about this area of our business, and I am very convinced it will work,” Ms. Sandberg said.

Chief Financial Officer David Wehner said the company, like others, is feeling the pinch from the strong dollar, which is weighing on the top line.

Meta’s shares have retreated since the company posted quarterly results in February that showed a sharper-than-expected decline in profit, gloomy revenue outlook and dip in daily users.

Meta’s stock closed more than 6% higher and fell more than 4% after hours following the results.

The company also said it expects its total expenses for 2022 to be between US$85 billion and US$88 billion, down from the company’s previous outlook of US$87 billion to US$92 billion. The company attributed the lowered forecast to a reduction in hiring and overall expense-growth plans for the year.

Mr. Zuckerberg repeated that the company plans to slow the pace of long-term investments and steadily reduce head-count growth over the next year.

“This is a period that demands more intensity,” Mr. Zuckerberg said. “And I expect us to get more done with fewer resources.”

Meta is going through a period of transition. Mr. Zuckerberg in April said the company would change how users would see content, in a bid to boost engagement. The company would use artificial intelligence to recommend content to Facebook and Instagram users from around those social networks, rather than solely showing users content from accounts they already follow. The effort mimics one of the signature features of rival TikTok, which Mr. Zuckerberg in February said posed stiff competition for Meta.

Nearly one in six posts shown on Facebook and Instagram feeds are now coming from accounts that users don’t follow and are based on artificial intelligence recommendations, according to stats shared by Mr. Zuckerberg. That could rise to nearly one in every three posts shown to users coming from accounts they don’t follow by the end of 2023.

During the quarter, Meta saw a 30% increase in the time that users are engaging with Reels, the company’s answer to TikTok short-form videos, Mr. Zuckerberg said Wednesday.

Meta, however, doesn’t yet monetize Reels at the levels of some of its other features.

“In the near term, the faster that Reels grows, the more revenue that actually displaces from higher monetizing surfaces,” Mr. Zuckerberg said. “In theory, we could mitigate the short-term headwind by pushing less hard on growing Reels. But that would be worse for our products and business longer term.”

Mr. Zuckerberg added that Reels ads are on pace to generate US$1 billion in annual revenue.

Earlier this year, Meta said it planned to slow the pace of some of its long-term investments and adjust hiring plans. In May, the company disclosed a sharp slowdown in hiring, and in June, the company’s head of engineering told his managers in an internal memo to identify and report low performers so they could force those employees out. Earlier this month, the company let go of 368 contractors, including several custodial staff, at its Menlo Park, Calif., headquarters.

The company on Tuesday also said it planned to raise the price of its Quest 2 virtual-reality headset by nearly 34% to US$399.99, citing a rise in the costs to make and ship the products.

The company’s Reality Labs division, which includes VR hardware, posted revenue of US$452 million. Analysts expected it to generate US$431 million in quarterly sales.

Separately, the Federal Trade Commission said Wednesday it is seeking to block Meta from acquiring Within Unlimited Inc. and its virtual-reality dedicated fitness app, Supernatural. The deal, the FTC alleges, would lessen competition in the market and violate antitrust laws. Meta rejected the FTC’s position and said the purchase would be good for the development of the virtual-reality market.

The company also announced that come November, Mr. Wehner will transition into chief strategy officer, a new role at the company. Succeeding him as CFO will be Susan Li, Meta’s current vice president of finance. Mr. Wehner has served as Meta’s CFO since June 2014.

Reprinted by permission of The Wall Street Journal, Copyright 2021 Dow Jones & Company. Inc. All Rights Reserved Worldwide. Original date of publication: July 28, 2022.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

An original watercolour illustration for the cover of Harry Potter and the Philosopher’s Stone, 1997 — the first book in J.K. Rowling’s hit series—could sell for US$600,000 at a Sotheby’s auction this summer.

The illustration is headlining a June 26 sale in New York that will also feature big-ticket items from the collection of the late Dr. Rodney P. Swantko, a surgeon and collector from Indiana, including manuscripts by poet Edgar Allan Poe and Arthur Conan Doyle, author of the Sherlock Holmes books

The Harry Potter illustration, which introduced the young wizard character to the world, is expected to sell for between US$400,000 to US$600,000, which would make it the highest-priced item ever sold related to the Harry Potter world. This is the second time the illustration has been sold, however—it was on the auction block at Sotheby’s in London in 2001, where it achieved £85,750 (US$107,316).

The artist of the illustration, Thomas Taylor, was 23 years old at the time and a graduate student working at a children’s bookshop. According to Sotheby’s, Taylor took a “professional commission from an unknown author to visualise a unique wizarding world,” Sotheby’s said in a news release. He depicted Harry Potter boarding the train to Hogwarts on platform9 ¾ platform, and the illustration became the “universal image” of the Harry Potter series, Sotheby’s said.

“It is exciting to see the painting that marks the very start of my career, decades later and as bright as ever! It takes me back to the experience of reading Harry Potter for the first time—one of the first people in the world to do so—and the process of creating what is now an iconic image,” Taylor said in the release.

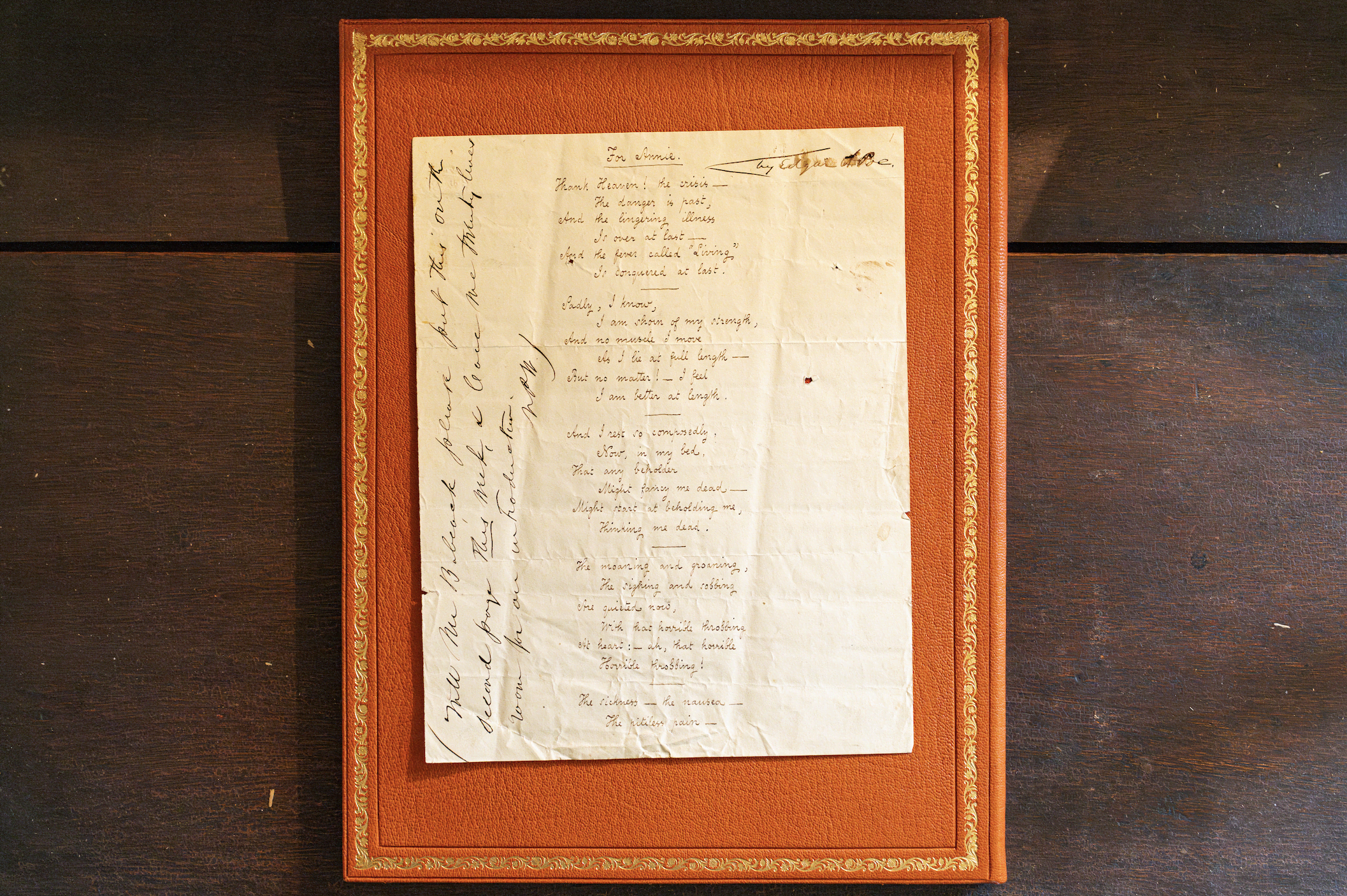

Meanwhile, to commemorate the 175th anniversary of Edgar Allan Poe’s For Annie , 1849, Sotheby’s recently reunited the autographed manuscript of the poem with the author’s home, Poe Cottage, in the Bronx.

The cottage is where the author lived with his wife, Virginia, and mother-in-law, Maria Clemm, from 1846 until he died in 1849. The manuscript, also from the Swantko collection, will remain at the home until it is offered at auction at Sotheby’s on June 26 with an estimate between US$400,000 and US$600,000.

Matthew Borowick for Sotheby’s

Poe Cottage, preserved and overseen by the Bronx County Historical Society, is home to many of the author’s famous works, including Eureka , 1948, and Annabel Lee , 1927.

“To reunite the For Annie manuscript with the Poe Cottage nearly two centuries after it was first composed brought to life literary history for a truly special and unique occasion,” Richard Austin , Sotheby’s Global Head of Books & Manuscripts, said in a news release.

For Annie was one of Poe’s most important compositions, and was addressed to Nancy “Annie” L. Richmond, one of the several women Poe pursued after his wife Viriginia’s death from tuberculosis in 1847.

In a letter to Richmond herself, Poe proclaimed For Annie was his best work: “I think the lines For Annie much the best I have ever written.”

The poem was composed in 1849, only months before Poe’s death, Sotheby’s said in the piece, Poe highlights the romantic comfort he feels from a woman named Annie while simultaneously grappling with the darkness of death, with lines like “And the fever called ‘living’ is conquered at last.”

Matthew Borowick for Sotheby’s

In the margins of the manuscript are the original handwritten instructions by Nathaniel P. Willis, co-editor of the New York Home Journal, where Poe published other poems such as The Raven and submitted For Annie on April 20, 1849.

Willis added Poe’s name in the top right and instructions about printing and presenting the poem on the side. The poem was also published in the Boston Weekly that same month.

Another piece of literary history included in the Swantko sale could surpass US$1 million. Conan Doyle’s autographed manuscript of the Sherlock Holmes tale The Sign of Four , 1889, is estimated to achieve between US$800,000 and US$1.2 million.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.