Crypto’s Onetime Fans Are Calling It Quits After FTX Collapse

Debacle is last straw for many who embraced crypto during pandemic

Buying crypto was so much fun when it was going up. Now, many onetime fans are getting out.

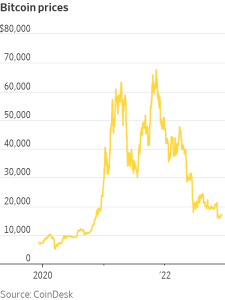

This year has brought crisis after crisis, raising questions about the industry’s long-term prospects. Two major lenders, Voyager Digital and Celsius Network, filed for bankruptcy this summer. The price of bitcoin has plunged some 75% from its peak late last year. For some traders, the recent collapse of the crypto exchange FTX—which is dragging down other firms—was the last straw.

Crypto fund asset managers saw investors withdraw almost $20 billion in November, or nearly 15% of total assets under management, according to the research firm CryptoCompare. That brought the fund managers’ collective AUM to its lowest point in nearly two years. By contrast, many small-time investors continue to stay in the relatively boring stock market, despite losses there as well.

Dennis Drent, a former executive at a pet-insurance company, said he waded into the crypto market last December, when the world felt very different. He was growing anxious that the stock market’s record run would soon sputter and was frustrated by how little his bond investments were generating.

Around that time, he caught an appearance by a bitcoin proponent, Michael Saylor, with Fox News’s Tucker Carlson.

“He had me convinced that you can’t lose,” said Mr. Drent, who lives in Southern California.

A few weeks later, he poured about $25,000 into Grayscale Bitcoin Trust. He even had a nod from his financial adviser, he said.

It didn’t work. Mr. Drent cashed out in May, taking about a 50% loss. By then, crypto prices were falling fast. But so were stocks and bonds, an unusual coupling that reflected broad uncertainty.

Mr. Drent said he should have known to avoid a market that was so lightly regulated and that he didn’t fully understand: “I wasn’t cautious enough.”

Mr. Saylor didn’t respond to a request for comment.

Crypto use exploded over the past few years and so did crypto prices, with bitcoin soaring from roughly $9,000 in early March 2020 to about $68,000 at its peak in November 2021.

Rookie traders stuck at home during pandemic lockdowns downloaded apps that made it easy to buy crypto with a few taps on their phones. Some embraced active trading, darting in and out of different cryptocurrencies. Others thought they were taking a safer route by parking their crypto holdings at companies that offered eye-popping yields in return.

The share of U.S. households that have ever transferred funds into a crypto-related account jumped to 13% as of June 2022, up from 3% before 2020, according to data from the JPMorgan Chase Institute. It estimates that many new investors flocked to crypto for the first time last year, with activity among new users peaking around the time bitcoin prices did in November. Since then, activity has tumbled.

While crypto prices soared, financial-services companies rolled out new products and services to allow everyday investors to add crypto to their nest eggs. Some of that enthusiasm has waned.

“New customer additions have slowed…because the trust of the industry has been damaged,” said Chris Kline, co-founder of Bitcoin IRA, which allows investors to trade crypto through retirement accounts.

Making matters worse, many people followed the herd and bought crypto only when prices rose.

JPMorgan estimates that many investors who transferred money to crypto accounts did so when prices were much higher than they are now. That means many investors are likely sitting on losses.

Of course, plenty of crypto traders say they are holding on or trying to buy the dip in cryptocurrencies. Some are doing so because they believe in crypto as a conduit to change global finance. Others just don’t need the money soon.

Stephen Jones, 28 years old, said he started buying cryptocurrencies when he was in college. Mr. Jones notched some wins but started having doubts over the past year, so he sold out of some positions. Getting married in June pushed him to take another closer look at his finances, he said.

Finally, he decided to cash out his remaining holdings in October. When he saw FTX collapse shortly afterward, he was relieved that he had already dumped his crypto.

FTX “definitely opened my eyes a little bit,” said Mr. Jones, who works in finance and is based in Houston. “I’m not really seeing as much value-added activity as was initially promised.”

Nick Torrico, 26, had about $10,000 in mainly bitcoin, Ethereum and VeChain at Voyager when it filed for bankruptcy in July, and he doesn’t know if he will see all of that money again.

After diving into cryptocurrencies a few years ago, he has pulled back on some of his trading, especially in smaller coins.

Mr. Torrico said he is glad that he has diversified his holdings and didn’t pour all of his money into crypto. He is holding more in cash in his investment account. He has made some stock trades with borrowed money and could face margin calls if shares of some of his companies fall farther.

Still, Mr. Torrico, who works in finance, said he remains optimistic about blockchain technology and expects more regulation of crypto, which he thinks will help the industry. He still holds bitcoin and ether, the two biggest cryptocurrencies, and plans to keep buying regularly.

“A lot of bad actors have been exposed,” Mr. Torrico said. “My biggest lesson is to be patient and not try to make fast money.”

—David Benoit contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The best course when stocks slide is for investors to stand pat, but ‘put’ options are one way to hedge against a drop and lock in some profits

The past five years have been good to stock-market investors. The S&P 500 index has climbed an annualised 12% during that period, outstripping the 9% annualised gain over the past 40 years. This year alone the index is up 6.9% as of April 26, tacking on to the 24% gain in 2023.

But signs are emerging that the stock market could be due for a breather. As of April 25, the S&P 500 went 133 trading days without a decline of at least 10%, according to PNC Institutional Asset Management. To be sure, that’s still short of the 172-day average since 1928. But the S&P 500 has jumped 24% in the past six months (about 180 days), which buttresses arguments for a correction.

What’s more, the multiyear ascent has arguably sent stocks to overvalued levels. The S&P 500’s forward price-to-earnings ratio—a gauge of market valuation based on earnings estimates for the next 12 months—registered 20 as of April 26, exceeding the five-year average of 19.1 and the 10-year average of 17.8, according to FactSet.

“A correction is certainly possible,” says Jack Ablin , chief investment officer at wealth-management firm Cresset Capital, pointing to the high valuations and the prospect that rate cuts will come later than expected thanks to inflation that has been higher than expected.

Given the danger of a stock-market correction, commonly defined as a 10% to 20% drop, how can investors guard the profits they have made in recent years?

Wait and see

Assuming you have a well-diversified portfolio and aren’t counting on the money from your stocks to finance an imminent expense, financial advisers say the best strategy is to hang tight.

Corrections generally don’t stick around long. Since 1985, declines between 10% and 20% for the S&P 500 have lasted only 97 days on average—three-plus months—according to a CFRA analysis of S&P data.

It then has taken the market an additional 101 days on average to recover the ground lost during the correction. So in about six months, investors tend to be back where they were before the correction.

“If there’s a shallow correction of 5% to 10%, we recommend riding it out,” says Karim Ahamed , an investment adviser at wealth-management firm Cerity Partners. “Eventually the market recovers. The idea of selling out and climbing back in is difficult to achieve. You’re more likely to stay on the sidelines with your losses crystallising.”

The S&P 500 did fall more than 5% in recent weeks, from March 28 to April 19.

Sell losers

Some people, though, simply find it impossible to do nothing if they fear a correction is looming. At the least, they want to protect the gains they have earned so far. What’s the most prudent way for them to reduce their market exposure?

Keep in mind that most actions you can take to guard your stock profits carry a cost. The easiest method, selling stocks, subjects you to capital-gains taxes unless you are selling from a tax-advantaged retirement account. That tax rate varies according to your income, but will likely be 15%.

One way to limit the burden is through tax-loss harvesting, says Amanda Agati , chief investment officer of PNC’s asset-management group. That is when you sell stocks at a loss, lowering your net capital gain. If you have any dogs in your portfolio—stocks with poor fundamentals—you can unload those.

If you do sell stocks, you could put the proceeds into a money-market fund for now, financial pros say. Many such funds yield 5% or more, far higher than rates over the past 15 years. Or if you want to increase the safety of your overall portfolio, you could put the money into safe government bonds. Three-year Treasury notes yield around 4.75%.

Play defence

If you are going to unload stocks, but don’t want to sell right away, you can put in a stop-limit sell order through your brokerage. That order can automatically sell your shares if they slide to a level you designate (they can go below it, too), protecting you from big drops.

Say you bought 100 shares of Tesla at $140, and they are now trading at $165. If you don’t want your profit to disappear in a downturn, you could enter a stop-limit sell order with your brokerage at $150 for some or all of your shares. Those shares can be sold if the price reaches $150, securing some of the gains.

You also might shift your holdings more toward defensive stocks, such as utilities and consumer-staple companies, which generally outperform during market downturns, says Michael Sheldon , executive director of wealth-management firm RDM Financial Group.

PNC’s Agati suggests an emphasis on quality stocks, those with high recurring revenues, strong and dependable profit margins, high cash flow and low debt. These stocks—such as AutoZone and Visa , she says—have lagged behind the leaders of the market’s surge over the past year.

Consider options

Advisers also suggest looking at “put” options to protect your stock gains. Puts give you the right but not the obligation to sell a security at a preset price by a preset deadline.

Note that we’re talking about a risk-reduction approach here, not the kind of risk-taking—to try to amplify returns— that has been rampant in the options market . The simplest strategy could be to purchase a put option on a market-index exchange-traded fund, such as one based on the S&P 500. You could buy puts on individual stocks rather than an index ETF, but that may get expensive and complicated as each option carries a purchase premium.

Here’s how the ETF strategy would work: First, buy an option that would let you sell the ETF at a price below the current one, protecting you from declines beneath that level. You wouldn’t have to sell the ETF, and you wouldn’t even have to own it. As the S&P 500 falls, the put option gains in value, and you can sell it.

Say on April 16 you wanted to protect 100 shares of SPDR S&P 500 ETF Trust (SPY) from a decline of more than 10%. With the ETF trading at $505 a share, you could buy an option that covers 100 shares for $1,050, or $10.50 a share. You’re paying a premium equal to 2% of your position.

The option’s expiration date is December, and its strike price is $455 a share, or 10% below the current value. The strike price is the price at which you could exercise the option. But generally you sell the option rather than exercising it, so you don’t have to dump any shares, especially if you don’t own them.

If the market doesn’t go down 10% by December, you let the option expire worthless, and you’re out the $1,050 you paid for it. If the market drops more than 10%, you can sell your option at a profit whenever you want until December.

While it might be more lucrative to sell it early, Ablin recommends holding until expiration if you’re using the option to protect your portfolio. “Think of it like homeowner insurance,” he says. “You pay a premium, like a deductible for insurance, and your coverage runs for a term.”

Keeping the option until expiration extends your coverage for the longest possible period.

By using options, you don’t have to sell any of your stocks, which are typically the best asset to generate strong long-term returns. “If you have the wherewithal to hold the S&P 500 for 10 years, your odds of making money are over 90%,” Ablin says.

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts