For a Good Job by 30, Do This in Your 20s

New research shows which career paths pay off and why steps made between ages 20 and 26 are so critical

Skepticism about the value of college is growing, but earning a four-year degree by your mid-20s is the surest route to a good job by age 30.

That is a key takeaway from a new analysis by Georgetown University’s Center on Education and the Workforce that aims to identify the paths that bring people to good jobs. The findings are important as companies, individuals and families are trying to better understand how college degrees affect career outcomes.

Georgetown researchers examined government data for more than 8,000 Americans born in the early 1980s from adolescence through age 30. They identified 38 decision points that could influence workers’ ability to land what they deemed a good job by age 30—one that pays the minimum for economic self-sufficiency, a median annual salary of $57,000.

Pursuing a bachelor’s degree made more of a difference than any other decision that researchers analysed.

“The main road to a good job is still to go get the BA,” said Anthony Carnevale, who directs the Georgetown centre.

The researchers focused on people who didn’t go directly from high school to college, because the cohort that graduated college in their early 20s had a high rate of good job outcomes.

Millions of people start bachelor’s degrees, but don’t finish them by their mid-20s. Those non-finishers have a 40% chance of getting a good job by 30, Georgetown data show. If they eventually earned a bachelor’s degree by age 26, they would have a higher chance—56%—of getting a good job, Georgetown estimates.

Even starting a bachelor’s degree by age 22 made a difference for some high-school graduates. People who pursued an associate degree, skills training or certificate had a 29% shot at a good job, compared with 23% for those who didn’t pursue higher education by that age.

College Debt—and Payoff

Escalating college costs have complicated people’s decision to attend, said Zack Mabel, an author of the Georgetown report and a research professor of education and economics at the university.

The expected payoff to getting a bachelor’s degree is higher than it has ever been, Prof. Mabel said, but added, “with the rising cost of college, and the increasing debt that students and families have to take on, the risk of pursuing higher education is higher than it’s ever been.”

Some 56% of respondents to a recent Wall Street Journal-NORC poll said a four-year degree isn’t worth it, because students often leave with large student debt loads and no specific job skills. Ten years ago, 40% of people polled thought a college degree wasn’t worth it.

Dany Nguyen, 30 years old, started a job in Austin last year as a software developer for General Motors after a decade of working while going to school.

Mr. Nguyen, who graduated from high school in 2010, said he spent four years stocking shelves at a store, running food orders at a restaurant and working at a banquet hall while taking community-college classes at night. Though exhausting, the arrangement ensured he could pay his bills and tuition. He got skills and connections that led to better paying roles, he said, including an inventory job with a dental-product company that he learned about from a co-worker at a different job.

Mr. Nguyen ultimately transferred from community college to California State University, Long Beach, and finished his bachelor’s degree in management information systems last year. Today, he is making more than ever and sees the benefit to working his way through school.

“Being able to combine both school teamwork and work teamwork, you’re able to do your job efficiently,” he said.

Salaries for college graduates are higher than those without degrees, but data analysed by the Federal Reserve Bank of St. Louis shows the gap in net worth between college grads and non grads has narrowed significantly. One reason is the high cost of college, with many grads’ higher earnings offset by student debt.

Renee Wooten worked while attending a for-profit university, delivering pizzas and fielding queries at a call centre, then turning a contract position in the video game industry into a full-time job with benefits. Mr. Wooten, 33, makes six figures as a video game producer but says having $40,000 in outstanding student debt is stressful.

“I don’t know if I would do it again,” Mr. Wooten said, adding that an associate degree to start may have been a better choice. “I’ve been dumping my bonuses and my tax returns into my student loans, just for them to be eaten up by interest.”

Industries Matter

Some companies have eliminated bachelor’s-degree requirements for hires, though almost 70% of the new jobs created in the U.S. between 2012 and 2019 were in occupations that typically require a four-year degree or higher for entry, according to Opportunity@Work, a nonprofit.

Georgetown’s analysis showed several other early-career decisions can help put 20-somethings on the path to a better-paying job if they don’t go to college after high school. Steady work between the ages of 20 and 22 and avoiding resume gaps in these years can help, researchers said, because hiring managers are more likely to hire experienced people who are actively working.

Industries count, too. Working at age 22 in a blue-collar job or in tech or finance, rather than fields such as education, food services and the arts, also helped raise the chance of getting a higher paying role. Still, workers who took one of those paths had no more than a 25% chance of landing a good job by 30. Those pathways proved more effective when combined with attending college.

Diego Padilla faced a choice in 2020 while in his late teens: Continue his internship with JP Morgan Chase, assisting clients with transactions such as opening accounts and withdrawals, or accept a full-time job managing a grocery store.

Mr. Padilla, then a fresh high-school graduate enrolled in community college, was drawn to the stability of a full-time job. But he wondered where he could go if he stayed at the bank. Now 22, Mr. Padilla has a full-time role with Chase, finished his associate degree and transferred to Chicago where he works with Chase clients.

Mr. Padilla is taking online classes in pursuit of his bachelor’s degree while working full time. After that he said he wants to get an M.B.A.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

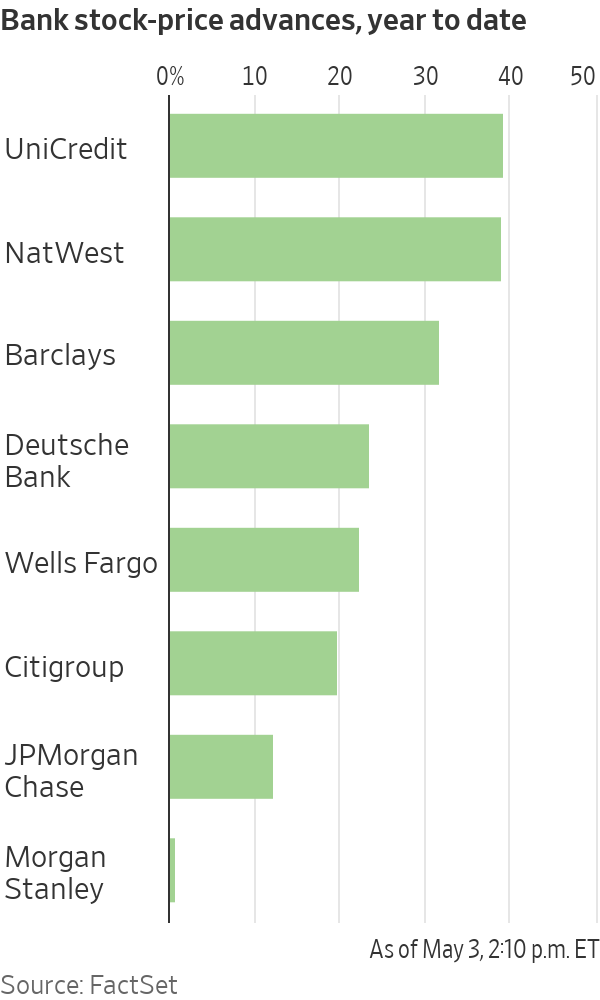

Shares in European banks such as UniCredit have been on a tear

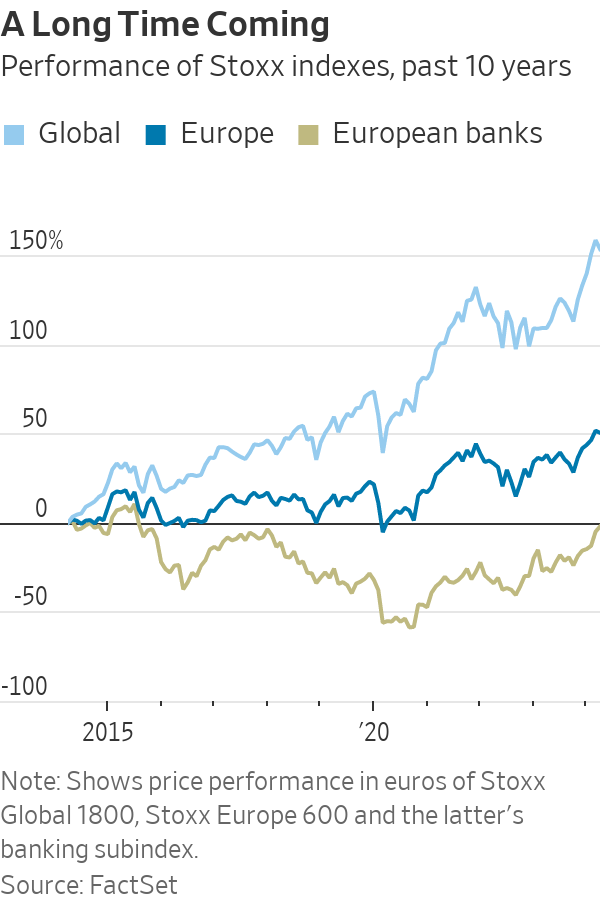

After years in the doldrums, European banks have cleaned up their balance sheets, cut costs and started earning more on loans.

The result: Stock prices have surged and lenders are preparing to hand back some $130 billion to shareholders this year. Even dealmaking within the sector, long a taboo topic, is back, with BBVA of Spain resurrecting an approach for smaller rival Sabadell .

The resurgence is enriching a small group of hedge funds and others who started building contrarian bets on European lenders when they were out of favour. Beneficiaries include hedge-fund firms such as Basswood Capital Management and so-called value investors such as Pzena Investment Management and Smead Capital Management.

It is also bringing in new investors, enticed by still-depressed share prices and promising payouts.

“There’s still a lot of juice left to squeeze,” said Bennett Lindenbaum, co-founder of Basswood, a hedge-fund firm based in New York that focuses on the financial sector.

Basswood began accumulating positions around 2018. European banks were plagued by issues including political turmoil in Italy and money-laundering scandals . Meanwhile, negative interest rates had hammered profits.

Still, Basswood’s team figured valuations were cheap, lenders had shored up capital and interest rates wouldn’t stay negative forever. The firm set up a European office and scooped up stock in banks such as Deutsche Bank , UniCredit and BNP Paribas .

Fast forward to 2024, and European banking stocks are largely beating big U.S. banks this year. Shares in many, such as Germany’s largest lender Deutsche Bank , have hit multiyear highs .

A long-only version of Basswood’s European banks and financials strategy—which doesn’t bet on stocks falling—has returned approximately 18% on an annualised basis since it was launched in 2021, before fees and expenses, Lindenbaum said.

The industry’s turnaround reflects years spent cutting costs and jettisoning bad loans, plus tougher operating rules that lifted capital levels. That meant banks were primed to profit when benchmark interest rates turned positive in 2022.

On a key measure of profitability, return on equity, the continent’s 20 largest banks overtook U.S. counterparts last year for the first time in more than a decade, Deutsche Bank analysts say.

Reflecting their improved health, European banks could spend almost as much as 120 billion euros, or nearly $130 billion, on dividends and share buybacks this year, according to Bank of America analysts.

If bank mergers pick up, that could mean takeover offers at big premiums for investors in smaller lenders. European banks were so weak for so long, dealmaking stalled. Acquisitive larger banks like BBVA could reap the rewards of greater scale and cost efficiencies, assuming they don’t overpay.

“European banks, in general, are cheaper, better capitalised, more profitable and more shareholder friendly than they have been in many years. It’s not surprising there’s a lot of new investor interest in identifying the winners in the sector,” said Gustav Moss, a partner at the activist investor Cevian Capital, which has backed institutions including UBS .

As central banks move to cut interest rates, bumper profits could recede, but policy rates aren’t likely to return to the negative levels banks endured for almost a decade. Stock prices remain modest too, with most far below the book value of their assets.

Among the biggest winners are investors in UniCredit . Shares in the Italian lender have more than quadrupled since Andrea Orcel became chief executive in 2021, reaching their highest levels in more than a decade.

Under the former UBS banker, UniCredit has boosted earnings and started handing large sums back to shareholders , after convincing the European Central Bank the business was strong enough to make large payouts.

Orcel said European banks are increasingly attracting investors like hedge funds with a long-term view, and with more varied portfolios, like pension funds.

He said that investor-relations staff initially advised him that visiting U.S. investors was important to build relationships—but wasn’t likely to bear fruit, given how they viewed European banks. “Now Americans ask you for meetings,” Orcel said.

UniCredit is the second-largest position in Phoenix-based Smead Capital’s $126 million international value fund. It started investing in August 2022, when UniCredit shares traded around €10. They now trade at about €35.

Cole Smead , the firm’s chief executive, said the stock has further to run, partly because UniCredit can now consider buying rivals on the cheap.

Sentiment has shifted so much that for some investors, who figure the biggest profits are to be made betting against the consensus, it might even be time to pull back. A recent Bank of America survey found regional investors had warmed to European banks, with 52% of respondents judging the sector attractive.

And while bets on banks are now paying off, trying to bottom-fish in European banking stocks has burned plenty of investors over the past decade. Investments have tied up money that could have made far greater returns elsewhere.

Deutsche Bank, for instance, underwent years of scandals and big losses before stabilising under Chief Executive Christian Sewing . Rewarding shareholders, he said, is now the bank’s priority.

U.S. private-equity firm Cerberus Capital Management built stakes in Deutsche Bank and domestic rival Commerzbank in 2017, only to sell a chunk when shares were down in 2022. The investor struggled to make changes at Commerzbank.

A Cerberus spokesman said it remains “bullish and committed to the sector,” with bank investments in Poland and France. It retains shares in both Deutsche and Commerzbank, and is an investor in another German lender, the unlisted Hamburg Commercial Bank.

Similarly, Capital Group also invested in both Deutsche Bank and Commerzbank, only to sell roughly 5% stakes in both banks in 2022—at far below where they now trade. Last month, Capital Group disclosed buying shares again in Deutsche Bank, lifting its holding above 3%. A spokeswoman declined to comment.

U.S.-based Pzena, which manages some $64 billion in assets, has backed banks such as UBS and U.K.-listed HSBC , NatWest and Barclays .

Pzena reckoned balance sheets, capital positions and profitability would all eventually improve, either through higher interest rates or as business models shifted. Still, some changes took longer than expected. “I don’t think anyone would have thought the ECB would keep rates negative for eight or nine years,” said portfolio manager Miklos Vasarhelyi.

Some Pzena investments date as far back as 2009 and 2010, Vasarhelyi said. “We’ve been waiting for this to turn for a long time.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts