U.S. Companies Face EU Deforestation Rules on Coffee, Wood and Other Everyday Goods

Businesses are bracing for tough new regulations after voluntary corporate efforts failed

Companies selling everyday products such as leather shoes, coffee and chocolate in the European Union will soon need to prove their wares aren’t causing forest loss under a new law, after voluntary efforts largely failed.

The world’s toughest rules on deforestation come into force Thursday, meaning that companies have 18 months to prepare for proving the origin of seven commodities imported into the EU that are known to drive forest loss: cattle, cocoa, coffee, palm oil, soy, rubber and wood.

Almost 40% of the world’s 500 largest companies using the seven commodities covered by the new EU rules haven’t set a policy on forest loss, environmental nonprofit Global Canopy said in a report in February. The nonprofit estimates at least 37 big U.S.-based companies, including Starbucks and Kellogg, will be covered by the new rules.

“Our team is reviewing the regulations and working with our materials and ingredients suppliers to prepare,” a Kellogg spokeswoman said. Starbucks declined to comment.

Businesses will need to pinpoint the plot of land where the product came from and prove no forests have been cleared on the site since 2020. They will need to provide evidence of due diligence, which will likely include satellite imagery. Planet Labs and Airbus-owned Starling—two businesses that use satellites to monitor land use—said U.S. companies have shown interest in their services because of the new regulations.

Importers failing to meet the new rules face fines of up to 4% of their annual revenue in the bloc. The law requires the bloc’s national authorities to check 9% of shipments coming from countries it considers to have a high risk of deforestation, 3% for nations it labels standard risk and 1% from low risk nations.

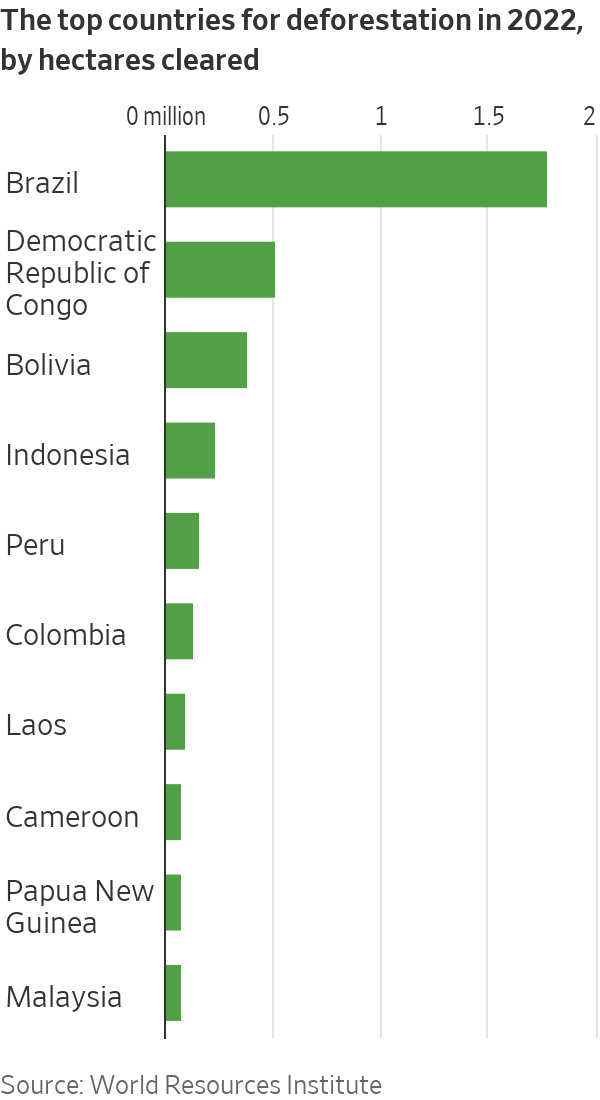

Companies are still waiting for the EU to provide a list of countries designated as high risk. Nations such as Brazil, Indonesia and Malaysia are lobbying against being classified as high risk, fearing the label will hurt trade.

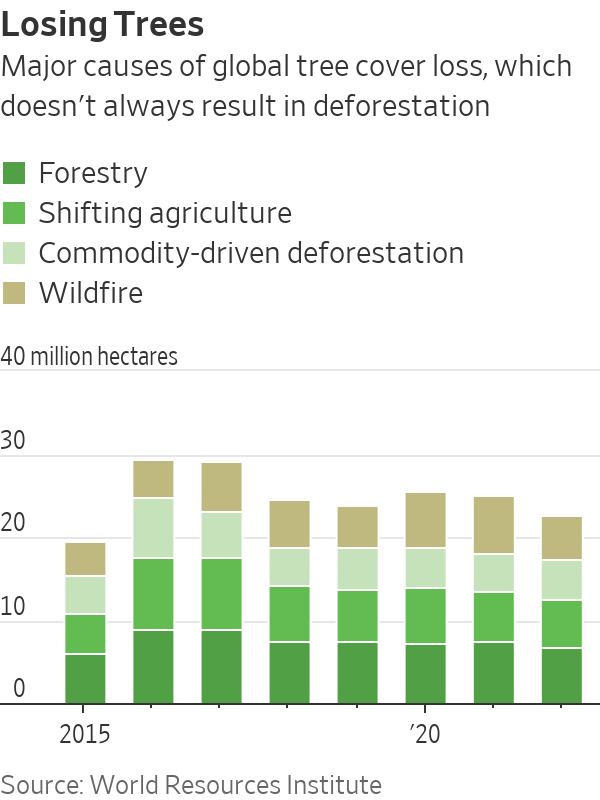

Loss of tropical primary, or mature, forests globally totalled 4.1 million hectares in 2022, the equivalent of losing 11 soccer fields of forest a minute, according to the World Resources Institute.

Many companies struggle to police their supply chains. Voluntary deforestation ambitions have failed, including the Consumer Goods Forum’s 2010 pledge to “achieve net zero deforestation” by 2020. In 2014, more than 200 companies pledged in the New York Declaration on Forests to eliminate deforestation by 2030, but they missed an interim target to halve deforestation by 2020.

Kellogg backed both initiatives and in a 2020 report identified a variety of reasons for the failure, including a lack of coordination between organisations, inconsistent regulations and opaque supplier ownership. It is among the companies working to fulfil the longer-term commitment of the New York Declaration on Forests to eliminate deforestation by 2030.

In 2021, leaders from more than 100 countries agreed to a deal at the COP26 climate summit aiming to end and then reverse deforestation by 2030.

The EU’s regulations aim to reduce the destruction of forests for economic activity and fight global warming. Trees absorb carbon dioxide, and forest loss and damage has caused around 10% of global warming, according to nonprofit World Wildlife Fund.

“Combating deforestation is an urgent task for this generation, and a great legacy to leave behind for the next,” Frans Timmermans, the EU official overseeing the bloc’s climate plans, said when political agreement on the regulations was reached in December.

The EU rules apply to companies meeting the bloc’s broad definition of an “operator,” which includes a business importing into the EU, exporting from it, or putting products on the bloc’s market. Operators can be big agribusinesses such as Cargill and Bunge supplying companies in the bloc, but also EU subsidiaries importing commodities to manufacture and sell products.

Guillaume Croisant, a Brussels-based lawyer at Linklaters, said that because the rules will be enforced by national officials, there could be discrepancies as “some authorities may be harsher.”

The EU has estimated the combined yearly due-diligence costs for importers to comply with the new rules could be as high as €2.6 billion a year, equivalent to roughly $2.8 billion.

Fast-moving consumer goods companies using coffee, cocoa, palm oil and soy could be hit with big compliance costs from the reporting requirements to trace precise geolocations as well as potential reorganisation of supply chains that are unable or unlikely to be compliant, according to an analyst report from Barclays.

The EU rules are expected to become stricter over time. A review on expanding them is scheduled in two years and some policy makers are pushing to have corn added to the list of commodities covered and for the financial sector to be regulated under the rules.

In the U.S., Democrats in Congress are pushing for similar legislation called the Forest Act. Sen. Brian Schatz, a Hawaii Democrat who is spearheading the effort, said the U.S. needs to follow the EU in enacting deforestation regulations on trade.

“If we do nothing, the U.S. market will become a dumping ground for commodities that can no longer make their way into Europe,” he said. “While companies talk a big game on preventing deforestation, we can no longer allow them to police themselves.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

The inflation rate ran at an annual pace of 2.2% in the quarter compared with a rise of 3.3% in the second quarter

SYDNEY—New Zealand’s inflation rate returned to within the central bank’s target band for the first time since early 2021 in the third quarter, opening a path to more supersized interest-rate cuts in coming months.

The inflation rate ran at an annual pace of 2.2% in the quarter, near the midpoint of the desired 1% to 3% target band, with some economists warning that the Reserve Bank of New Zealand must continue lowering the official cash rate at speed as a neutral policy rate is still well off in the distance.

The annual increase in inflation compares with a rise of 3.3% in the second quarter, StatsNZ said Wednesday. Inflation rose by 0.6% in quarterly terms.

The inflation data justifies the 75 basis points of cuts announced so far since August, with the RBNZ stepping up the pace of lowering the official cash rate last week by joining the Federal Reserve in slashing by 50 basis points.

Economists warn that there is a risk that inflation will undershoot the target band in coming quarters, especially if the RBNZ backs away from more significant cuts.

The official cash rate has so far fallen to 4.75% from 5.50%, with a neutral policy rate likely closer to 3.00%, according to economists.

New Zealand’s farm-rich economy has been in and out of recession for years as the RBNZ proved to be one of the more aggressive central banks globally when combating the inflation surge that emerged after the Covid-19 pandemic.

Economic activity remains flat and in need of resuscitation, especially with growth in China, its main trading partner, in a slowdown, economists said.

Higher rents were the biggest contributor to the annual inflation rate, up 4.5%. Almost a fifth of the annual increase in the consumer-price index was due to rent prices.

Prices for local authority rates and payments increased 12.2% in the 12 months to the third quarter, StatsNZ said. Prices for cigarettes and tobacco also rose sharply in line with an annual excise-tax increase.

Still, lower prices for gasoline and vegetables helped to offset rising prices, StatsNZ added.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.